Professional Documents

Culture Documents

Documentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), or

Uploaded by

Shaina Obrero0 ratings0% found this document useful (0 votes)

15 views2 pagesOriginal Title

Section-174_DST

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesDocumentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), or

Uploaded by

Shaina ObreroCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

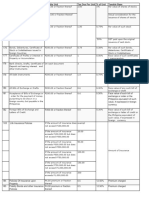

Section 174.

Stamp tax on Original Issuance of share of stocks

On every original issue, whether on organization, reorganization or for any lawful

purpose, of shares of stock by any association, company or corporation, there shall be collected a

documentary stamp tax of Two peso (P2.00) on each Two hundred pesos (P200), or

fractional part thereof, of the par value, of such shares of stock: Provided, That in the case of the

original issue of shares of stock without par value, the amount of the documentary stamp tax

herein prescribed shall be based upon the actual consideration for the issuance of such shares of

stock: Provided, further, That in the case of stock dividends, on the actual value represented by

each share.

Document Tax due per unit % of unit Taxable base

Share issuance with par value P2.00/P200 1% Par value

Share issuance with no par P2.00/P200 1% Actual consideration

value received

Stock dividend P2.00/P200 1% Actual value represented

by share

Section 175. Stamp Tax on Sales, Agreements to sell, Memoranda of sales, Deliveries or

transfer of shares or Certificates Stocks.

Document Tax due per unit % of unit Taxable base

Sales,

Agreements to sell, P 1.50/200 0.75% Par value of such stocks

Memoranda of sales,

Deliveries or transfer of shares

or Certificates Stocks

DST paid upon the

Stock without par value 50% original issuance of said

stocks

Section 176. Stamp Tax on Bonds, Debentures, Certificate of Stock or Indebtedness Issued

in Foreign Countries

On all bonds, debentures, certificates of stock, or certificates of indebtedness issued in

any foreign country, there shall be collected from the person selling or transferring the same in

the Philippines, such as tax as is required by law on similar instruments when issued, sold or

transferred in the Philippines.

Comparison of DST rules on shares and debt instrment

Domestic Foreign

Shares of stocks Taxable Exempt

Issue of stocks Taxable Taxable

Transfer of stocks

Debt instrument

Issue of debt instrument Taxable Exempt

Assignment of debt instruments Taxable Taxable

Document Tax due per unit % of unit Taxable base

Stamp Tax on Bonds,

Debentures, P .75 / P200 .375% Par value

Certificate of Stock or

Indebtedness Issued in Foreign

Countries

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Documentary Stamp TaxDocument120 pagesDocumentary Stamp Taxnegotiator50% (2)

- Documentary Stamp Tax GuideDocument16 pagesDocumentary Stamp Tax GuideWilma P.No ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal Revenueroy rebosuraNo ratings yet

- Documentary Stamp TaxDocument13 pagesDocumentary Stamp TaxJessNo ratings yet

- Accounting Treatment For Documentary Stamp TaxDocument22 pagesAccounting Treatment For Documentary Stamp TaxJo CelNo ratings yet

- Documentary Stamp Ta1Document12 pagesDocumentary Stamp Ta1JessNo ratings yet

- BIR Documentary Stamp Tax GuideDocument5 pagesBIR Documentary Stamp Tax GuideArlene2 ColoradoNo ratings yet

- Ch05 Documentary Stamp TaxDocument9 pagesCh05 Documentary Stamp TaxRenelyn FiloteoNo ratings yet

- Tax 3 Chapter 14 Documentary Stamp Tax EditedDocument10 pagesTax 3 Chapter 14 Documentary Stamp Tax Editedokay alexNo ratings yet

- Lecture-Documentary Stamp TaxDocument13 pagesLecture-Documentary Stamp TaxJaiselle EscobedoNo ratings yet

- DST & OPT: Understanding the Documentary Stamp TaxDocument31 pagesDST & OPT: Understanding the Documentary Stamp TaxJeffrey Fuentes100% (2)

- Documentary Stamp TaxDocument10 pagesDocumentary Stamp TaxDura LexNo ratings yet

- DST Tax RatesDocument4 pagesDST Tax RatesmixxNo ratings yet

- TST Les5Document3 pagesTST Les5leomartinqtNo ratings yet

- Documentary Stamp Tax - BIRDocument11 pagesDocumentary Stamp Tax - BIRBenjamin Hernandez Jr.No ratings yet

- DST SummaryDocument19 pagesDST SummaryRb BalanayNo ratings yet

- BIR Documentary Stamp Tax Rates and ProceduresDocument12 pagesBIR Documentary Stamp Tax Rates and ProceduresKristarah HernandezNo ratings yet

- DST OverviewDocument14 pagesDST OverviewMa. Corazon CaramalesNo ratings yet

- Tax 3 Chapter 14 Documentary Stamp TaxDocument13 pagesTax 3 Chapter 14 Documentary Stamp Taxokay alexNo ratings yet

- Additional Subscription by Way of Shares of StockDocument3 pagesAdditional Subscription by Way of Shares of Stockregine rose bantilanNo ratings yet

- Title ViiDocument5 pagesTitle ViiErica Mae GuzmanNo ratings yet

- DOCSTAMPCOMPARISONDocument10 pagesDOCSTAMPCOMPARISONLyka Dennese SalazarNo ratings yet

- Tax II Prefinals AnnexesDocument5 pagesTax II Prefinals AnnexesVincent john NacuaNo ratings yet

- Tax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDocument3 pagesTax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BasecristinatubleNo ratings yet

- Tax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDocument6 pagesTax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseNJPMsmashNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal RevenueJenny Amante-BesasNo ratings yet

- Documentary Stamp Tax GuideDocument9 pagesDocumentary Stamp Tax GuideQuinnee VallejosNo ratings yet

- DSTDocument2 pagesDSTveloxenergy.taxcompspecialistNo ratings yet

- Understanding Bills of Exchange and Stamp Taxes in the PhilippinesDocument4 pagesUnderstanding Bills of Exchange and Stamp Taxes in the PhilippinesShaina ObreroNo ratings yet

- Doc Stamp Tax GuideDocument5 pagesDoc Stamp Tax Guidepretityn19No ratings yet

- Taxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orDocument2 pagesTaxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orFabrienne Kate LiberatoNo ratings yet

- VII Documentary Stamp TaxDocument7 pagesVII Documentary Stamp TaxfelizvillanuevaNo ratings yet

- Documentary Stamps Tax Transaction / Document Rate Tax BaseDocument3 pagesDocumentary Stamps Tax Transaction / Document Rate Tax BaseMark AbraganNo ratings yet

- BIR Revenue Regulation 13-04Document9 pagesBIR Revenue Regulation 13-04kyroe104No ratings yet

- BIR Revenue Regulations No. 13-04Document8 pagesBIR Revenue Regulations No. 13-04kyroe104No ratings yet

- Documentary Stamp TaxDocument7 pagesDocumentary Stamp TaxRyan Sabungan100% (1)

- Bir Ruling No. 052-99Document4 pagesBir Ruling No. 052-99Ren Mar CruzNo ratings yet

- 2 RR 13-2004 PDFDocument14 pages2 RR 13-2004 PDFJoyceNo ratings yet

- Document Taxable Unit Tax Due Per Unit % of UnitDocument6 pagesDocument Taxable Unit Tax Due Per Unit % of Unitveloxenergy.taxcompspecialistNo ratings yet

- DST DOCUMENTARY STAMPS TAXDocument4 pagesDST DOCUMENTARY STAMPS TAXPaulynn OlpocNo ratings yet

- Ra 9243Document3 pagesRa 9243Chino SisonNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNo ratings yet

- Dealings in Properties and The Withholding Tax SystemDocument38 pagesDealings in Properties and The Withholding Tax SystemKenzel lawasNo ratings yet

- Documentary Stamp TaxesDocument2 pagesDocumentary Stamp TaxesOwlHeadNo ratings yet

- Documentary Stamp TaxDocument8 pagesDocumentary Stamp TaxRam DerickNo ratings yet

- How Much Does It Cost To Transfer A Land Title in The PhilippinesDocument5 pagesHow Much Does It Cost To Transfer A Land Title in The PhilippinesDebra BraciaNo ratings yet

- Documentary Stamp Tax GuideDocument41 pagesDocumentary Stamp Tax Guidemoshi kpop cartNo ratings yet

- CorporationDocument8 pagesCorporationDESTIN KATE KINUH-OLNo ratings yet

- Lincoln Phil Life Insurance Co V. CADocument3 pagesLincoln Phil Life Insurance Co V. CASha SantosNo ratings yet

- DST & OPT overviewDocument37 pagesDST & OPT overviewEder EpiNo ratings yet

- LINCOLN PHILIPPINE LIFE INSURANCE VS CADocument10 pagesLINCOLN PHILIPPINE LIFE INSURANCE VS CAJazem AnsamaNo ratings yet

- Documentary Stamp Tax Rates Increased Under TRAINDocument8 pagesDocumentary Stamp Tax Rates Increased Under TRAINJade BelenNo ratings yet

- 6903 PPT Materials For UploadDocument13 pages6903 PPT Materials For UploadAljur SalamedaNo ratings yet

- Guide When Buying Real Estate in The PhilippinesDocument1 pageGuide When Buying Real Estate in The PhilippinesER O'PlaneNo ratings yet

- Tax 1 Review AddendumDocument6 pagesTax 1 Review AddendumAnie Guiling-Hadji GaffarNo ratings yet

- Gain On Disposal of A Capital Asset in A Tax Year Is Chargeable Under The Head Capital Gains On Accrual BasisDocument19 pagesGain On Disposal of A Capital Asset in A Tax Year Is Chargeable Under The Head Capital Gains On Accrual BasisAmarKumarNo ratings yet

- Philippine VAT and Percentage Tax RatesDocument41 pagesPhilippine VAT and Percentage Tax RatesKim AranasNo ratings yet

- Acc 109-CFE revDocument5 pagesAcc 109-CFE revGhie RodriguezNo ratings yet

- SEC. 179. Stamp Tax On All Debt InstrumentsDocument1 pageSEC. 179. Stamp Tax On All Debt InstrumentsMccoy SabanalNo ratings yet

- Section 177 - Stamp Tax On Certificate of Profits or Interest in Property or AccumulationsDocument1 pageSection 177 - Stamp Tax On Certificate of Profits or Interest in Property or AccumulationsShaina ObreroNo ratings yet

- Deductive QuestionsDocument2 pagesDeductive QuestionsShaina ObreroNo ratings yet

- Understanding Bills of Exchange and Stamp Taxes in the PhilippinesDocument4 pagesUnderstanding Bills of Exchange and Stamp Taxes in the PhilippinesShaina ObreroNo ratings yet

- Sec 274 - 282 - Other Penal ProvisionsDocument3 pagesSec 274 - 282 - Other Penal ProvisionsShaina ObreroNo ratings yet

- Project Selction - Payback PeriodDocument2 pagesProject Selction - Payback PeriodShaina ObreroNo ratings yet

- Enterprise Systems - Integrates Business Process Functionality and Information From All of AnDocument12 pagesEnterprise Systems - Integrates Business Process Functionality and Information From All of AnShaina ObreroNo ratings yet

- Question No 5Document1 pageQuestion No 5Shaina ObreroNo ratings yet

- Notes in COMMERCIAL LAW Corporation Code of The Philippines SRC FRIADocument123 pagesNotes in COMMERCIAL LAW Corporation Code of The Philippines SRC FRIAEleasar Banasen PidoNo ratings yet

- RCCP Title I General ProvisionsDocument31 pagesRCCP Title I General ProvisionsChet Buenfeliz TacliadNo ratings yet

- March 23 2021-Stocks QUESTION AND SOLUTION (Preffered Stock Notes & Dividends Notes)Document7 pagesMarch 23 2021-Stocks QUESTION AND SOLUTION (Preffered Stock Notes & Dividends Notes)Britania RanqueNo ratings yet

- Shareholders' Equity QuestionsDocument4 pagesShareholders' Equity QuestionsXienaNo ratings yet

- BA Outline 2009Document48 pagesBA Outline 2009EminKENNo ratings yet

- SheDocument2 pagesSheRhozeiah LeiahNo ratings yet

- rev-mat-2-IA Print PDFDocument31 pagesrev-mat-2-IA Print PDFAyaka FujiharaNo ratings yet

- CH 1 & 14Document13 pagesCH 1 & 14Rabie HarounNo ratings yet

- Corporation Law Notes Under Atty. Ladia (Revised)Document73 pagesCorporation Law Notes Under Atty. Ladia (Revised)yumiganda91% (11)

- Notes On Stock and StockholdersDocument19 pagesNotes On Stock and Stockholderscharmagne cuevasNo ratings yet

- Lincoln Phil Life Insurance Co V. CADocument3 pagesLincoln Phil Life Insurance Co V. CASha SantosNo ratings yet

- Accounting Principles: Second Canadian EditionDocument35 pagesAccounting Principles: Second Canadian EditionEshetieNo ratings yet

- CCP V RCCP PDFDocument122 pagesCCP V RCCP PDFJose MasarateNo ratings yet

- BY-LAWS AND MEETINGSDocument25 pagesBY-LAWS AND MEETINGSGabrielNo ratings yet

- Accounting for Investments in SubsidiariesDocument7 pagesAccounting for Investments in Subsidiariesgilli1trNo ratings yet

- Stimulating Long Term ShareholdingDocument69 pagesStimulating Long Term ShareholdingAniruddha RoyNo ratings yet

- Financial Accounting Chapter 12 Test 2 FinalDocument4 pagesFinancial Accounting Chapter 12 Test 2 Finalronny nyagakaNo ratings yet

- Stice 18e Ch13 SOL FinalDocument56 pagesStice 18e Ch13 SOL FinalKhôi NguyênNo ratings yet

- How To Draft Articles of IncorporationDocument7 pagesHow To Draft Articles of Incorporationgilbertmalcolm100% (1)

- RFBT 5-Corporation Pre-TestDocument4 pagesRFBT 5-Corporation Pre-TestCharles D. FloresNo ratings yet

- Corporation CodeDocument54 pagesCorporation CodeLordson RamosNo ratings yet

- FINLCOR - TermsDocument10 pagesFINLCOR - TermsClaire MadriagaNo ratings yet

- M. Louise Collins, Administratrix v. Commissioner of Internal Revenue, 216 F.2d 519, 1st Cir. (1954)Document8 pagesM. Louise Collins, Administratrix v. Commissioner of Internal Revenue, 216 F.2d 519, 1st Cir. (1954)Scribd Government DocsNo ratings yet

- Calculate Conversion Prices, Ratios and Values for Convertible BondsDocument4 pagesCalculate Conversion Prices, Ratios and Values for Convertible BondsGailee VinNo ratings yet

- Corp Accounting - Prac ProblemsDocument5 pagesCorp Accounting - Prac ProblemsFigie KuNo ratings yet

- Common Stock q1Document2 pagesCommon Stock q1Omnia HassanNo ratings yet

- SheDocument5 pagesSheLorie Jae Domalaon0% (1)

- Castillo Et - Al Vs BalinghasayDocument10 pagesCastillo Et - Al Vs BalinghasaySimeon SuanNo ratings yet

- Acctg 104 Equity FinancingDocument54 pagesAcctg 104 Equity FinancingskzstayhavenNo ratings yet

- Solved The Following Information Is Available For Bernard Corporation For 2019 Required 1Document1 pageSolved The Following Information Is Available For Bernard Corporation For 2019 Required 1Anbu jaromiaNo ratings yet