Professional Documents

Culture Documents

Schultz Company Prepares Interim Financial Statements at The End of

Uploaded by

Freelance Worker0 ratings0% found this document useful (0 votes)

12 views1 pageThe document provides information about the Schultz Company's interim financial statements for the first half of 2016. It includes a trial balance as of June 30, 2016 and additional notes with information needed to prepare the company's financial statements for the periods. The assistant is to use the information to prepare a 10-column worksheet, income statements for the first six months and second quarter of 2016, a retained earnings statement, and a June 30, 2016 balance sheet.

Original Description:

Original Title

Schultz Company Prepares Interim Financial Statements at the End Of

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information about the Schultz Company's interim financial statements for the first half of 2016. It includes a trial balance as of June 30, 2016 and additional notes with information needed to prepare the company's financial statements for the periods. The assistant is to use the information to prepare a 10-column worksheet, income statements for the first six months and second quarter of 2016, a retained earnings statement, and a June 30, 2016 balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageSchultz Company Prepares Interim Financial Statements at The End of

Uploaded by

Freelance WorkerThe document provides information about the Schultz Company's interim financial statements for the first half of 2016. It includes a trial balance as of June 30, 2016 and additional notes with information needed to prepare the company's financial statements for the periods. The assistant is to use the information to prepare a 10-column worksheet, income statements for the first six months and second quarter of 2016, a retained earnings statement, and a June 30, 2016 balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Schultz Company prepares interim financial statements at

the end of #2446

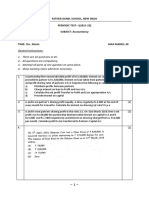

Schultz Company prepares interim financial statements at the end of each quarter. The income

statement presented at the end of the first quarter of 2016 is as follows:Shown next is the

Schultz Company trial balance as of June 30, 2016:Additional information:1. The company uses

a perpetual inventory system.2. The company uses control accounts for selling and

administrative expenses.3. The company records and posts its adjusting entries to its accounts

only at year-end.4. Uncollectible accounts average 0.5% of net sales.5. The $4,000 note

receivable was received on March 1, 2016. The 6-month note carries an annual interest rate of

12%, the interest to be collected at the maturity date.6. The balance in the Prepaid Insurance

account represents payment made on January 1, 2016, for a 1-year comprehensive insurance

policy.7. The Property and Equipment account consists of land, $5,000; buildings, $55,000; and

equipment, $20,000. The buildings are being depreciated over a 25-year life; the equipment

over an 8-year life. Straight- line depreciation is used; residual value is disregarded. No

acquisitions have been made in 2016. The depreciation on the buildings is treated as an

administrative expense; depreciation on the equipment as a selling expense.8. On February 1,

2016, the company rented some floor space to another company, receiving 1 year’s rent of

$1,800 in advance.9. The bonds pay interest semiannually on January 1 and July 1. Straight-

line amortization of the discount is recorded at the end of each year.10. The company estimates

that its pretax income for the second half of 2016 will total $11,550. All items in income are

subject to the same income tax rate schedule. The income tax rate schedule is 15% on the first

$20,000 of taxable income and 30% on the excess. There is no difference between the

company’s pretax financial income and taxable income, and no tax credits are available. The

company rounds its estimated effective income tax rate to the nearest tenth of a percent.

Income taxes will be paid during the first quarter of 2017.11. On June 29, 2016, the company

had declared and recorded (directly in Retained Earnings) a semiannual dividend of $0.40 per

share, payable on August 3, 2016.12. The 8,000 shares of common stock have been

outstanding the entire 6 months of 2016.Required:1. Prepare a 10-column worksheet to develop

the Schultz financial statements for the first 6 months of 2016. (Refer to Chapter 3 for a

worksheet illustration, if necessary.)2. Prepare the income statement for(a) The first 6 months of

2016 and(b) The second quarter of 2016.3. Prepare a retained earnings statement for the first 6

months of 2016.4. Prepare the June 30, 2016, balance sheet.View Solution:

Schultz Company prepares interim financial statements at the end of

ANSWER

http://paperinstant.com/downloads/schultz-company-prepares-interim-financial-statements-at-

the-end-of/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- MPS 2 The Fashion Rack 14eDocument5 pagesMPS 2 The Fashion Rack 14eLeian Barbosa67% (3)

- Accounting and Cost Allocation ManualDocument53 pagesAccounting and Cost Allocation ManualESSU Societas Discipulorum LegisNo ratings yet

- Agrokor Financial Report For 2016Document57 pagesAgrokor Financial Report For 2016Goran MarjevNo ratings yet

- Using The Trial Balance Prepared For Binbutti Engineering in PartDocument1 pageUsing The Trial Balance Prepared For Binbutti Engineering in PartFreelance Worker0% (2)

- Acquisition and Leveraged Finance BookDocument290 pagesAcquisition and Leveraged Finance BookJanet NyxNo ratings yet

- Lurch Company S December 31 2015 Balance Sheet Follows During 2016 TheDocument1 pageLurch Company S December 31 2015 Balance Sheet Follows During 2016 TheHassan JanNo ratings yet

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- 16 Altprob 8eDocument4 pages16 Altprob 8eRama DulceNo ratings yet

- Kelompok 10 - Tugas P3 - Completing The Audit Assignment (WUP 13-15) - REVISIDocument26 pagesKelompok 10 - Tugas P3 - Completing The Audit Assignment (WUP 13-15) - REVISIRayhan Dewangga SaputraNo ratings yet

- Bidding Document - Cold Storage For Meat and Associated Facilities Final-1Document184 pagesBidding Document - Cold Storage For Meat and Associated Facilities Final-1dmugalloy100% (1)

- Full-Time Mba Programs: 2019 Employment ReportDocument6 pagesFull-Time Mba Programs: 2019 Employment ReportPiyush MalhotraNo ratings yet

- April 6 16 Webinar Stock Study Session Mark DavDocument57 pagesApril 6 16 Webinar Stock Study Session Mark Davetuz89% (18)

- Annexes : (See Annexes Next Page)Document5 pagesAnnexes : (See Annexes Next Page)arnel tanggaroNo ratings yet

- Near The End of 2015 The Management of Isle CorpDocument2 pagesNear The End of 2015 The Management of Isle CorpAmit PandeyNo ratings yet

- Assume The Following Facts For Munoz Company in 2016 Munoz PDFDocument1 pageAssume The Following Facts For Munoz Company in 2016 Munoz PDFHassan JanNo ratings yet

- Unit 6. Audit of Investments, Hedging Instruments - Handout - Final - t31516Document8 pagesUnit 6. Audit of Investments, Hedging Instruments - Handout - Final - t31516mimi96No ratings yet

- One Product Corp Opc Incorporated at The Beginning of LastDocument2 pagesOne Product Corp Opc Incorporated at The Beginning of LastLet's Talk With HassanNo ratings yet

- Soal Advanced 2 Mid 2018 2019Document2 pagesSoal Advanced 2 Mid 2018 2019dwi davisNo ratings yet

- Near The End of 2009 The Management of Pak CorpDocument2 pagesNear The End of 2009 The Management of Pak CorpAmit PandeyNo ratings yet

- On January 1 2015 James Company Purchases 70 of TheDocument1 pageOn January 1 2015 James Company Purchases 70 of TheMuhammad ShahidNo ratings yet

- Jagger y SidneyDocument1 pageJagger y SidneyAndrea SalazarNo ratings yet

- Statement of Major Financial Assumptions REVISEDasDocument2 pagesStatement of Major Financial Assumptions REVISEDasAries Gonzales CaraganNo ratings yet

- Byers Company Presents The Following Condensed Income Statement For 2016Document1 pageByers Company Presents The Following Condensed Income Statement For 2016Taimur TechnologistNo ratings yet

- 2023.05.10 Exercise - Audit of Financing Cycle 2 With Answers-1Document3 pages2023.05.10 Exercise - Audit of Financing Cycle 2 With Answers-1misonim.eNo ratings yet

- KTQTE2Document10 pagesKTQTE2THẢO PHẠM THỊ THANHNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business Part 2Document65 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business Part 2Aizle Trixia AlcarazNo ratings yet

- Cost II Chap3Document11 pagesCost II Chap3abelNo ratings yet

- Fabm 11: Module 08 (Q4-Week 2-5) : Complete Accounting Cycle For A Merchandising Business - PeriodicDocument12 pagesFabm 11: Module 08 (Q4-Week 2-5) : Complete Accounting Cycle For A Merchandising Business - PeriodicChristian Zebua100% (5)

- ACCExpanded Opportunity Part 1Document4 pagesACCExpanded Opportunity Part 1Hilarie JeanNo ratings yet

- Comprehensive Bryant Corporation Was Incorporated On December 1 2015 andDocument1 pageComprehensive Bryant Corporation Was Incorporated On December 1 2015 andTaimur TechnologistNo ratings yet

- Icaew FMDocument16 pagesIcaew FMcima2k15No ratings yet

- Debussy Company Has Prepared A Set of Financial Statements BalanceDocument1 pageDebussy Company Has Prepared A Set of Financial Statements BalanceTaimur TechnologistNo ratings yet

- ACCTBA1 - Exercises On Adjusting EntriesDocument5 pagesACCTBA1 - Exercises On Adjusting EntriesRichard Leighton100% (1)

- 110 WarmupDay1Document25 pages110 WarmupDay1shiieeNo ratings yet

- Bahan Ajar KonsolidasiDocument13 pagesBahan Ajar KonsolidasiZachra MeirizaNo ratings yet

- Olson Company S Bookkeeper Prepared The Following Income Statement and RetainedDocument1 pageOlson Company S Bookkeeper Prepared The Following Income Statement and RetainedHassan JanNo ratings yet

- Accounting LalaDocument2 pagesAccounting LalaPaw PaladanNo ratings yet

- 11 - Article Ship Registratin Letter1fr Compiler 2.0 - Ca Final New - by Ca Ravi AgarwalDocument27 pages11 - Article Ship Registratin Letter1fr Compiler 2.0 - Ca Final New - by Ca Ravi Agarwalhrudaya boysNo ratings yet

- Planning of Gaining Profit: Planned Income StatementDocument12 pagesPlanning of Gaining Profit: Planned Income Statementmims08babyNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesShang BugayongNo ratings yet

- 4 Finacre - Assignment3 - AIS1ADocument2 pages4 Finacre - Assignment3 - AIS1Adexter gentrolesNo ratings yet

- p1 Managerial Finance August 2017Document24 pagesp1 Managerial Finance August 2017ghulam murtazaNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- AdditionalDocument18 pagesAdditionaldarlene floresNo ratings yet

- Revised MOU With SOWDA SignedDocument9 pagesRevised MOU With SOWDA SignedNaveed UllahNo ratings yet

- Quiz On Other LiabilitiesDocument14 pagesQuiz On Other Liabilitiesimsana minatozakiNo ratings yet

- Southern Exposure LTD Begins Operations On January 2 2016 During PDFDocument1 pageSouthern Exposure LTD Begins Operations On January 2 2016 During PDFLet's Talk With HassanNo ratings yet

- ICAEW Financial Accounting Questions March 2015 To March 2016 (SPirate)Document49 pagesICAEW Financial Accounting Questions March 2015 To March 2016 (SPirate)Ahmed Raza Mir100% (4)

- You Have Been Assigned To Examine The Financial Statements of PDFDocument2 pagesYou Have Been Assigned To Examine The Financial Statements of PDFHassan JanNo ratings yet

- Near The End of 2013 The Management of Isle CorpDocument2 pagesNear The End of 2013 The Management of Isle CorpAmit PandeyNo ratings yet

- 2Document17 pages2shaniaNo ratings yet

- ProblemC ch05Document5 pagesProblemC ch05Adan FakihNo ratings yet

- The Following Selected Accounts Are Taken From Crandle Corporation S DecemberDocument1 pageThe Following Selected Accounts Are Taken From Crandle Corporation S DecemberTaimur TechnologistNo ratings yet

- All Seatworks PDFDocument14 pagesAll Seatworks PDFLouiseNo ratings yet

- Huff Company Presents The Following Items Derived From Its DecemberDocument1 pageHuff Company Presents The Following Items Derived From Its DecemberLet's Talk With HassanNo ratings yet

- 3Document8 pages3여자라라No ratings yet

- Financial Accounting 2 ReviewerDocument5 pagesFinancial Accounting 2 ReviewerKimberlyVillarinNo ratings yet

- 2918 - Quarterly Financial Update Q2-2016Document6 pages2918 - Quarterly Financial Update Q2-2016Brad TabkeNo ratings yet

- Exam 1 Practice Questions Summer 2017Document8 pagesExam 1 Practice Questions Summer 2017Sandip AgarwalNo ratings yet

- REVISI - 041911535029 - Helen Puja MelaniaDocument29 pagesREVISI - 041911535029 - Helen Puja MelaniaHelen PujaNo ratings yet

- Auditing - MasterDocument11 pagesAuditing - MasterJohn Paulo SamonteNo ratings yet

- Correction of ErrorsDocument15 pagesCorrection of ErrorsEliyah Jhonson100% (1)

- Mack-Cali Realty Corporation Announces Third Quarter 2016 ResultsDocument8 pagesMack-Cali Realty Corporation Announces Third Quarter 2016 ResultsAnonymous Feglbx5No ratings yet

- Vencap Inc Is A Venture Capital Financier It Estimates ThatDocument1 pageVencap Inc Is A Venture Capital Financier It Estimates ThatFreelance WorkerNo ratings yet

- Valor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsDocument1 pageValor Ventures Prepares Adjusting Entries Monthly The Following Information ConcernsFreelance WorkerNo ratings yet

- Using The Information Provided in Part 1 of Problem 1Document1 pageUsing The Information Provided in Part 1 of Problem 1Freelance WorkerNo ratings yet

- Using The Trial Balance Prepared For X Factor Accounting in PartDocument1 pageUsing The Trial Balance Prepared For X Factor Accounting in PartFreelance WorkerNo ratings yet

- Using The Ledger Balances and Additional Data Shown On TheDocument1 pageUsing The Ledger Balances and Additional Data Shown On TheFreelance WorkerNo ratings yet

- Using The Information in Problem 3b Complete The Requirements AssumingDocument1 pageUsing The Information in Problem 3b Complete The Requirements AssumingFreelance WorkerNo ratings yet

- Using The Information in Problem 3 9a Complete The Following in ProblemDocument1 pageUsing The Information in Problem 3 9a Complete The Following in ProblemFreelance WorkerNo ratings yet

- Using The Information in Exercise 7 A Present The Journal EntriesDocument1 pageUsing The Information in Exercise 7 A Present The Journal EntriesFreelance WorkerNo ratings yet

- Using The General Journal Entries Prepared in Problem 2 3b CompleteDocument1 pageUsing The General Journal Entries Prepared in Problem 2 3b CompleteFreelance WorkerNo ratings yet

- Use The Data From Problem 6 5a and Do The QuestionDocument1 pageUse The Data From Problem 6 5a and Do The QuestionFreelance WorkerNo ratings yet

- Ubs Ag Is A Global Provider of Financial Services ToDocument1 pageUbs Ag Is A Global Provider of Financial Services ToFreelance WorkerNo ratings yet

- Using The Following Independent Situations Answer The Following Questions SituationDocument1 pageUsing The Following Independent Situations Answer The Following Questions SituationFreelance WorkerNo ratings yet

- Two Alternative Machines Are Being Considered For A Cost Reduction ProjectDocument1 pageTwo Alternative Machines Are Being Considered For A Cost Reduction ProjectFreelance WorkerNo ratings yet

- CW3 AppDocument2 pagesCW3 AppSamir IsmailNo ratings yet

- ComplaintDocument6 pagesComplainthdcottonNo ratings yet

- Act 110 Activity 8Document8 pagesAct 110 Activity 8Norkan DimalawangNo ratings yet

- Feasibility Study TemplateDocument13 pagesFeasibility Study TemplateFeasibilitypro100% (1)

- Axis Securities Sees 8% UPSIDE in DCB Bank LTD Another Couple ofDocument8 pagesAxis Securities Sees 8% UPSIDE in DCB Bank LTD Another Couple ofDhaval MailNo ratings yet

- Celernus Pivot Private Credit Fund Quarterly - Q12020Document2 pagesCelernus Pivot Private Credit Fund Quarterly - Q12020CGrantNo ratings yet

- The Cheyne SIV Case Summary Judgment RulingDocument97 pagesThe Cheyne SIV Case Summary Judgment RulingscottleeyNo ratings yet

- Prinsip EkonomiDocument19 pagesPrinsip EkonomiDandy Maslow Panungkunan ManurungNo ratings yet

- Simulation Tutorial QuestionsDocument2 pagesSimulation Tutorial QuestionsClaudia ChoiNo ratings yet

- Board-2011 Aof QTR 3Document7 pagesBoard-2011 Aof QTR 3EllenBeth WachsNo ratings yet

- Chapter 13 International Equity Markets Answers & Solutions To End-Of-Chapter Questions and ProblemsDocument5 pagesChapter 13 International Equity Markets Answers & Solutions To End-Of-Chapter Questions and ProblemsAnthony White0% (1)

- Jadual Ketiga 04012019 EngDocument92 pagesJadual Ketiga 04012019 EngAlexander HoNo ratings yet

- Beda Pajak Dan RetribusiDocument6 pagesBeda Pajak Dan RetribusiimantaNo ratings yet

- Boa Tos Auditing.Document4 pagesBoa Tos Auditing.DaphneNo ratings yet

- Mixed Methods in Finance Research: The Rationale and Research DesignsDocument13 pagesMixed Methods in Finance Research: The Rationale and Research DesignsRjendra LamsalNo ratings yet

- SBN-824: Augmenting The Budget For The K-To-12 Program of The DepEd, Providing Funds From The PAGCOR IncomeDocument6 pagesSBN-824: Augmenting The Budget For The K-To-12 Program of The DepEd, Providing Funds From The PAGCOR IncomeRalph RectoNo ratings yet

- Ind AS 102 - Share Based Payment - QuestionsDocument3 pagesInd AS 102 - Share Based Payment - QuestionsKashika AgarwalNo ratings yet

- Smart Communications Vs City of DavaoDocument1 pageSmart Communications Vs City of DavaoPilyang SweetNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow Statementasherjoe67% (3)

- Sublord of 2nd Cusp Placement and ResultsDocument1 pageSublord of 2nd Cusp Placement and ResultsAnonymous AQPr7tkSBNo ratings yet

- Village Fund: A Balanced Scorecard ApproachDocument25 pagesVillage Fund: A Balanced Scorecard ApproachAli FarhanNo ratings yet

- A Comprehensive Guide To Investing in GoldDocument27 pagesA Comprehensive Guide To Investing in GoldBrian BarrettNo ratings yet

- 2010 Oakland A's Ballpark at Jack London Square Howard Terminal Economic Analysis ReportDocument78 pages2010 Oakland A's Ballpark at Jack London Square Howard Terminal Economic Analysis ReportZennie AbrahamNo ratings yet

- Derivative Market Dealer Module Practice Book SampleDocument35 pagesDerivative Market Dealer Module Practice Book SampleMeenakshi0% (1)

- 1810 AFAR Home Office Branch and Agency TransactionDocument9 pages1810 AFAR Home Office Branch and Agency TransactionMina Valencia100% (1)