Professional Documents

Culture Documents

Liquidity Analysis: Current Ratio

Liquidity Analysis: Current Ratio

Uploaded by

Ritu Singh0 ratings0% found this document useful (0 votes)

7 views4 pagesThe document analyzes various liquidity ratios for a company over 5 years from 2011-2012 to 2015-2016. It shows that the current ratio, which measures a company's ability to pay short-term debts, fluctuated over the years but was highest in 2015. The quick ratio, which measures a company's ability to pay debts without relying on inventory, was above 2 for all years and peaked in 2015-2016. Net working capital, the difference between current assets and current liabilities, varied year to year but was highest in 2014-2015. The asset turnover ratio, which measures how efficiently a company uses its assets, remained relatively steady around 1.13 each year.

Original Description:

statements

Original Title

httpswww.scribd.compresentation237727751Archies

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document analyzes various liquidity ratios for a company over 5 years from 2011-2012 to 2015-2016. It shows that the current ratio, which measures a company's ability to pay short-term debts, fluctuated over the years but was highest in 2015. The quick ratio, which measures a company's ability to pay debts without relying on inventory, was above 2 for all years and peaked in 2015-2016. Net working capital, the difference between current assets and current liabilities, varied year to year but was highest in 2014-2015. The asset turnover ratio, which measures how efficiently a company uses its assets, remained relatively steady around 1.13 each year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views4 pagesLiquidity Analysis: Current Ratio

Liquidity Analysis: Current Ratio

Uploaded by

Ritu SinghThe document analyzes various liquidity ratios for a company over 5 years from 2011-2012 to 2015-2016. It shows that the current ratio, which measures a company's ability to pay short-term debts, fluctuated over the years but was highest in 2015. The quick ratio, which measures a company's ability to pay debts without relying on inventory, was above 2 for all years and peaked in 2015-2016. Net working capital, the difference between current assets and current liabilities, varied year to year but was highest in 2014-2015. The asset turnover ratio, which measures how efficiently a company uses its assets, remained relatively steady around 1.13 each year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Liquidity Analysis

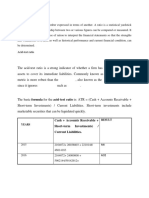

CURRENT RATIO

YEAR

2011-2012

:-

1.94

2012-2013

:-

1.55

2013-2014

:-

1.98

2014-2015

:-

2.16

2015-1016

:-

2.11

ratio of current assets to current liabilities.

current ratio is always 2:1 it means the current assets two

time of current liability.

After observing the figure the current ratio is fluctuating.

In the year 2015 ratio is showing good shine.

Hear ratio is increase as a increasing rate from 2011 to

2015.

QUICK RATIO

YEAR

2011-2012

:-

2.50

2012-2013

:-

2.02

2013-2014

:-

2.53

2014-2015

:-

2.95

2015-2016

:-

3.06

Companys Quick Assets is more than Quick Liabilities for all

these 5 years.

In 2015-2016 the ratio is increasing because of increase in

bank and cash balance.

So all the years has quick ratio exceeding 2, the firm is in

position to meet its immediate obligation in all the years.

In 2012-2013 quick ratio is decreased because the increase in

quick assets is less proportionate to the increased quick

liabilities.

The Quick ratio was at its peak in 2015-2016, while was lowest

in the 2012-2013.

NET WORKING CAPITAL

YEAR

2011-2012

:-

118.08

2012-2013

:-

97.56

2013-2014

:-

127.39

2014-2015

:-

176.44

2015-2016

:-

151.88

This ratio represents that part of the long term funds

represented by the net worth and long term debt, which

are permanently blocked in the current assets.

It is being fluctuating year by year because of assets

increasing and decreasing faster than liabilities

ASSETS TURN OVER RATIO

YEAR

2011-2012

:-

1.14

2012-2013

:-

1.15

2013-2014

:-

1.25

2014-2015

:-

1.11

2015-2016

:-

1.01

The total assets turnover ratio is almost same in all years.

The Assets turnover Ratio is near by 1.13 in all 5 years which

shows effective utilization of assets from the companys view

point.

In the year 2013-2014 ratio is increased because of companys

total assets is increased, sales are increased. So the ratio is

increased but in current year it is decreased because sale

increasing and Assets increasing.

You might also like

- Data Analysis and InterpretationDocument27 pagesData Analysis and InterpretationeshuNo ratings yet

- Sadafco PartDocument6 pagesSadafco PartQusai BassamNo ratings yet

- University of Swabi: Group Leader:-Awais Ali (02) Group Members: - Waqas Ali (05) Sohail IqbalDocument23 pagesUniversity of Swabi: Group Leader:-Awais Ali (02) Group Members: - Waqas Ali (05) Sohail IqbalFarhan IsrarNo ratings yet

- Deptor Turn Over RatioDocument2 pagesDeptor Turn Over RatioananthakumarNo ratings yet

- FIN 440 FinalDocument31 pagesFIN 440 FinalKajiul Hazad KhondokerNo ratings yet

- 1) Current Ratio:: FormulaDocument6 pages1) Current Ratio:: FormulaniceprachiNo ratings yet

- Ratio Analysis of TAJGVK Hotels and Resort - Group4Document32 pagesRatio Analysis of TAJGVK Hotels and Resort - Group4Shuvam DotelNo ratings yet

- Analysis of Ratios:: Liquidity RatioDocument3 pagesAnalysis of Ratios:: Liquidity RatioAmitesh PuriNo ratings yet

- Acc CaDocument10 pagesAcc CaBhumika BiyaniNo ratings yet

- DD Finance ReportDocument25 pagesDD Finance ReportVishwasKariyaNo ratings yet

- Name: Yesha Gandhi & Meghana Vansiya Class: MBA (Sem 1) Subject: Accounting For Managers Roll No.Document16 pagesName: Yesha Gandhi & Meghana Vansiya Class: MBA (Sem 1) Subject: Accounting For Managers Roll No.Tapan ShahNo ratings yet

- Cia 3Document10 pagesCia 3Yashvi JainNo ratings yet

- Days Sales Outstanding: Introduction To Business Finance Assignment No 1Document10 pagesDays Sales Outstanding: Introduction To Business Finance Assignment No 1Varisha AlamNo ratings yet

- Finance Report - Bcom B.docx 2Document10 pagesFinance Report - Bcom B.docx 2Krishna SisodiyaNo ratings yet

- GAIL 2015 Financial Ratio AnalysisDocument8 pagesGAIL 2015 Financial Ratio AnalysisVarun PatelNo ratings yet

- Nestle Pakistan Project Report by Dilawer Askari - 180795Document16 pagesNestle Pakistan Project Report by Dilawer Askari - 180795mirza dilawerNo ratings yet

- Fin 254 - Project: Company Name: Meghna Cement Mills LimitedDocument18 pagesFin 254 - Project: Company Name: Meghna Cement Mills LimitedAniruddha RantuNo ratings yet

- Analysis of The Evolution of Financial Indicators For The Period 2004-2014 TRANSGAZ SADocument8 pagesAnalysis of The Evolution of Financial Indicators For The Period 2004-2014 TRANSGAZ SAMinh Anh MinhNo ratings yet

- AnalysisDocument3 pagesAnalysisRaphael SisonNo ratings yet

- 1) Ratio Calculations: (1) CurrentDocument13 pages1) Ratio Calculations: (1) CurrentRahul KumarNo ratings yet

- Nestle Ratio AnalysisDocument16 pagesNestle Ratio Analysistech& GamingNo ratings yet

- Research MethodologyDocument3 pagesResearch MethodologyGoutam SoniNo ratings yet

- Analysis of Balance Sheet: Current AssetsDocument2 pagesAnalysis of Balance Sheet: Current AssetsAjayNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisikramNo ratings yet

- Alafco Company Financial AnalysisDocument3 pagesAlafco Company Financial AnalysisBusiness ConsultancyNo ratings yet

- Financial Ratio Analysis of HealthsouthDocument11 pagesFinancial Ratio Analysis of Healthsouthfarha tabassumNo ratings yet

- Data Analysis and Interpretation Calculation and Interpretation of RatiosDocument27 pagesData Analysis and Interpretation Calculation and Interpretation of RatiosGGUULLSSHHAANNNo ratings yet

- Engro Foods Engro Foods Engro FoodsDocument37 pagesEngro Foods Engro Foods Engro FoodsAli haiderNo ratings yet

- Company Profile Company Overview Caely Holding BerhadDocument20 pagesCompany Profile Company Overview Caely Holding BerhadAnonymous qnKORAm3KNo ratings yet

- Data Analysis and InterpretationDocument15 pagesData Analysis and InterpretationMukesh KarunakaranNo ratings yet

- Assignment Assess The Period 2013 To 2016 and Answer These Questions: Financial Enterprises: Scotia Bank, InterbankDocument5 pagesAssignment Assess The Period 2013 To 2016 and Answer These Questions: Financial Enterprises: Scotia Bank, InterbankRESOLUCION DE EXAMENESNo ratings yet

- ANALYSISDocument14 pagesANALYSISAnika Tabassum RodelaNo ratings yet

- Financial Statement AnalysisDocument13 pagesFinancial Statement AnalysisAhmad YounasNo ratings yet

- Excel CalculationDocument3 pagesExcel CalculationSharanya RamasamyNo ratings yet

- SampleDocument5 pagesSampleDyuty FirozNo ratings yet

- Sample AssignmentDocument24 pagesSample AssignmentanushkaNo ratings yet

- Project: Flying Cement CompanyDocument21 pagesProject: Flying Cement CompanyAleena IdreesNo ratings yet

- 6.1 Findings: Ratio Is 1.5 in 2014. in The Year 2015, The Current Ratio of The Company Deteriorates Further ToDocument3 pages6.1 Findings: Ratio Is 1.5 in 2014. in The Year 2015, The Current Ratio of The Company Deteriorates Further TolkNo ratings yet

- Group 7 Vinamilk Financial AnalysisDocument17 pagesGroup 7 Vinamilk Financial AnalysisLại Ngọc Cẩm NhungNo ratings yet

- Kirukku 4 and 5Document36 pagesKirukku 4 and 5Smart Earn 2020 ONLINENo ratings yet

- Standard Ratio-InterpretDocument3 pagesStandard Ratio-InterpretNational ProjectCentreNo ratings yet

- Costco Financial AnalysisDocument1 pageCostco Financial AnalysisSakshiNo ratings yet

- DocumentDocument1 pageDocumentOshin MenNo ratings yet

- Literature Review On Financial Statements AnalysisDocument10 pagesLiterature Review On Financial Statements AnalysisLaarnie PantinoNo ratings yet

- Name: Akbar Khan Roll No: 181889 Class: BSAF 4A Sub. To: Sir Abdul KhalidDocument10 pagesName: Akbar Khan Roll No: 181889 Class: BSAF 4A Sub. To: Sir Abdul Khalidtech& GamingNo ratings yet

- Analysis and TabulationDocument6 pagesAnalysis and TabulationManjesh KumarNo ratings yet

- Unilever Financial AnalysisDocument6 pagesUnilever Financial AnalysisMehwish IlyasNo ratings yet

- Ratio - Dutch LadyDocument7 pagesRatio - Dutch Ladyushanthini santhirasegarNo ratings yet

- 3.0 Liquidity and Financial StabilityDocument4 pages3.0 Liquidity and Financial StabilityJeThro LockingtonNo ratings yet

- Nestle BHD VSF&NDocument18 pagesNestle BHD VSF&NLina LinaNo ratings yet

- Report PresentationDocument23 pagesReport PresentationdigitycoonNo ratings yet

- CAPM and RatiosDocument5 pagesCAPM and Ratiospankaj chandnaNo ratings yet

- Liquidity Market Performance AnalysisDocument4 pagesLiquidity Market Performance AnalysisJessicaNo ratings yet

- Analysis For Dalmia Bharat LTD: Capital StructureDocument4 pagesAnalysis For Dalmia Bharat LTD: Capital Structurejaiminspatel127No ratings yet

- Liquidity Ratios1Document3 pagesLiquidity Ratios1Rahul KhajuriaNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument5 pagesRatio Analysis: Liquidity RatiosVanshGuptaNo ratings yet

- Chapter 5 - ThesisDocument5 pagesChapter 5 - ThesisPradipta KafleNo ratings yet

- Faisal Spinning Mills Limited: Ratio AnalysisDocument11 pagesFaisal Spinning Mills Limited: Ratio Analysisaitzaz ahmedNo ratings yet

- Pantaloons Ratio AnalysisDocument15 pagesPantaloons Ratio Analysisdhwani3192No ratings yet