Professional Documents

Culture Documents

Green Banking Report 2013 PDF

Green Banking Report 2013 PDF

Uploaded by

EmranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Green Banking Report 2013 PDF

Green Banking Report 2013 PDF

Uploaded by

EmranCopyright:

Available Formats

Green Banking Report 2013

This document

2 | Ppresents

a g e information about Standard Chartered Banks environmental activities and performances in Bangladesh

for the year 2013 under the Policy Guideline for Green Banking of Bangladesh Bank.

Green Banking Report 2013

Contents

Sustainability and Our Business

Policy Formulation and Governance

Incorporation of Environmental Risk in

Core Risks Management

In-house Environment Management

Introducing Green Marketing

Employee Training, Consumer

Awareness and Green Event

13

Appendix 1: In-house Green Initiatives

and spent in 2013

14

1|Page

Green Banking Report 2013

Sustainability and Our Business

Sustainability is integrated into how we do

business. It guides everything we do,

from the services we provide to our

clients and customers, to the way we run

our bank and support the local

communities in which we live and work.

Our approach to sustainability is captured

in our brand promise, Here for good.

Our business strategy focuses on

banking the people and companies

driving investment, trade and the creation

of wealth across Asia, Africa and the

Middle East. Our core markets are

continuing to see strong economic

growth, with rising incomes and

increasing demand for financial services.

This represents a massive opportunity for

our business and, with it, the opportunity

to promote sustainable, balanced and

inclusive growth in our markets.

As a major international financial

institution, our commitment to society

goes beyond creating value for our

shareholders. We seek to ensure that the

financing we provide is sustainable and

supports

economic

and

social

development for all of our stakeholders.

Our approach focuses on three key

priorities:

-

2|Page

Contributing

to

sustainable

economic growth

Being a responsible company

Investing in communities

Green Banking Report 2013

Policy Formulation and Governance

Standard Chartered takes a long term

view of the environmental consequences

of its actions, either directly from our

operations or indirectly through our

relationship with business partners. We

ensure we build a sustainable business

that brings benefit to our shareholders,

society, the environment and local

economies.

Globally the management has indicated it

wants to ensure the brand is not

undermined

through

inappropriate

financing of environmentally vulnerable

projects, inefficient use of scarce natural

resource, or environmental volunteering

with poorly considered outcomes. The

bank also recognises that the Group has

an important role to play in ensuring that

employee interest in green issues is

harnessed through communication of the

Groups position, and role modelling

responsible behaviour with respect to the

environment. In this context, we position

ourselves to remain in the leading pack

in

relation

to

our environmental

commitments and place more emphasis

on optimal utilization of resources rather

than climate change issues to underpin

our approach.

In Bangladesh, Country Health, Safety

and Environment Committee has been

reviewing green banking and environment

related initiatives and Green Banking Unit

has been formed to coordinate the

activities

as per Green

banking

regulations as well as reporting the same

to Bangladesh Bank. As per the

Bangladesh Bank circular in December

2013; Risk Management Committee in

addition to the Country Health, Safety and

Environment Committee has taken up

same responsibility.

3|Page

Green Banking Report 2013

Incorporation of Environmental Risk in Core Risks Management

Standard Chartered recognises that its

financing decisions have a potential

impact on people and the environment.

The bank has 20 position statements on

high-impact sectors such as oil and gas,

mining and forestry, as well as key

issues, such as child labour, climate

change and water.

Environmental risk means the risk of

causing pollution or destruction of the

natural environment (land, water, air.

natural habitats, animals and plant

species), either through accidental or

deliberate actions.

149 projects having ETP (Effluent

Treatment Plant) financed

The Businesses will ensure that

appropriate procedures are designed to

meet these policy requirements e.g.

Project and Export Finance proposals will

be assessed in accordance with the

Equator Principles.

We recognise that our primary impact on

the natural environment is through our

The statements set out the environmental relationship with our customers and the

and social standards that Standard lending decisions we take. Therefore:

Chartered expects of itself and its clients.

The banks sustainable finance approach All our lending proposals will include

enables it to identify environmental risks consideration of environmental and social

and propose mitigating solutions at an issues where appropriate

early stage.

All lending proposals will take account of

internationally acceptable environmental

and social standards or local laws and

regulations where these are more

Our Highlights in 2013:

stringent

1420

projects

rated

under

Environment Due Diligence (100% The risks associated with both

implementation)

environmental and social issues will be

properly recognised, evaluated and

1238 rated projects financed

where appropriate mitigated

BDT 34223 Million disbursed for

projects having ETP

BDT 683 Million disbursed as direct

Green finance in 3 projects

4|Page

As per the above principles, we have

implemented

Environmental

Due

Diligence from June 2011 and have

applied the same as part of our risk

assessment. Since June 2011, we have

applied the Environment Risk Ratings to

100% of our projects that are applicable

for such due diligence.

Green Banking Report 2013

Improving standards in ship breaking

Standard Chartered Bangladesh has served the ship breaking sector for nearly 20

years, with most of its clients recognised as leaders in the industry.

By 2007, a number of accidents had occurred in the ship breaking industry, though

the frequency of accidents among Standard Chartered Bangladeshs clients had

remained low. Given the social implication of these accidents, Standard Chartered

requested all its ship breaking clients in Bangladesh and elsewhere to apply

stringent safety measures as a condition of financing. This included a restriction on

the purchase of ships with a high asbestos content. To secure a safer working

environment for ship breakers, all Standard Chartered clients were requested to

meet the standards of the International Labour Organization and International

Maritime Authority.

In making its changes at the risk of losing business Standard Chartered

Bangladesh acted ahead of standards being enforced by the Bangladesh

government. Subsequently, the government has introduced mandatory regulatory

approval by the Department of Environment as a condition for any ship breaking

activity taking place in Bangladesh.

5|Page

Green Banking Report 2013

In-house Environment Management

In 2009, we had made a global To reduce energy & water consumption:

commitment to significantly reduce Green cars introduced as part of car

energy and water use by 2019. Our

pool to save energy and reduce

design standards and operational criteria

carbon emissions.

are starting to transform the built Energy saving T5 lights introduced in

environment. We have made solid

all office buildings in Dhaka (Headprogress, but the pace has slowed as we

office and Monem Business District).

realised quick wins.

Renewable energy (Solar Power)

introduced for 2 ATM machines as

The economic imperative to save energy

pilot.

is growing as energy prices continue to Air-conditioning is centralized in all

rise more sharply. The impact is

Dhaka offices to save energy.

significant with every one per cent Motion sensors have been installed in

improvement in Group Energy Usage

our new premises in Monem

Intensity (EUI) equating to USD 600,000

Business District to optimize power

in running costs globally.

consumption in office lighting.

Energy usage for central airIn line with Global strategy; various

conditioning

has

been

further

continuous processes have been there to

reduced by the installation of Variable

minimize the banks direct operational

Frequency Devices (VFD).

impact to environment in Bangladesh:

In smaller premises (branch offices);

Airco saver equipments introduced

To reduce Paper usage and help save

for energy efficiency.

Trees:

Video conferencing with overseas

Green Printing Guideline is being

offices and between offices in Dhaka

circulated among staffs through

and Chittagong has reduced the need

internal communication on regular

for physical travel with associated

basis

carbon emission.

Soft archival of customer documents

Self-closing water taps installed in

for electronic access and retrieval is

Dhaka offices (Country HO and

enabling us to reduce consumption of

Monem Business District) which is

paper

saving water.

Majority of internal memos, process

Hand-wash towels replaced with

notes and records are in electronic

Dyson Air-blade equipments which

form

are saving both water and energy

Internal communications are done

usage in our offices in Dhaka.

through emails. All staffs have

dedicated email IDs for office use.

Customer communications are being

done through emails, SMS or ATM

display

instead

of

letter

communication (except for regulatory

requirements)

6|Page

Green Banking Report 2013

Greener cars for energy efficiency and reduced carbon

emission

As part of the plan to reduce carbon emission resulted by direct operational

impact; Standard Chartered bank has introduced green cars in its car pool. 2

units of 'HONDA INSIGHT HYBRID 2012' run at 11 KM/litre whereas

conventional cars run at 6 KM/litre. With daily operational distance of 200 KM;

these cars will save 15 litres of fuel per day which is equivalent of 36Kg of

carbon di-oxide emission to the environment (burning 1 Lt Petrol emits 2.3Kg

of carbon di-oxide and uses 1.7 Kg of oxygen which is the roughly equal to

daily oxygen required by average human). Therefore in other words, each of

these cars will save oxygen for 7 individuals per day.

Responsible and ethical e-waste disposal

Standard Chartered dispose obsolete or broken IT equipment ethically and

responsibly. Standard Chartered has implemented IT Asset Disposal Policy. It

is a part of the Banks commitment to limit our electronic waste impact on

environment.

The Waste Electrical and Electronic Equipment (WEEE) directive is European

Union law to ensure that electronic waste, or e-waste, is disposed of in a safe

way. At Standard Chartered, since 2008, we have been complying with this

global law by partnering with the right vendor to dispose, recover or

recondition our technological assets in an environmental-friendly manner.

However, retiring our IT assets has been a costly and logistical challenge for

the Bank.

In Bangladesh, we have engaged with a local vendor (DNET Limited) to

refurbish and distribute as donation, obsolete IT equipments to various schools

and other organizations for the underprivileged population since 2009. Under

the scheme, a total of 3744 pieces of various technology equipments (such as

computer CPU, monitor etc) has been distributed to around 200 organizations

worth estimated 5.72 million BDT during the period between 2009 and 2013.

7|Page

Green Banking Report 2013

Conserving energy with solar-powered ATMs

Bangladesh, as a country, suffers from an insufficient and erratic power supply. To

conserve energy and reduce its dependency on conventional power sources,

Standard Chartered Bangladesh is adopting renewable energy alternatives where

possible. Solar power is commonly used for lights, fans and computer operation in

Bangladesh to help ensure a continuous electricity supply.

Standard Chartered Bangladesh is also experimenting with using solar power to

run ATMs during daylight hours since 2012. From 9am to 7pm, an ATM machine at

the banks head office is run with solar power from a 1 kilowatt solar panel. After

7pm a timer transfers the power supply back to the regular source. The use of

solar power to run the ATM saves 3,600 KWH of energy annually, and reduces the

banks dependence on diesel generators.

Following the successful pilot, Standard Chartered Bangladesh is now considering

using solar power for ATMs at other branches and offices, as well off-site ATMs.

Another solar-powered ATM is installed in North Gulshan branch in 2013.

8|Page

Green Banking Report 2013

Introducing Green Marketing

Our Green Marketing and Products

initiatives are:

1. Customers can now avail instant

registration for Online Banking interface:

Customers can sign up instantly to Online

Banking using their Debit or Credit card.

No more visiting the branch and no more

hassle. Our Online Banking facility allows

the customer to bank from anywhere,

anytime

with

total

security

and

confidentiality. This service is absolutely

free for customers. Following banking

services can be availed through Online

Banking:

Transfer fund from One account to

another account within Standard

Chartered or to any BEFTN member

bank account (daily transfer limit

BDT 500K)

Pay bills for Standard Chartered

credit

cards,

mobile

phones

(Grameenphone, Banglalink, Airtel

and

Citicell),

internet

service

providers (Qubee and Banglalion)

and insurance premium (MetLife

Alico).

Request chequebook or account

statement

Place instruction for a regular

transfer of fund from account at

desired frequency

2. Round the clock book transfer

introduced for Straight2Bank (Online

Banking for institutional clients) client

see following section.

3. British Council online exams fee

collection launched through Online

Banking portal: Standard Chartered

Bangladesh, in collaboration with The

British Council Bangladesh launched a

9|Page

unique examination fee collection solution

based on Standard Chartered award

winning consumer banking internet

channel - online banking. All Standard

Chartered account holders can now pay

the British Council exam fees through the

online banking portal of Standard

Chartered Bank. This enables them to

pay for the different exams, without

having to come to the Standard

Chartered Bank branches. This is in line

with the digitalization strategy of both the

organizations and offers convenience of

online banking to British Council

examinees who are also Standard

Chartered Bank account holders.

4. Enhanced ATM functionality in

Bangladesh:

Standard

Chartered

accountholders can now transfer fund up

to BDT 500K per day to any Standard

Chartered account using Standard

Chartered ATM.

5. Enrolment to SMS banking and eStatement mandatory for all new

customers: E-Statement and SMS

Banking has been made mandatory for all

NTB (New to the bank) customers

effective from 1 May 2013.

6. We have introduced online application

for Credit Cards in Bangladesh: For the

first time in Bangladesh, Standard

Chartered Bank introduced the state-ofthe-art Online Application system to apply

for the Credit Card easily through online

from the website! This is giving the

customer an Approval-In-Principle, based

on which the customer will receive a

notification via email and a sales agent

will collect all the necessary documents

from the applicant.

Green Banking Report 2013

8. Paperless PIN introduced for credit

cards: Personal Identification Number

(PIN) delivery for cards has historically

been a costly and inconvenient paperbased process. Customers wait for

delivery of paper PIN that can be delayed

due to varieties of reasons. To address

the issue, we have explored alternate

mediums for PIN delivery and developed

a new PIN setting via phone banking

solution i.e. customer selects their own

PIN upfront via the phone which is

convenient, instantaneous, secure and

paperless.

Bangladesh becomes the first among

Standard Chartered market and the first

bank in the country to have paperless PIN

delivery service for both debit and credit

cards. Customer in Bangladesh now

enjoy following benefits:

Speed: Customers can change PIN

without

visiting

ATM

almost

instantaneously. The 2 to 3 days wait

for paper PIN is eliminated.

Personalisation: The PIN is set by

the customers post verification as per

bank standards and is done in a

secure manner.

27,000 sheets of paper are saved via

elimination of printing and postage of

envelopes in 3 years which generates a

total cost savings of USD 28000 for the

paper, printing and postage.

10 | P a g e

9. We are increasingly focusing on online

advertising: As opposed to tradition

paper-based advertisement mediums we

are increasingly focusing on online

platforms like Facebook, Websites etc. to

reach out customers with our offers and

promotions. We now have, by far, the

biggest community on Facebook among

all Financial Institutes in the country,

through which we are reaching out to

more than 300,000 people every week

electronically without any use of paper

mediums. All our offers, promotions,

news are also available on websites

which is visited by numerous people

everyday reducing the dependency from

paper-based notice circulation. All these

Digital initiatives are reducing our Carbon

footprints from day-to-day communication

activities.

Green Banking Report 2013

Online Banking Milestones

As the pioneering bank in Bangladesh market in introducing various technological

developments in providing customer services to reduce paper waste, saving gas

and minimize carbon emission, reducing printing costs and postage expenses. We

take pride in our online banking achievements in Bangladesh. Some of these

achievements are:

All of our 19 branches, 9 cash booths, 20 financial kiosks, 96 ATMs, 3 call

centres and own offices are connected to transaction processing systems

via intranet. So, 100% of our service points (branches and other service

points) are online.

All VISA ATMs in Bangladesh accept our debit cards.

As of year-end 2013, 63% of our customers are using internet banking. In

2011, this figure was 45%.

As of year-end 2013, 73% of our customers are using SMS banking

services.

As the pioneer in rolling out e-Statement in Bangladesh, we have saved 2

million sheets of paper in 2013 due to delivery of e-Statement instead of

paper statement to the customers.

In 2013, we have delivered 61% of all our customer statements through

email which was 30% in 2011 and 54% in 2012.

11 | P a g e

Green Banking Report 2013

Round the clock book transfer for Straight2Bank Client

(Online Banking for Institutional Clients)

Standard Chartered Bangladesh successfully launched of Round the clock

Domestic Book Transfer through Staright2Bank that enables clients to initiate same

currency domestic SCB to SCB payments round-the-clock with enhanced

bandwidth capacity for faster processing. No more cut-off times!

Value Proposition for Clients:

Anytime Book Transfer: Initiate and complete domestic fund transfer to any

Standard Chartered corporate or individual account anytime.

Real-time credit to beneficiary: The beneficiary will receive the credit on a

near real-time basis.

No more cut off time: No scrambling to effect funds transfers within

Standard Chartered cut off time.

Supports multiple channels: Transactions can be initiated from

Straight2Bank Web and Host to Host

No Setup required: Effective immediately, you will be able to make domestic

funds transfers within Standard Chartered Round the Clock without any

setup or additional fees.

Powerful tool to make salary or other time critical payment after office or

during holidays

Benefits to the Bank:

Operational efficiency as there is no manual intervention

Minimization of operational risk

Embedding flexible payment solutions deepens relationship, attracting sticky

liabilities

How does it work?

Client initiates and submits domestic Book Transfer payment through

Staright2Bank web or host to host.

Transaction is being processed near real time round the clock

The beneficiary receives fund instantly round the clock

12 | P a g e

Green Banking Report 2013

Employee Training, Consumer Awareness and Green Event

Health, Safety and Environment elearning training is mandatory for all

newly joined staffs in Bangladesh. For our

Corporate Relationship Managers to have

in-depth

understanding

on

Green

Finance, we have introduced Sustainable

Awareness

development

among Finance Training in 2012. In 2013, a total

consumers and clients are a continuous of 280 staffs have attended these

job of the bank under its Corporate Affair trainings.

department.

In 2013, Standard Chartered Bank

organized various Green Banking events.

Employee awareness development and

training on environmental and social risk

and the relevant issues are continuous

process as part of the bank's Employee

Training Program.

Keeping in mind the slogan "Plant Two

Trees Against Loss of One Tree"

Standard Chartered volunteer team led a

Tree Plantation event on 16th May 2014

and decided to extend little endeavour to

contribute to the environment by planting

trees at Aftab Nagar. The team ensured

active participation in selecting good

trees, plantation and nursing of these.

At the World Environment Day 2013 on

6th June 2013, our passionate colleagues

participated in the Riding Green

initiative in partnership with JAAGO

Foundation to raise awareness about

environmental issues. The team also

actively participated to monitor wastage

of food at the Head office Cafeteria and

ensured disposable environment friendly

paper glass to drink water towards the

agenda "Think. Eat. Save".

Standard Chartered Bank organized

another Tree Plantation program on 5th

October 2013 as part of the employee

volunteering to reinforce the brand

promise Here for Good. Over 80

passionate volunteers across the bank

participated in the program. A good

number of saplings were planted in both

sides of the Aftab Nagar canal.

13 | P a g e

Green Banking Report 2013

In-house Green Initiatives and spent in 2013

As per the Green Banking policy requirement of Bangladesh Bank; BDT 12.30M has

been allocated in the environment risk management plan for 2013 for various inhouse initiatives. However, BDT 8.40M has been utilized under the plan as few of

the projects could not be undertaken. In Q4 2013, BDT 5.50M has been approved

and utilized for the purchase of green cars for bank use outside of the annual

environment risk management plan. As a result; total spending for in-house green

initiatives stands at BDT 13.90M in 2013.

Following in-house energy and water saving initiatives were undertaken in 2013:

Figures in 000 BDT

SNO

Projects

Allocation

Utilization

Description

L8 Light Change to L5 in

Head Office building

1,000.00

1,428.60

VFD for the Central AC for

Head-Office.

6,000.00

5,216.69

Dyson Air Blade for the

washroom at Head Office

1,000.00

880.00

These

devices

would

eliminate the need for towel

and hence would result in

net save in cost, energy and

water consumption.

Airco saver for North

Gulshan Branch

500.00

350.00

These are power regulator

for single air-conditioning

units. As a result the airconditioning process is more

efficient and energy saving.

Self Closing Water Tap

1,000.00

528.00

Purchase of 2 units of

energy efficient and

environment friendly Green

cars (Model HONDA

INSIGHT HYBRID 2012)

5,502.00

5,502.00

Various office buildings has

been provided with selfclosing water tap to minimize

water consumption.

These green cars run at 11

KM/litre

whereas

conventional cars run at 6

KM/litre.

With

daily

operational distance of 200

KM; these cars will save 15

litres of fuel per day which is

equivalent of 36Kg of carbon

di-oxide emission to the

environment.

15,002.00

13,905.29

Grand Total

14 | P a g e

New version of energy

saving lights installed in

Head-office building which

saves energy.

Variable Frequency Devices

(VFD) for Central Airconditioning unit would save

energy and help reduce

carbon emission.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EASA Exam - Module 04 ElectronicsDocument115 pagesEASA Exam - Module 04 Electronicsbika100% (1)

- Asset Life Cycle ManagementDocument14 pagesAsset Life Cycle ManagementSheeba Mathew100% (1)

- Shop Policies and ProceduresDocument1 pageShop Policies and ProcedureseaeastepNo ratings yet

- EditDocument64 pagesEditHagenimana ErnestNo ratings yet

- GearsDocument246 pagesGearsVinayak AryanNo ratings yet

- 145kV GTP BPDBDocument4 pages145kV GTP BPDBJRC TestingNo ratings yet

- Jurnal EntropionDocument7 pagesJurnal EntropionOgiesilaenNo ratings yet

- Rayo X Protable XFM ITALRAYDocument18 pagesRayo X Protable XFM ITALRAYaplicacionista.imagenesNo ratings yet

- A Broadband Planar Magic-T Using Microstrip-Slotline TransitionsDocument6 pagesA Broadband Planar Magic-T Using Microstrip-Slotline TransitionsSarvesh HireNo ratings yet

- Activity No. 4 Amino Acids and ProteinsDocument6 pagesActivity No. 4 Amino Acids and ProteinsAngel EspanolNo ratings yet

- Electrix TweakerDocument1 pageElectrix TweakerUSER58679No ratings yet

- Generator Breaker Equipped With Vacuum InterruptersDocument4 pagesGenerator Breaker Equipped With Vacuum InterruptersVenna Karthik ReddyNo ratings yet

- Wa0001Document1 pageWa0001Boru RajaNo ratings yet

- Aujeszky's DiseaseDocument30 pagesAujeszky's DiseaseFrances ChewNo ratings yet

- Ak95S Error Code ListDocument118 pagesAk95S Error Code ListEnderson Ramos100% (2)

- Chapters 1, 2 & 6Document95 pagesChapters 1, 2 & 6Mwizukanji NakambaNo ratings yet

- Introduction To Reverse Engineering: October 2007Document10 pagesIntroduction To Reverse Engineering: October 2007Sudeep Kumar Singh100% (1)

- Cases Histories and Recent Development of The Sand Compaction PilDocument7 pagesCases Histories and Recent Development of The Sand Compaction PilVetriselvan ArumugamNo ratings yet

- GMORS Rubber Especification O Rings Guidebook AS568ADocument90 pagesGMORS Rubber Especification O Rings Guidebook AS568AfeltofsnakeNo ratings yet

- BSBINews 78Document96 pagesBSBINews 78Anonymous dEztzVueNo ratings yet

- Instruction Manual Instruction Manual: HDI 2D949-80Document30 pagesInstruction Manual Instruction Manual: HDI 2D949-80GeorgianaNo ratings yet

- Body MechanicsDocument26 pagesBody MechanicsSandeepNo ratings yet

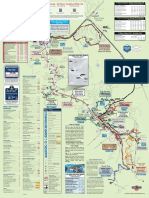

- Transit System Guide MapDocument2 pagesTransit System Guide Mapzhu xdNo ratings yet

- Carbon CycleDocument12 pagesCarbon CyclePorco dioNo ratings yet

- Horn AntennasDocument29 pagesHorn AntennasAbderrahmane BadisNo ratings yet

- Μflo (Microflo) : Basic Flow ComputerDocument2 pagesΜflo (Microflo) : Basic Flow ComputerROberto cavacoNo ratings yet

- Monitoring of The New Svinesund BridgeDocument18 pagesMonitoring of The New Svinesund BridgeNachoNo ratings yet

- UntitledDocument2 pagesUntitledSergey ShashminNo ratings yet

- Oxygen Concentrator 7F-5 User's ManualDocument9 pagesOxygen Concentrator 7F-5 User's ManualJunx TripoliNo ratings yet

- Science 7 DLP q3w9d4 & w10d1Document4 pagesScience 7 DLP q3w9d4 & w10d1Tammy SelaromNo ratings yet