Professional Documents

Culture Documents

Chapter 17 PDF

Chapter 17 PDF

Uploaded by

shopnoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 17 PDF

Chapter 17 PDF

Uploaded by

shopnoCopyright:

Available Formats

Chapter 17

Mergers, LBOs, Divestitures, and Business Failure

Solutions to Problems

P17-1. LG 1, 3: Tax Effects of Acquisition

Intermediate

(a)

Years

Earnings

Tax Liability

115

$280,000

$112,000

After-Tax

Earnings

$168,000

Tax liability = $112,000 15 = $1,680,000

(b)

Years

1

2

3

415

Earnings after Write-off

$280,000 $280,000 = 0

$280,000 $280,000 = 0

$280,000 $240,000 = $40,000

$280,000 0 = $280,000

Tax Liability

$0

0

16,000

112,000

Total =

Tax Savings

$112,000

112,000

96,000

0

$320,000

(c) With respect to tax considerations only, the merger would not be recommended because the

savings ($320,000) are less than the cost ($350,000). The merger must also be justified on the

basis of future operating benefits or on grounds consistent with the goal of maximizing

shareholder wealth.

414

Part 6 Special Topics in Managerial Finance

P17-2. LG 1, 3: Tax Effects of Acquisition

Intermediate

(a)

Year

Net Profits Before Taxes

(1)

1

$150,000

2

400,000

3

450,000

4

600,000

5

600,000

Total taxes without merger

Taxes

[0.40 (1)]

(2)

Net Income

[(1) (2)]

(3)

$60,000

160,000

180,000

240,000

240,000

$880,000

$90,000

240,000

270,000

360,000

360,000

(b)

Year

Taxes [0.40 (1)]

(2)

Net Profits Before Taxes

(1)

1

$150,000 $150 000 = 0

2

$400,000 $400,000 = 0

3

$450,000 $450,000 = 0

4

$600,000 $600,000 = 0

5

$600,000 $200,000 = $400,000

Total taxes with merger

$0

0

0

0

160,000

$160,000

(c) Total benefits (ignoring time value): $880,000 $160,000 = $720,000

(d) Net benefit = Tax benefits (cost liquidation of assets)

= ($1,800,000 0.4) ($2,100,000 $1,600,000) = $220,000

The proposed merger is recommended based on the positive net benefit of $226,060.

P17-3. LG 1, 3: Tax Benefits and Price

Challenge

(a)

Reilly Investment Group

Net Profit Before Tax

Year

(1)

1

2

3

4

57

$200,000 $200,000

$200,000 $200,000

$200,000 $200,000

$200,000 $200,000

$200,000

Total Tax Advantage

Taxes [0.40 (1)]

(2)

Tax Advantage

(3)

$0

0

0

0

80,000

$80,000

80,000

80,000

80,000

0

$320,000

Chapter 17

Mergers, LBOs, Divestitures, and Business Failure

415

(b)

Webster Industries

Net Profit Before Tax

Year

(1)

$80,000 $80,000

$120,000 $120,000

$200,000 $200,000

$300,000 $300,000

$400,000 $100,000

$400,000

$500,000

1

2

3

4

5

6

7

Taxes [0.40 (1)]

(2)

$0

0

0

0

120,000

160,000

200,000

Total Tax Advantage

Tax Advantage

(3)

$32,000

48,000

80,000

120,000

40,000

0

0

$320,000

(c) Reilly Investment Group PV of benefits:

PV15%,4 Yrs. = $80,000 2.855 = $228,400 (Calculator solution: $228,398.27)

Webster Industries PV of benefits:

Year

1

2

3

4

5

Cash Flow PV Factor (15%, n yrs.)

$32,000 0.870

$48,000 0.756

$80,000 0.658

$120,000 0.572

$40,000 0.497

PV of Benefits

=

=

=

=

=

Total

$27,840

36,288

52,640

68,640

19,880

$205,288

Calculator solution: $205,219.74

Reilly would pay up to $228,400.

Webster would pay no more than $205,288.

(d) Both firms receive $320,000 in tax shield benefits. However, Reilly can use these at an

earlier time; therefore, the acquisition is worth more to this firm.

P17-4. LG 3: Asset Acquisition Decision

Challenge

(a) Effective cost of press: = $60,000 + $90,000 $65,000 = $85,000

NPV14%,10yrs. = ($20,000 5.216) $85,000 = $19,320

Calculator solution: $19,322.31

(b) Zarin should merge with Freiman, since the NPV is greater than zero.

(c) NPV14%,10yrs. = ($26,000 5.216) $120,000 = $15,616

Calculator solution: $15,619.01

Since the NPV of the acquisition is greater than the NPV of the new purchase, the firm

should make the acquisition of the press from Freiman. The advantage of better quality from

the new press would have to be considered on a subjective basis.

416

Part 6 Special Topics in Managerial Finance

P17-5. LG 3: Cash Acquisition Decision

Challenge

(a)

PV of cash inflows

Year

Cash Flow PVA Factor (15%)

15

$25,000 3.352

610

$50,000 (5.019 3.352)

Total present value of cash inflows

Less Cost of acquisition

NPV

PV

Calculator

Solution

$83,800

83,350

$167,150

125,000

$42,150

$83,803.88

53,330.68

$167,134.56

125,000.00

$42,134.56

Since the NPV is positive, the acquisition is recommended. Of course, the effects of a rise in

the overall cost of capital would need to be analyzed.

(b) PV of equipment purchase (12%, 10yrs.):

PV = $40,000 5.650 = $226,000

Calculator solution: $226,008.92

NPV = $226,000 $125,000 = $101,000

The purchase of equipment results in a higher NPV ($101,000 versus $42,150). This is

partially due to the lower discount factor (12% versus 15%). The equipment purchase is

recommended.

(c)

PV of cash inflows

Year

Cash Flow PVIFA12%

15

$25,000 3.605

610

$50,000 (5.650 3.605)

Total present value of cash inflows

Less Cost of acquisition

NPV

Calculator

Solution

PV

$90,125

102,250

$192,375

125,000

$67,375

$ 90,119.41

102,272.34

$192,391.75

125,000.00

$67,391.75

No, the recommendation would not change. The NPV of the equipment purchase ($101,000)

remains greater than the NPV of the acquisition ($67,375).

P17-6. LG 3: Ratio of Exchange and EPS

Intermediate

Number of additional shares needed = 1.8 4,000

EPS of merged firm

= $28,000 (20,000 + 7,200)

EPS of Marlas

EPS of Victory

= $1.029 1.8

=

=

=

=

7,200

$1.029

$1.029

$1.852

(b) Number of additional shares needed = 2.0 4,000

EPS of merged firm

= $28,000 (20,000 + 8,000)

EPS of Marlas

EPS of Victory

= $1.00 2.0

=

=

=

=

8,000

$1.00

$1.00

$2.00

(a)

Chapter 17

Mergers, LBOs, Divestitures, and Business Failure

(c) Number of additional shares needed = 2.2 4,000

EPS of merged firm

= $28,000 (20,000 + 8,800)

EPS of Marlas

EPS of Victory

= $0.972 2.2

=

=

=

=

417

8,800

$0.972

$0.972

$2.139

(d) P/E calculations:

(a) Price paid per share: $12.00 1.8 = $21.60

P/E paid =

Price paid per share $21.60

=

= 10.8

EPS of target

$2.00

(b) Price paid per share: $12.00 2.0 = $24.00

P/E paid =

Price paid per share $24.00

=

= 12.0

EPS of target

$2.00

(c) Price paid per share: $12.00 2.2 = $26.40

P/E paid =

Price paid per share $26.40

=

= 13.2

EPS of target

$2.00

When the P/E paid (10.8) is less than the P/E of the acquiring firm (12.0), as in (a), the EPS

of the acquiring firm increases and the EPS of the target firm decreases.

When the P/E paid (12.0) is the same as the P/E of the acquiring firm (12.0), as in (b), the

EPS of the acquiring and target firms remain the same.

When the P/E paid (13.2) is more than the P/E of the acquiring firm (12.0), as in (c), the EPS

of the acquiring firm decreases and the EPS of the target firm increases.

P17-7. LG 3: EPS and Merger Terms

Challenge

(a)

(b)

(c)

(d)

20,000 0.4 = 8,000 new shares

($200,000 + $50,000) 58,000 = $4.31 per share

$4.31 0.4 = $1.72 per share

$4.31 per share. There is no change from the figure for the merged firm.

P17-8. LG 3: Ratio of Exchange

Intermediate

Case

A

B

C

D

E

Ratio of Exchange

$30 $50 = 0.60

$100 $80 = 1.25

$70 $40 = 1.75

$12.50 $50 = 0.25

$25 $25 = 1.00

Market Price Ratio of Exchange

($50 0.60) $25 = 1.20

($80 1.25) $80 = 1.25

($40 1.75) $60 = 1.17

($50 0.25) $10 = 1.25

($50 1.00) $20 = 2.50

The ratio of exchange of shares is the ratio of the amount paid per share of the target firm to the

market price of the acquiring firms shares. The market price ratio of exchange indicates the

amount of market price of the acquiring firm given for every $1.00 of the acquired firm.

418

Part 6 Special Topics in Managerial Finance

P17-9. LG 3: Expected EPS-Merger Decision

Challenge

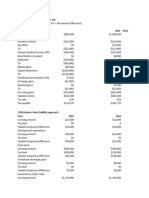

(a)

Graham & Sons Premerger

Year

Earnings

2006

2007

2008

2009

2010

2011

$200,000

$214,000

$228,980

$245,009

$262,160

$280,511

EPS

$2.000

$2.140

$2.290

$2.450

$2.622

$2.805

(b) (1) New shares issued = 100,000 0.6 = 60,000

Year

Earnings/Shares

2006

2007

2008

2009

2010

2011

[($800,000 + $200,000) 260,000] 0.6

[($824,000 + $214,000) 260,000] 0.6

[($848,720 + $228,980) 260,000] 0.6

[($874,182 + $245,009) 260,000] 0.6

[($900,407 + $262,160) 260,000] 0.6

[($927,419 + $280,511) 260,000] 0.6

EPS

=

=

=

=

=

=

$2.308

$2.395

$2.487

$2.583

$2.683

$2.788

(2) New shares issued = 100,000 0.8 = 80,000

Year

Earnings/Shares

2006

2007

2008

2009

2010

2011

[($800,000 + $200,000) 280,000] 0.8

[($824,000 + $214,000) 280,000] 0.8

[($848,720 + $228,980) 280,000] 0.8

[($874,182 + $245,009) 280,000] 0.8

[($900,407 + $262,160) 280,000] 0.8

[($927,419 + $280,511) 280,000] 0.8

EPS

=

=

=

=

=

=

$2.857

$2.966

$3.079

$3.198

$3.322

$3.451

Chapter 17

(c)

Mergers, LBOs, Divestitures, and Business Failure

419

Merger Impact on Earning per Share

3.6

3.4

Postmerger, .8 Exchange Ratio

3.2

3

Postmerger, .6 Exhange Ratio

2.8

EPS ($)

2.6

2.4

Premerger

2.2

2

2006

2007

2008

2009

2010

2011

Year

(d) Graham & Sons shareholders are much better off at the 0.8 ratio of exchange. The

management would probably recommend that the firm accept the merger. If the ratio is 0.6,

between 2010 and 2011, the EPS falls below what the firm would have earned without being

acquired. Here management would probably recommend the merger be rejected.

P17-10. LG 3: EPS and Postmerger Price

Challenge

(a)

Market price ratio of exchange: ($45 1.25) $50 = 1.125

(b) Henry Company EPS =

P/E =

Mayer Services EPS =

P/E =

(c)

$225,000 90,000

$45 $2.50

$50,000 15,000

$50 $3.33

=

=

=

=

$2.50

18 times

$3.33

15 times

Price paid = Ratio of exchange Market price of acquirer

= $56.25

Price paid = 1.25 $45

P/E

= $56.25 $3.33 = 16.89 times

(d) New shares issued = 1.25 15,000

= 18,750

= 90,000 + 18,750

= 108,750

Total shares

EPS

= $275,000 108,750 = $2.529

(e)

New market price = New EPS P/E

= $2.529 18 = $45.52

The market price increases due to the higher P/E ratio of the acquiring firm and the fact that

the P/E ratio is not expected to change as a result of the acquisition.

420

Part 6 Special Topics in Managerial Finance

P17-11. LG 4: Holding Company

Challenge

(a)

Total assets controlled: $35,000 ($500,000 + $900,000) = 2.5%

(b) Outside companys equity ownership:

$5,250 ($500,000 + $900,000) = 0.375%

(c)

By gaining voting control in a company for a small investment, then using that company to

gain voting control in another, a holding company provides control for a relatively small

investment.

(d) (a) Total assets controlled:

$35,000 ($500,000 + $900,000 + $400,000 + $50,000 + $300,000 + $400,000)

= 1.37%

(b) Outside companys equity ownership: 0.15 1.37% = 0.206%

P17-12. LG 5: Voluntary Settlements

Basic

(a) Composition

(b) Extension

(c) Combination

P17-13. LG 5: Voluntary Settlements

Basic

(a)

(b)

(c)

(d)

Extension

Composition (with extension of terms)

Composition

Extension

P17-14. LG 5: Voluntary Settlements-Payments

Intermediate

(a)

(b)

(c)

(d)

$75,000 now; composition

$75,000 in 90 days, $45,000 in 180 days; composition

$75,000 in 60 days, $37,500 in 120 days, $37,500 in 180 days; extension

$50,000 now, $85,000 in 90 days; composition

P17-15. Ethics Problem

Intermediate

These employees and suppliers may believe that the companys problems are only temporary, and

that management will somehow make it up to them if they are supportive throughout the

proceedings. They may worry about finding new jobs or sales contracts.

On the CEOs part, being open and honest before, during, and after reorganization proceedings is

paramount. The big dilemma the CEO faces is being honest but not crying wolf too early.

Should she do so, this may cause an exodus of customers, employees, and suppliers, and hasten

the demise of the company. If the company is turned around, an ethical CEO may somehow

reward loyal employees and suppliers. Best of all, she will make up all back wages and unpaid

invoicesregardless of what the reorganization settlement was.

You might also like

- How To Stop Employers From Withholding Income TaxesDocument14 pagesHow To Stop Employers From Withholding Income TaxesSaleem Alhakim90% (10)

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Re-KYC Diligence of NRE or NRO or FCNR (B) AccountDocument2 pagesRe-KYC Diligence of NRE or NRO or FCNR (B) Accounticq4joyNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Gitman pmf13 ppt09Document56 pagesGitman pmf13 ppt09moonaafreenNo ratings yet

- Tolentino Vs Sec of FinanceDocument3 pagesTolentino Vs Sec of FinanceHyuga NejiNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 10 Steps To Building A Winning Trading Plan PDFDocument8 pages10 Steps To Building A Winning Trading Plan PDFscreen1 record100% (1)

- CFIN 4 4th Edition Besley Solutions Manual PDFDocument9 pagesCFIN 4 4th Edition Besley Solutions Manual PDFbill334No ratings yet

- Financial Reporting Standards CouncilDocument6 pagesFinancial Reporting Standards CouncilFrancis Jerome Cuarteros0% (1)

- Problem 7-15 Part ADocument7 pagesProblem 7-15 Part AImelda100% (1)

- Budget Summary Report: (Company Name)Document6 pagesBudget Summary Report: (Company Name)chatree pokaew100% (1)

- Etc2440 S1 2018Document14 pagesEtc2440 S1 2018moonaafreenNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsTamar PkhakadzeNo ratings yet

- Chapter 7 Introduction To Portfolio ManagementDocument6 pagesChapter 7 Introduction To Portfolio Managementmoonaafreen0% (1)

- Group 2 - Answers To QuestionsDocument2 pagesGroup 2 - Answers To QuestionsJr Roque100% (4)

- Real Property Taxes Case DigestsDocument65 pagesReal Property Taxes Case DigestsJordan Tumayan50% (2)

- Course Outline MicrofinanceDocument2 pagesCourse Outline Microfinancemoonaafreen100% (3)

- Proposal Submitted To HDFC ERGODocument7 pagesProposal Submitted To HDFC ERGOTathagat JhaNo ratings yet

- Practice Problems Ch12 PDFDocument57 pagesPractice Problems Ch12 PDFzoeyNo ratings yet

- Solution Manual For Cfin 5Th Edition by Besley and Brigham Isbn 1305661656 9781305661653 Full Chapter PDFDocument36 pagesSolution Manual For Cfin 5Th Edition by Besley and Brigham Isbn 1305661656 9781305661653 Full Chapter PDFtiffany.kunst387100% (9)

- Chapter 2 Financial Statements Cash Flow and TaxesDocument7 pagesChapter 2 Financial Statements Cash Flow and TaxesM. HasanNo ratings yet

- Solutions (Chapter17)Document5 pagesSolutions (Chapter17)James Domini Lopez LabianoNo ratings yet

- CFIN 4th Edition Besley by Besley and Brigham ISBN Solution ManualDocument9 pagesCFIN 4th Edition Besley by Besley and Brigham ISBN Solution Manualrussell100% (27)

- Solution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFDocument30 pagesSolution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFtiffany.kunst387100% (12)

- T1 - IAS 12 - BT1 - KeyDocument3 pagesT1 - IAS 12 - BT1 - KeyKotoru HanoelNo ratings yet

- MGT 225 Intermediate Accounting IIDocument6 pagesMGT 225 Intermediate Accounting IIchetna sharmaNo ratings yet

- Class Work - CH 3 - Tagged 2Document7 pagesClass Work - CH 3 - Tagged 2Manar FakhrNo ratings yet

- Answers Lt2Document4 pagesAnswers Lt2scryx bloodNo ratings yet

- Gross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsDocument85 pagesGross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsMaria Dana BrillantesNo ratings yet

- Assignment 3 ACC 401Document9 pagesAssignment 3 ACC 401ShannonNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Dwnload Full Cfin 4 4th Edition Besley Solutions Manual PDFDocument35 pagesDwnload Full Cfin 4 4th Edition Besley Solutions Manual PDFbrandihansenjoqll2100% (14)

- Cfin 4 4th Edition Besley Solutions ManualDocument35 pagesCfin 4 4th Edition Besley Solutions Manualghebre.comatula.75ew100% (23)

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Assignment 1Document8 pagesAssignment 1Bianca LizardoNo ratings yet

- XLSXDocument12 pagesXLSXShashwat JhaNo ratings yet

- Assignment 1 Business FinanceDocument3 pagesAssignment 1 Business Financedanish afzaalNo ratings yet

- Solutions Chapter 8Document6 pagesSolutions Chapter 8Carmella DismayaNo ratings yet

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocument38 pagesFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (10)

- Practice Assignment 1 SolutionDocument5 pagesPractice Assignment 1 SolutionJared PriceNo ratings yet

- Corporate Tax Return Project Book-Tax Reconciliation (Adrian Purnama)Document6 pagesCorporate Tax Return Project Book-Tax Reconciliation (Adrian Purnama)akpNo ratings yet

- Isna Wirda Lutfiyah - 17 - 4-17Document10 pagesIsna Wirda Lutfiyah - 17 - 4-17DewaSatriaNo ratings yet

- Managerial Economics (Chapter 14)Document4 pagesManagerial Economics (Chapter 14)api-3703724No ratings yet

- Net Income Answer: B Diff: MDocument2 pagesNet Income Answer: B Diff: MCasper John Nanas MuñozNo ratings yet

- Dwnload Full Cfin 5th Edition Besley Solutions Manual PDFDocument35 pagesDwnload Full Cfin 5th Edition Besley Solutions Manual PDFandrefloresxudd100% (12)

- Cfin 5th Edition Besley Solutions ManualDocument35 pagesCfin 5th Edition Besley Solutions Manualghebre.comatula.75ew100% (29)

- FFM 9 Im 12Document31 pagesFFM 9 Im 12Mariel CorderoNo ratings yet

- Tax Homework Chapter 4Document7 pagesTax Homework Chapter 4RosShanique ColebyNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- BACC497 - Midterm Revision Sheet - AK - Fall 2023-2024Document8 pagesBACC497 - Midterm Revision Sheet - AK - Fall 2023-2024bill haddNo ratings yet

- Seatwork Problem 1Document11 pagesSeatwork Problem 1Zihr EllerycNo ratings yet

- FIN300 Ch3HW Solutions-1Document2 pagesFIN300 Ch3HW Solutions-1Janet TramNo ratings yet

- Ebit - Eps Analysis: No Debt Case With DebtDocument3 pagesEbit - Eps Analysis: No Debt Case With DebtParvesh AghiNo ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- WPC Assignment - FM CaseDocument6 pagesWPC Assignment - FM CaseAhmed AliNo ratings yet

- Financial Management: Capital StructureDocument18 pagesFinancial Management: Capital StructureSamiul AzamNo ratings yet

- Soal Kuis 2Document6 pagesSoal Kuis 2Rahajeng SantosoNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- MTP 12 25 Answers 1697029886Document13 pagesMTP 12 25 Answers 1697029886harshallahotNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Feasibility Study Excel TemplateDocument9 pagesFeasibility Study Excel TemplateBeede AshebirNo ratings yet

- Inclass Solutions 5Document2 pagesInclass Solutions 5AceNo ratings yet

- 6306903Document4 pages6306903maudiNo ratings yet

- Tugas TM 8 Abdul Azis Faisal 041611333243Document4 pagesTugas TM 8 Abdul Azis Faisal 041611333243Abdul AzisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Chapter 1: Managers, Profits, and Markets: Ninth EditionDocument60 pagesChapter 1: Managers, Profits, and Markets: Ninth Editionmoonaafreen100% (1)

- Introduction To Finance: Time Value of MoneyDocument44 pagesIntroduction To Finance: Time Value of MoneymoonaafreenNo ratings yet

- Index MathDocument2 pagesIndex MathmoonaafreenNo ratings yet

- Andhakarer Bondhu by Hemendra Kumar Roy PDFDocument50 pagesAndhakarer Bondhu by Hemendra Kumar Roy PDFmoonaafreenNo ratings yet

- Gitman pmf13 ppt10Document433 pagesGitman pmf13 ppt10moonaafreenNo ratings yet

- Gitman pmf13 ppt05Document79 pagesGitman pmf13 ppt05moonaafreenNo ratings yet

- Gitman pmf13 ppt05Document79 pagesGitman pmf13 ppt05moonaafreenNo ratings yet

- The Role of Managerial Finance: All Rights ReservedDocument45 pagesThe Role of Managerial Finance: All Rights ReservedmoonaafreenNo ratings yet

- Corporate Finance: Capital Structure, Financial Planning, Financial Markets, Growth, Cost of MoneyDocument26 pagesCorporate Finance: Capital Structure, Financial Planning, Financial Markets, Growth, Cost of MoneymoonaafreenNo ratings yet

- Objective of Financial Market RegulationDocument5 pagesObjective of Financial Market RegulationmoonaafreenNo ratings yet

- The Smurfs PresentationDocument22 pagesThe Smurfs PresentationDieu HuynhNo ratings yet

- Fintech Comparison Tool - Dentons Publisher - GlobalDocument84 pagesFintech Comparison Tool - Dentons Publisher - GlobalOlegNo ratings yet

- Nis Registered OfficeDocument2 pagesNis Registered OfficeSamim AktarNo ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- Strategy - PWC - Institutional Development - Performance Improvement On GECOLDocument55 pagesStrategy - PWC - Institutional Development - Performance Improvement On GECOLDavidSeowNo ratings yet

- Module 4-Operating, Financial, and Total LeverageDocument45 pagesModule 4-Operating, Financial, and Total LeverageAna ValenovaNo ratings yet

- Insider Trading Broker DealerDocument20 pagesInsider Trading Broker Dealerajaw267No ratings yet

- 100 149 PDFDocument53 pages100 149 PDFSamuelNo ratings yet

- DAR v. SPOUSES STA. ROMANADocument2 pagesDAR v. SPOUSES STA. ROMANABaphomet JuniorNo ratings yet

- I. Fill in The Blanks:-: Imst English Medium Nursery and High School, MKG Periodic Test - I Class - 7 NameDocument4 pagesI. Fill in The Blanks:-: Imst English Medium Nursery and High School, MKG Periodic Test - I Class - 7 NameSoumit PaulNo ratings yet

- TACTIC - Virtual Technical Scoping Mission ML April 2020 (Final) PDFDocument3 pagesTACTIC - Virtual Technical Scoping Mission ML April 2020 (Final) PDFMugorozi, MNo ratings yet

- Is This Really The End of Neoliberalism?: by David HarveyDocument7 pagesIs This Really The End of Neoliberalism?: by David HarveyRapahNo ratings yet

- BCM CommissionDocument1 pageBCM CommissionchqaiserNo ratings yet

- SLS Roommate Agreement 2011Document3 pagesSLS Roommate Agreement 2011Tony HockmanNo ratings yet

- Web3 and DeFi ApplicationsDocument59 pagesWeb3 and DeFi ApplicationsalabbbNo ratings yet

- Master of Finance: Course: Financial Markets and Institutions (Fin 7302)Document13 pagesMaster of Finance: Course: Financial Markets and Institutions (Fin 7302)TIBEBU TIMOTEWOSNo ratings yet

- International Business LawDocument4 pagesInternational Business LawSatyam RastogiNo ratings yet

- Class 11 Business Studies Chapter 1 NotesDocument10 pagesClass 11 Business Studies Chapter 1 NotesShaurya ManiktalaNo ratings yet

- Analysing Risk and Return On Chargers Products' Investments: Case Analysis in BA 142Document7 pagesAnalysing Risk and Return On Chargers Products' Investments: Case Analysis in BA 142ice1025No ratings yet

- PDF Conceptual Framework and Accounting Standard Syllabus DDDocument11 pagesPDF Conceptual Framework and Accounting Standard Syllabus DDMariya BhavesNo ratings yet

- Pre Issue ManagementDocument19 pagesPre Issue Managementbs_sharathNo ratings yet

- Prospectus: Kazi Murad HossainDocument16 pagesProspectus: Kazi Murad HossainTawsif AnikNo ratings yet

- Commerce Accounts QuestionsDocument18 pagesCommerce Accounts QuestionsNirmal K PradhanNo ratings yet