Professional Documents

Culture Documents

TDS Survey Analysis Bond Selloff

Uploaded by

SoberLookCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Survey Analysis Bond Selloff

Uploaded by

SoberLookCopyright:

Available Formats

Narrative assessment on Fixed Income and Inflation regime per your survey responses. Thanks again for participating!

@MattGarrett3

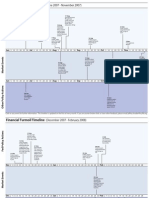

09/21/16 Survey 1 results:

1) What was the biggest contributor to 30yr selloff? The trade got too crowded (35%)/Change in thinking on inflation (13%)

2) What will global yields do for the remainder of the 2016? Range bound (44%) / Begin to enter a bear market (18%)

Lets look at the crowded trade aspect:

a)

Return chasing with added

kicker of negative

correlation when you need

it - Total Return

comparison of CBoT UST

Bond contract vs S&P500

Total Return Index.

The above dynamic with a consensus

of persistent low levels of inflation

drove this trend and a buildup of

positions.

b)

Price sensitivity to change

in yield - CTD Forward

Risk/DV01 of CBoT 10yr,

30yr, and Ultra Bond

futures contract (2nd chart

middle pane).

As yields pushed lower, DVO1

increased, making any potential

unwind in fixed income more violent

10/13/2016 Survey 2 results:

1) What will be the biggest problem for central banks over

the next 12 months? Fiscal policy falls short on stimulus

As of 12/01/16 US 30yr yields and 5y5y forward inflation swaps are up (72bps

(31%)/An uptick in inflation expectations (10%)

and 51bps since the first survey, respectively) and (48bps and 32bps from the

11/22/2016 Survey 3 results:

election, respectively). As the last survey showed there has been a major shift

1) What was the top contributor to the post-election selloff

in attentions to fiscal stimulus induced inflation.

in bonds? Heightened inflation expectations via fiscal

expansionism (70%) / Risk of disruptions in global capital flows + Risk of trade related price shocks + Expectations of increased supply of

long duration papers = (26%)

Now is a good time to assess the narrative on inflation and yields going forward

Views on US fiscal expansion via tax cuts and increased expenditures on infrastructure were boosted by stated policy stances of PEOTUS

Trump. There is also great expectations that his agenda will meet little resistance given how effectively he pierces through any opposition

as was the case in the Republican primary. However, it will be the market (enter Bond Vigilantes) that has the final say.

The expected departure from the current regime of global trade and the US active role in securing that regime creates the real potential for

price shocks via trade disruptions (milder versions of the oil shock of the 1970s where OPEC pushed oil up >200% causing US CPI to

>10%. This is at a time when US imports have become a significant % of GDP and had provided a structural disinflationary pressure.

The other knock on risk as the US does less trade with foreign trading partners they will be less incented to hold US based assets and

particularly treasury or agency securities. Below is a heat map of recent changes in total trade and official UST holdings with major trading

partners of the US. Were likely to see a continuation of some recent selling of the large official holders of treasury securities.

You might also like

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsFrom EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsNo ratings yet

- Group 5 - Marquette Case 8Document7 pagesGroup 5 - Marquette Case 8Bimly Shafara100% (1)

- Defying the Market (Review and Analysis of the Leebs' Book)From EverandDefying the Market (Review and Analysis of the Leebs' Book)No ratings yet

- From Low Volatility To High GrowthDocument4 pagesFrom Low Volatility To High GrowthdpbasicNo ratings yet

- Strategic Insights - Four Horsemen of The ApocalypseDocument3 pagesStrategic Insights - Four Horsemen of The Apocalypsedavid_smith_mediaNo ratings yet

- Financial Crisis Means: IntroductionDocument3 pagesFinancial Crisis Means: IntroductionKaushlya DagaNo ratings yet

- Winter 2017Document3 pagesWinter 2017Amin KhakianiNo ratings yet

- ECO201 Pricniples of Macroeconomics Final ExaminationDocument5 pagesECO201 Pricniples of Macroeconomics Final ExaminationGinoh K.No ratings yet

- The Perfect StormDocument41 pagesThe Perfect StormNickKr100% (1)

- Session 3 Di Giovanni RogersDocument51 pagesSession 3 Di Giovanni RogersPhuoc Tran Ba LocNo ratings yet

- Investment and Tax Planning Strategies For Uncertain Economic TimesDocument16 pagesInvestment and Tax Planning Strategies For Uncertain Economic TimesMihaela NicoaraNo ratings yet

- Global Market Structures and The High Price of ProtectionismDocument9 pagesGlobal Market Structures and The High Price of ProtectionismHeisenbergNo ratings yet

- January 2017 - Market Outlook 1 1 2Document5 pagesJanuary 2017 - Market Outlook 1 1 2api-350764536No ratings yet

- No. 131 – 1st quarter 2011 Copy deadline: 17th December 2010 Rules, discretion and the right assessmentDocument40 pagesNo. 131 – 1st quarter 2011 Copy deadline: 17th December 2010 Rules, discretion and the right assessmenttekkiangNo ratings yet

- Gs Gea Nov13Document10 pagesGs Gea Nov13Martinec TomášNo ratings yet

- LCG 2011 Economic OutlookDocument7 pagesLCG 2011 Economic OutlookC. Bradley ChapmanNo ratings yet

- The End of Buy and Hold ... and Hope Brian ReznyDocument16 pagesThe End of Buy and Hold ... and Hope Brian ReznyAlbert L. PeiaNo ratings yet

- Impact of the US-China trade war on China's economyDocument3 pagesImpact of the US-China trade war on China's economyhuyền myNo ratings yet

- Silverbullet 01Document7 pagesSilverbullet 01Matthias DtNo ratings yet

- Globalization and Global DisinflationDocument36 pagesGlobalization and Global DisinflationOkechukwu MeniruNo ratings yet

- Bain Macro Trends Group Briefing Points: What The US Election Means For Business and The EconomyDocument2 pagesBain Macro Trends Group Briefing Points: What The US Election Means For Business and The EconomyvikrantNo ratings yet

- V14-048 The Brexit SurveyDocument10 pagesV14-048 The Brexit Surveytabbforum100% (1)

- Lane Asset Management Commentary For November 2016Document14 pagesLane Asset Management Commentary For November 2016Edward C LaneNo ratings yet

- Quarterly Review and Outlook: Interest Rates and Over-IndebtednessDocument4 pagesQuarterly Review and Outlook: Interest Rates and Over-Indebtednessrichardck61No ratings yet

- Impacts of the US-China Trade War on Global EconomyDocument5 pagesImpacts of the US-China Trade War on Global EconomyM.h. SamratNo ratings yet

- Ulman Financial Newsletter - 2017-01Document8 pagesUlman Financial Newsletter - 2017-01Clay Ulman, CFP®No ratings yet

- Lane Asset Management Stock Market Commentary For January 2017Document9 pagesLane Asset Management Stock Market Commentary For January 2017Edward C LaneNo ratings yet

- Bob Chapman An Economy On Steroids US Poverty Levels Equal To The 1930s 12 3 2011Document4 pagesBob Chapman An Economy On Steroids US Poverty Levels Equal To The 1930s 12 3 2011sankaratNo ratings yet

- Quarterly Outlook - SVDocument6 pagesQuarterly Outlook - SVAldo WdnrNo ratings yet

- U.S. or Domestic Monetary Policy: Which Matters More for Financial StabilityDocument30 pagesU.S. or Domestic Monetary Policy: Which Matters More for Financial StabilityJhay Zem OrtizNo ratings yet

- The Effect of Pandemic Covid 19Document2 pagesThe Effect of Pandemic Covid 19Desy PastinaNo ratings yet

- Global Economics Weekly: From The Great Recession' To The Great Stagnation'?Document8 pagesGlobal Economics Weekly: From The Great Recession' To The Great Stagnation'?hotadidas5851No ratings yet

- Group 6 - AM BDocument14 pagesGroup 6 - AM BABHAY KUMAR SINGHNo ratings yet

- A Better StimulusDocument9 pagesA Better StimulusJohn McGowanNo ratings yet

- I M P A C T S o F B R e X I T: T H e K N o W N, T H e L I K e L y A N D T H e U N K N o W NDocument4 pagesI M P A C T S o F B R e X I T: T H e K N o W N, T H e L I K e L y A N D T H e U N K N o W NShubham SharmaNo ratings yet

- The Best Strategies For Inflationary TimesDocument32 pagesThe Best Strategies For Inflationary TimesAlvaro Neto TarcilioNo ratings yet

- BIS Working Papers: The Economics of Revoking NAFTADocument38 pagesBIS Working Papers: The Economics of Revoking NAFTAHeisenbergNo ratings yet

- The Difficult Arithmetic of Rapid Chinese Consumption GrowthDocument4 pagesThe Difficult Arithmetic of Rapid Chinese Consumption GrowthLe Duc HuyenNo ratings yet

- Fiscal PolicyDocument7 pagesFiscal PolicySara de la SernaNo ratings yet

- International Economics Final ExamDocument9 pagesInternational Economics Final ExamWilson LiNo ratings yet

- Rethinking Globalization - NotesDocument13 pagesRethinking Globalization - NotesLana HNo ratings yet

- FRBSF: Economic LetterDocument5 pagesFRBSF: Economic LetterAnamaria VadanNo ratings yet

- Ijrmec 881 32616Document14 pagesIjrmec 881 32616Nguyễn Viết ĐạtNo ratings yet

- Congress Resolution on Taxing Cross-Border Currency TransactionsDocument3 pagesCongress Resolution on Taxing Cross-Border Currency TransactionsakshayforgloryNo ratings yet

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocument11 pagesThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicNo ratings yet

- Is Economic Growth Good For InvestorsDocument13 pagesIs Economic Growth Good For InvestorsdpbasicNo ratings yet

- Alesina, Alberto Et Al. (2010) - Fiscal Adjustments Lessons From Recent HistoryDocument18 pagesAlesina, Alberto Et Al. (2010) - Fiscal Adjustments Lessons From Recent HistoryAnita SchneiderNo ratings yet

- JP Morgan 1655406568Document27 pagesJP Morgan 1655406568Mohamed MaherNo ratings yet

- MonthlyBarometer April2020-P2Document1 pageMonthlyBarometer April2020-P2Business Families FoundationNo ratings yet

- The Economic and Financial Outlook - 22!07!11!16!02Document12 pagesThe Economic and Financial Outlook - 22!07!11!16!02BerezaNo ratings yet

- The Broyhill Letter (Q3-10)Document5 pagesThe Broyhill Letter (Q3-10)Broyhill Asset ManagementNo ratings yet

- Macroeconomic Consequences of TariffsDocument2 pagesMacroeconomic Consequences of TariffsCato InstituteNo ratings yet

- Higher Long Term YieldsDocument3 pagesHigher Long Term Yieldsglerner133926No ratings yet

- 2012Q3 - Newsletter October 2012 - PDF Single PageDocument4 pages2012Q3 - Newsletter October 2012 - PDF Single PagePacifica Partners Capital ManagementNo ratings yet

- Mayank Aggarwal - JULY REPORTDocument5 pagesMayank Aggarwal - JULY REPORTMayank AggarwalNo ratings yet

- Macroeconomic and FX Policies of Major Trading PartnersDocument45 pagesMacroeconomic and FX Policies of Major Trading PartnersJohanne Rhielle OpridoNo ratings yet

- Presented By:: (Jon Faust, John H. Rogers, Shing-Yi B. Wang and Jonathan H. Wright)Document24 pagesPresented By:: (Jon Faust, John H. Rogers, Shing-Yi B. Wang and Jonathan H. Wright)Wicky AkhtarNo ratings yet

- Moving Beyond the Washington ConsensusDocument46 pagesMoving Beyond the Washington ConsensusMadalina XiangNo ratings yet

- Rohan Grey Articles MMT InflationDocument6 pagesRohan Grey Articles MMT Inflationjuanito gomezNo ratings yet

- Bank Clerks' Exam: EnglishDocument8 pagesBank Clerks' Exam: Englishਰਾਹ ਗੀਰNo ratings yet

- US Election Policies OutcomeDocument1 pageUS Election Policies OutcomeSoberLookNo ratings yet

- Letter To The Editor Re Hacking of A Bitcoin ExchangeDocument3 pagesLetter To The Editor Re Hacking of A Bitcoin ExchangeSoberLookNo ratings yet

- Unconventional Policies and Their Effects On Financial Markets PDFDocument36 pagesUnconventional Policies and Their Effects On Financial Markets PDFSoberLookNo ratings yet

- HY TR CorrelationDocument36 pagesHY TR CorrelationSoberLookNo ratings yet

- The Impact of Lower RatesDocument17 pagesThe Impact of Lower RatesSoberLookNo ratings yet

- Markit Leveraged Loan Study 1Q09Document5 pagesMarkit Leveraged Loan Study 1Q09SoberLookNo ratings yet

- Crisis TimelineDocument8 pagesCrisis TimelineSoberLookNo ratings yet

- OCC's Quarterly Report On Bank Trading and Derivatives Activities First Quarter 2009Document33 pagesOCC's Quarterly Report On Bank Trading and Derivatives Activities First Quarter 2009ZerohedgeNo ratings yet

- Max232 DatasheetDocument9 pagesMax232 DatasheetprincebahariNo ratings yet

- Online Customized T-Shirt StoresDocument5 pagesOnline Customized T-Shirt StoresPalash DasNo ratings yet

- AgribusinessDocument6 pagesAgribusinessshevadanzeNo ratings yet

- Cash Flow Statement - QuestionDocument27 pagesCash Flow Statement - Questionhamza khanNo ratings yet

- 21PGDM177 - I&E AssignmentDocument6 pages21PGDM177 - I&E AssignmentShreya GuptaNo ratings yet

- Fundamentals of Accounting 3- Segment Reporting and Responsibility AccountingDocument25 pagesFundamentals of Accounting 3- Segment Reporting and Responsibility AccountingAndrew MirandaNo ratings yet

- Manage Greenbelt Condo UnitDocument2 pagesManage Greenbelt Condo UnitHarlyne CasimiroNo ratings yet

- 7 Steps To Eliminate DebtDocument4 pages7 Steps To Eliminate Debttiongann2535No ratings yet

- Module 5 NotesDocument20 pagesModule 5 NotesHarshith AgarwalNo ratings yet

- IQA QuestionsDocument8 pagesIQA QuestionsProf C.S.PurushothamanNo ratings yet

- Customer Profitability in A Manufacturing Firm Bizzan ManufactuDocument2 pagesCustomer Profitability in A Manufacturing Firm Bizzan Manufactutrilocksp SinghNo ratings yet

- ERP at BPCL SummaryDocument3 pagesERP at BPCL SummaryMuneek ShahNo ratings yet

- B&O Annual Report 2015-16Document136 pagesB&O Annual Report 2015-16anon_595151453No ratings yet

- Appendix - Structural Vetting ProjectsDocument37 pagesAppendix - Structural Vetting Projectsqsultan100% (1)

- Allen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Document9 pagesAllen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Chandra KumarNo ratings yet

- Assignment 2 - IPhonesDocument6 pagesAssignment 2 - IPhonesLa FlâneurNo ratings yet

- PsychographicsDocument12 pagesPsychographicsirenek100% (2)

- Case Study - Swiss ArmyDocument16 pagesCase Study - Swiss Armydineshmaan50% (2)

- CH 01Document23 pagesCH 01Karan MadaanNo ratings yet

- Module 2 - Extra Practice Questions With SolutionsDocument3 pagesModule 2 - Extra Practice Questions With SolutionsYatin WaliaNo ratings yet

- TVSM 2004 2005 1ST InterimDocument232 pagesTVSM 2004 2005 1ST InterimMITCONNo ratings yet

- A Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerDocument11 pagesA Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerBryan AdamsNo ratings yet

- AM.012 - Manual - UFCD - 0402Document23 pagesAM.012 - Manual - UFCD - 0402Luciana Pinto86% (7)

- The Role of Business ResearchDocument23 pagesThe Role of Business ResearchWaqas Ali BabarNo ratings yet

- MM Case Study FinalDocument22 pagesMM Case Study FinalPrasanjeet DebNo ratings yet

- New Ideas, Technologies To Support "Build, Build, Build": Position PaperDocument8 pagesNew Ideas, Technologies To Support "Build, Build, Build": Position PaperCloudKielGuiangNo ratings yet

- Credit Assessment On Agricultural LoansDocument84 pagesCredit Assessment On Agricultural LoansArun SavukarNo ratings yet

- The History of ConverseDocument39 pagesThe History of Conversebungah hardiniNo ratings yet

- En (1119)Document1 pageEn (1119)reacharunkNo ratings yet

- ARCHITECTURAL INTERNSHIP ReportDocument41 pagesARCHITECTURAL INTERNSHIP ReportsinafikebekeleNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- How an Economy Grows and Why It Crashes: Collector's EditionFrom EverandHow an Economy Grows and Why It Crashes: Collector's EditionRating: 4.5 out of 5 stars4.5/5 (102)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (16)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Second Class: How the Elites Betrayed America's Working Men and WomenFrom EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNo ratings yet

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineFrom EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineRating: 4.5 out of 5 stars4.5/5 (36)

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsFrom EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsRating: 5 out of 5 stars5/5 (2)

- Against the Gods: The Remarkable Story of RiskFrom EverandAgainst the Gods: The Remarkable Story of RiskRating: 4 out of 5 stars4/5 (352)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyFrom EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyRating: 4.5 out of 5 stars4.5/5 (69)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The Finance Curse: How Global Finance Is Making Us All PoorerFrom EverandThe Finance Curse: How Global Finance Is Making Us All PoorerRating: 4.5 out of 5 stars4.5/5 (18)