Professional Documents

Culture Documents

Enron Case Summary

Uploaded by

Merrill Ojeda SaflorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enron Case Summary

Uploaded by

Merrill Ojeda SaflorCopyright:

Available Formats

ENRON CASE SUMMARY

In 1999, Enron launched its broadband services unit and Enron Online, the

company's website for trading commodities, which soon became the largest

business site in the world. About 90 per cent of its income eventually came

from trades over Enron Online.

Growth for Enron was rapid. In2000, it ranked as the seventh-largest

company on the Fortune 500 and the sixth-largest energy company in the

world. However, cracks began to appear inOctober 2001, Enron reported a

loss of $618 million: its first quarterly loss in four years.

As a response to this problem, Enron' financial statements did not clearly

detail its operations and finances to shareholders and analysts. The

company's CEO used the mark-to-market accounting to misrepresent

earnings and modify the balance sheet to indicate favorable performance.

The U.S. Securities and Exchange commission launched an investigation into

investment partnerships led by Fastow. That investigation would later show

that a complex web of partnerships was designed to hide Enron's debt. On

Dec. 2, 2001, Enron filed for bankruptcy protection in the biggest case of

bankruptcy in the United States up to that point. Almost 5,600 Enron

employees subsequently lost their jobs.

You might also like

- The Enron Scandal: How Accounting Fraud Brought Down an Energy GiantDocument8 pagesThe Enron Scandal: How Accounting Fraud Brought Down an Energy GiantJenny May GodallaNo ratings yet

- Enron ScandalDocument5 pagesEnron Scandalaroha5238No ratings yet

- Enron's rise and fall from America's largest energy companyDocument10 pagesEnron's rise and fall from America's largest energy companyShunNo ratings yet

- Enron Fraud Case SummaryDocument5 pagesEnron Fraud Case Summaryamara cheema100% (3)

- What Was EnronDocument8 pagesWhat Was EnronRika Nur CahyaniNo ratings yet

- Report On Enron Company ScandalDocument4 pagesReport On Enron Company ScandalHarpreet SinghNo ratings yet

- Enron Company Case StudyDocument6 pagesEnron Company Case StudyRabia FazalNo ratings yet

- Enron 1Document25 pagesEnron 1yashkhlaseNo ratings yet

- Sythesis 8Document7 pagesSythesis 8Jhonerl YbañezNo ratings yet

- The Rise and Fall of EnronDocument7 pagesThe Rise and Fall of Enronyatz24No ratings yet

- Enron CompanyDocument3 pagesEnron Companyjayvee OrfanoNo ratings yet

- The Crooked EDocument3 pagesThe Crooked EJahziel Lim Irabon100% (2)

- Enron Scandal ReportDocument15 pagesEnron Scandal ReportBatool DarukhanawallaNo ratings yet

- Enron ScandalDocument25 pagesEnron ScandalNeemal EhsanNo ratings yet

- Enron ScandalDocument7 pagesEnron ScandalMirdual JhaNo ratings yet

- ENRON Group1Document10 pagesENRON Group1Akanksha JaiswalNo ratings yet

- IntroductionDocument5 pagesIntroductionLydia MasrudyNo ratings yet

- Company Background: Enron CorporationDocument6 pagesCompany Background: Enron Corporationyatz24No ratings yet

- 19 Enron ShortDocument5 pages19 Enron ShortMuhlisNo ratings yet

- Enron Corporation: Enron's Energy OriginsDocument7 pagesEnron Corporation: Enron's Energy Originsislam hamdyNo ratings yet

- Enron Corporation: Enron's Energy OriginsDocument7 pagesEnron Corporation: Enron's Energy Originsislam hamdyNo ratings yet

- Enron's Dramatic Rise and Staggering CollapseDocument7 pagesEnron's Dramatic Rise and Staggering Collapseislam hamdyNo ratings yet

- Corprate Finance-Final AssignmentDocument37 pagesCorprate Finance-Final Assignmentifti_MENo ratings yet

- Fraud of Enron A. Background of The CaseDocument2 pagesFraud of Enron A. Background of The CaseVivienne Rozenn LaytoNo ratings yet

- Edades, Angelica T. Bsba-Fm The Enron'S CollapseDocument7 pagesEdades, Angelica T. Bsba-Fm The Enron'S Collapsearman atipNo ratings yet

- Enron Corporation and Andersen LlP Đã Chuyển Đổi 1Document17 pagesEnron Corporation and Andersen LlP Đã Chuyển Đổi 1Kim NguyenNo ratings yet

- An ENRON Scandal SummaryDocument7 pagesAn ENRON Scandal SummaryNimraa NoorNo ratings yet

- Case Study (Ethical Issues)Document10 pagesCase Study (Ethical Issues)Abelle Rina Villacencio GallardoNo ratings yet

- Assignment 1 (Answered)Document6 pagesAssignment 1 (Answered)Areez IsrarNo ratings yet

- Enron Scandal: How Accounting Tricks Led to CollapseDocument5 pagesEnron Scandal: How Accounting Tricks Led to Collapsenidhi nageshNo ratings yet

- Subject:-Investigative Journalism Topic: - Case Study On Enron Scandal Name: - Shray Ved Class: - T.Y.B.A.MMC - B ROLL No.: - 3151Document23 pagesSubject:-Investigative Journalism Topic: - Case Study On Enron Scandal Name: - Shray Ved Class: - T.Y.B.A.MMC - B ROLL No.: - 3151ShrayNo ratings yet

- Good Enron Fraud PaperDocument38 pagesGood Enron Fraud PaperAnkur YadavNo ratings yet

- Enron Scandal The Fall of A Wall Street DarlingDocument3 pagesEnron Scandal The Fall of A Wall Street DarlingAnonymous 2LqTzfUHY50% (2)

- The Rise and Fall of Enron: A Guide to the ScandalDocument28 pagesThe Rise and Fall of Enron: A Guide to the ScandalJohn Philip De GuzmanNo ratings yet

- A Dissertation ReportDocument42 pagesA Dissertation ReportKapil ChoudharyNo ratings yet

- Enron CorporationDocument8 pagesEnron CorporationNadine Clare FloresNo ratings yet

- Enron Scandal SummaryDocument15 pagesEnron Scandal SummaryMarielNo ratings yet

- Audit CaseDocument30 pagesAudit CaseAnnisa Kurnia100% (1)

- SPEs and Mark-to-Market Accounting Fueled Enron's Rise and FallDocument8 pagesSPEs and Mark-to-Market Accounting Fueled Enron's Rise and FallMustansar RanjhaNo ratings yet

- How Enron's Fraud Led to Collapse and New RegulationsDocument5 pagesHow Enron's Fraud Led to Collapse and New RegulationsShubhankar ThakurNo ratings yet

- The Enron ScandalDocument1 pageThe Enron ScandalKent AguilarNo ratings yet

- Enron Accounting Scandal and Its Impact To Stakeholders Voice Over (Pictures or Videos of Enron C/O Youtube)Document3 pagesEnron Accounting Scandal and Its Impact To Stakeholders Voice Over (Pictures or Videos of Enron C/O Youtube)Raven ShadowsNo ratings yet

- Enron CaseDocument5 pagesEnron CaseTri Oka Putra0% (1)

- The Enron Scandal: How America's 7th Largest Company Collapsed Due to Accounting FraudDocument7 pagesThe Enron Scandal: How America's 7th Largest Company Collapsed Due to Accounting FraudArif HasanNo ratings yet

- The Collapse of Enron CORPORATION (USA) (2001) : Pre-Final in Internal AuditingDocument7 pagesThe Collapse of Enron CORPORATION (USA) (2001) : Pre-Final in Internal AuditingKathlynJoySalazarNo ratings yet

- Enron ScandalDocument7 pagesEnron ScandalDhruv JainNo ratings yet

- Enron Scandal NewDocument8 pagesEnron Scandal NewDiah Permata Ayu K.PNo ratings yet

- EnronDocument22 pagesEnrondrishti100% (2)

- Expand Further On EnronDocument2 pagesExpand Further On EnronSean Chris ConsonNo ratings yet

- ENRON Corporation: Introduction To Finance Assignment OnDocument10 pagesENRON Corporation: Introduction To Finance Assignment OnSaifSaemIslamNo ratings yet

- Enron Scandal: The Fall of A Wall Street Darling: "America's Most Innovative Company"Document19 pagesEnron Scandal: The Fall of A Wall Street Darling: "America's Most Innovative Company"Jamielyn Dy DimaanoNo ratings yet

- Enron ScandalDocument22 pagesEnron ScandalGaurav SavlaniNo ratings yet

- Enron bankruptcy report: How accounting fraud led to collapseDocument2 pagesEnron bankruptcy report: How accounting fraud led to collapsemohidul islamNo ratings yet

- Enron Case StudyDocument7 pagesEnron Case Studynaila khanNo ratings yet

- Enron's Desperate Remedial Actions Before BankruptcyDocument3 pagesEnron's Desperate Remedial Actions Before BankruptcyblahblahblueNo ratings yet

- Acc394 - Edited Case Study Answers 1Document10 pagesAcc394 - Edited Case Study Answers 1api-607959293No ratings yet

- EntrinaDocument7 pagesEntrinaevemil berdinNo ratings yet

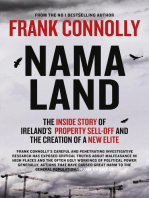

- NAMA-Land: The Inside Story of Ireland's Property Sell-off and The Creation of a New EliteFrom EverandNAMA-Land: The Inside Story of Ireland's Property Sell-off and The Creation of a New EliteNo ratings yet

- Presented By: Merrill O. Saflor, 5-BSADocument17 pagesPresented By: Merrill O. Saflor, 5-BSAMerrill Ojeda SaflorNo ratings yet

- Chapter 29Document32 pagesChapter 29Merrill Ojeda SaflorNo ratings yet

- Chapter 1Document68 pagesChapter 1Merrill Ojeda SaflorNo ratings yet

- Compare IASDocument3 pagesCompare IASMerrill Ojeda SaflorNo ratings yet

- Oriental DramaDocument25 pagesOriental DramaMerrill Ojeda Saflor100% (2)

- CTA upholds CIR vs ExxonMobil claimDocument4 pagesCTA upholds CIR vs ExxonMobil claimMerrill Ojeda SaflorNo ratings yet

- MicroscopeDocument12 pagesMicroscopeMerrill Ojeda SaflorNo ratings yet

- The Case For NonDocument4 pagesThe Case For NonMerrill Ojeda SaflorNo ratings yet

- Major Accounting Issues in Forming The PartnershipDocument2 pagesMajor Accounting Issues in Forming The PartnershipMerrill Ojeda SaflorNo ratings yet

- CHAPTER 10 (Papa and Saflor)Document27 pagesCHAPTER 10 (Papa and Saflor)Merrill Ojeda SaflorNo ratings yet

- ThesisDocument38 pagesThesisMerrill Ojeda SaflorNo ratings yet