Professional Documents

Culture Documents

Mobile Proximity Payments Sample Pages

Uploaded by

heruOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mobile Proximity Payments Sample Pages

Uploaded by

heruCopyright:

Available Formats

3

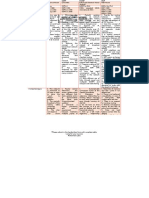

Mobile proximity payments: scenarios for market development

Table 1.1: SWOT analysis of mobile NFC [Source: Analysys Mason, 2008]

Strengths

Opportunities

Mobile devices provide the electronic

capabilities (including battery, processing

power and memory) to support NFC

applications

The high penetration of mobile devices

in developed markets offers vast economies

of scale for NFC deployment (in 2006,

Analysys Research forecasted that

1.1 billion mobile phones would be sold

worldwide in 2007)2

NFC can significantly extend the range of

applications that can be offered via mobile

devices, and thereby presents significant

revenue opportunities for stakeholders, as

well as benefits such as a reduction in cash

handling and card issuing costs

NFC is compatible with contactless card

standards, so can employ infrastructure

deployed for other contactless services

NFC infrastructure is already in place as a

result of the deployment of contactless cards

and readers for payment and transportation

ticketing. This should enable wider take-up

of NFC-based services

Subscribers to mobile wallet applications

may be less likely to switch service provider

because of the perceived difficulties of

transferring multiple applications

Services based on NFC may provide

co-branding and cross-marketing

opportunities between stakeholders

Mobile devices are one of a small number

of personal items that users always carry

around with them

Weaknesses

Threats

Trials indicate strong consumer demand

for NFC despite security concerns, but the

success of a commercial launch remains

uncertain

The business case for MNOs is unclear

Mutually beneficial business models have

yet to be established between MNOs and

major application owners (such as financial

service providers and transport companies).

Key issues still have to be resolved,

including share of costs and revenue, and

ownership of the customer

Several handset manufacturers (such as

Motorola, Nokia and Samsung) support

NFC, but have yet to ship large volumes

of NFC-compatible handsets

The chip price (at USD35 per handset) is

prohibitively expensive for MNOs. Suppliers

believe that they are unable to reduce the

price to a more favourable level in the

absence of sizeable orders, and no MNO

has committed to a large order to date

The cost of upgrading to an NFC-enabled

mobile phone may be prohibitive for

consumers unless it is subsidised

Consumers are concerned about the

security of mobile-device-based transactions

Mobile phones may be at greater risk of

being stolen if they are NFC-enabled

Adding more hardware and software to the

mobile handset will place further demands

on the form factor

NFC functionality may reduce mobile phone

battery life

See Suo-Saunders, Y., Evolution of Mobile Handsets to 2011 and Beyond: market analysis and forecasts,

Analysys Research (Cambridge, 2006).

Analysys Mason Limited 2008

1: Mobile proximity payments can create valuable revenue opportunities

10

Mobile proximity payments: scenarios for market development

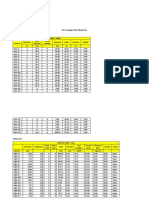

Figure 2.1: Key events in the development of mobile proximity payments in Japan,

4Q 20012Q 2007 [Source: Analysys Mason, 2008]

July 2004: NTT

November 2001:

DoCoMo launches

November 2005:

Launch of Edy

the Osaifu-Keitai

Vodafone (now Softbank)

(Euro, Dollar,

(mobile wallet)

launches S! FeliCa

Yen) a prepaid

phone

September 2005:

March 2007:

electronic money

KDDI launches

Launch of MNO

service promoted October 2003: FeliCa

EZ FeliCa

EMOBILE

networks founded

by bitWallet

4Q01 2Q02 4Q02 2Q03 4Q03 2Q04 4Q04 2Q05 4Q05 2Q06 4Q06 2Q07

November 2001:

Launch of SuICa,

a contactless smart

card used on the JR

East railway network,

Tokyo Monorail and

Rinkai Line in Japan

November 2003:

October 2005:

Introduction of

Launch of the ICOCA

MNP in Japan

card for usage on the

Urban Network, which

encompasses the major

cities of Osaka, Kyoto

and Kobe

September 2006: JR

East, NTT DoCoMo,

JCB and bitWallet

announce that they

will share a common

platform to enable

their e-payment

brands to share the

same POS

reader/writer devices

and data centres

NTT DoCoMos Osaifu-Keitai is arguably the worlds most successful implementation

of contactless technologies as an enabler of mobile payment and ticketing to date in terms

of end-user adoption. NTT DoCoMo had 28.5 million Osaifu-Keitai subscribers at the end

of March 2008, which represented 53% of its total subscriber base. The service comprises

a range of payment and ticketing applications, including:

online shopping

in-store shopping

financial services (such as cash withdrawals and credit card payments)

membership and loyalty cards

keys and ID cards

transportation (for example, train tickets and airport check-in)

event ticketing (such as for cinema screenings).

2: Initiatives in southern Asia demonstrate the potential for NFC

Analysys Mason Limited 2008

You might also like

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondFrom EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondNo ratings yet

- Near Field Communication (NFC) Technology: The Future Mobile Money Service For KenyaDocument11 pagesNear Field Communication (NFC) Technology: The Future Mobile Money Service For KenyaAakash SheelvantNo ratings yet

- Age of Mobile Data: The Wireless Journey To All Data 4G NetworksFrom EverandAge of Mobile Data: The Wireless Journey To All Data 4G NetworksRating: 4.5 out of 5 stars4.5/5 (5)

- SWOT Analysis of Near Field Communication TechnologyDocument17 pagesSWOT Analysis of Near Field Communication Technologymd rizwanNo ratings yet

- Unit 10 OMBE 307 - Digital MarketingDocument20 pagesUnit 10 OMBE 307 - Digital MarketingJibandaanPharmacy Doctors ChamberNo ratings yet

- (About Business) : QuestionsDocument2 pages(About Business) : QuestionsFahri HamzalahNo ratings yet

- (About Business) : QuestionsDocument2 pages(About Business) : QuestionsFahri HamzalahNo ratings yet

- The Effects of Technology Readiness and Technology Acceptance On NFC Mobile Payment Services in KoreaDocument12 pagesThe Effects of Technology Readiness and Technology Acceptance On NFC Mobile Payment Services in KoreaBejoSinambelaNo ratings yet

- An Assessment of NFC For Future Mobile Payment SystemsDocument7 pagesAn Assessment of NFC For Future Mobile Payment Systemswoody woodpeckerNo ratings yet

- Presentation1Document2 pagesPresentation1saininitika87No ratings yet

- The Japan Mobile Internet ReportDocument51 pagesThe Japan Mobile Internet ReportmicroHackerNo ratings yet

- Mobile PaymentsDocument36 pagesMobile Paymentsadnan67No ratings yet

- Kyoshi Mori NTT DocomoDocument20 pagesKyoshi Mori NTT DocomoRicha BudhirajaNo ratings yet

- Architecture of a Mediation SystemDocument10 pagesArchitecture of a Mediation System20025041No ratings yet

- GSMA Mobile Wallet White Paper Version 1 0Document18 pagesGSMA Mobile Wallet White Paper Version 1 0sergemartinbkkNo ratings yet

- Preface: Different Features People Considered While Purchasing Mobile PhoneDocument35 pagesPreface: Different Features People Considered While Purchasing Mobile PhoneSujish NairNo ratings yet

- NFC Payment Applications Explored in Mobile DevicesDocument5 pagesNFC Payment Applications Explored in Mobile DevicesAhmed adelNo ratings yet

- NFC Enabling Technology FinalDocument11 pagesNFC Enabling Technology FinalKunal KrishnaNo ratings yet

- A Comparative Study of Critical Success Factors Csfs in Implementation of Mobile Money Transfer Services in KenyaDocument24 pagesA Comparative Study of Critical Success Factors Csfs in Implementation of Mobile Money Transfer Services in Kenyaauroob_irshadNo ratings yet

- Topic: Journey of Mobile Phones and It's FutureDocument11 pagesTopic: Journey of Mobile Phones and It's FuturePrabha KaruppuchamyNo ratings yet

- Benefits and challenges of M-Commerce in MalaysiaDocument13 pagesBenefits and challenges of M-Commerce in MalaysiaNoorazian NoordinNo ratings yet

- History Introduction Architecture Application Potential Threats ConclusionDocument15 pagesHistory Introduction Architecture Application Potential Threats ConclusionShailesh JainNo ratings yet

- Ecommerce Transaction in Moble Computing EnvironmentDocument16 pagesEcommerce Transaction in Moble Computing EnvironmentkhshethNo ratings yet

- The Mobile Money Revolution - NFC Mobile PaymentsDocument22 pagesThe Mobile Money Revolution - NFC Mobile PaymentsITU-T Technology Watch100% (1)

- E CommerceDocument18 pagesE CommerceFaaiso LajecleeyNo ratings yet

- Why Cell Phones Will Dominate The Future Internet: Categories and Subject Descriptors 2. OverviewDocument4 pagesWhy Cell Phones Will Dominate The Future Internet: Categories and Subject Descriptors 2. OverviewNishank AgarwalNo ratings yet

- Regulation of Indian Mobile Network Industry: "Enabler or Disabler"Document78 pagesRegulation of Indian Mobile Network Industry: "Enabler or Disabler"Jaspal SolankiNo ratings yet

- Mobile BankingDocument19 pagesMobile BankingIbe CollinsNo ratings yet

- White Paper: Mobile NFC in Transport: September 2012 Non ConfidentialDocument31 pagesWhite Paper: Mobile NFC in Transport: September 2012 Non ConfidentialJoe NelsonNo ratings yet

- Mobile Network Operator Strategy: An Obstacle For Mobile Value Services?Document11 pagesMobile Network Operator Strategy: An Obstacle For Mobile Value Services?Arvind ShuklaNo ratings yet

- Mobile Commerce Overview and Key ConceptsDocument7 pagesMobile Commerce Overview and Key ConceptsNIDHIHINDORIA88GMAILNo ratings yet

- Mobile Payments Using NPC TechnologyDocument13 pagesMobile Payments Using NPC TechnologyTu Nguyen MinhNo ratings yet

- NFC Technology in Public TransportDocument6 pagesNFC Technology in Public TransportAhmed adelNo ratings yet

- Consumer Behavior Towards Mobile Phones in Rural Areas: U.S. Patent 887,357 Nathan B. Stubblefield Murray, KentuckyDocument24 pagesConsumer Behavior Towards Mobile Phones in Rural Areas: U.S. Patent 887,357 Nathan B. Stubblefield Murray, Kentuckyphaneedhar reddyNo ratings yet

- M CommerceDocument19 pagesM CommerceShaikYusafNo ratings yet

- NFCDocument24 pagesNFCArjunkrishnanep Arjun100% (2)

- Bresson BissonDocument13 pagesBresson Bissonafzallodhi736No ratings yet

- Report of Mobile Communication by Mussab MohammedDocument15 pagesReport of Mobile Communication by Mussab Mohammedمصعب محمد عدنانNo ratings yet

- Unit II Mobile CommerceDocument29 pagesUnit II Mobile Commercehemanth kumarNo ratings yet

- Mobile Banking ProjectDocument7 pagesMobile Banking ProjectAnonymous FMNH3ZpNo ratings yet

- Defining User Requirements for Next-Gen Mobile AppsDocument16 pagesDefining User Requirements for Next-Gen Mobile AppsMohamed YaacoubNo ratings yet

- It's All About My Phone! Use of Mobile Services in Two Finnish Consumer SamplesDocument15 pagesIt's All About My Phone! Use of Mobile Services in Two Finnish Consumer Samplesdominic3586No ratings yet

- Mobile CommerceDocument10 pagesMobile CommerceAbel JacobNo ratings yet

- Analysis of Mobile Payment Influencing FactorsDocument7 pagesAnalysis of Mobile Payment Influencing FactorsCS & ITNo ratings yet

- Analysis of The Global Smartphone Market and The Strategies of Its Major PlayersDocument21 pagesAnalysis of The Global Smartphone Market and The Strategies of Its Major PlayersrhldxmNo ratings yet

- Near-Field Communication: Where Next?Document4 pagesNear-Field Communication: Where Next?Ralph AdamNo ratings yet

- NFC-enabled payments and e-wallets adoptionDocument6 pagesNFC-enabled payments and e-wallets adoptionAman SharmaNo ratings yet

- Mobile Banking Background Services and A PDFDocument12 pagesMobile Banking Background Services and A PDFsome oneNo ratings yet

- Executive SummaryDocument22 pagesExecutive SummaryshahramliveNo ratings yet

- Subscriber Analytix WhitepaperDocument28 pagesSubscriber Analytix WhitepaperPatrick OmoyaNo ratings yet

- Intention To Use New Mobile Payment Systems A Comparative Analysis of SMS and NFC PaymentsDocument20 pagesIntention To Use New Mobile Payment Systems A Comparative Analysis of SMS and NFC PaymentsFadjar StwnNo ratings yet

- Personal Broadband and The Evolution of Mobile IndustryDocument21 pagesPersonal Broadband and The Evolution of Mobile Industryi_liveNo ratings yet

- White Paper Flexi NG Versus RoutersDocument16 pagesWhite Paper Flexi NG Versus RoutersClueMarinemailinatoNo ratings yet

- Paper 75Document16 pagesPaper 75tsureda1290No ratings yet

- M-Commerce: Presented By: Jan-e-Ali Nabi Junaid HemaniDocument22 pagesM-Commerce: Presented By: Jan-e-Ali Nabi Junaid Hemaniaskfor73No ratings yet

- Ajba 05022007 Newsnet BDocument9 pagesAjba 05022007 Newsnet BMancy Nish S.No ratings yet

- ITFMDocument9 pagesITFMmizsitiNo ratings yet

- Despre Smartphone-Uri - ReferatDocument5 pagesDespre Smartphone-Uri - ReferatChiribău Radu ŞtefanNo ratings yet

- Mobility in Wireless CommunicationDocument5 pagesMobility in Wireless CommunicationAkhilesh GoyalNo ratings yet

- Mobile Payments Research: A Literature Review FrameworkDocument17 pagesMobile Payments Research: A Literature Review FrameworkVanessa ZehNo ratings yet

- Kode Icd X AdmedikaDocument8 pagesKode Icd X AdmedikaA- RONIENo ratings yet

- Test Substansi Program Online Academy DTS 2020-2 PDFDocument1 pageTest Substansi Program Online Academy DTS 2020-2 PDFJordiNo ratings yet

- Lat Sol 2Document4 pagesLat Sol 2heruNo ratings yet

- Latihansoal PDFDocument49 pagesLatihansoal PDFheruNo ratings yet

- Identifying The ProblemDocument8 pagesIdentifying The ProblemheruNo ratings yet

- Contoh Soal SapDocument20 pagesContoh Soal Sapheru100% (2)

- Dijk StraDocument4 pagesDijk StraheruNo ratings yet

- Assignment RPDocument2 pagesAssignment RPheruNo ratings yet

- Chapter 14Document28 pagesChapter 14heruNo ratings yet

- DBX 1066 Cut Sheeta 2Document2 pagesDBX 1066 Cut Sheeta 2ZoranNo ratings yet

- WSDOT McDowell Final WirelessCommDocument83 pagesWSDOT McDowell Final WirelessCommoldjanusNo ratings yet

- Bombe 4Document154 pagesBombe 4Adith K PNo ratings yet

- Abb - Technical Guide VFDDocument44 pagesAbb - Technical Guide VFDThejas HK100% (1)

- Nama: Fiqo Pramudia NPM: 09.2018.1.00609 Jurusan: Teknik LingkunganDocument3 pagesNama: Fiqo Pramudia NPM: 09.2018.1.00609 Jurusan: Teknik LingkunganFiqo PramudiaNo ratings yet

- Comparative Study of Honda City and Hyundai Verna Project ReportDocument78 pagesComparative Study of Honda City and Hyundai Verna Project ReportjasikaNo ratings yet

- Experiment 6Document10 pagesExperiment 6Kabir AgnihotriNo ratings yet

- TDS Turbonycoil TN600 1E19Document2 pagesTDS Turbonycoil TN600 1E19Emad The EnthusiastNo ratings yet

- Astm E140-2012Document25 pagesAstm E140-2012Alessio MercataliNo ratings yet

- Service Manual: Super PlusDocument250 pagesService Manual: Super PlusАндрей Рычков100% (1)

- Tandemloc Aj12a00Document2 pagesTandemloc Aj12a00baloo122No ratings yet

- Orgone Motor SkepticismDocument2 pagesOrgone Motor SkepticismoyomiNo ratings yet

- Ficha Tecnica Ciac Hi Wall 60 HZ R-22Document1 pageFicha Tecnica Ciac Hi Wall 60 HZ R-22Eduardo GarcíaNo ratings yet

- Alcohol Phenol Ether One Shot Bounce BackDocument129 pagesAlcohol Phenol Ether One Shot Bounce BackShivadeep VishwakarmaNo ratings yet

- ViewingDocument49 pagesViewingnishasaiyed2304No ratings yet

- Debug 1214Document9 pagesDebug 1214D-rifkyNo ratings yet

- Solidworks SimulationDocument30 pagesSolidworks SimulationDavid Raj100% (1)

- Alspa Drive Range - Drives Solutions PDFDocument8 pagesAlspa Drive Range - Drives Solutions PDFRahul AnandNo ratings yet

- ISO 3834 2 - Rev. 1.0 - ENG - Final 20201016 1Document2 pagesISO 3834 2 - Rev. 1.0 - ENG - Final 20201016 1musthafaNo ratings yet

- Fundamentals Satellite Communication Part 1Document51 pagesFundamentals Satellite Communication Part 1Safwan MohamedNo ratings yet

- Bias Point Analysis by Hand and in SPICE DescriptionDocument6 pagesBias Point Analysis by Hand and in SPICE DescriptionMit MA0% (1)

- SM Maintenance Instructions: Author: Lars Rydén, Konecranes AB, SwedenDocument132 pagesSM Maintenance Instructions: Author: Lars Rydén, Konecranes AB, SwedenDan VekasiNo ratings yet

- P343 Relay Testing ReportDocument8 pagesP343 Relay Testing ReportUsman MughalNo ratings yet

- Chapter 7 Software Development StrategiesDocument41 pagesChapter 7 Software Development StrategiesBurime GrajqevciNo ratings yet

- 10 21 0030 - MPFDocument20 pages10 21 0030 - MPFdavid leeNo ratings yet

- AHU DetailsDocument2 pagesAHU DetailsamitbslpawarNo ratings yet

- Form Summary: MR Sukumar DhanapalanDocument8 pagesForm Summary: MR Sukumar Dhanapalanaadhya guptaNo ratings yet

- Livrari Autoturisme Autohtone / Domestic Passenger Car DeliveriesDocument3 pagesLivrari Autoturisme Autohtone / Domestic Passenger Car DeliveriesBogdan PopNo ratings yet

- STC PDFDocument34 pagesSTC PDFМиша ШаулаNo ratings yet

- CATALAGO ZITRON Rev 1Document16 pagesCATALAGO ZITRON Rev 1Vaibhav GuptaNo ratings yet

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Defensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityFrom EverandDefensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityRating: 5 out of 5 stars5/5 (1)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Rating: 5 out of 5 stars5/5 (1)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- Elevate: The Three Disciplines of Advanced Strategic ThinkingFrom EverandElevate: The Three Disciplines of Advanced Strategic ThinkingRating: 4.5 out of 5 stars4.5/5 (3)

- Sales Pitch: How to Craft a Story to Stand Out and WinFrom EverandSales Pitch: How to Craft a Story to Stand Out and WinRating: 4.5 out of 5 stars4.5/5 (2)

- The Digital Marketing Handbook: A Step-By-Step Guide to Creating Websites That SellFrom EverandThe Digital Marketing Handbook: A Step-By-Step Guide to Creating Websites That SellRating: 5 out of 5 stars5/5 (6)

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantFrom EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantRating: 4 out of 5 stars4/5 (387)

- Python for Beginners: The 1 Day Crash Course For Python Programming In The Real WorldFrom EverandPython for Beginners: The 1 Day Crash Course For Python Programming In The Real WorldNo ratings yet

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- Lean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdFrom EverandLean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdRating: 4.5 out of 5 stars4.5/5 (17)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffFrom EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffNo ratings yet

- Impact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeFrom EverandImpact Networks: Create Connection, Spark Collaboration, and Catalyze Systemic ChangeRating: 5 out of 5 stars5/5 (8)

- HBR Guide to Setting Your StrategyFrom EverandHBR Guide to Setting Your StrategyRating: 4.5 out of 5 stars4.5/5 (18)

- The Internet Con: How to Seize the Means of ComputationFrom EverandThe Internet Con: How to Seize the Means of ComputationRating: 5 out of 5 stars5/5 (6)

- Systems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessFrom EverandSystems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessRating: 4.5 out of 5 stars4.5/5 (80)

- The Wires of War: Technology and the Global Struggle for PowerFrom EverandThe Wires of War: Technology and the Global Struggle for PowerRating: 4 out of 5 stars4/5 (34)

- Your Creative Mind: How to Disrupt Your Thinking, Abandon Your Comfort Zone, and Develop Bold New StrategiesFrom EverandYour Creative Mind: How to Disrupt Your Thinking, Abandon Your Comfort Zone, and Develop Bold New StrategiesRating: 4 out of 5 stars4/5 (10)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (11)

- Net Positive: How Courageous Companies Thrive by Giving More Than They TakeFrom EverandNet Positive: How Courageous Companies Thrive by Giving More Than They TakeRating: 4.5 out of 5 stars4.5/5 (17)

- Power and Prediction: The Disruptive Economics of Artificial IntelligenceFrom EverandPower and Prediction: The Disruptive Economics of Artificial IntelligenceRating: 4.5 out of 5 stars4.5/5 (38)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- The 10X Rule: The Only Difference Between Success and FailureFrom EverandThe 10X Rule: The Only Difference Between Success and FailureRating: 4.5 out of 5 stars4.5/5 (289)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffFrom EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffRating: 5 out of 5 stars5/5 (61)

- Amp It Up: Leading for Hypergrowth by Raising Expectations, Increasing Urgency, and Elevating IntensityFrom EverandAmp It Up: Leading for Hypergrowth by Raising Expectations, Increasing Urgency, and Elevating IntensityRating: 5 out of 5 stars5/5 (50)