Professional Documents

Culture Documents

2014 Analyses by Segment

2014 Analyses by Segment

Uploaded by

BurhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 Analyses by Segment

2014 Analyses by Segment

Uploaded by

BurhanCopyright:

Available Formats

3.

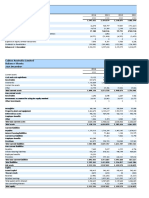

Analyses by segment

3.1 Operating segments

Revenue and results

In millions of CHF

Impairment

of goodwill

of which

restructuring costs

of which

impairment (c)

Sales

(a)

Trading

operating profit

Net other trading

income/(expenses) (b)

2014

Zone Europe

15,175

2,327

(105)

(27)

(81)

Zone Americas

27,277

5,117

(316)

(59)

(59)

(1,835)

Zone Asia, Oceania and Africa

18,272

3,408

(110)

(11)

(31)

(52)

Nestl Waters

7,390

714

(34)

(7)

(28)

(1)

Nestl Nutrition

9,614

1,997

(105)

(45)

(13)

(4)

13,884

2,654

(35)

(6)

(4)

(16)

Other businesses

(d)

Unallocated items

(e)

(2,198)

91,612

Total

14,019

(92)

(4)

(41)

(797)

(159)

(257)

(1,908)

In millions of CHF

Impairment

of goodwill

of which

restructuring costs

of which

impairment (c)

Sales

(a)

Trading

operating profit

Net other trading

income/(expenses) (b)

2013 (f)

Zone Europe

15,567

2,331

(115)

(33)

(54)

(2)

Zone Americas

28,358

5,162

(415)

(31)

(91)

Zone Asia, Oceania and Africa

18,851

3,562

(37)

(7)

(13)

7,257

665

(24)

(11)

9,826

1,961

(78)

(11)

(34)

(84)

12,299

2,175

(67)

(43)

(18)

(23)

(109)

(7)

(67)

(845)

(143)

(274)

(114)

Nestl Waters

Nestl Nutrition

Other businesses

(d)

Unallocated items

(e)

92,158

Total

(1,809)

14,047

(5)

(a) Inter-segment sales are not significant.

(b) Included in Trading operating profit.

(c) Impairment of property, plant and equipment and intangible assets.

(d) Mainly Nespresso, Nestl Professional, Nestl Health Science and Nestl Skin Health (renamed following the integration of Galderma as from July 2014).

(e) Refer to the Segment reporting section of Note 1 Accounting policies for the definition of unallocated items.

(f) 2013 comparatives have been restated following the transfer of responsibility for Nestea RTD businesses in geographic Zones to Nestl Waters

effective as from 1 January 2014.

00-031Extract from the Conolidated Financial Statements of the Nestl Group 2014

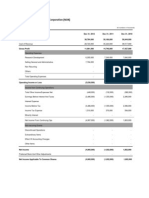

3. Analyses by segment (continued)

3.1 Operating segments

Assets and other information

In millions of CHF

Depreciation and

amortisation of

segment assets

of which

capital expenditure

Capital additions

Segment assets

of which

goodwill and

intangible assets

2014

Zone Europe

11,308

2,050

749

747

(473)

Zone Americas

20,915

7,952

1,226

1,039

(681)

Zone Asia, Oceania and Africa

15,095

4,580

803

697

(510)

6,202

1,569

327

308

(403)

Nestl Nutrition

24,448

15,352

501

363

(330)

Other businesses (a)

21,345

13,295

10,399

573

(525)

Unallocated items (b)

11,892

9,559

258

187

(136)

Nestl Waters

(1,928)

Inter-segment eliminations

109,277

Total segments

54,357

14,263

3,914

(3,058)

24,173

Non-segment assets

133,450

Total

In millions of CHF

Depreciation and

amortisation of

segment assets

of which

capital

expenditure

Capital additions

Segment assets

of which

goodwill and

intangible assets

2013 (c)

Zone Europe

11,779

2,229

980

964

(517)

Zone Americas

21,243

9,058

1,134

1,019

(769)

Zone Asia, Oceania and Africa

14,165

4,284

1,279

1,280

(520)

6,046

1,575

405

377

(442)

22,517

14,089

562

430

(337)

Nestl Waters

Nestl Nutrition

9,564

3,709

1,091

642

(437)

Unallocated items (b)

11,060

8,768

293

216

(143)

Inter-segment eliminations

(2,021)

Other businesses

(a)

Total segments

Non-segment assets

Total

94,353

43,712

5,744

4,928

(3,165)

26,089

120,442

(a) Mainly Nespresso, Nestl Professional, Nestl Health Science and Nestl Skin Health (renamed following the integration of Galderma

as from July 2014).

(b) Refer to the Segment reporting section of Note 1 Accounting policies for the definition of unallocated items.

(c) 2013 comparatives have been restated following the transfer of responsibility for Nestea RTD businesses in geographic Zones to

Nestl Waters effective as from 1 January 2014.

00-031Extract from the Conolidated Financial Statements of the Nestl Group 2014

3. Analyses by segment (continued)

3.2 Products

Revenue and results

In millions of CHF

Impairment

of goodwill

of which

restructuring costs

of which

impairment (b)

Trading

operating profit

Sales

Powdered and Liquid Beverages

Net other trading

income/(expenses) (a)

2014

(16)

20,302

4,685

(51)

(23)

(28)

6,875

710

(34)

(7)

(27)

(1)

Milk products and Ice cream

16,743

2,701

(162)

(19)

(62)

(1,028)

Nutrition and Health Science (c)

13,046

2,723

(121)

(45)

(16)

(4)

Prepared dishes and cooking aids

13,538

1,808

(148)

(39)

(29)

(807)

9,769

1,344

(129)

(4)

(42)

(52)

11,339

2,246

(60)

(18)

(12)

(2,198)

(92)

(4)

(41)

(797)

(159)

(257)

(1,908)

Water

Confectionery

PetCare

Unallocated items

(d)

91,612

Total

14,019

In millions of CHF

Impairment

of goodwill

of which

restructuring costs

of which

impairment (b)

Trading

operating profit

Sales

Powdered and Liquid Beverages

Net other trading

income/(expenses) (a)

2013

4,649

(95)

(21)

6,773

678

(21)

(9)

Milk products and Ice cream

17,357

2,632

(177)

(14)

(44)

Nutrition and Health Science (c)

11,840

2,228

(120)

(44)

(38)

(107)

Prepared dishes and cooking aids

14,171

1,876

(120)

(28)

(61)

Confectionery

10,283

1,630

(86)

(19)

(23)

PetCare

11,239

2,163

(117)

(1)

(17)

(1,809)

(109)

(7)

(67)

(2)

(845)

(143)

(274)

(114)

Unallocated items

(d)

92,158

Total

14,047

(a) Included in Trading operating profit.

(b) Impairment of property, plant and equipment and intangible assets.

(c) Renamed following the integration of Galderma as from July 2014.

(d) Refer to the Segment reporting section of Note 1 Accounting policies for the definition of unallocated items.

00-031Extract from the Conolidated Financial Statements of the Nestl Group 2014

(27)

20,495

Water

(5)

3. Analyses by segment (continued)

3.2 Products

Assets and liabilities

In millions of CHF

Powdered and Liquid Beverages

Water

Milk products and Ice cream

Nutrition and Health Science

(a)

Prepared dishes and cooking aids

Confectionery

PetCare

Unallocated items

eliminations

Total

(b)

and intra-group

Liabilities

Assets

of which

goodwill and

intangible assets

2014

11,599

648

4,790

5,928

1,532

1,764

14,387

4,874

3,818

32,245

21,578

4,325

13,220

6,099

2,934

7,860

1,964

2,561

14,344

9,182

2,004

1,179

2,176

(2,668)

100,762

48,053

19,528

In millions of CHF

Powdered and Liquid Beverages

Water

Milk products and Ice cream

Nutrition and Health Science

(a)

Prepared dishes and cooking aids

Confectionery

PetCare

Unallocated items

eliminations

Total

(b)

and intra-group

Liabilities

Assets

of which

goodwill and

intangible assets

2013

11,044

477

4,607

6,209

1,621

1,747

14,805

5,220

3,773

28,699

18,648

3,838

13,289

6,373

2,761

8,190

2,071

2,611

14,064

9,185

1,819

1,081

2,146

(2,821)

97,381

45,741

(a) Renamed following the integration of Galderma as from July 2014.

(b) Refer to the Segment reporting section of Note 1 Accounting policies for the definition of unallocated items.

00-031Extract from the Conolidated Financial Statements of the Nestl Group 2014

18,335

You might also like

- PDF GemaraDocument10 pagesPDF Gemaracberman10150% (2)

- New Heritage Doll Company Case SolutionDocument42 pagesNew Heritage Doll Company Case SolutionRupesh Sharma100% (6)

- Practice Questions-Adjusting Entries, DepreciationDocument7 pagesPractice Questions-Adjusting Entries, DepreciationmianwaseemNo ratings yet

- CCC Report - ECT, Climate Change and Clean Energy TransitionDocument78 pagesCCC Report - ECT, Climate Change and Clean Energy TransitionJosé Ángel Sánchez Villegas100% (1)

- Revocable vs. Irrevocable Trust AgreementDocument3 pagesRevocable vs. Irrevocable Trust AgreementJfm A DazlacNo ratings yet

- Comprehensive Barangay Youth Development Plan (Cbydp)Document3 pagesComprehensive Barangay Youth Development Plan (Cbydp)Ahmie Jhoy Mangibat82% (33)

- Tata Steel Q1 FY15 16Document6 pagesTata Steel Q1 FY15 16mariyathai_1No ratings yet

- People vs. Ringor, 320 SCRA 342 (1999)Document4 pagesPeople vs. Ringor, 320 SCRA 342 (1999)Clark LimNo ratings yet

- Investment PrimerDocument39 pagesInvestment PrimerMartin MartelNo ratings yet

- Case 3 RespondentDocument12 pagesCase 3 RespondentRicha Baweja100% (3)

- Financial Results Up To DateDocument24 pagesFinancial Results Up To DateWilliam HernandezNo ratings yet

- Puma Energy Results Report q4 2016Document8 pagesPuma Energy Results Report q4 2016KA-11 Єфіменко ІванNo ratings yet

- 21 Profit and Loss AccountDocument1 page21 Profit and Loss AccountAhmad KhanNo ratings yet

- Puma Energy Results Report q3 2016 v3Document8 pagesPuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванNo ratings yet

- FMT Tafi Federal LATESTDocument62 pagesFMT Tafi Federal LATESTsyamputra razaliNo ratings yet

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaNo ratings yet

- Audited Financial FY2014Document11 pagesAudited Financial FY2014Da Nie LNo ratings yet

- Brean Capital Expecting Positive Panel in June Reiterates PGNX With A BUY and $11PTDocument4 pagesBrean Capital Expecting Positive Panel in June Reiterates PGNX With A BUY and $11PTMayTepper100% (1)

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2014Document21 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2014rikky adiwijayaNo ratings yet

- Emma Walker s0239551 Ass#3Document23 pagesEmma Walker s0239551 Ass#3Emma WalkerNo ratings yet

- Horizontal Analysis of The Income StatementDocument11 pagesHorizontal Analysis of The Income StatementIntan HidayahNo ratings yet

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015Document19 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015rikky adiwijayaNo ratings yet

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Document4 pagesUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikNo ratings yet

- Half-Year 2013 Results: Belek - TurquieDocument28 pagesHalf-Year 2013 Results: Belek - TurquieEugen IonescuNo ratings yet

- Third Quarter Ended 31 December 2011Document19 pagesThird Quarter Ended 31 December 2011Norliza YusofNo ratings yet

- Attock CementDocument16 pagesAttock CementHashim Ayaz KhanNo ratings yet

- Nevro Reports Fourth Quarter and Full Year 2016 Financial Results and Provides 2017 OutlookDocument5 pagesNevro Reports Fourth Quarter and Full Year 2016 Financial Results and Provides 2017 OutlookmedtechyNo ratings yet

- Bayern Publisher DataDocument24 pagesBayern Publisher DataDipiNo ratings yet

- DQ'12 ResultsDocument4 pagesDQ'12 ResultsAdib RahmanNo ratings yet

- Nhs England Annual Accounts Report 2019 20Document50 pagesNhs England Annual Accounts Report 2019 20Michel LNo ratings yet

- DemonstraDocument75 pagesDemonstraFibriaRINo ratings yet

- Financial Report Financial ReportDocument14 pagesFinancial Report Financial Report8001800No ratings yet

- Consolidated Statement of Changes in Equity Ar15 Tcm244-477390 en Tcm244-477390 enDocument1 pageConsolidated Statement of Changes in Equity Ar15 Tcm244-477390 en Tcm244-477390 enAnonymous f7wV1lQKRNo ratings yet

- HUL MQ 12 Results Statement - tcm114-286728Document3 pagesHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNo ratings yet

- Tiso Blackstar Annoucement (CL)Document2 pagesTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNo ratings yet

- TCS Balance SheetDocument3 pagesTCS Balance SheetdushyantkrNo ratings yet

- Airbus Annual ReportDocument201 pagesAirbus Annual ReportfsdfsdfsNo ratings yet

- Cisco - Balance Sheeet Vertical AnalysisDocument8 pagesCisco - Balance Sheeet Vertical AnalysisSameh Ahmed Hassan0% (1)

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- Horizontal Balance SheetDocument2 pagesHorizontal Balance Sheetkathir_petroNo ratings yet

- Mills 3Q12 ResultDocument17 pagesMills 3Q12 ResultMillsRINo ratings yet

- XVI. Appendix: (A) Competitor's Financial StatementDocument4 pagesXVI. Appendix: (A) Competitor's Financial StatementMargenete CasianoNo ratings yet

- Nokia Financial StatementsDocument5 pagesNokia Financial StatementsSaleh RehmanNo ratings yet

- DAI 2009 Annual ReportDocument264 pagesDAI 2009 Annual Reportdarshit88No ratings yet

- Kuantan Flour Mills SolverDocument20 pagesKuantan Flour Mills SolverSharmila DeviNo ratings yet

- Analysis of Financial Statements: Bs-Ba 6Document13 pagesAnalysis of Financial Statements: Bs-Ba 6Saqib LiaqatNo ratings yet

- National Foods by Saqib LiaqatDocument14 pagesNational Foods by Saqib LiaqatAhmad SafiNo ratings yet

- VW Group. Q4 AnalysisDocument15 pagesVW Group. Q4 AnalysisSilviu TrebuianNo ratings yet

- NBP Unconsolidated Financial Statements 2015Document105 pagesNBP Unconsolidated Financial Statements 2015Asif RafiNo ratings yet

- CJE2016年报 锦江环境年报Document35 pagesCJE2016年报 锦江环境年报hua tianNo ratings yet

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocument17 pages2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlNo ratings yet

- Copia de Analytical Information 30 Sep 2010Document12 pagesCopia de Analytical Information 30 Sep 2010Ivan Aguilar CabreraNo ratings yet

- Nexa - Financial Statements 2021Document74 pagesNexa - Financial Statements 2021Jefferson JuniorNo ratings yet

- Research and Development Sanofi-AventisDocument36 pagesResearch and Development Sanofi-AventisKnyazev DanilNo ratings yet

- Financial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Document13 pagesFinancial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Ghizal NaqviNo ratings yet

- SummaryDocument11 pagesSummaryarmeneh khachoomianNo ratings yet

- 02 Statement of Income With NotesDocument3 pages02 Statement of Income With NotesThinkingPinoyNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Financial StatementsDocument20 pagesFinancial Statementswilsonkoh1989No ratings yet

- Mills' 2Q12 Result: Ebitda Financial Indicators Per Division Income StatementDocument16 pagesMills' 2Q12 Result: Ebitda Financial Indicators Per Division Income StatementMillsRINo ratings yet

- Cebu AirDocument22 pagesCebu AirCamille BagadiongNo ratings yet

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgNo ratings yet

- Maybank Nestle ResearchDocument7 pagesMaybank Nestle ResearchCindy SimNo ratings yet

- Balance Sheet: Titan Industries LimitedDocument4 pagesBalance Sheet: Titan Industries LimitedShalini ShreyaNo ratings yet

- Financial Accounting 2020 June - July Exam Question PaperDocument16 pagesFinancial Accounting 2020 June - July Exam Question PaperLaston Milanzi50% (2)

- FY 2012 Audited Financial StatementsDocument0 pagesFY 2012 Audited Financial StatementsmontalvoartsNo ratings yet

- Copy of (SW.BAND) Урок 6. Lenta - DCF - SolutionDocument143 pagesCopy of (SW.BAND) Урок 6. Lenta - DCF - SolutionLee SinNo ratings yet

- PPIC Outline Fall 2016Document8 pagesPPIC Outline Fall 2016mianwaseemNo ratings yet

- Role of Demand Management in MPC SystemDocument40 pagesRole of Demand Management in MPC SystemmianwaseemNo ratings yet

- To Whom It May ConcernDocument1 pageTo Whom It May ConcernmianwaseemNo ratings yet

- Volunteership FormDocument3 pagesVolunteership Formmianwaseem50% (2)

- Mag 7Document3 pagesMag 7mianwaseemNo ratings yet

- Criminal Justice Dissertation ExamplesDocument7 pagesCriminal Justice Dissertation ExamplesCollegePapersForSaleUK100% (1)

- Print Bringing Your Pet Dog, Cat or Ferret To Great Britain - Overview - GOV - UKDocument16 pagesPrint Bringing Your Pet Dog, Cat or Ferret To Great Britain - Overview - GOV - UKChimpsNo ratings yet

- Technology Vs CA DigestDocument2 pagesTechnology Vs CA Digestadeline_tan_4100% (1)

- Complete B.SC EconomicsDocument42 pagesComplete B.SC EconomicsKajal Chaudhary100% (1)

- Parameter List PDFDocument4 pagesParameter List PDFNaresh HingonikarNo ratings yet

- Social Accountability in Sierra Leone: Influencing For Pro-Poor WASH Investment in The 24-Month Post-Ebola Recovery PlanningDocument8 pagesSocial Accountability in Sierra Leone: Influencing For Pro-Poor WASH Investment in The 24-Month Post-Ebola Recovery PlanningOxfamNo ratings yet

- Cariaga Bir Lease Contract (Kamias)Document8 pagesCariaga Bir Lease Contract (Kamias)florelee de leonNo ratings yet

- The General Aptitude Test Battery As Predictor O F Vocational Readjustment by Psychiatric PatientsDocument1 pageThe General Aptitude Test Battery As Predictor O F Vocational Readjustment by Psychiatric PatientsKRUNAL ParmarNo ratings yet

- GRP 8 PPT PresentationDocument21 pagesGRP 8 PPT PresentationTinotenda ChiveseNo ratings yet

- Lalla VakyaniDocument233 pagesLalla Vakyanirazvan rotaru100% (1)

- New Research ReportDocument4 pagesNew Research ReportRaviNo ratings yet

- User Manual PDFDocument7 pagesUser Manual PDFabdulsamadNo ratings yet

- LAP Application Form 2019Document5 pagesLAP Application Form 2019brampokNo ratings yet

- Full Text For Vergara vs. OmbudsmanDocument24 pagesFull Text For Vergara vs. OmbudsmannoonalawNo ratings yet

- Functional Language PDFDocument6 pagesFunctional Language PDFDacian BarbosuNo ratings yet

- Little Dog Tie PDFDocument6 pagesLittle Dog Tie PDFAshleigh GriffithNo ratings yet

- Formal Complaint Against Moustafa Awad MattDocument5 pagesFormal Complaint Against Moustafa Awad MattAnonymous oUYx023Ng4No ratings yet

- Some Psychological Aspects of DecisionmakingDocument32 pagesSome Psychological Aspects of DecisionmakingSefarielNo ratings yet

- Akrama Sakrama Form 2014Document12 pagesAkrama Sakrama Form 2014Uttam Hoode100% (1)

- Submitted To: Submitted By:: Dr. Kartik Dave Neha NagarDocument5 pagesSubmitted To: Submitted By:: Dr. Kartik Dave Neha NagarPANKAJNo ratings yet

- Akuntansi 3Document4 pagesAkuntansi 3Icha Novia R.No ratings yet

- NonTeaching Staff NotificationDocument5 pagesNonTeaching Staff NotificationArunNo ratings yet

- Decided CasesDocument24 pagesDecided CasesJuvz BezzNo ratings yet