Professional Documents

Culture Documents

JOng

JOng

Uploaded by

Ashesh PoudelOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JOng

JOng

Uploaded by

Ashesh PoudelCopyright:

Available Formats

Jong is a carpenter and runs his own business building and installing kitchen cupboards.

Jong decided to sell his business and to retire when he was aged 53 years.

Jong sold his business premises for $680,000 on 1 May 2016. He had inherited this

building on the death of his father in June 2006. Jasons father was also a carpenter and had

acquired the building in 1998 for $60,000 and it was valued at $520,000 at the time of his death.

The company that bought the business premises from Jong paid him an additional

$25,000 for his promise not to carry on another carpentry business in the local area for three

years from 1 May 2016. Jong has a carry forward capital loss of $31,000 as at 30 June 2015 from

the sale of shares.

1. Assuming Jong is not entitled to the small business CGT concessions, advise him on the

CGT consequences of these transactions.

2. Assuming Jong is entitled to the small business CGT concessions, explain how these may

apply to the capital gains made by Jong

Advice on Capital gain tax consequences not entitled to small business CGT concessions

Capital gain tax consequences- assuming he is entitled to small business CGT consequences

You might also like

- NBS-7026A Workshop 2 Questions - AccountingDocument1 pageNBS-7026A Workshop 2 Questions - Accountingizudominic03No ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Question and Answer - 14Document31 pagesQuestion and Answer - 14acc-expert0% (2)

- Sunway T1 (TX4014) - Business IncomeDocument4 pagesSunway T1 (TX4014) - Business IncomeEe LynnNo ratings yet

- Fall 2015 Test 3Document14 pagesFall 2015 Test 3Adam MichaelNo ratings yet

- Brandon Company S Annual Accounting Year Ends On June 30 ItDocument1 pageBrandon Company S Annual Accounting Year Ends On June 30 ItM Bilal SaleemNo ratings yet

- M16 Advisory OMB QPDocument6 pagesM16 Advisory OMB QPkarlr9No ratings yet

- Past Exam QuestionDocument2 pagesPast Exam QuestionHuda AkramNo ratings yet

- GST Tax and Property Intro GuideDocument8 pagesGST Tax and Property Intro GuidetestnationNo ratings yet

- Legt2751 s2 2009 Final ExamDocument5 pagesLegt2751 s2 2009 Final ExamYvonne ChanNo ratings yet

- IAS 20 Extra QuestionsDocument3 pagesIAS 20 Extra QuestionsNimra MerajNo ratings yet

- Tutorial 2-2Document3 pagesTutorial 2-2Tan Zhao FeiNo ratings yet

- CGT 4Document6 pagesCGT 4Abhiraj RNo ratings yet

- Simple InterestDocument19 pagesSimple InterestJohn Rhimon Abaga GelacioNo ratings yet

- Accounting I Nov 2019 Exam Final PaperDocument8 pagesAccounting I Nov 2019 Exam Final Paper2603803No ratings yet

- Kinds of Simple InterestDocument2 pagesKinds of Simple InterestchloeNo ratings yet

- Class Activity 2 Principles of MicroeconomicsDocument1 pageClass Activity 2 Principles of MicroeconomicsTooba NoushadNo ratings yet

- Capital Gains Tax QuestionsDocument4 pagesCapital Gains Tax QuestionsRedfield GrahamNo ratings yet

- TQ U6 Salaries 4 2019 PDFDocument3 pagesTQ U6 Salaries 4 2019 PDFhelenNo ratings yet

- Homeloan DetailsDocument3 pagesHomeloan Detailsgurudev001No ratings yet

- Investment Accounting ProblemsDocument7 pagesInvestment Accounting Problemspritika mishraNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- Capital Gains Tax PDFDocument3 pagesCapital Gains Tax PDFvalsupmNo ratings yet

- Case Study 1: Make A Financial Report Part 1: Make A Balance SheetDocument3 pagesCase Study 1: Make A Financial Report Part 1: Make A Balance SheetThảo LêNo ratings yet

- Case Study-Statute of LimitationDocument2 pagesCase Study-Statute of LimitationpablopoparamartinNo ratings yet

- Sample Paper 2Document6 pagesSample Paper 2Law GuruNo ratings yet

- CFAP 5 AT SupplementDocument28 pagesCFAP 5 AT SupplementHassan NaeemNo ratings yet

- Bcom 3Document26 pagesBcom 3Nayan MaldeNo ratings yet

- Franchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFDocument1 pageFranchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFAllyssa ThalliaNo ratings yet

- ACC 1102 Case StudyDocument1 pageACC 1102 Case StudyMohammad Mosharof HossainNo ratings yet

- Unit 2 Time and Money D PDFDocument2 pagesUnit 2 Time and Money D PDFCarmelo Janiza LavareyNo ratings yet

- Tax 1 Mock BarDocument8 pagesTax 1 Mock BarMarco RvsNo ratings yet

- The Mound View Motel Opened For Business On May 1 PDFDocument1 pageThe Mound View Motel Opened For Business On May 1 PDFAnbu jaromiaNo ratings yet

- JD IiiDocument4 pagesJD IiiCharina BalunsoNo ratings yet

- 3-Pit ExercisesDocument4 pages3-Pit Exercisesngothanhthuy829No ratings yet

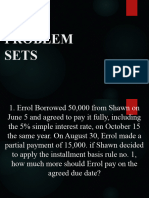

- Problem SetsDocument9 pagesProblem SetsBuddy OverthinkerNo ratings yet

- Intermediate Accounting 2Document23 pagesIntermediate Accounting 2hsjhsNo ratings yet

- Sac 407-Bsc Actuarial Science AssignmentDocument2 pagesSac 407-Bsc Actuarial Science AssignmentPatrick Mugo100% (1)

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- Sem V AssignmentDocument4 pagesSem V Assignmentpritika mishraNo ratings yet

- Topic 4 Class Discussion QuestionsDocument2 pagesTopic 4 Class Discussion Questionssyedimranmasood100No ratings yet

- Legal Forms Exercise April 13, 2021Document2 pagesLegal Forms Exercise April 13, 2021Sandra DomingoNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Single SystemDocument7 pagesSingle SystemRobert HensonNo ratings yet

- Lat NicolaiDocument7 pagesLat NicolaiKennyNovaniNo ratings yet

- Specific Financial Reporting Ac413 May19aDocument4 pagesSpecific Financial Reporting Ac413 May19aAnishahNo ratings yet

- Basis PeriodDocument26 pagesBasis Periodbehzadji7No ratings yet

- INTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Document1 pageINTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Ronn Robby RosalesNo ratings yet

- EEFM Assignment 1 ModifiedDocument2 pagesEEFM Assignment 1 ModifiedChinmay Swain0% (1)

- June 2021 SolutionDocument10 pagesJune 2021 SolutionJalees Ul HassanNo ratings yet

- Acc412 NCLDocument3 pagesAcc412 NCLNychi SitchonNo ratings yet

- 3-Pit ExercisesDocument5 pages3-Pit ExercisesNguyen Hoang Tram AnhNo ratings yet

- FR QuestionsDocument12 pagesFR Questionsram_eiNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Capital Budgeting Case StudyDocument2 pagesCapital Budgeting Case StudyAnand Prakash Sharma100% (1)

- 2021 Unit 12 Tutorial QuestionsDocument3 pages2021 Unit 12 Tutorial Questions日日日No ratings yet

- Assignment Chapter 5Document2 pagesAssignment Chapter 5Nati AlexNo ratings yet

- S - Adjusting Entry ProblemsDocument4 pagesS - Adjusting Entry ProblemsYusra PangandamanNo ratings yet

- Finals Barlis TaxDocument46 pagesFinals Barlis TaxRG BNo ratings yet

- Real Estate Investing Strategies: The Secret to Financial Independence with Real Estate: Real Estate Investing, #1From EverandReal Estate Investing Strategies: The Secret to Financial Independence with Real Estate: Real Estate Investing, #1No ratings yet