Professional Documents

Culture Documents

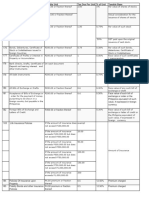

Tax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable Base

Uploaded by

NJPMsmashOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable Base

Uploaded by

NJPMsmashCopyright:

Available Formats

Tax Rates

Tax

Code

Sectio

n

174

Document

Original Issue of Shares of

Stock with par value

Original Issue of Shares of

Stock without par value

Taxable Unit

Tax Due Per

Unit

% of

Unit

P200.00 or fraction

thereof

1.00

.5%

P200.00 or fraction

thereof

1.00

.5%

Taxable Base

Par value of shares of

stocks

Actual consideration for

the issuance of shares of

stocks

Actual value represented

by each share

Stock Dividend

175

Sales, Agreements to Sell,

Memoranda of Sales,

Deliveries or Transfer of

Shares or Certificates of

Stock

P200.00 or fraction

thereof

1.00

.5%

P200.00 or fraction

thereof

.75

3.75% Par value of such stock

Stock without par value

25%

DST paid upon the

original issuance of said

stock.

176

Bonds, Debentures,

Certificate of Stock or

Indebtedness issued in

foreign Countries

P200.00 or fraction

thereof

.75

3.75% Par value of such bonds,

debentures, Certificate of

Stock or Indebtedness

177

Certificate of Profits or

Interest in Property or

Accumulation

P200.00 or fraction

thereof

.50

.25%

Face value of such

certificate / memorandum

178

Bank Checks, Drafts,

Certificate of Deposit not

bearing interest and other

Instruments

On each Document

1.50

179

All Debt Instruments

P200.00 or fraction

thereof

1.00

.5%

Issue price of any such

instruments

180

All Bills of Exchange or

Drafts

P200.00 or fraction

thereof

.30

.15%

Face value of any such

bill of exchange or draft

181

Acceptance of Bills of

Exchange or order for the

payment of money

purporting to be drawn in a

foreign country but

payable in the Philippines

P200.00 or fraction

thereof

.30

.15%

Face value of such bill of

exchange or order or the

Philippine equivalent of

such value, if expressed

in foreign currency

182

Foreign Bills of Exchange

and Letters of Credit

P200.00 or fraction

thereof

.30

.15%

Face value of such bill of

exchange or letter of

credit or the Philippine

equivalent of such value,

if expressed in foreign

currency

183

Life Insurance Policies

If the amount of

insurance does not

exceed P100,000.00

exempt

If the amount of

insurance exceeds

P100,000.00 but

does not exceed

P300,000.00

Amount of Insurance

Amount of Insurance

10.00

Amount of Insurance

If the amount of

insurance exceeds

P300,000.00 but

does not exceed

P500,000.00

If the amount of

insurance exceeds

P500,000.00 but

does not exceed

P750,000.00

If the amount of

insurance exceeds

P750,000.00 but

does not exceed

P1,000,000.00

If the amount of

insurance exceeds

P1,000,000.00

25.00

Amount of Insurance

50.00

Amount of Insurance

75.00

Amount of Insurance

100.00

184

Policies Of Insurance upon

Property

P4.00 premium or

fraction thereof

.50

12.5% Premium charged

185

Fidelity Bonds and other

P4.00 premium or

.50

12.5% Premium charged

186

Insurance Policies

fraction thereof

Policies of Annuities or

other instruments

P200.00 or fraction

thereof

.50

.25%

Premium or installment

payment or contract price

collected

Premium or contribution

collected

Pre-Need Plans

P200.00 or fraction

thereof

.20

.10%

7.5%

Premium charged

10%

Cost of the ticket

187

Indemnity Bonds

P4.00 or fraction

thereof

.30

188

Certificates of Damage or

otherwise and Certificate or

document issued by any

customs officers, marine

surveyor, notary public and

certificate required by law

or by rules and regulations

of a public office

Each Certificate

15.00

189

Warehouse Receipts

(except if value does not

exceed P200.00)

Each Receipt

15.00

190

Jai-alai, Horse Race

Tickets, lotto or Other

Authorized Number

Games

P1.00 cost of ticket

.10

Cost of the ticket

Additional P0.10 on

every P1.00 or

fraction thereof if

cost of ticket

exceeds P1.00

191

Bills of Lading or

Receipts(except charter

party)

If the value of such

goods exceeds

P100.00 and does

not exceed

P1,000.00

1.00

Value of such goods

Value of such goods

If the value exceeds

P1,000.00

Freight tickets

covering goods,

merchandise or

effects carried as

accompanied

baggage of

passengers on land

and water carriers

primarily engaged in

the transportation of

passengers

10.00

Exempt

192

Proxies(except proxies

issued affecting the affairs

of associations or

corporations, organized for

religious, charitable or

literary purposes)

Each proxy

15.00

193

Powers of Attorney(except

acts connected with the

collection of claims due

from or accruing to the

Government of the

Republic of the Philippines,

or the government of any

province, city or

Municipality)

Each Document

5.00

194

Lease and other Hiring

agreements or

memorandum or contract

for hire, use or rent of any

land or tenements or

portions thereof

First 2,000 or

fractional part

thereof

3.00

.15%

For every P1,000 or

fractional part

thereof in excess of

the first P2,000 for

each year of the

term of the said

contract or

agreement

1.00

.1%

195

196

197

Mortgages Pledges of

lands, estate, or property

and Deeds of Trust

Deed of Sale, instrument or

writing and Conveyances of

Real Property (except

grants, patents or original

certificate of the

government)

Charter parties and Similar

Instruments

First 5,000

20.00

.4%

On each P5,000 or

fractional part

thereof in excess of

5,000

10.00

.2%

First 1,000

15.00

1.5%

Amount Secured

Amount Secured

Consideration or Fair

Market Value, whichever

is higher (if government

is a party, basis shall be

the consideration)

For each additional

P1,000 or fractional

part thereof in

excess of P1,000

15.00

1,000 tons and

below

P500.00 for

the first 6

months Plus

P50 each

month or

fraction thereof

in excess of 6

months

Registered gross tonnage

P1,000 for the

first 6

months Plus

P100 each

month or

fraction thereof

in excess of 6

months

Registered gross tonnage

P1,500 for the

first 6

months Plus

P150 each

month or

fraction thereof

in excess of 6

months

Registered gross tonnage

1,001 to 10,000 tons

Over 10,000 tons

1.5%

Consideration or Fair

Market Value, whichever

is higher (if government

is a party, basis shall be

the consideration)

198

Stamp Tax on Assignments

and Renewals or

Continuance of Certain

Instruments

At the same

rate as that

imposed on

the original

instrument.

You might also like

- Tax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDocument3 pagesTax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BasecristinatubleNo ratings yet

- Tax 3 Chapter 14 Documentary Stamp Tax EditedDocument10 pagesTax 3 Chapter 14 Documentary Stamp Tax Editedokay alexNo ratings yet

- Doc Stamp Tax GuideDocument5 pagesDoc Stamp Tax Guidepretityn19No ratings yet

- Document Taxable Unit Tax Due Per Unit % of UnitDocument6 pagesDocument Taxable Unit Tax Due Per Unit % of Unitveloxenergy.taxcompspecialistNo ratings yet

- DST & OPT: Understanding the Documentary Stamp TaxDocument31 pagesDST & OPT: Understanding the Documentary Stamp TaxJeffrey Fuentes100% (2)

- Tax 3 Chapter 14 Documentary Stamp TaxDocument13 pagesTax 3 Chapter 14 Documentary Stamp Taxokay alexNo ratings yet

- Documentary Stamp Tax: DST DefinedDocument9 pagesDocumentary Stamp Tax: DST DefinedLumingNo ratings yet

- Documentary Stamp TaxDocument6 pagesDocumentary Stamp TaxchrizNo ratings yet

- Documentary Stamp TaxDocument7 pagesDocumentary Stamp TaxRyan Sabungan100% (1)

- Accounting Treatment For Documentary Stamp TaxDocument22 pagesAccounting Treatment For Documentary Stamp TaxJo CelNo ratings yet

- Documentary Stamp TaxDocument8 pagesDocumentary Stamp TaxRam DerickNo ratings yet

- Documentary Stamp Tax Rates Increased Under TRAINDocument8 pagesDocumentary Stamp Tax Rates Increased Under TRAINJade BelenNo ratings yet

- Documentary Stamp Tax GuideDocument41 pagesDocumentary Stamp Tax Guidemoshi kpop cartNo ratings yet

- DST Tax RatesDocument4 pagesDST Tax RatesmixxNo ratings yet

- Documentary Stamp Tax GuideDocument9 pagesDocumentary Stamp Tax GuideQuinnee VallejosNo ratings yet

- Tax Rates Description Tax Form Documentary Requirements Procedures Deadlines Related Revenue Issuances Codal Reference Frequently Asked QuestionsDocument10 pagesTax Rates Description Tax Form Documentary Requirements Procedures Deadlines Related Revenue Issuances Codal Reference Frequently Asked Questionsshawn7800No ratings yet

- Documentary Stamp TaxDocument120 pagesDocumentary Stamp Taxnegotiator50% (2)

- Documentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), orDocument2 pagesDocumentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), orShaina ObreroNo ratings yet

- TAXATION LAW HIGHLIGHTSDocument4 pagesTAXATION LAW HIGHLIGHTSJM BermudoNo ratings yet

- Title ViiDocument5 pagesTitle ViiErica Mae GuzmanNo ratings yet

- VII Documentary Stamp TaxDocument7 pagesVII Documentary Stamp TaxfelizvillanuevaNo ratings yet

- 2307Document3 pages2307Anonymous yCFuth7BL80% (1)

- Understanding Bills of Exchange and Stamp Taxes in the PhilippinesDocument4 pagesUnderstanding Bills of Exchange and Stamp Taxes in the PhilippinesShaina ObreroNo ratings yet

- 2307Document5 pages2307jblopez66No ratings yet

- 2307Document16 pages2307Mika AkimNo ratings yet

- DSTDocument2 pagesDSTveloxenergy.taxcompspecialistNo ratings yet

- Session 13: Excise Tax, Documentary Stamp Tax and Local Tax: October 14, 2018Document56 pagesSession 13: Excise Tax, Documentary Stamp Tax and Local Tax: October 14, 2018Jericho LuisNo ratings yet

- TAX - 3 Documentary Stamp Tax RatesDocument2 pagesTAX - 3 Documentary Stamp Tax RatesYamateNo ratings yet

- DST SummaryDocument19 pagesDST SummaryRb BalanayNo ratings yet

- What Are Registration FeesDocument4 pagesWhat Are Registration FeesRochelle Adajar-BacallaNo ratings yet

- FinalDocument2 pagesFinalJessica FordNo ratings yet

- Kind of Income Tax RateDocument2 pagesKind of Income Tax RateTJ MerinNo ratings yet

- Documentary Stamp TaxDocument10 pagesDocumentary Stamp TaxDura LexNo ratings yet

- Ra 9243 DSTDocument6 pagesRa 9243 DSTapi-247793055100% (1)

- Listed Under Pse Tax Code 199 (Stock Transaction Tax 5/10 of 1%)Document11 pagesListed Under Pse Tax Code 199 (Stock Transaction Tax 5/10 of 1%)Vedia Genon IINo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- 2307 PDFDocument2 pages2307 PDFAnonymous BVowhxQPNo ratings yet

- Final Income TaxesDocument13 pagesFinal Income TaxesEar TanNo ratings yet

- Estate Tax - Bureau of Internal RevenueDocument15 pagesEstate Tax - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- Documentary Stamp TaxDocument13 pagesDocumentary Stamp TaxJessNo ratings yet

- INCTAX QuizletDocument4 pagesINCTAX QuizletJoshua LisingNo ratings yet

- Tax obligations of resident Filipino citizensDocument2 pagesTax obligations of resident Filipino citizensAJ Quim100% (1)

- Documentary Stamp Ta1Document12 pagesDocumentary Stamp Ta1JessNo ratings yet

- BIR Form 2307 Tax CodesDocument16 pagesBIR Form 2307 Tax CodesAnalyn Velasco Matibag100% (1)

- EPayments Import TemplateDocument10 pagesEPayments Import TemplateGhulam MustafaNo ratings yet

- Bir 2306Document6 pagesBir 2306RodnieGubatonNo ratings yet

- Income TaxationDocument32 pagesIncome TaxationkarlNo ratings yet

- RA 9243 - Rationalizing The Provision of Documentary Stamp TaxDocument5 pagesRA 9243 - Rationalizing The Provision of Documentary Stamp TaxCrislene CruzNo ratings yet

- Tax II Prefinals AnnexesDocument5 pagesTax II Prefinals AnnexesVincent john NacuaNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal Revenueroy rebosuraNo ratings yet

- Non Resident CitizensDocument3 pagesNon Resident CitizensJessa Belle EubionNo ratings yet

- Individual and corporate tax carryovers and carrybacksDocument8 pagesIndividual and corporate tax carryovers and carrybacksFang JiangNo ratings yet

- Bir Ruling No. 052-99Document4 pagesBir Ruling No. 052-99Ren Mar CruzNo ratings yet

- BIR Revenue Regulation No. 02-98 Dated 17 April 1998Document74 pagesBIR Revenue Regulation No. 02-98 Dated 17 April 1998wally_wanda93% (14)

- O o o O: Percentage Tax DescriptionDocument3 pagesO o o O: Percentage Tax Descriptionscartoneros_1No ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Property & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsFrom EverandProperty & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsNo ratings yet

- Special Power of Attorney SampleDocument2 pagesSpecial Power of Attorney SampleNJPMsmashNo ratings yet

- Director S Compensation Under Corp Code PhilippinesDocument1 pageDirector S Compensation Under Corp Code PhilippinesNJPMsmashNo ratings yet

- Preferred Stock Corporation Code of The PhilippinesDocument2 pagesPreferred Stock Corporation Code of The PhilippinesNJPMsmashNo ratings yet

- Affidavit of Filing and ServiceDocument2 pagesAffidavit of Filing and ServiceNJPMsmashNo ratings yet

- Sec Email CorpsecDocument1 pageSec Email CorpsecNJPMsmashNo ratings yet

- Affidavit For Solo Parent Act PhilippinesDocument1 pageAffidavit For Solo Parent Act PhilippinesNJPMsmashNo ratings yet

- Ra 9335Document7 pagesRa 9335NJPMsmashNo ratings yet

- Salazar To Felipe IIDocument4 pagesSalazar To Felipe IINJPMsmashNo ratings yet

- Ep of Tbe Ibtlippine, G Upreme Lourt ManilaDocument23 pagesEp of Tbe Ibtlippine, G Upreme Lourt ManilaNJPMsmashNo ratings yet

- Extrajudicial Settlement of Estate TemplateDocument4 pagesExtrajudicial Settlement of Estate Templateblue13_fairy100% (1)

- Eco Circular Flow Chart EnglishDocument1 pageEco Circular Flow Chart EnglishNJPMsmashNo ratings yet

- Rules Implementing Code of Conduct for Public OfficialsDocument18 pagesRules Implementing Code of Conduct for Public OfficialsicebaguilatNo ratings yet

- Day CareDocument19 pagesDay CareNJPMsmashNo ratings yet

- SleepDocument1 pageSleepNJPMsmashNo ratings yet

- SN 2306Document4 pagesSN 2306NJPMsmashNo ratings yet

- SlaveryDocument1 pageSlaveryNJPMsmashNo ratings yet

- Salazar To Felipe IIDocument4 pagesSalazar To Felipe IINJPMsmashNo ratings yet

- Education Budgetary ImplicationsDocument9 pagesEducation Budgetary ImplicationsNJPMsmashNo ratings yet

- TertullianDocument1 pageTertullianNJPMsmashNo ratings yet

- US Israel RelationshipDocument4 pagesUS Israel RelationshipNJPMsmashNo ratings yet

- EquilibriumDocument1 pageEquilibriumNJPMsmashNo ratings yet

- Culture & Development by Amartya SenDocument10 pagesCulture & Development by Amartya Senapi-3730405100% (4)

- Sulu ZoneDocument2 pagesSulu ZoneNJPMsmashNo ratings yet

- Proclamation 131, July 22, 1987Document5 pagesProclamation 131, July 22, 1987Rbee C. AblanNo ratings yet

- History of ParanaqueDocument5 pagesHistory of ParanaqueNJPMsmashNo ratings yet

- Propaganda, La Liga, KatipunanDocument11 pagesPropaganda, La Liga, KatipunanNJPMsmash100% (3)

- Qin Dynasty 秦Document15 pagesQin Dynasty 秦NJPMsmashNo ratings yet

- Deductive Method2Document2 pagesDeductive Method2NJPMsmashNo ratings yet

- Deductive MethodDocument2 pagesDeductive MethodNJPMsmashNo ratings yet

- Dynastic CycleDocument4 pagesDynastic CycleNJPMsmash100% (1)

- Crim Cases MidtermsDocument76 pagesCrim Cases MidtermsCoreine Valledor-SarragaNo ratings yet

- Parent DC Promo Ui LogDocument193 pagesParent DC Promo Ui LogRachell SmithNo ratings yet

- TD2Document4 pagesTD2Terry ChoiNo ratings yet

- Data Protection Act (DPA)Document14 pagesData Protection Act (DPA)Crypto SavageNo ratings yet

- FR-F800 Instruction Manual PDFDocument614 pagesFR-F800 Instruction Manual PDFelivandrojuniorNo ratings yet

- Measurements and QoS Analysis SwissQualDocument6 pagesMeasurements and QoS Analysis SwissQualkshitij1979No ratings yet

- Etextbook 978 0078025884 Accounting Information Systems 4th EditionDocument61 pagesEtextbook 978 0078025884 Accounting Information Systems 4th Editionmark.dame383100% (49)

- Serena Berman PW Res - 2020Document2 pagesSerena Berman PW Res - 2020Serena BermanNo ratings yet

- FCPP Fiberglass Coated ConcreteDocument20 pagesFCPP Fiberglass Coated ConcretemahdiNo ratings yet

- PDF-Product Sheet-H100 EURODocument2 pagesPDF-Product Sheet-H100 EUROJhonny SarmientoNo ratings yet

- Houghton Mifflin Harcourt Sap Document of UnderstandingDocument10 pagesHoughton Mifflin Harcourt Sap Document of UnderstandingSunil KumarNo ratings yet

- PSC Vacancy Government SpokespersonDocument3 pagesPSC Vacancy Government SpokespersonMoreen WachukaNo ratings yet

- EY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Document35 pagesEY - NASSCOM - M&A Trends and Outlook - Technology Services VF - 0Tejas JosephNo ratings yet

- Workday Studio - Complex Integration Tool OverviewDocument3 pagesWorkday Studio - Complex Integration Tool OverviewHarithaNo ratings yet

- FEA Finite Element Analysis Tutorial ProblemsDocument16 pagesFEA Finite Element Analysis Tutorial ProblemsVinceTanNo ratings yet

- Impact On Cocoon Quality Improvement.1Document10 pagesImpact On Cocoon Quality Improvement.1Naveen NtrNo ratings yet

- Manipulative MediaDocument15 pagesManipulative MediaCris Popol100% (2)

- Tipster Job AdvertDocument3 pagesTipster Job AdvertDatateq ConsultancyNo ratings yet

- EE370 L1 IntroductionDocument38 pagesEE370 L1 IntroductionAnshul GoelNo ratings yet

- Instructions To Employee For Submitting Online Application For Transfer Under Rule - 38 of Postal Manual Vol.-IVDocument6 pagesInstructions To Employee For Submitting Online Application For Transfer Under Rule - 38 of Postal Manual Vol.-IVSankarMathi VaigundhamNo ratings yet

- Engine Tune-UpDocument43 pagesEngine Tune-UpЮра ПетренкоNo ratings yet

- Supreme Court: Arsenio C. Villalon, Jr. For Petitioner. Labaguis, Loyola, Angara & Associates For Private RespondentDocument43 pagesSupreme Court: Arsenio C. Villalon, Jr. For Petitioner. Labaguis, Loyola, Angara & Associates For Private RespondentpiaNo ratings yet

- Unit 4:: Incident Commander and Command Staff FunctionsDocument16 pagesUnit 4:: Incident Commander and Command Staff FunctionsAntonio Intia IVNo ratings yet

- Indian Pharmaceutical Industry: The Changing Dynamics: April 2016Document26 pagesIndian Pharmaceutical Industry: The Changing Dynamics: April 2016payal joshiNo ratings yet

- Philips LCD Monitor 220EW9FB Service ManualDocument10 pagesPhilips LCD Monitor 220EW9FB Service Manualpagy snvNo ratings yet

- Electricity Began With Man's Curiosity On The Peculiar Ability of Amber and Lodestone To Attract Other Material.Document2 pagesElectricity Began With Man's Curiosity On The Peculiar Ability of Amber and Lodestone To Attract Other Material.Axle Rose CastroNo ratings yet

- Clinical Practice Guidelines For Acute Otitis Media in Children: A Systematic Review and Appraisal of European National GuidelinesDocument3 pagesClinical Practice Guidelines For Acute Otitis Media in Children: A Systematic Review and Appraisal of European National GuidelinesusmfdocNo ratings yet

- How Nokia Failed to Adapt to Market ChangesDocument5 pagesHow Nokia Failed to Adapt to Market ChangesRiangelli ExcondeNo ratings yet

- ACFCS Certification BrochureDocument7 pagesACFCS Certification Brochurebeena pandeyNo ratings yet

- Chemestry CollageDocument85 pagesChemestry CollageET039 Sudhabrata SahooNo ratings yet