Professional Documents

Culture Documents

What Is Central Value

Uploaded by

Sathish Kumar J0 ratings0% found this document useful (0 votes)

12 views2 pagesCentral Value

Original Title

What is Central Value

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCentral Value

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesWhat Is Central Value

Uploaded by

Sathish Kumar JCentral Value

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

What is Central Value-added Tax and how it is configured?

What is CENVAT (Central Value-added Tax) and how it is configured?

Anil

Before I am going to explain what is cenvat, you have to under stand the Indian tax

Central Excise Duty (BED). It is called as basic excise duty. Every manufacturer is

liable to pay the excise duty in various kinds namely Basic Excise Duty, Special

Excise Duty, Additional Excise Duty etc.,

Just think over a product which is reached to a end user, how many manufacturing

activities are done. So to reduce the tax burden of the end user, the Govt. of India

introduce the MODVAT scheme which is now called CENVAT scheme.

Based on this, if any manufacturer purchased a material, which is duty paid, and if it

is used for his further manufacturing activity, he can avail this as credit in his book

based on the Central Excise Invoice. At the time of selling his manufactured goods,

he is liable to pay the excise duty. He can adjust the credit which he has taken into his

book and pay the rest. For example:

CENVAT availed at the time purchased various goods Rs.20,000

alone)

CENVAT payable for his product at the time sales

Rs.25,000

He will pay only Rs.5000 through cash deposit in PLA.

(EXcise duty

This customizing are in SAP CIN Module. If you are having the CIN CD, go

through.

K. SUNDAR

Good Explanation. In addition to this. The CENVAT means, Tax on Value Addition on

the goods manufactured according to Central Excise & Customs Act Difinition. Here

the value addition means the Additional Services/Activities etc. which converts the

Input in to Output, and the output is newly recognised as per the this act as Exciseble

goods. Like this the discussion

is goes on for definition.

In 4.7 SAP version, there is no CIN version seperately, it is available with Standard

SAP it self.

I hope Mr. Anil Gurjar's query is completely answered.

You might also like

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Goods & Service Tax (India)Document27 pagesGoods & Service Tax (India)devanshugaur550% (2)

- India GST For Beginners - Jayaram HiregangeDocument224 pagesIndia GST For Beginners - Jayaram Hiregangesatya1947No ratings yet

- 10 Things To Do Before Becoming An EntrepreneurDocument15 pages10 Things To Do Before Becoming An EntrepreneurSathish Kumar JNo ratings yet

- Institute Cargo ClausesDocument20 pagesInstitute Cargo ClausesSathish Kumar JNo ratings yet

- What Is GST - Goods & Services Tax Law Explained With Facts & ExamplesDocument7 pagesWhat Is GST - Goods & Services Tax Law Explained With Facts & ExamplesPrabhat Shukla100% (1)

- Project Report On Value Added Tax (VAT)Document77 pagesProject Report On Value Added Tax (VAT)Royal Projects100% (6)

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyFrom EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyRating: 5 out of 5 stars5/5 (1)

- Phytosanitary CertificateDocument2 pagesPhytosanitary Certificatesasibreeze0% (1)

- Excise Duty: and Distribution (SD), and Posts Them in Financial Accounting (FI)Document6 pagesExcise Duty: and Distribution (SD), and Posts Them in Financial Accounting (FI)Tuhin DuttaNo ratings yet

- FI Document: List of Update Terminations: SA38 SE38Document11 pagesFI Document: List of Update Terminations: SA38 SE38Manohar G ShankarNo ratings yet

- What Is Goods and Services Tax (GST) ?Document20 pagesWhat Is Goods and Services Tax (GST) ?Utkarsh NolkhaNo ratings yet

- Solutions For GST Question BankDocument73 pagesSolutions For GST Question BankSuprajaNo ratings yet

- Taxation IiDocument60 pagesTaxation IiAnkush GuptaNo ratings yet

- Hand Book - SAP-Taxation IndiaDocument116 pagesHand Book - SAP-Taxation IndiaNpsw Social-workers100% (5)

- Summer Training Report on GST and Accounting ServicesDocument48 pagesSummer Training Report on GST and Accounting ServicesRishabh DevNo ratings yet

- GST Book for June & Dec 2024 by CA Vivek GabaDocument604 pagesGST Book for June & Dec 2024 by CA Vivek GabaZoya KaziNo ratings yet

- Basic Understanding of GST in IndiaDocument13 pagesBasic Understanding of GST in IndiasrivarshiniNo ratings yet

- Understanding Indirect Taxes in IndiaDocument18 pagesUnderstanding Indirect Taxes in IndiaPrachi SharmaNo ratings yet

- GST RecordDocument30 pagesGST RecordThota KeerthiNo ratings yet

- Prof Simply Simple Understanding Goods Services Tax (GST) Version 2Document17 pagesProf Simply Simple Understanding Goods Services Tax (GST) Version 2sanjayjograNo ratings yet

- CIN OverviewDocument107 pagesCIN OverviewroopendravermaNo ratings yet

- CIN Overview SD ModuleDocument76 pagesCIN Overview SD ModuleCampa ColaNo ratings yet

- Goods and Service Tax 4Document2 pagesGoods and Service Tax 4Anonymous H1TW3YY51KNo ratings yet

- India Localization With Respect To INDIA: Modus Operandi Session IDocument31 pagesIndia Localization With Respect To INDIA: Modus Operandi Session IpsroyalNo ratings yet

- VatDocument9 pagesVatmayurgharatNo ratings yet

- CIN India LocalizationSD Ver 1Document76 pagesCIN India LocalizationSD Ver 1YogeshNo ratings yet

- Country Version IndiaDocument1 pageCountry Version Indiaananth-jNo ratings yet

- GST ExamDocument11 pagesGST ExamHarsh Malhotra JiNo ratings yet

- GSTDocument6 pagesGSTmuffin muffinNo ratings yet

- Project On Mutual FundsDocument11 pagesProject On Mutual FundsVivek MishraNo ratings yet

- Value Added Tax (VAT)Document20 pagesValue Added Tax (VAT)Nitish KhuranaNo ratings yet

- Impact of GST On Businesses-A Case Study by Numberz: Figure 1 Bifurcation For Indirect Taxes in IndiaDocument5 pagesImpact of GST On Businesses-A Case Study by Numberz: Figure 1 Bifurcation For Indirect Taxes in IndiaKunal MittalNo ratings yet

- Presentation On GST by Himanshu and KrishnaDocument21 pagesPresentation On GST by Himanshu and KrishnahimanshuNo ratings yet

- Paper No and Title 9-Public Finance and Policy in India. Module No and Title 31 - Value Added Tax and Goods & Services Tax Module Tag ECO - P9 - M31Document13 pagesPaper No and Title 9-Public Finance and Policy in India. Module No and Title 31 - Value Added Tax and Goods & Services Tax Module Tag ECO - P9 - M31Adarsh TilakNo ratings yet

- VAT vs GST: Key Differences Between Value Added Tax and Goods and Services TaxDocument7 pagesVAT vs GST: Key Differences Between Value Added Tax and Goods and Services TaxArundhuti RoyNo ratings yet

- Activate CIN Master Data Screen in Vendor CreationDocument16 pagesActivate CIN Master Data Screen in Vendor CreationPankaj KumarNo ratings yet

- Guide to Assets and Depreciation 2014Document16 pagesGuide to Assets and Depreciation 2014Muhedin HussenNo ratings yet

- Indirect TaxDocument42 pagesIndirect TaxSundar SundaramNo ratings yet

- Tax Law - Ii: " Background and Concept of VAT, Advantages of VAT."Document13 pagesTax Law - Ii: " Background and Concept of VAT, Advantages of VAT."Ishraque Zeya KhanNo ratings yet

- Impact of GST in India and Comparisions With Other CountriesDocument7 pagesImpact of GST in India and Comparisions With Other CountriesVamsi KrishNo ratings yet

- GST Lab 2022Document78 pagesGST Lab 2022Sreeja Reddy100% (1)

- Which Companies Are Required To File Vat in India: Vasu Vibhav Purohit MAY 27, 2016Document9 pagesWhich Companies Are Required To File Vat in India: Vasu Vibhav Purohit MAY 27, 2016Mohammad IrfanNo ratings yet

- CIN 02 DetailsDocument80 pagesCIN 02 DetailsBiranchi MishraNo ratings yet

- CIN Accounting Entries Accounting Entry in Procurement: For Domestic Procurement of Raw MaterialDocument20 pagesCIN Accounting Entries Accounting Entry in Procurement: For Domestic Procurement of Raw MaterialPriyabrata RayNo ratings yet

- Goods and Service TaxDocument12 pagesGoods and Service Taxshourima mishraNo ratings yet

- CIN Overview: Accenture, Its Logo, and Accenture High Performance Delivered Are Trademarks of AccentureDocument24 pagesCIN Overview: Accenture, Its Logo, and Accenture High Performance Delivered Are Trademarks of AccenturecharanNo ratings yet

- Vat 220424091227Document16 pagesVat 220424091227vishal.patel250897No ratings yet

- SAP MM CIN GuideDocument175 pagesSAP MM CIN GuideMohit Jain100% (2)

- 908 - GST E BookDocument63 pages908 - GST E Bookdcsreddy94No ratings yet

- GST Project on TDS and TCSDocument12 pagesGST Project on TDS and TCSAnamika VatsaNo ratings yet

- Take Home Salary Calculator IndiaDocument1 pageTake Home Salary Calculator IndiaSenthil KumarNo ratings yet

- 47318bosfinal p8 Part1 Cp1Document33 pages47318bosfinal p8 Part1 Cp1Manas Kumar SahooNo ratings yet

- CIN Document ConfigurationDocument11 pagesCIN Document ConfigurationRajuNo ratings yet

- GST Practical 1-39Document88 pagesGST Practical 1-39HarismithaNo ratings yet

- How To Learn Anything FastDocument14 pagesHow To Learn Anything FastSathish Kumar JNo ratings yet

- Final Circular Export Awareness Program 16 Jan Shamli SWC200113184939Document5 pagesFinal Circular Export Awareness Program 16 Jan Shamli SWC200113184939Sathish Kumar JNo ratings yet

- 12 Mistakes I Made My First Year As An EntrepreneurDocument25 pages12 Mistakes I Made My First Year As An EntrepreneurSathish Kumar JNo ratings yet

- Ask Yourself ! Before Product SelectionDocument2 pagesAsk Yourself ! Before Product SelectionSathish Kumar JNo ratings yet

- Three E's Product Selection GuideDocument2 pagesThree E's Product Selection GuideSathish Kumar JNo ratings yet

- Bank Account Registration / Exporters Data Base Structure: Shipper Letter HeadDocument2 pagesBank Account Registration / Exporters Data Base Structure: Shipper Letter HeadSathish Kumar JNo ratings yet

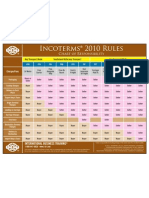

- Incoterms 2010 at A GlanceDocument1 pageIncoterms 2010 at A GlanceAftab UddinNo ratings yet

- Export Business Training Center in MaduraiDocument1 pageExport Business Training Center in MaduraiSathish Kumar JNo ratings yet

- Registrations For Importing CosmeticsDocument5 pagesRegistrations For Importing CosmeticsSathish Kumar JNo ratings yet