Professional Documents

Culture Documents

Homework Due Week 3

Homework Due Week 3

Uploaded by

Ng Jing HaoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework Due Week 3

Homework Due Week 3

Uploaded by

Ng Jing HaoCopyright:

Available Formats

Homework Due Week 3

ACC3601 Corporate Accounting and Reporting

On August 10th 2016 (beginning of day), HDB issued notes with a maturity of August 10 2023 (beginning

of day) and a face value of S$700,000,000. The notes have a coupon rate of 1.91% p.a. with semi-annual

coupons payable in arrears (at the end of each semi-annual period following the issue).

Assume that the note issue attracted an effective interest rate (APR) of 3.3% p.a.1

Required:

1. Calculate the proceeds and state the initial premium or discount on the note.

2. Prepare the initial journal entries to record the note issue.

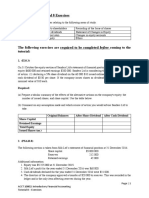

3. Prepare an interest payment schedule over the life of the notes.

4. HDB has a balance-sheet date of March 31st. Show the entries relating to the notes in the

financial year ending March 31st 2017 (no need to repeat the entries shown in 1).

5. Show the balance-sheet presentation of the notes as of March 31st 2017 (follow lecture note).

6. Show the entries relating to the notes in the financial year ending March 31st 2018.

7. Show the balance-sheet presentation of the notes as of March 31st 2018 (follow lecture note).

This is just a hypothetical assumption. The actual effective interest rate may be different.

You might also like

- MPS 2 The Fashion Rack 14eDocument5 pagesMPS 2 The Fashion Rack 14eLeian Barbosa67% (3)

- Tutorial Questions 2 - CHP 3 4 10th EdtDocument3 pagesTutorial Questions 2 - CHP 3 4 10th EdtShayal ChandNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- MODAUD2 - Unit 3 - Audit of Accounts and Notes Payable - T31516 - FINALDocument4 pagesMODAUD2 - Unit 3 - Audit of Accounts and Notes Payable - T31516 - FINALmimi96No ratings yet

- San Beda College Alabang Homework Exercise-Act851RDocument4 pagesSan Beda College Alabang Homework Exercise-Act851RJomel BaptistaNo ratings yet

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- (C) San Antonio Home Furnishings CompanyDocument3 pages(C) San Antonio Home Furnishings Companyjojo0% (2)

- Annexes : (See Annexes Next Page)Document5 pagesAnnexes : (See Annexes Next Page)arnel tanggaroNo ratings yet

- Ulep - Future ValueDocument4 pagesUlep - Future ValueNoel BajadaNo ratings yet

- The Following Transactions Were Completed by Montague Inc Whose FiscalDocument1 pageThe Following Transactions Were Completed by Montague Inc Whose Fiscaltrilocksp SinghNo ratings yet

- Analisis Biaya Semester Gasal 2016 - 2017 Tugas Individual IDocument1 pageAnalisis Biaya Semester Gasal 2016 - 2017 Tugas Individual IMaulana HasanNo ratings yet

- Solutiondone 305Document1 pageSolutiondone 305trilocksp SinghNo ratings yet

- Jagger y SidneyDocument1 pageJagger y SidneyAndrea SalazarNo ratings yet

- Soal Asis PA2Document2 pagesSoal Asis PA2Fahmi HaritsNo ratings yet

- Apllied Auditing Q&ADocument10 pagesApllied Auditing Q&APeterJorgeVillarante100% (2)

- RP Bonds-PayableDocument2 pagesRP Bonds-PayableQueenie BuisanNo ratings yet

- FM I - Tutorial Excercise 2 Ch3Document2 pagesFM I - Tutorial Excercise 2 Ch3natnaelsleshi3No ratings yet

- Mickelson Reports On A Calendar Year Basis On January 1: Unlock Answers Here Solutiondone - OnlineDocument1 pageMickelson Reports On A Calendar Year Basis On January 1: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Soal Pengantar Akuntansi 1Document5 pagesSoal Pengantar Akuntansi 1Nadiiatun MaslehaaNo ratings yet

- Accounting Theory and Current Issues PDFDocument5 pagesAccounting Theory and Current Issues PDFTahir MaqsoodNo ratings yet

- Soalan Tutorial Liabiliti Bukan SemasaDocument5 pagesSoalan Tutorial Liabiliti Bukan Semasaa194900No ratings yet

- Tugas Materi KewajibanDocument1 pageTugas Materi KewajibanandNo ratings yet

- Soal Asis Ak2 Pertemuan 1Document2 pagesSoal Asis Ak2 Pertemuan 1Aisya Fadhilla ShamaraNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial Managementkarlr9No ratings yet

- Schultz Company Prepares Interim Financial Statements at The End ofDocument1 pageSchultz Company Prepares Interim Financial Statements at The End ofFreelance WorkerNo ratings yet

- Ac102 ch7Document22 pagesAc102 ch7Mohammed OsmanNo ratings yet

- MBA-5107, Short QuestionsDocument2 pagesMBA-5107, Short QuestionsShajib GaziNo ratings yet

- CA Inter MTP 2 M'19 PDFDocument149 pagesCA Inter MTP 2 M'19 PDFSunitha SuniNo ratings yet

- 54940bosmtpsr2 Inter p1 QDocument6 pages54940bosmtpsr2 Inter p1 QAryan GurjarNo ratings yet

- PL M17 Far Uk GaapDocument8 pagesPL M17 Far Uk GaapIssa BoyNo ratings yet

- p1 Managerial Finance August 2017Document24 pagesp1 Managerial Finance August 2017ghulam murtazaNo ratings yet

- Exercises Fixed Income WT 2013Document2 pagesExercises Fixed Income WT 2013xs_of_hateNo ratings yet

- Solved Answer Accounts CA IPCC May. 2010Document13 pagesSolved Answer Accounts CA IPCC May. 2010Akash GuptaNo ratings yet

- Practice Note On Change in Accounting DateDocument8 pagesPractice Note On Change in Accounting DatememphixxNo ratings yet

- Chapter 10Document21 pagesChapter 10RBNo ratings yet

- Contoh Kasus Instrumen KeuanganDocument31 pagesContoh Kasus Instrumen KeuanganDedy SiburianNo ratings yet

- 43 RTP Pe2 Nov07 gp1Document107 pages43 RTP Pe2 Nov07 gp1P VenkatesanNo ratings yet

- Tugas Materi KewajibanDocument2 pagesTugas Materi Kewajibansavira andayani0% (2)

- AccountingDocument4 pagesAccountingnwanguiNo ratings yet

- Acct 212 Homework 6 Chapter 23 QDocument11 pagesAcct 212 Homework 6 Chapter 23 QLucky LyNo ratings yet

- BCIT Exam Review Problem 9-D2Document2 pagesBCIT Exam Review Problem 9-D2Kim HangNo ratings yet

- Near The End of 2015 The Management of Isle CorpDocument2 pagesNear The End of 2015 The Management of Isle CorpAmit PandeyNo ratings yet

- Topic 2 MFRS134 Interim ReportingDocument28 pagesTopic 2 MFRS134 Interim ReportingelinaNo ratings yet

- Bookkeeping (Second Part)Document38 pagesBookkeeping (Second Part)Thuzar Lwin100% (3)

- Solution Time Value of Money 1 FV of Single Cash Flow TCKq3rCrdXDocument7 pagesSolution Time Value of Money 1 FV of Single Cash Flow TCKq3rCrdXShareshth JainNo ratings yet

- ACCT10002 Tutorial 8 ExercisesDocument5 pagesACCT10002 Tutorial 8 ExercisesJING NIENo ratings yet

- Accts Xi Analytical Ques.Document2 pagesAccts Xi Analytical Ques.DEV NANKANINo ratings yet

- F-Fin Analysis-Class 1 & 2Document26 pagesF-Fin Analysis-Class 1 & 2Karan Setia100% (1)

- A Partial Amortization Schedule For A 10 Year Note Payable IssuedDocument1 pageA Partial Amortization Schedule For A 10 Year Note Payable Issuedtrilocksp SinghNo ratings yet

- Bkaf 3123 Analysis and Use of Financial Statements SEMESTER 2 SESI 2015/2016 Tutorial 4 DUE DATE: 18 May 2016 (BEFORE 12.00 NOON)Document3 pagesBkaf 3123 Analysis and Use of Financial Statements SEMESTER 2 SESI 2015/2016 Tutorial 4 DUE DATE: 18 May 2016 (BEFORE 12.00 NOON)Mìthßæn GèñésæñNo ratings yet

- PARALEL QUIZ - Introduction of AccountingDocument5 pagesPARALEL QUIZ - Introduction of AccountingCut Farisa MachmudNo ratings yet

- On August 1 2018 The Beginning of Its Current FiscalDocument3 pagesOn August 1 2018 The Beginning of Its Current FiscalCharlotteNo ratings yet

- Accounting Assignment 2 BSAF QuestionsDocument3 pagesAccounting Assignment 2 BSAF QuestionsShahzad C7No ratings yet

- Non Profit Questions EdexcelDocument35 pagesNon Profit Questions EdexcelNipuni PereraNo ratings yet

- Valuation of GoodwillDocument4 pagesValuation of GoodwillPANKAJ's ACCOUNTANCY PATHSHALANo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet