Professional Documents

Culture Documents

0001 00index PDF

0001 00index PDF

Uploaded by

Muhamad UmarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0001 00index PDF

0001 00index PDF

Uploaded by

Muhamad UmarCopyright:

Available Formats

SNA VIII Solo, 15 16 September 2005

KEYWORD INDEX

A

Abnormal accrual

514

Abnormal return

203;223

Accounting information

87

Accounting information

strategy

Accrual

747

Accrual-based and cash flowbased

Accruals

Budget participation

656

Business performance

694

Business process

820

Business process performance

820

Business unit performance

708

441

Capability of information

system personnel

Capital

340

117

Cash flow

Cash flow component

460;514

308

Adoption and implementation

774

Causal cognitive mapping

736

Affect toward use

880

Chi-square test

441

Agency problems

262

Classical linier model

504

Alliance

207

Client characteristics

46

Amortization

325

Client cycle time

941

Artificial and classificatory

smoothing

Asset intensity

195

903

667

Client importance for public

accountant frms

Client preference

917

308

836

Asymmetric information

117

Client size

941

Audit committee

147

917

Audit judgment

903

Client-public accountant

firms relationship

Client's audit experience

903

Audit experience

903

Audit report lag

941

Clients' expectations

903

Auditee-auditor relationship

characteristic

Auditing

46

Comitment escalation

747

Company size

379

917;955

Company's growth

966

Auditor characteristics

46

Company's net profit margin

136

Auditor independence

917

46

Auditors

617

Company's operating

leverage ratios

Company's profitability ratios

136

Auditor litigation

136

Auditors' individual

characteristics

Auto regressive model

929

Competitive dinamycs

820

Complience reporting

248

Computer anxiety

894

Conservatism

396

Corporate governance

248;475

Corporate governance

mechanism

Corporate ownership

172

504

B

Bankcruptcy of bank

340

Bankruptcy prediction model

441;966

Belief adjustment model

955

Benevolents

617

Board characteristics

248

Bond performance

355

Budget goal commitment

656

262

Corporate social responsibility

disclosure

Corporate valuation

379

1

Cost of equity capital

100

Customer capital

694

70

SNA VIII Solo, 15 16 September 2005

D

808

Financial performance

23;37;808

Financial ratios

277;441;524

Financial report ethics

791

Data envelopment

analysis (DEA)

Debt

262

Financial risk

340

Debt ratio

288

Financial statement

325

Diamond specification

694

Firm characteristic

367

Disclosure

379

Firm cycle time

941

Disclosure (Kep. 38/PM/1996)

117

Firm size

631

Discretionary accruals

117

Firm value

297

Diversification

297

207

Dividend

288

Formalization of information

system development

Formalization of policy

836

Divestiture

631

Dividend announcements

75

Formalization relations

631

Dividend payout

262

Format rasio

849

Dividends changes policy

23

Format skematik (kartun)

849

Dividend-signaling hypothesis

23

Framing

736;955

Downgrade

355

Friday returns

491

Dysfunctional audit behavior

929

E

E/P Ratios

Earned income

554

Earning response coefficient

159

Earnings

1;308;460;514

Earnings management

100;117;172;514

Earnings quality

147;172

Earnings response coefficient

147

Efektif dan efisien

849

Efficiency

524

Employee intensity

667

Endowed income

554

Entitleds

617

Enviromental performance

37

Ethical behaviour

617

Ex ante uncertainty

11

Excess value

297

Expected consequences of use

880

External locus of control

617

G

Gaya kepemimpinan

586

Gender

631

General and administrative cost

667

Geografies segments

941

Going concern audit opinion

966

Going concern opinion

941

Good coorporate governance

238

Goodwill

325

Governmental auditor

979

Granger causality model

504

Gross profit

159

H

Hirarki akuntan

634

Human capital

694

I

Income (Inequality)

759

Income smoothing

136

Individual performance

722

Facilitating conditions

880

Individual-group decision

747

Financial distress

340;396;460

Industrial type

136

71

SNA VIII Solo, 15 16 September 2005

Industry

367

Information content

355

Information system

866

Macro economic

367

Initial public offering (IPO)

11;87

Macro variables

504

Initial return

11;87;538

Macroeconomic growth

667

Instrumental variables

396

Management accounting systems

708

Intellectual capital

694

Management performance

565

Intensity of market competition

708

Managerial ownership

262

Internal locus of control

617

Managerial performance

656

Internal market

297

Market efficiency

514

Inventory

955

Market reaction

75;159

Investor motivation

195

565

IPO

538

Measurement performance

systems

Men

617

ISO 14001 certification

37

Mentoring

676

IT Investments

808

Monday returns

491

Jakarta stock exchange

64;87;966

Negative earnings surprise

223

Jenis Industri

538

Net profit

159

Job relevant information

656

New accounting students

791

Job satisfaction

676

New information system

722

JSX

195

Non accounting information

87

Junior

617

Non audit services provided by

public accountant firms

Non smother companies

903

223

Kinerja keuangan

238

Kinerja manajerial

586

Komitmen afektif

643

Komitmen berkelanjutan

643

Organization procedures

631

Komitmen organisasi

586

Organization size

836

Komitmen profesional

643

Over reaction

64

Kurs

538

O

Operating profit

L

Last two weeks

491

Leverage

379

Liquidity ratio

288

Loser-Winner

159

64

Partisipasi anggaran

586

Pengelolaan laba

475

Penyajian informasi akuntansi

849

Penyajian informasi dalam

format laporan keuangan

Perceived barriers

849

631

Perception

617

Performance

676

72

SNA VIII Solo, 15 16 September 2005

Performance changes of firms

277

Skill of computer use

894

Performance measure

774

Smoother companies

223

Political and organizatonal

culture factors

Positive accounting theory

774

Social norms

880

396

Social security

759

Positive earnings surprise

223

Sticky cost

667

Poverty

759

Stock return

504

Proffesion ethics

617

Strategic decision

736

Profile

379

Structural capital

676

Profit center

565

Structural equation modeling

820

Profitability

379

Struktur kepemilikan

238;475

Profitability ratio

288

Syariah stock beta

367

Public accounting firm

631

System quality

866

Q

Qualitiy measurement

866

Task technology fit

880

Tax player complience

554

Tax reform 2000

524

Tax tariff

554

Rating announcement

355

Technology

722

Rational factors

774

617

Real

195

The ethic code of the indonesian

accountants associate

The monday effect

491

Reliance

722

Time-varying

491

Reputasi Penjamin Emisi

538

Top management support

836

Reputation of public

accounting firm

Return

966

Total aktiva

538

288

565

Return on asset

37

Total quality management

(TQM)

Trading volume activity

223

Return stock

308

Transparency

248

Reward systems

565

Turnover intention

676

ROE

538

Two-group discriminant analysis

441

Role conflict

676

Ukuran perusahaan

475

Underpricing

538

Sampling Audit

979

Selection Bias

979

Up grade

355

Selling

667

836

Senior

617

Senior accounting students

791

Signaling theory

396

User accounting information

system satisfaction

User accounting information

use

User involvement

836

Significantly influences

277

User satisfaction

866

Size of board commissioner

379

Utilization

774

Size of the company

136

Utilization and performance

880

836

73

SNA VIII Solo, 15 16 September 2005

V

Value chain

820

Value of firms

248

W

Weak form efficient market

491

Welfare

759

Women

617

Y

Yield to maturity

355

74

SNA VIII Solo, 15 16 September 2005

AUTHOR INDEX

H

A

Ahmad, Hamzah

Alim, M. Nisarul

Amrul S, Sadat

Anindhita, Anggara A.

Apriani, Lisia

Ari, Syahril

Ariyani, Yayuk

Ariyanto, Andry

Astuti, Istiati Diah

Astuti, Partiwi Dwi

Atmini, Sari

941

941

866

325

75

23

808

11

894

694;880

460

B

Baridwan, Zaki

Bastian, Indra

Biyanto, Frasto

Boediono, Gideon SB.

Budileksmana, Antariksa

Budiyanto, Enjang Tachyan

355

759

667

172

491

903

676

514

E

Effriyanti

Ekawati, Erni

Ekayani, Ni Nengah Seri

747

1

820

F

Fanny, Margaretta

Febrianto, Rahmat

Fitriany

Fuad

966

23;159

791

262

G

Ghozali, Imam

Gumanti, Tatang Ari

774

117

367

297

238

136

849

I

Ika, Siti Rohmah

Ikhsan, Arfan

Irawati, Yuke

Iyhig, Wulan

524

708

929

759

J

Januarti, Indira

Jumaili, Salman

903

722

C

Cahyono, Dwi

Cahyonowati, Nur

Halim, Abdul

Halim, Julia

Hamzah, Ardi

Harto, Puji

Hastuti, Theresia Dwi

Herawaty, Arleen

Heriningsih, Sucahyo

656;820

11

Komalasari, Puput Tri

Komara, Acep

Koroy, Tri Ramaraya

Kurniawan, Bobby

Kusuma, Indra Wijaya

Kusumawati, Dwi Novi

554

836

917

23

631

248

L

Lekatompessy, Jantje Eduard

Lestari, Murti

Listianingsih

Lo, Eko Widodo

643

504

565

396

M

Mardiyah, Aida Ainul

Martani, Dwi

Mayangsari, Sekar

Meiden, Carmel

Meriewaty, Dian

Mukhlasin

Mulia, Teodora Winda

Mursalim

565

325;538

46

117

277

929

631

195

75

SNA VIII Solo, 15 16 September 2005

N

Nashih, Moh.

Nasir, Mohamad

Nugrahaningsih, Putri

554

903

617

475

100

O

Oktorina, Megawati

288

Widiastuty, Erna

Windyastuti

Wuryan A

159

667

460

Pebrikasari, Patricia Ajeng

Petronila, Thio Anastasia

Prabowo, Ronny

207

929

808

R

Raharja, Surya

Rahmawati

Rasdianto

Ratmono, Dwi

Riyanto LS, Bambang

Utama, Siddharta

Utami, Wiwik

979

64;308

708

514

248

Yolana, Chastina

Yulianti

Yusfaningrum, Kusnariyanti

Yushanti, Lucia

Yusnaini

538

791

656

849

736

Z

Zu'amah, Surroh

Zuhrotun

Zulaekha

441

355

820

S

Sabeni, Arifin

Saputra, Sylvia

Sembiring, Eddy Rismanda

Setyani, Astuti Yuli

Sihaloho, Ferry Laurensius

Siregar, Sylvia Veronica NP.

Suartana, I Wayan

Suaryana, Agung

Subekti, Imam

Sudaryono, Eko Arief

Sudibyo, Bambang

Suharli, Michell

Sukarno, Hari

Sulistio, Helen

Sumarno, J.

Sunarta, I Nyoman

Suryani, Tri

Suryaningsum, Sri

Susi

Suwito, Edy

Syar'ie, Ahyadi

694

966

379

277

774

475

955

147

223;941

894

46

288

340

87

596

880

64

849

37

136

866

T

Tobing, Rudolf Lumban

117

76

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Partnership ReviewerDocument21 pagesPartnership ReviewerAnonymous FmktZlQNo ratings yet

- Time Driven ABC (003 073)Document71 pagesTime Driven ABC (003 073)Leon RodriguezNo ratings yet

- List of BPO CompaniespdfDocument17 pagesList of BPO CompaniespdfMbamali Chukwunenye100% (1)

- SAP For PharmaDocument36 pagesSAP For PharmaAbdulla Fatiya100% (3)

- Data Privacy VS Data SecurityDocument3 pagesData Privacy VS Data SecurityTeo ShengNo ratings yet

- Design4india DatabaseDocument18 pagesDesign4india DatabasePrabhu GNo ratings yet

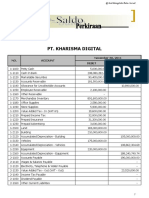

- Kunci Jawaban Pt. Kharisma DigitalDocument91 pagesKunci Jawaban Pt. Kharisma DigitalSanti Mulya100% (3)

- Bookkeeping Module Work in ProgressDocument37 pagesBookkeeping Module Work in Progressalmira lubanNo ratings yet

- Week 4 Morgan PLC ProblemDocument6 pagesWeek 4 Morgan PLC Problemgiangpham271003No ratings yet

- Strategic Management: Prof. Anita KeraiDocument12 pagesStrategic Management: Prof. Anita KeraiMuskan ValbaniNo ratings yet

- BRF+ in Real TimeDocument12 pagesBRF+ in Real TimeJanardhan raoNo ratings yet

- Upload Assignment 2Document3 pagesUpload Assignment 2ashibhallauNo ratings yet

- SWOT and PEST Analysis of Southwest AirlinesDocument6 pagesSWOT and PEST Analysis of Southwest AirlinesAmmara LatifNo ratings yet

- Case SummaryDocument11 pagesCase SummaryAditya ChaudharyNo ratings yet

- The Influence of Inventory Control Management On Financial Organization PerformanceDocument19 pagesThe Influence of Inventory Control Management On Financial Organization Performancemiljane perdizoNo ratings yet

- Mas CVP AnalysisDocument7 pagesMas CVP AnalysisVanessa Arizo ValenciaNo ratings yet

- Bindhu SunseraDocument15 pagesBindhu SunserabinduNo ratings yet

- Intp LK TW Iv 2019Document141 pagesIntp LK TW Iv 2019Davila RANo ratings yet

- Uganda Standards Template - DUS - ISO - IEC - 27003Document79 pagesUganda Standards Template - DUS - ISO - IEC - 27003balajiNo ratings yet

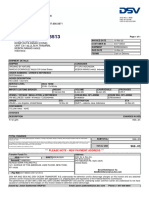

- Freight Inv-8Document5 pagesFreight Inv-8dpotgrNo ratings yet

- Osha MQP'SDocument6 pagesOsha MQP'S1DA19CS156 Shubha SNo ratings yet

- Chapter 9 - Interim Financial ReportingDocument17 pagesChapter 9 - Interim Financial Reportingarlynajero.ckcNo ratings yet

- Unit 5erpDocument16 pagesUnit 5erpmayilu2122No ratings yet

- Ch04 SolutionDocument9 pagesCh04 SolutionNoor ALiNo ratings yet

- Sties 2017 Invitation OriginalDocument10 pagesSties 2017 Invitation OriginalHarry FabrosNo ratings yet

- Field Work Assignment: Submited To Indira School of ManagementDocument42 pagesField Work Assignment: Submited To Indira School of ManagementManav Pratap SinghNo ratings yet

- Work Book Operating Costing and VarianceDocument6 pagesWork Book Operating Costing and VarianceAshwini KhareNo ratings yet

- ETHICSDocument12 pagesETHICSAilyn AriasNo ratings yet

- FAQs - MarketingDocument4 pagesFAQs - MarketingAmresh YadavNo ratings yet

- PAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsDocument15 pagesPAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsSandeep ModhNo ratings yet