Professional Documents

Culture Documents

Form No 16 - Jun2016

Uploaded by

NICKOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No 16 - Jun2016

Uploaded by

NICKCopyright:

Available Formats

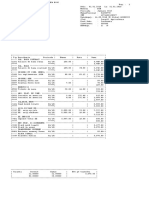

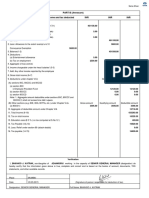

FORM NO.

16

[See Rule 31(1)(a)]

6043

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted

at source from income chargable under the head "Salaries"

-----------------------------------------------------------------------------------| Name and Address of the Employer | Name and designation of the Employee

|

| COMMANDING OFFICER

|

|

| 747 SQN (CG)

| K SINGH 01497 H

|

| KOCHI

| 900045 ADH(DOM)

|

-----------------------------------------------------------------------------------|

TAN:MUMP30808B

| PAN NO : AYTPS8606F

|

-----------------------------------------------------------------------------------| TDS Circle where Annual Return/Statement |

PERIOD

| Assessment

|

| under section 206 is to be filed

|--------------| Year

|

|

| From | To

|

|

|

| March | Feb | 2016-2017

|

|

| 2015 | 2016 |

|

-----------------------------------------------------------------------------------DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

-----------------------------------------------------------------------------------|1. Gross Salary

|

| Rs.481560 |

|2. Less:Allowance to the extent exempt under Sec 10

|

|

|

|

Transportation Allow

| Rs. 11200 |

|

|

Total:Under Sec 10

|

| Rs. 9040 |

|3. Balance (1-2)

|

| Rs.470360 |

|

|

|

|

|4,5. Deductions

|

| Rs. 2160 |

|6. Income chargable under the head salaries (3-5)

|

| Rs.468200 |

|7. ADD: Any other income reported

|

|

|

|8. Gross total income (6+7)

|

| Rs.468200 |

|

|

|

|

|9. Deductions under Chapter VI-A

|

|

|

|

(A) Sections 80C, 80CCC and 80CCD

|

|

|

|

i)

GPF Subscription

| Rs.153000 |

|

|

ii) CGBF

| Rs.

640 |

|

|

iii) NGIS

| Rs. 30000 |

|

|

Aggregate amount deductible 80C, 80CCC & 80CCD

| Rs.150000 |

|

|10. Aggregate of deductable amount under Chapter VI-A

|

| Rs.150000 |

|

|

|

|

|11. Total income (8-10)

|

| Rs.318200 |

|

|

|

|

|12. Tax on total income

|

| Rs. 4820 |

|13,14 Surcharge & Cess

|

| Rs.

145 |

|15. Tax Payable (12+13+14)

|

| Rs. 4965 |

|

|

|

|

|16. Tax deducted at source

|

| Rs. 4965 |

|

|

|

|

|17. Tax Payable/Refundable (15-16)

|

| Rs.

NIL |

-----------------------------------------------------------------------------------Details of Tax Deducted and deposited into Central Government Account.

-----------------------------------------------------------------------------------| Amount (Rs.):4965

Date of payment : 04/2015 to 03/2016

BOOK ADJUSTMENT

|

------------------------------------------------------------------------------------

Certify that a sum of Rs.4965 has been deducted at source and paid to the credit

of the Central Government. Further certify that the information given above is true and

correct based on the book of accounts, documents and other available records.

Signature of person responsible

for deduction of Tax

Place : Mumbai - 39

Date : 05/05/2016

Full Name

: _______________

Designation : _______________

U/900045/1497H/#6043/^65

Note: This FORM 16 is computer generated as per soft copy provided by PCDA(N), Mumbai

You might also like

- Salary Slip OctDocument1 pageSalary Slip OctJoshua GarrettNo ratings yet

- Form 16Document1 pageForm 16tdsbolluNo ratings yet

- Form No.16: Page 1 of 2 (SAHTRUGHAN SINGH TOMAR - Asst. Yr.: 2020-2021)Document2 pagesForm No.16: Page 1 of 2 (SAHTRUGHAN SINGH TOMAR - Asst. Yr.: 2020-2021)Ankit SijariyaNo ratings yet

- CombinepdfDocument19 pagesCombinepdfYashodhaNo ratings yet

- GL Balance Slip Without Zero 13112019135559Document10 pagesGL Balance Slip Without Zero 13112019135559RISHABHNo ratings yet

- January 2023Document1 pageJanuary 2023biplab chowdhuryNo ratings yet

- Payslip - 2022 08 29Document1 pagePayslip - 2022 08 29SHIVARAM KULKARNINo ratings yet

- January 2018Document1 pageJanuary 2018NellyUSANo ratings yet

- 111110120003621ffd PSPDocument3 pages111110120003621ffd PSPPranay JainNo ratings yet

- ATMBDMEDocument1 pageATMBDMESuma KotaNo ratings yet

- FORM NO 16: PART B (ANNEXURE) Asst Year: 2019-2020Document2 pagesFORM NO 16: PART B (ANNEXURE) Asst Year: 2019-2020Anshul PathakNo ratings yet

- Form PDFDocument1 pageForm PDFVinod KumarNo ratings yet

- Oct2023 PSDocument1 pageOct2023 PSRavi KanheNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- Payslip 00037846Document1 pagePayslip 00037846Monti SiwachNo ratings yet

- Payslip - 2018 09 28 - ID 48027903 PDFDocument2 pagesPayslip - 2018 09 28 - ID 48027903 PDFMvans MnlstsNo ratings yet

- 31 03Document1 page31 03balaNo ratings yet

- Rep ShowDocument1 pageRep Showprabu sNo ratings yet

- Wanoi General StoreDocument1 pageWanoi General Storeatifah3322No ratings yet

- Annexure 630430Document3 pagesAnnexure 630430mohammadNo ratings yet

- FormDocument1 pageFormDeepakNo ratings yet

- RGTSPL DEC 2023 HYD603100 PayslipDocument1 pageRGTSPL DEC 2023 HYD603100 Payslipabhishek.roushanNo ratings yet

- Excel GSTR 3b May 2020Document2 pagesExcel GSTR 3b May 2020Sanjay Mahajan AmritsarNo ratings yet

- Dar CementDocument1 pageDar Cementatifah3322No ratings yet

- TdsDocument4 pagesTdsSahil SheikhNo ratings yet

- Compiot O21Document105 pagesCompiot O21kd.sujeet233No ratings yet

- Payslip January, 2024Document1 pagePayslip January, 2024negishilpa051No ratings yet

- Form16Document10 pagesForm16anon-263698No ratings yet

- Aiatsl: (Wholly Owned Subsidiary of Air India Limited)Document1 pageAiatsl: (Wholly Owned Subsidiary of Air India Limited)Krishna Webkrishna100% (1)

- (CaseSt1) Trial Balance PBDocument2 pages(CaseSt1) Trial Balance PBtitu patriciuNo ratings yet

- FormDocument1 pageFormKaushik KumarNo ratings yet

- Form 16Document1 pageForm 16Manish Varghese MathewNo ratings yet

- FCM StationaryDocument5 pagesFCM StationaryChishale FridayNo ratings yet

- 85Document58 pages85damnrod23100% (1)

- Milton Form16Document4 pagesMilton Form16sundar1111No ratings yet

- 3657 Atmpa0825cDocument5 pages3657 Atmpa0825cnithinmamidala999No ratings yet

- I.T - Sem-I Results C-Scheme Nov-2019Document64 pagesI.T - Sem-I Results C-Scheme Nov-2019TestuserNo ratings yet

- PART B (Annexure) Details of Salary Paid and Any Other Income and Tax Deducted INR Inr InrDocument3 pagesPART B (Annexure) Details of Salary Paid and Any Other Income and Tax Deducted INR Inr InrAshraf KhanNo ratings yet

- Glo-Stick, Inc.: Financial Statement Investigation A02-11-2015Document3 pagesGlo-Stick, Inc.: Financial Statement Investigation A02-11-2015碧莹成No ratings yet

- 223957Document4 pages223957yuvionfireNo ratings yet

- BalantaDocument2 pagesBalantaTania BențaNo ratings yet

- 0310000100113329ffd - PSP (1) .RPTDocument4 pages0310000100113329ffd - PSP (1) .RPTrahulNo ratings yet

- Get Payslip by Offset PDFDocument1 pageGet Payslip by Offset PDFanon_535796411100% (1)

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- Paystub 202205Document2 pagesPaystub 202205Sandeep RakholiyaNo ratings yet

- Regd Office: Gadepan Dist Kota (Rajasthan) : Mechanical Mech Mech MechDocument1 pageRegd Office: Gadepan Dist Kota (Rajasthan) : Mechanical Mech Mech MechRavi KasaudhanNo ratings yet

- 6-3-569/1, Surana House Somajiguda, Hyderabad-83Document2 pages6-3-569/1, Surana House Somajiguda, Hyderabad-83seshu18098951No ratings yet

- Salary SlipDocument2 pagesSalary Slipashish.20scse1300001No ratings yet

- DocumentDocument1 pageDocumentKen livingstonNo ratings yet

- Gstr3b Dec 23Document2 pagesGstr3b Dec 23AbhishekSinghPatelNo ratings yet

- Rnlic Pay Slip 70648381 Oct 2023Document1 pageRnlic Pay Slip 70648381 Oct 2023Neeraj BhardwajNo ratings yet

- Fqnrfy202223itall WORD PrintDocument1,642 pagesFqnrfy202223itall WORD PrintsysfqnrNo ratings yet

- UntitledDocument1,024 pagesUntitledHarry DavisNo ratings yet

- DecDocument1 pageDecnegishilpa051No ratings yet

- Itr - TCSDocument3 pagesItr - TCSsivaNo ratings yet

- Form 1620092010Document5 pagesForm 1620092010Chidurala KrishnaNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet