Professional Documents

Culture Documents

Accounting Assignment

Uploaded by

Adrian Christian Lee100%(6)100% found this document useful (6 votes)

5K views2 pagesAccounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(6)100% found this document useful (6 votes)

5K views2 pagesAccounting Assignment

Uploaded by

Adrian Christian LeeAccounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

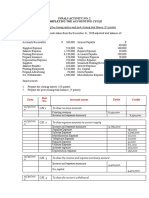

A.

Miranda Invests P300,000 in the business

Debit: Cash P300,000

Credit: Miranda, Capital P300,000

B. Acquired office equipment for P100,000, Miranda paid P20,000 in

cash and promised to pay the balance equally every end of month

Debit: Office Equipment P100,000

Credit: Cash P20,000

Credit: Accounts Payable P80,000

C. Paid rent for December, P5,000

Debit: Rent Expense P5,000

Credit: Cash P5,000

D. Provided shopping services for corporate accounts, P52,000

Debit: Accounts Receivable P52,000

Credit: Shopping Revenues P52,000

E. Paid telephone bill, P900

Debit: Utilities Expense P900

Credit: Cash P900

F. Borrowed cash from the bank by signing a note payable, P50,000

Debit: Cash P50,000

Credit: Notes Payable P50,000

G. Bought a computer for office use, P48,000 cash

Debit: Office Equipment P48,000

Credit: Cash P48,000

H. Collected cash from clients for services performed on account,

P40,000

Debit: Cash P40,000

Credit: Accounts Receivable P40,000

I. Paid commissions to shoppers for revenues generated during the

first half of the month, P18,200

Debit: Commission expense P18,200

Credit: Cash P18,200

J. Paid Electricity Bill, P6,000

Debit: Utilities Expense P6,000

Credit: Cash P6,000

K. Earned shopping revenues of P132,000: P60,000 cash, P72,000 on

account

Debit: Cash 60,000

Debit: Accounts Receivable P72,000

Credit: Shopping Revenues P132,000

L. Paid shoppers commissions for last half of month, P46,200

Debit: Commission Expense P46,200

Credit: Cash P46,200

M. Paid transportation allowances for the moth, P15,000

Debit: Transportation Expense P15,000

Credit: Cash P15,000

N. Paid P10,000 on note payable to bank

Debit: Notes Payable P10,000

Credit: Cash P10,000

O. Paid cash on account for the office equipment purchased in

transaction (b), P20,000

Debit: Accounts Payable P20,000

Credit: Cash P20,000

P. Miranda withdrew P20,000 for personal use

Debit: Miranda, withdrawals P20,000

Credit: Cash P20,0000

You might also like

- EN FABM - Final ExaminationDocument2 pagesEN FABM - Final ExaminationArsebelle Bais50% (6)

- Stephanie Calamba ACCA101Document1 pageStephanie Calamba ACCA101Nicole FidelsonNo ratings yet

- Notes BfarDocument4 pagesNotes BfarJoyce Ramos100% (2)

- Problem-5 - AFCAR Chapter 3Document9 pagesProblem-5 - AFCAR Chapter 3kakao100% (1)

- Error in Recording & Posting: Fabm 2Document17 pagesError in Recording & Posting: Fabm 2Earl Hyannis Elauria0% (1)

- Abueg Clarence Angela R. Bsa1cDocument8 pagesAbueg Clarence Angela R. Bsa1cAnonnNo ratings yet

- AlisuagDocument5 pagesAlisuagAgatha Alcid100% (1)

- Of The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesDocument5 pagesOf The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesLoriNo ratings yet

- Orca Share Media1605010109407 6731900321930361605Document37 pagesOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTNo ratings yet

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- Prob-1 - AFCAR Chapter 3Document2 pagesProb-1 - AFCAR Chapter 3kakao100% (1)

- Jose Rizal Heavy BombersDocument12 pagesJose Rizal Heavy BombersKYN KIETH PAMA100% (3)

- Worksheet 1 PrelimDocument8 pagesWorksheet 1 PrelimGetteric obafial90% (20)

- WorksheetDocument13 pagesWorksheetAlyanne Patrice Medrana100% (1)

- Lec2 Bookkeeping QuizDocument3 pagesLec2 Bookkeeping QuizJasmine Carpio100% (1)

- Accounting 1 ReviewDocument13 pagesAccounting 1 ReviewAlyssa Lumbao100% (1)

- MerchandisingDocument18 pagesMerchandisinghamida sarip100% (2)

- Lab Posttest 2 - Journal EntriesDocument1 pageLab Posttest 2 - Journal EntriesRaymond Pacaldo50% (4)

- Balance SheetDocument2 pagesBalance SheetzavriaNo ratings yet

- Account Transactions: Kareen LeonDocument13 pagesAccount Transactions: Kareen LeonPaula BautistaNo ratings yet

- Jackielyn Magpantay Chart of AccountsDocument9 pagesJackielyn Magpantay Chart of AccountsIgnite NightNo ratings yet

- Nelson Daganta CashDocument10 pagesNelson Daganta CashDan RioNo ratings yet

- Elegant Home Decors Worksheet For The Year Ended December 31,20ADocument8 pagesElegant Home Decors Worksheet For The Year Ended December 31,20AChloe CatalunaNo ratings yet

- Jose Rizal Heavy Bombers Trial Balance: Totals P 44,793,750 P 44,793,750Document16 pagesJose Rizal Heavy Bombers Trial Balance: Totals P 44,793,750 P 44,793,750Sou TVNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Acctg 101 Ass. #15,17,19&21Document8 pagesAcctg 101 Ass. #15,17,19&21Danilo Diniay Jr67% (6)

- VICTORINODocument6 pagesVICTORINODenise Ortiz Manolong100% (2)

- On June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDocument63 pagesOn June 1, 2019, ELENO BURAY, JR. Forest Products Sol Sold Merchandise With A P120,000 List PriceDachell Chiva SantiagoNo ratings yet

- FS Mariano Lerin FinalDocument15 pagesFS Mariano Lerin FinalMaria Beatriz Aban Munda75% (4)

- 9 Problems After Accounting Cycle Book1Document7 pages9 Problems After Accounting Cycle Book1Efi of the IsleNo ratings yet

- Adjusting Entries Discussion and Solution5Document23 pagesAdjusting Entries Discussion and Solution5Garp BarrocaNo ratings yet

- Trade and Cash Discount, Problem #1Document1 pageTrade and Cash Discount, Problem #1Feiya LiuNo ratings yet

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- The Ledger & Trial BalanceDocument4 pagesThe Ledger & Trial BalanceJohn Marvin Delacruz Renacido80% (5)

- Problems in AccountingDocument4 pagesProblems in AccountingRaul Soriano CabantingNo ratings yet

- Journal (Remedios Palaganas)Document2 pagesJournal (Remedios Palaganas)Mika CunananNo ratings yet

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Document6 pagesThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Chapter 2 JournalizingDocument21 pagesChapter 2 Journalizingkakao100% (1)

- Froilan Lim PDFDocument2 pagesFroilan Lim PDFgrace0% (1)

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Problem 15 - Group 5Document9 pagesProblem 15 - Group 5Francine TorresNo ratings yet

- Accounting Problem 5Document8 pagesAccounting Problem 5Carlo AniNo ratings yet

- Total: Adjusting EntriesDocument8 pagesTotal: Adjusting EntriesLj BesaNo ratings yet

- Karen Leon Bicycle RentalDocument6 pagesKaren Leon Bicycle RentalYanaiza Irisari Alvarez50% (2)

- Eva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Document7 pagesEva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Stephen ReloxNo ratings yet

- C3 - Problem 13 - Journalizing, Posting and Preparing A Trial BalanceDocument6 pagesC3 - Problem 13 - Journalizing, Posting and Preparing A Trial BalanceLorence John Imperial67% (6)

- Noel Hungria, Adjusting EntriesDocument1 pageNoel Hungria, Adjusting EntriesFeiya Liu100% (4)

- Illustrative Problem Worksheet ADocument6 pagesIllustrative Problem Worksheet AJoy Santos33% (3)

- Prepare Journal Entries 2Document1 pagePrepare Journal Entries 2Rie CabigonNo ratings yet

- FAR ReviewerDocument3 pagesFAR ReviewerPASCUA, ROWENA V.No ratings yet

- Noel Hungria, Adjusting EntriesDocument1 pageNoel Hungria, Adjusting EntriesFeiya Liu100% (2)

- ASSIGNMENT 1 and 2Document20 pagesASSIGNMENT 1 and 2Na Lisa Lee100% (3)

- Chapter 3Document14 pagesChapter 3Anjelika ViescaNo ratings yet

- Chapter 1 Assignment 1Document9 pagesChapter 1 Assignment 1LADY TEDD PONGOSNo ratings yet

- Problem 1Document15 pagesProblem 1Sphencer KielNo ratings yet

- Acctg 1 Problems - JMCDocument1 pageAcctg 1 Problems - JMCJohn Alfred CastinoNo ratings yet

- Compilation Notes On Journal Ledger and Trial Balance - Part 2Document8 pagesCompilation Notes On Journal Ledger and Trial Balance - Part 2Andra FleurNo ratings yet

- Activity No. 3 - Activity J, K and LDocument3 pagesActivity No. 3 - Activity J, K and LAlansalon JamelNo ratings yet

- ACTIVITY 04 - Analyzing TransactionsDocument6 pagesACTIVITY 04 - Analyzing TransactionsJohn Luis Cordova CacayurinNo ratings yet

- New Vacant Permanent Position001Document12 pagesNew Vacant Permanent Position001Adrian Christian LeeNo ratings yet

- EOT Log SampleDocument12 pagesEOT Log SampleAdrian Christian LeeNo ratings yet

- Rhino Quotation For Brand New Swifold Gate Mechanism Engr Adrian Rev1Document2 pagesRhino Quotation For Brand New Swifold Gate Mechanism Engr Adrian Rev1Adrian Christian LeeNo ratings yet

- Sustainability: Measurement and Numerical Simulation of Air Velocity in A Tunnel-Ventilated Broiler HouseDocument20 pagesSustainability: Measurement and Numerical Simulation of Air Velocity in A Tunnel-Ventilated Broiler HouseAdrian Christian LeeNo ratings yet

- Personal Data Sheet: Filipino Dual Citizenship by Birth by NaturalizationDocument4 pagesPersonal Data Sheet: Filipino Dual Citizenship by Birth by NaturalizationAdrian Christian LeeNo ratings yet

- Letter To MeralcoDocument1 pageLetter To MeralcoAdrian Christian LeeNo ratings yet

- Application For Registration: Combong Julius Paolo Noot PaoloDocument1 pageApplication For Registration: Combong Julius Paolo Noot PaoloJulius Noot CombongNo ratings yet

- Final Review Template: Project InformationDocument4 pagesFinal Review Template: Project InformationAdrian Christian LeeNo ratings yet

- Provident Benefits Claim: Checklist of Requirements Member/ClaimantDocument4 pagesProvident Benefits Claim: Checklist of Requirements Member/ClaimantAdrian Christian LeeNo ratings yet

- 1801 - Estate Tax ReturnDocument2 pages1801 - Estate Tax ReturnErikajane BolimaNo ratings yet

- Proof of Surviving Legal HeirsDocument3 pagesProof of Surviving Legal HeirsLecel Llamedo0% (1)

- Sorbetes CostingDocument1 pageSorbetes CostingAdrian Christian LeeNo ratings yet

- Application For Provident Benefits (Apb) ClaimDocument2 pagesApplication For Provident Benefits (Apb) ClaimJoey Singson100% (1)

- Budget Template 2008Document11 pagesBudget Template 2008sefrouNo ratings yet

- Lesson31 1Document1 pageLesson31 1Adrian Christian LeeNo ratings yet

- Purchase Order: Ceramica de Milano, IncDocument1 pagePurchase Order: Ceramica de Milano, IncAdrian Christian LeeNo ratings yet

- Wbs and Division of Work Excel Spread Sheet1Document12 pagesWbs and Division of Work Excel Spread Sheet1Adrian Christian Lee100% (1)

- Solar Light PricingDocument1 pageSolar Light PricingAdrian Christian LeeNo ratings yet

- Procurement Tracking Chart Excel TemplateDocument1 pageProcurement Tracking Chart Excel TemplateSlimAyedi100% (2)

- Procurement Tracking Chart Excel TemplateDocument1 pageProcurement Tracking Chart Excel TemplateSlimAyedi100% (2)

- DIV 02 Site Work LaborDocument55 pagesDIV 02 Site Work Laborm13naserrajaNo ratings yet

- RFQ - Hi Chi PDFDocument1 pageRFQ - Hi Chi PDFAdrian Christian LeeNo ratings yet

- Mirror and Shower EnclosuresDocument1 pageMirror and Shower EnclosuresAdrian Christian LeeNo ratings yet

- Purchase Order: Landlite Philippines CorporationDocument2 pagesPurchase Order: Landlite Philippines CorporationAdrian Christian LeeNo ratings yet

- Item/s Qty Price Disc. (%) SubtotalDocument6 pagesItem/s Qty Price Disc. (%) SubtotalAdrian Christian LeeNo ratings yet

- 8.4.3 Institutionalizing The Philippine Greenhouse Gas Inventory Management and Reporting System PDFDocument12 pages8.4.3 Institutionalizing The Philippine Greenhouse Gas Inventory Management and Reporting System PDFChrlene CoNo ratings yet

- Cutting ListDocument1 pageCutting ListAdrian Christian LeeNo ratings yet

- SPLBE 2016 Review Program - Rev03 (FINAL) APRIL 01, 2016Document2 pagesSPLBE 2016 Review Program - Rev03 (FINAL) APRIL 01, 2016Adrian Christian LeeNo ratings yet

- A A A A A A: Polyhedron - FormulaeDocument1 pageA A A A A A: Polyhedron - FormulaeAdrian Christian LeeNo ratings yet

- Summary of NBCP PDFDocument2 pagesSummary of NBCP PDFAdrian Christian LeeNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet