Professional Documents

Culture Documents

178 Income Statement and Related Information: - Chapter 4

Uploaded by

Zulkifli SaidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

178 Income Statement and Related Information: - Chapter 4

Uploaded by

Zulkifli SaidCopyright:

Available Formats

178

Chapter 4

Income Statement and Related

Information

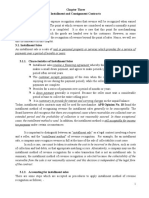

THOMPSON

CORPORATION

TRIAL BALANCE

DECEMBER 3 1 ,

2010

Debits

Purchase Discounts

Cash

Accounts Receivable

Rent Revenue

Retained Earnings

Salaries Payable

Sales

Notes Receivable

Accounts Payable

Accumulated DepreciationEquipment

Sales Discounts

Sales Returns

Notes Payable

Selling Expenses

Administrative Expenses

Share CapitalOrdinary

Income Tax Expense

Cash Dividends

Allowance for Doubtful Accounts

Supplies

Freight-in

Land

Equipment

Bonds Payable

Gain on Sale of Land

Accumulated DepreciationBuilding

Merchandise Inventory

Building

Purchases

Totals

Credits

10,000

189,700

105,000

18,000

160,000

18,000

1,100,000

110,000

49,000

28,000

14,500

17,500

70,000

232,000

99,000

300,000

53,900

45,000

5,000

14,000

20,000

70,000

140,000

100,000

30,000

19,600

89,000

98,000

610,000

1,907,600

1,907,600

A physical count of inventory on December 31 resulted in an inventory amount of 64,000; thus, cost of

goods sold for 2010 is 645,000.

Instructions

Prepare an income statement and a retained earnings statement. Assume that the only changes in retained

earnings during the current year were from net income and dividends. Thirty thousand ordinary shares

were outstanding the entire year.

P4-4 (Income Statement Items) Maher Inc. reported income before income tax during 2010 of $790,000.

Additional transactions, occurring in 2010 but not considered in the $790,000 are as follows.

1.

2.

The corporation experienced an uninsured flood loss in the amount of $90,000 during the year.

At the beginning of 2008, the corporation purchased a machine for $54,000 (residual value of $9,000)

that had a useful life of 6 years. The bookkeeper used straight-line depreciation for 2008,2009, and

2010 but failed to deduct the residual value in computing the depreciation base.

3. Sale of securities held as a part of its portfolio resulted in a gain of $47,000.

4. The corporation disposed of its recreational division at a loss of $115,000 before taxes. Assume that

this transaction meets the criteria for discontinued operations.

5. The corporation decided to change its method of i n v p n t n r v n r i r m r r f m , > , - ~ ~

T~>

5. The corporation decided to change its method of inventory pricing from average cost to the FIFO

method. The effect of this change on prior years is to increase 2008 income by $60,000 and decrease

2009 income by $20,000 before taxes. The FIFO method has been used for 2010.

Instructions

Prepare an income statement for the year 2010, starting with income before income tax. Compute earnings

per share as it should be shown on the face of the income statement. Ordinary shares outstanding for the

year are 120,000 shares. (Assume a tax rate of 30% on all items.)

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Acc101 - Chapter 14: Statement of Cash FlowsDocument12 pagesAcc101 - Chapter 14: Statement of Cash FlowsSyed Asad Ali GardeziNo ratings yet

- BA 211 Midterm 2Document6 pagesBA 211 Midterm 2Gene'sNo ratings yet

- BuwisDocument23 pagesBuwisshineneigh00No ratings yet

- 03-Chapter Three-Installment and Consignment ContractsDocument22 pages03-Chapter Three-Installment and Consignment ContractsHaile100% (1)

- Taxes and Cash Flow AnalysisDocument12 pagesTaxes and Cash Flow AnalysismrohaizamNo ratings yet

- P1 - Winding UpDocument23 pagesP1 - Winding Upjinky2470% (10)

- Ch05-Accounting PrincipleDocument9 pagesCh05-Accounting PrincipleEthanAhamed100% (2)

- Financial Management - FSADocument6 pagesFinancial Management - FSAAbby EsculturaNo ratings yet

- Ipcc - Chapter 13: Insurance Claims For Loss of Profit and Loss of StockDocument46 pagesIpcc - Chapter 13: Insurance Claims For Loss of Profit and Loss of StockAvinash GanesanNo ratings yet

- Latihan MatrikulasiDocument4 pagesLatihan MatrikulasiD Ayu Hamama PitraNo ratings yet

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- 3tay1112 Jpia Finals E-Review - Actbas1Document3 pages3tay1112 Jpia Finals E-Review - Actbas1CGNo ratings yet

- Paid and Not Currently Matched With EarningsDocument46 pagesPaid and Not Currently Matched With EarningsBruce SolanoNo ratings yet

- 1 Deductions From Gross Income-FinalDocument24 pages1 Deductions From Gross Income-FinalSharon Ann BasulNo ratings yet

- Assignment 2 Revenue RecognitionDocument2 pagesAssignment 2 Revenue RecognitionJuvy DimaanoNo ratings yet

- Wyeth Company - SolutionDocument2 pagesWyeth Company - SolutionimpurewolfNo ratings yet

- Retail Stores Financial StatementsDocument29 pagesRetail Stores Financial Statementssribalakarthik_21435No ratings yet

- Statement of Cash Flows - Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows - Lecture Questions and AnswersEynar Mahmudov83% (6)

- CPALE Syllabus Covere1Document7 pagesCPALE Syllabus Covere1Rian EsperanzaNo ratings yet

- Final Accounts 1Document25 pagesFinal Accounts 1ken philipsNo ratings yet

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsDocument4 pagesB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemNo ratings yet

- Income Tax NotesDocument16 pagesIncome Tax NotesAntonette Contreras DomalantaNo ratings yet

- ALL Quiz Ia 2Document45 pagesALL Quiz Ia 2julia4razo100% (7)

- Lecture13 Accounting For Inventory&ContractWIP 12 13 BBDocument35 pagesLecture13 Accounting For Inventory&ContractWIP 12 13 BBHappy AdelaNo ratings yet

- A 201 Chapter 12Document14 pagesA 201 Chapter 12blackprNo ratings yet

- Chapter 10Document14 pagesChapter 10GODNo ratings yet

- AFAR Part 1 Page 1-20Document2 pagesAFAR Part 1 Page 1-20Tracy Ann AcedilloNo ratings yet

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- Principles of DeductionsDocument4 pagesPrinciples of DeductionsStanley Renz Obaña Dela CruzNo ratings yet

- FDNACCT Quiz-2 Answer-Key Set-ADocument4 pagesFDNACCT Quiz-2 Answer-Key Set-APia DigaNo ratings yet

- 3rd Examination Test in AccountingDocument23 pages3rd Examination Test in AccountingNanya BisnestNo ratings yet

- ENT503M MidtermQuestionnaireDocument7 pagesENT503M MidtermQuestionnaireNevan NovaNo ratings yet

- Quiz Bowl 10Document9 pagesQuiz Bowl 10mark_somNo ratings yet

- Chapter 17 - Consolidated Financial Statements: Intragroup TransactionsDocument14 pagesChapter 17 - Consolidated Financial Statements: Intragroup TransactionsShek Kwun HeiNo ratings yet

- Chapter 13Document9 pagesChapter 13RBNo ratings yet

- Icaew Accounting Mock (Pilot Test) : 1. EmailDocument13 pagesIcaew Accounting Mock (Pilot Test) : 1. EmailSteve IdnNo ratings yet

- Tanzania Revenue Authority: Institute of Tax Administration PGDT ExecutivesDocument33 pagesTanzania Revenue Authority: Institute of Tax Administration PGDT ExecutivesMoud KhalfaniNo ratings yet

- Review Session 6 TEXTDocument6 pagesReview Session 6 TEXTAliBerradaNo ratings yet

- Chapter12 - (Applied Auditing)Document5 pagesChapter12 - (Applied Auditing)Christian Ibañez AbenirNo ratings yet

- Lobrigas - Week2 Ia3Document39 pagesLobrigas - Week2 Ia3Hensel SevillaNo ratings yet

- Using Excel For Business AnalysisDocument5 pagesUsing Excel For Business Analysis11armiNo ratings yet

- Corporate Reporting: Statement of Cash FlowsDocument19 pagesCorporate Reporting: Statement of Cash FlowsageoshyNo ratings yet

- Installment Sales OldDocument3 pagesInstallment Sales OldThea Grace Bianan0% (1)

- Accounting-errorssDocument5 pagesAccounting-errorssJuvilynNo ratings yet

- Lesson 4 Business Income and Income From Exercise of ProfessionDocument52 pagesLesson 4 Business Income and Income From Exercise of ProfessionAngelica Faith MorcoNo ratings yet

- Chapter FourDocument37 pagesChapter FourbiyaNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- Reading 13 Integration of Financial Statement Analysis Techniques - AnswersDocument21 pagesReading 13 Integration of Financial Statement Analysis Techniques - Answerstristan.riolsNo ratings yet

- Retained Earnings and Cost of Debentures: Presented by P. Madhuri Prinkle Jain Shersti JainDocument37 pagesRetained Earnings and Cost of Debentures: Presented by P. Madhuri Prinkle Jain Shersti JainPrinkle JainNo ratings yet

- F3 02 SCI and SCE HandoutsDocument7 pagesF3 02 SCI and SCE HandoutsRichard de LeonNo ratings yet

- Fa Mod1 Ont 0910Document511 pagesFa Mod1 Ont 0910subash1111@gmail.comNo ratings yet

- Advanced Financial Reporting EthicsDocument4 pagesAdvanced Financial Reporting Ethicswaresh36No ratings yet

- Review of Chapter 6Document54 pagesReview of Chapter 6BookAddict721No ratings yet

- Chapter 1 - Financial Statements and ReportsDocument44 pagesChapter 1 - Financial Statements and ReportsNguyễn Yến Nhi100% (1)

- ACCA Tax Adjusted Trading ProfitDocument14 pagesACCA Tax Adjusted Trading ProfitAnas KhalilNo ratings yet

- Revenue Recognition: Installment ContractDocument11 pagesRevenue Recognition: Installment ContractJean Ysrael MarquezNo ratings yet

- Partnership - OperationDocument53 pagesPartnership - OperationJulius B. OpriasaNo ratings yet

- Analyzing Long Term AssetsDocument18 pagesAnalyzing Long Term AssetsJähäñ ShërNo ratings yet

- Session 1: Summary of Biases in Probability AssessmentDocument8 pagesSession 1: Summary of Biases in Probability AssessmentZulkifli SaidNo ratings yet

- ExerciseDocument1 pageExerciseZulkifli SaidNo ratings yet

- Krakatau Steel A Report 4Document7 pagesKrakatau Steel A Report 4Zulkifli SaidNo ratings yet

- Summay Chapter 6 and 8 (Paul Goodwin and George Wright)Document10 pagesSummay Chapter 6 and 8 (Paul Goodwin and George Wright)Zulkifli SaidNo ratings yet

- Summay Chapter 6 and 8 (Paul Goodwin and George Wright)Document10 pagesSummay Chapter 6 and 8 (Paul Goodwin and George Wright)Zulkifli SaidNo ratings yet

- CASE Krakatau Steel (A)Document20 pagesCASE Krakatau Steel (A)Ariq LoupiasNo ratings yet

- Culture and Customer Behavior PDFDocument4 pagesCulture and Customer Behavior PDFZulkifli SaidNo ratings yet

- CASE Krakatau Steel (A)Document20 pagesCASE Krakatau Steel (A)Ariq LoupiasNo ratings yet

- Krakatau Steel A Study Cases Financial M PDFDocument8 pagesKrakatau Steel A Study Cases Financial M PDFZulkifli SaidNo ratings yet

- Air AsiaDocument37 pagesAir AsiaZulkifli Said100% (1)

- Perhitungan Population DensityDocument4 pagesPerhitungan Population DensityZulkifli SaidNo ratings yet

- Zulkifli Week 3 Chapter 16Document3 pagesZulkifli Week 3 Chapter 16Zulkifli SaidNo ratings yet

- Bobot Penilaian Recruitment of StarDocument2 pagesBobot Penilaian Recruitment of StarZulkifli SaidNo ratings yet

- Berkas PendaftaranDocument2 pagesBerkas PendaftaranZulkifli SaidNo ratings yet

- ch03.ppt Intermediate 1Document107 pagesch03.ppt Intermediate 1Yozi Ikhlasari Dahelza ArbyNo ratings yet

- Student Handbook MBA-ITB - Vrs October 2014 PDFDocument102 pagesStudent Handbook MBA-ITB - Vrs October 2014 PDFZulkifli SaidNo ratings yet

- Swot of AirasiaDocument13 pagesSwot of AirasiaShirley LinNo ratings yet

- Text Summarization Extraction System TSES Using Extracted Keywords - DocDocument5 pagesText Summarization Extraction System TSES Using Extracted Keywords - DocZulkifli SaidNo ratings yet

- Presentation Marketing ManagementDocument7 pagesPresentation Marketing ManagementZulkifli SaidNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Presentation Marketing ManagementDocument7 pagesPresentation Marketing ManagementZulkifli SaidNo ratings yet

- Step 2 - Understand The Business FunctionDocument44 pagesStep 2 - Understand The Business FunctionZulkifli SaidNo ratings yet