Professional Documents

Culture Documents

USDA Export Sales Report - Current and Recent History

Uploaded by

spartak_serbiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

USDA Export Sales Report - Current and Recent History

Uploaded by

spartak_serbiaCopyright:

Available Formats

USDA Export Sales Report - Current and Recent History

Report Date: 10/20/2016

Week Ending

Weekly Sales

1000MT

(Cotton 1000 RB)

Sales Needed

Per Week to

Meet USDA Est.

Current Year

% of USDA Est.

5 Year Average

% of USDA Est.

BEANS - 2016/2017 (Current) Marketing Year

13-Oct

2008.5

506.9

57.6%

58.4%

6-Oct

1417.1

538.8

53.9%

56.2%

29-Sep

2179.6

557.0

51.3%

54.2%

22-Sep

1692.9

590.0

47.4%

51.9%

15-Sep

875.7

612.0

44.3%

48.4%

BEAN MEAL - 2016/2017 (Current) Marketing Year

13-Oct

398.0

155.0

29.9%

37.3%

6-Oct

119.7

159.8

26.4%

35.5%

29-Sep

230.7

168.7

20.7%

28.5%

22-Sep

67.3

169.9

18.7%

25.7%

15-Sep

133.4

168.0

18.1%

23.8%

BEAN OIL - 2016/2017 (Current) Marketing Year

13-Oct

0.3

14.7

27.1%

19.1%

6-Oct

16.8

14.5

27.1%

16.9%

29-Sep

-3.8

17.1

11.9%

11.1%

22-Sep

13.3

16.8

12.2%

8.9%

15-Sep

13.6

16.7

10.9%

8.0%

CORN - 2016/2017 (Current) Marketing Year

13-Oct

1023.0

737.3

39.8%

40.9%

6-Oct

873.4

743.3

38.0%

39.3%

29-Sep

2060.9

746.0

36.5%

37.0%

22-Sep

575.0

772.8

32.8%

35.1%

15-Sep

921.9

768.8

31.8%

33.9%

WHEAT - 2016/2017 (Current) Marketing Year

13-Oct

513.8

336.9

58.1%

57.3%

6-Oct

491.0

342.1

56.2%

56.1%

29-Sep

377.0

346.4

54.3%

54.6%

22-Sep

570.8

347.2

52.9%

53.1%

15-Sep

560.9

353.3

50.8%

51.3%

USDA Export Sales - Weekly Net Sales

Report Date: 10/20/2016

NET EXPORT SALES FOR THE WEEK ENDING 10/13/2016

In 1000 Metric Tonnes (Cotton is 1000 Running Bales)

CROP YEAR

Current

Market

BEANS

BEAN MEAL

BEAN OIL

CORN

WHEAT

COTTON

2008.5

398

0.3

1023

513.8

340.2

Next

Total

0.3

0

0

0

0

0

2008.8

398

0.3

1023

513.8

340.2

NET EXPORT SALES FOR THE WEEK ENDING

10/13/2016

In Million Bushels

Market

BEANS

CORN

WHEAT

CROP YEAR

Current

Next

73.80

40.27

18.88

0.01

0.00

0.00

Total

73.81

40.27

18.88

***This report includes information from sources believed to be reliable and accurate as of the date of this publication, but no independent

verification has been made and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice.

This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or

commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully

consider the inherent risks of such an investment in light of their financial condition.

You might also like

- Moraga Market StatDocument1 pageMoraga Market Statpeyman33No ratings yet

- US quarterly milk production and feed price dataDocument8 pagesUS quarterly milk production and feed price datapeateyNo ratings yet

- San Ramon Market StatDocument1 pageSan Ramon Market Statpeyman33No ratings yet

- 30 March, 2016 Daily Exclusive ORYZA Rice E-Newsletter by Riceplus MagazineDocument11 pages30 March, 2016 Daily Exclusive ORYZA Rice E-Newsletter by Riceplus MagazineMujahid AliNo ratings yet

- World Agricultural Supply and Demand Estimates: Interagency Commodity Estimates Committee ForecastsDocument66 pagesWorld Agricultural Supply and Demand Estimates: Interagency Commodity Estimates Committee ForecastsIvan Yuri RodarteNo ratings yet

- Philadelphia Housing StatisticsDocument1 pagePhiladelphia Housing StatisticsMaureen BrownNo ratings yet

- Spring Milk Production April 2018Document2 pagesSpring Milk Production April 2018Growing AmericaNo ratings yet

- USDA Export Sales Report - Current and Recent HistoryDocument2 pagesUSDA Export Sales Report - Current and Recent HistoryPhương NguyễnNo ratings yet

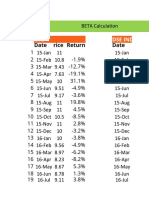

- DSE Index Beta Calculation and Stock ValuationDocument16 pagesDSE Index Beta Calculation and Stock ValuationHassan NasifNo ratings yet

- Yoghurt Production Analysis.: Date Receiption Packaging Units OUTPUT ESTI. LOSS Lab SamplesDocument5 pagesYoghurt Production Analysis.: Date Receiption Packaging Units OUTPUT ESTI. LOSS Lab SamplesmosonikNo ratings yet

- Dairy Unit Cost of Rearing Two Crossbred Cows (Av. Dairy Milk Yield-6 Litres/Cow)Document6 pagesDairy Unit Cost of Rearing Two Crossbred Cows (Av. Dairy Milk Yield-6 Litres/Cow)Srini PappulaNo ratings yet

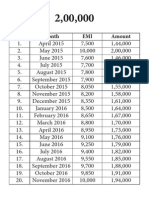

- Loan repayment schedule with EMI detailsDocument2 pagesLoan repayment schedule with EMI detailsSubramanianChidambaramNo ratings yet

- Grain PDFDocument59 pagesGrain PDFSUPER INDUSTRIAL ONLINENo ratings yet

- Chapter 2 Sales ForecastingDocument11 pagesChapter 2 Sales ForecastingCaren SilvaNo ratings yet

- Livestock Risk Protection (LRP) : A Price Risk Management Tool For Livestock ProducersDocument38 pagesLivestock Risk Protection (LRP) : A Price Risk Management Tool For Livestock ProducersSaipolNo ratings yet

- OPSCMProjectDocument4 pagesOPSCMProjectRinku SinghNo ratings yet

- Gross Margin (1 YEAR) 2018Document2 pagesGross Margin (1 YEAR) 2018Jinky DeypalubosNo ratings yet

- 2016-07 County Sales & Price PPT PublicDocument16 pages2016-07 County Sales & Price PPT PublicC.A.R. Research & Economics100% (2)

- Budgeting 101: Projecting and Evaluating PerformanceDocument21 pagesBudgeting 101: Projecting and Evaluating PerformanceRanier Armand Valle MagnoNo ratings yet

- Macro Indicators and Economic Environment in IndiaDocument9 pagesMacro Indicators and Economic Environment in IndiaVaibh SinghNo ratings yet

- 3Q12 Conference Call PresentationDocument34 pages3Q12 Conference Call PresentationJBS RINo ratings yet

- Table 1 Value of Production Index (Vapi), Year-On-Year Growth Rates For Manufacturing Sector: January 2013 - April 2014 (2000 100)Document29 pagesTable 1 Value of Production Index (Vapi), Year-On-Year Growth Rates For Manufacturing Sector: January 2013 - April 2014 (2000 100)jomardansNo ratings yet

- Fundamental AnalysisDocument6 pagesFundamental AnalysisbatrisyaNo ratings yet

- BULIGA ST 2Document10 pagesBULIGA ST 2Alexandra-Alina SELAVARDEANUNo ratings yet

- UsdaDocument27 pagesUsdaTuấn Thế NguyễnNo ratings yet

- Proyecto Gerencia Financiera FinalDocument109 pagesProyecto Gerencia Financiera FinalDante DornanNo ratings yet

- IDirect Inflation Oct16Document7 pagesIDirect Inflation Oct16Dinesh ChoudharyNo ratings yet

- GAIN Report: Thailand Grain and Feed Weekly Rice Price Update 2009Document3 pagesGAIN Report: Thailand Grain and Feed Weekly Rice Price Update 20090331428No ratings yet

- 2016-03 County Sales & Price PublicDocument16 pages2016-03 County Sales & Price PublicC.A.R. Research & EconomicsNo ratings yet

- Manhattan Beach Real Estate Market Conditions - June 2016Document15 pagesManhattan Beach Real Estate Market Conditions - June 2016Mother & Son South Bay Real Estate AgentsNo ratings yet

- Echap07 Vol2 AGRIDocument22 pagesEchap07 Vol2 AGRISuman SharmaNo ratings yet

- Declared Profit Rates of Last Two Years: Products: Saving Accounts Falah Mahana AmdaniDocument7 pagesDeclared Profit Rates of Last Two Years: Products: Saving Accounts Falah Mahana AmdaniAbdul AwanNo ratings yet

- 07.VISSAN Case4study EN (2021)Document12 pages07.VISSAN Case4study EN (2021)Trương M ÁnhNo ratings yet

- Cambodia Grain and Feed Annual Report 2018Document15 pagesCambodia Grain and Feed Annual Report 2018Faran MoonisNo ratings yet

- ANZ Job Ads Mar-13Document16 pagesANZ Job Ads Mar-13Belinda WinkelmanNo ratings yet

- SPR Milk Prod 10 2018Document2 pagesSPR Milk Prod 10 2018Brittany EtheridgeNo ratings yet

- Nielsen August 2014 Meats Market InsightsDocument15 pagesNielsen August 2014 Meats Market InsightsAlexandra CioriiaNo ratings yet

- Sales Forecast - predict revenues for Ezra's RestaurantDocument12 pagesSales Forecast - predict revenues for Ezra's RestaurantKathleen Galit ApiladoNo ratings yet

- Brazil - Industrial Production and Manufacturing PMIDocument1 pageBrazil - Industrial Production and Manufacturing PMIEduardo PetazzeNo ratings yet

- Manhattan Beach Real Estate Market Conditions - August 2016Document15 pagesManhattan Beach Real Estate Market Conditions - August 2016Mother & Son South Bay Real Estate AgentsNo ratings yet

- Chapter 05Document32 pagesChapter 05Mario Alberto PerezNo ratings yet

- Investment Performance Credicorp vs AmazonDocument3 pagesInvestment Performance Credicorp vs AmazonYesi GarNo ratings yet

- Sales Performance and Target Achievement by Outlets (March - August 2016Document69 pagesSales Performance and Target Achievement by Outlets (March - August 2016popopioNo ratings yet

- Chen-Chen'S Lechon House: LocationDocument12 pagesChen-Chen'S Lechon House: LocationMardjon SalmorinNo ratings yet

- Milk ProductionDocument6 pagesMilk ProductionGrowing AmericaNo ratings yet

- CPI Rural India Major CommoditiesDocument2 pagesCPI Rural India Major CommoditiesSai harshaNo ratings yet

- Economic Instability in PakistanDocument35 pagesEconomic Instability in PakistanJunaid NaseemNo ratings yet

- DR G RaviprasadDocument14 pagesDR G RaviprasadRavi RajaniNo ratings yet

- Special Report Usda Preview 2017 07Document5 pagesSpecial Report Usda Preview 2017 07Muhammad Azhar SaleemNo ratings yet

- IDirect Inflation Sep16Document7 pagesIDirect Inflation Sep16Dinesh ChoudharyNo ratings yet

- Research Paper BroilerDocument18 pagesResearch Paper Broilerjomarie67% (6)

- Annual Milk Prod FactorsDocument6 pagesAnnual Milk Prod FactorsdhanrajkamatNo ratings yet

- Generation and Reservoirs Statistics: October 03, 2016Document11 pagesGeneration and Reservoirs Statistics: October 03, 2016nandarathanaNo ratings yet

- ZPA Newsletter December 2019Document19 pagesZPA Newsletter December 2019Susan BvochoraNo ratings yet

- Sugar Semi-Annual - Islamabad - Pakistan - 10-01-2021Document8 pagesSugar Semi-Annual - Islamabad - Pakistan - 10-01-2021TzvineZNo ratings yet

- Contrarian PerformanceDocument1 pageContrarian PerformanceContrarian Investors, LLCNo ratings yet

- Torrance Real Estate Market Conditions - May 2016Document15 pagesTorrance Real Estate Market Conditions - May 2016Mother & Son South Bay Real Estate AgentsNo ratings yet

- Sample NNA Monthly STARDocument23 pagesSample NNA Monthly STARCap TikusNo ratings yet

- Myanmar Livestock Industry Overview DR Hla Hla Thein DR Thet MyanmarDocument51 pagesMyanmar Livestock Industry Overview DR Hla Hla Thein DR Thet MyanmarMasood AhmedNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets. October 2016From EverandFood Outlook: Biannual Report on Global Food Markets. October 2016No ratings yet

- Ventili Sa SenzoromDocument8 pagesVentili Sa Senzoromspartak_serbiaNo ratings yet

- 1H FY2018 Results Presentation: February 2018Document26 pages1H FY2018 Results Presentation: February 2018spartak_serbiaNo ratings yet

- Project Matador Teaser: New Serbian Silo-Port OpportunityDocument5 pagesProject Matador Teaser: New Serbian Silo-Port Opportunityspartak_serbiaNo ratings yet

- California Blueberry ProductionDocument31 pagesCalifornia Blueberry Productionspartak_serbiaNo ratings yet

- Crawfish ManualDocument40 pagesCrawfish ManualdarreneckNo ratings yet

- EM8526 Cost BlueberryDocument41 pagesEM8526 Cost Blueberryspartak_serbiaNo ratings yet

- Sergey Chumak ENGDocument55 pagesSergey Chumak ENGspartak_serbiaNo ratings yet

- SND SRB in HRV 2017Document41 pagesSND SRB in HRV 2017spartak_serbiaNo ratings yet

- 1RS InsigniaDocument13 pages1RS Insigniaspartak_serbiaNo ratings yet