Professional Documents

Culture Documents

Asr

Uploaded by

chahunay0 ratings0% found this document useful (0 votes)

14 views1 pageExample of Asset Status Report

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentExample of Asset Status Report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageAsr

Uploaded by

chahunayExample of Asset Status Report

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

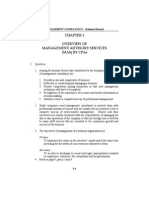

6 The Expenditure Cycle Pat: Payroll Processing and Fixed Asset Procedures 287

eer

‘OZMENT'S INDUSTRIAL SUPPLY

ASSET LISTING

Code Type Description

100 OFFA

COMPUTER SYSTEM

Depn. method: SL

Lite in years: 5

Date acquired 1/01/09

Date reited

Cost 40,000.00

Residual 4,000.00,

‘Ace, Depn, 10,800.00,

200 OFFaF

‘OFFICE FURNITURE

Dopn. method: SL

Lite in years: 5

Date acquire 2/01/09

Date retired

Cost 5,500.00

Residual ‘500.00

‘Ace. Depn, 2,222.23,

300 MACH

SNOWBLOWER

Depn. method: DDB

Life in years: 5

Date acquired 2/01/09,

Date retired

Cost 1,000.00

Residual 0.00

‘Ace. Depn, 499.96

400 MACH

‘Tauck

Depn, method: SL

Lite in years: 3

Date acquired 12/01/08

Date reed

Cost 2,000.00

Residual 0.00

‘Ace. Depa, 2,993.31

fixed assets are being used in accordance with the organization's policies and business practices, For

example, microcomputers purchased for individual employees should be secured in their proper location

and should not be removed from the premises without explicit approval. Company vehicles should be

secured in the organization’s motor pool at the end of the shift and should not be taken home for personal

use unless authorized by the appropriate supervisor.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- BPDocument1 pageBPchahunayNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Fas RecordDocument1 pageFas RecordchahunayNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Boa Tos MasDocument3 pagesBoa Tos MasAaron Joy Dominguez PutianNo ratings yet

- Cartoon NetworkDocument10 pagesCartoon NetworkchahunayNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Chapter 01 - Management Consultancy by CabreraDocument2 pagesChapter 01 - Management Consultancy by Cabrerarogienelr75% (8)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Johnson & Johnson's Credo StatementDocument1 pageJohnson & Johnson's Credo StatementchahunayNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Business PolicyDocument20 pagesBusiness PolicychahunayNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 01 - Management Consultancy by CabreraDocument2 pagesChapter 01 - Management Consultancy by Cabrerarogienelr75% (8)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- CPA licensure exam syllabus management accountingDocument3 pagesCPA licensure exam syllabus management accountingLouie de la TorreNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- You, My Love, Have Been Reborn, and This Time You Will Decide What To Grow IntoDocument2 pagesYou, My Love, Have Been Reborn, and This Time You Will Decide What To Grow IntochahunayNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Johnson & Johnson's Credo StatementDocument1 pageJohnson & Johnson's Credo StatementchahunayNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chapter 1 - Solution Manual CabreraDocument2 pagesChapter 1 - Solution Manual CabreraClarize R. Mabiog67% (12)

- Management Accounting by CabreraDocument21 pagesManagement Accounting by CabrerachahunayNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- RFMDocument42 pagesRFMchahunay0% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Financial Management by CabreraDocument8 pagesFinancial Management by Cabrerachahunay0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Multiple Choice Questions and SolutionsDocument7 pagesMultiple Choice Questions and Solutionschahunay50% (2)

- RFM Corporation Annual Report for Fiscal Year 2014Document132 pagesRFM Corporation Annual Report for Fiscal Year 2014chahunayNo ratings yet

- Articles of IncorporationDocument1 pageArticles of IncorporationchahunayNo ratings yet

- Cost Accounting by GuerreroDocument17 pagesCost Accounting by Guerrerochahunay100% (1)

- Income Taxation Chapters 1-3Document20 pagesIncome Taxation Chapters 1-3chahunay100% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Part A - ACTL5313 Part II Actuaries OutlineDocument15 pagesPart A - ACTL5313 Part II Actuaries OutlineMayank Reach TutejaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Inclass Exercise Chapter 17Document4 pagesInclass Exercise Chapter 17임재영No ratings yet

- Safal Niveshak's Cheat Sheet for Investing MoneyDocument62 pagesSafal Niveshak's Cheat Sheet for Investing MoneyVikrant Deshmukh100% (3)

- Email List 4 Hola SpanishDocument20 pagesEmail List 4 Hola SpanishLourdes LinaresNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Cidam Business FinanceDocument6 pagesCidam Business FinanceNardsdel RiveraNo ratings yet

- Chapter 6: RatesDocument5 pagesChapter 6: RatesHunter FaughnanNo ratings yet

- The Time Value of MoneyDocument5 pagesThe Time Value of Moneysunny syNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Schwesernotes 2024 Frm Part I Book 4 Valuation And Risk Models Kaplan Schweser full download chapterDocument51 pagesSchwesernotes 2024 Frm Part I Book 4 Valuation And Risk Models Kaplan Schweser full download chapterbenjamin.bernhardt881100% (14)

- VXRT SchwabEquityRatingsReportDocument5 pagesVXRT SchwabEquityRatingsReportnnn kkkNo ratings yet

- Growth and Sustainability of Indian Capital Markets A Myth or RealtyDocument16 pagesGrowth and Sustainability of Indian Capital Markets A Myth or RealtyshashrzNo ratings yet

- Jonas Tech Corporation Recently Acquired Innovation Plus Company The CombinedDocument1 pageJonas Tech Corporation Recently Acquired Innovation Plus Company The CombinedAmit PandeyNo ratings yet

- Bus. Com. Part 1Document10 pagesBus. Com. Part 1Jaycel BayronNo ratings yet

- Assignment On Financial Statement Ratio Analysis PDFDocument27 pagesAssignment On Financial Statement Ratio Analysis PDFJosine JonesNo ratings yet

- Elss 1 PDFDocument26 pagesElss 1 PDFrachealllNo ratings yet

- Sample Options Report CVSDocument4 pagesSample Options Report CVSrudy_wadhera4933No ratings yet

- Scope and LimitationDocument1 pageScope and LimitationJonmar Mari82% (11)

- Pru Basic 1: Variable Life Licensing Mock ExamDocument24 pagesPru Basic 1: Variable Life Licensing Mock ExamMikaella SarmientoNo ratings yet

- Final ThesisDocument84 pagesFinal ThesisHari Sundar Kusi82% (11)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- EMBA710 - SyllabusDocument3 pagesEMBA710 - SyllabusShatha QamhiehNo ratings yet

- 2016 Level I IFT Mock Exam 1 Morning SAMPLEDocument4 pages2016 Level I IFT Mock Exam 1 Morning SAMPLEMuhibUrRasoolNo ratings yet

- Phillips, Hager & North Global Equity Fund F: Growth of 10,000 10-09-2009 - 10-09-2019 Morningstar Risk MeasuresDocument3 pagesPhillips, Hager & North Global Equity Fund F: Growth of 10,000 10-09-2009 - 10-09-2019 Morningstar Risk MeasuresRoger SongNo ratings yet

- A Dissertation On InvestmentDocument108 pagesA Dissertation On InvestmentPrakash SinghNo ratings yet

- Black BookDocument59 pagesBlack BookPrachi MachiwaleNo ratings yet

- Fullerton SGD Heritage Income Fund June 2020 ReviewDocument3 pagesFullerton SGD Heritage Income Fund June 2020 ReviewInaRizkyNo ratings yet

- DMCIHI - 073 SEC 17Q - Second Quarter - Aug 12 PDFDocument61 pagesDMCIHI - 073 SEC 17Q - Second Quarter - Aug 12 PDFRinna Jane Rivera BolandresNo ratings yet

- Marketing Management Project - ITC-Aashirvaad-AttaDocument57 pagesMarketing Management Project - ITC-Aashirvaad-AttaBimalendu Konar100% (7)

- 2014 CFA Level 3 Mock Exam Afternoon - AnsDocument48 pages2014 CFA Level 3 Mock Exam Afternoon - AnsElsiiieNo ratings yet

- Global FocusDocument43 pagesGlobal FocusYehoNo ratings yet

- Discuss Soal GRADE XI SENIOR HIGH SCHOOLDocument7 pagesDiscuss Soal GRADE XI SENIOR HIGH SCHOOLmelati pratiwiNo ratings yet

- Chapter 6 Introduction To InvestmentsDocument25 pagesChapter 6 Introduction To InvestmentsAyen Kaye IbisNo ratings yet