Professional Documents

Culture Documents

T1 - IAS 12 - BT1 - Key

Uploaded by

Kotoru Hanoel0 ratings0% found this document useful (0 votes)

6 views3 pagesOriginal Title

T1 - IAS 12 - BT1 - key

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesT1 - IAS 12 - BT1 - Key

Uploaded by

Kotoru HanoelCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

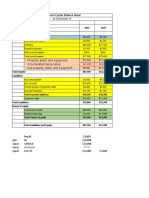

1 (a) Tax Computation for ABC Ltd

(TD = Temporary Difference; PD = Permanent Difference)

Year:

20x1 20x2

Net profit before tax $800,000 $1,000,000

Adjustments

Dividend income $(25,000) $(18,000)

Remitted $0 $33,000

TD $(25,000) $(15,000)

Exempt dividend income (PD) $(40,000) $(35,000)

Amortization of patent $0 $8,000

Deduction $(40,000) $0

TD $(40,000) $8,000

Depreciation $66,000 $88,000

Capital allowances $(200,000) $(150,000)

TD $(146,000) $(62,000)

Disallowed amortization (PD) $7,500 $7,500

Exchange gains $(5,000) $(8,000)

Realized gains $0 $5,000

TD $(5,000) $(3,000)

Fair value gains $(70,000) $(65,000)

Taxable income $543,500 $865,500

Tax rate 22% 21%

Tax payable $119,570 $181,755

1 (b) Balance sheet liability approach

Year: 20x1 20x2

Carrying amount $25,000 $10,000

Tax base $0 0

Taxable temporary difference $25,000 $10,000

Development expenditure

Carrying amount $40,000 $32,000

Tax base $0 $0

Taxable temporary difference $40,000 $32,000

Fixed asset

Carrying amount $384,000 $296,000

Tax base $300,000 $150,000

Taxable temporary difference $84,000 $146,000

Unrealized exchange gains

Carrying amount $5,000 $8,000

Tax base $0 $0

Taxable temporary difference $5,000 $8,000

Investments at fair value

Carrying amount $1,270,000 $1,335,000

Tax base $1,200,000 $1,200,000

Taxable temporary difference $70,000 $130,000

Cumulative taxable temporary differences $224,000 $331,000

Taxable temporary difference of $15,000 (20x1: $22,500) arising from trademarks are not

recognized under IAS 12 paragraph 15.

Movements in cumulative taxable temporary differences

Year 20x1 20x2

Balance, 1 January $0 $224,000

Change $224,000 $107,000

Balance, 31 December $224,000 $331,000

1 (c) Movements in deferred tax liability

Year: 20x1 20x2

Balance, 1 January $0 $49,280

Change $49,280 $20,230

Balance, 31 December $49,280 $69,510

Determination of tax expense

Year: 20x1 20x2

Tax payable $119,570 $181,755

Deferral tax liability $49,280 $20,230

Tax expense $168,850 $201,985

2. Journal entries

Year: 20x1 20x2

Dr Tax expense $168,850 $201,985

Cr Deferred tax liability $49,280 $20,230

Cr Tax payable $119,570 $181,755

Being tax expense recorded for the respective years.

3. Analytical check of tax expense

Year: 20x1 20x2

Profit before tax (PBT) $800,000 $1,000,000

Permanent differences (PD) $(32,500) $(27,500)

PBT +/- PD $767,500 $972,500

Tax on PBT after PD $168,850 $204,225

Effect of change in tax rates on beginning deferred tax (Note 1) $ (2,240)

Tax expense $168,850 $201,985

Note 1: A 1% reduction in tax rate leads to a reduction in tax expense. Beginning cumulative taxable

temporary differences was $224,000. With the reduction in tax rate, future tax payable is reduced and

a write-back can be made of the beginning deferred tax liability of $2,240 (i.e. 1% * $224,000)

You might also like

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Akl P4.3 & P4.4Document18 pagesAkl P4.3 & P4.4Dhivena JeonNo ratings yet

- Project Cost and Revenue Recognition Over 3 YearsDocument3 pagesProject Cost and Revenue Recognition Over 3 YearsHappy MichaelNo ratings yet

- 6306903Document4 pages6306903maudiNo ratings yet

- Accounting Problems with SolutionsDocument22 pagesAccounting Problems with Solutionsbusiness docNo ratings yet

- Value Drivers (Assumptions)Document6 pagesValue Drivers (Assumptions)Phuong ThaoNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Net Income Answer: B Diff: MDocument2 pagesNet Income Answer: B Diff: MCasper John Nanas MuñozNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADocument17 pagesOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarNo ratings yet

- AKL 2 - Tugas 5 Marselinus A H T (A31113316)Document4 pagesAKL 2 - Tugas 5 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowTang De MelanciaNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowBarbara H.CNo ratings yet

- Group financial report analysisDocument5 pagesGroup financial report analysisAhmad SaleemNo ratings yet

- Practice Problems Chapter 12 Corporate Cash Flow and Project AnalysisDocument57 pagesPractice Problems Chapter 12 Corporate Cash Flow and Project AnalysiszoeyNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Intermediate Accounting Exam 3 SolutionsDocument7 pagesIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNo ratings yet

- Determining relevant cash flows for hoist replacementDocument19 pagesDetermining relevant cash flows for hoist replacementJhoni Lim67% (3)

- 6-FAC 4 ADocument5 pages6-FAC 4 Anachofr2704No ratings yet

- Latihan AKLDocument4 pagesLatihan AKLMin RinNo ratings yet

- Bab 4 Kelompok 7Document5 pagesBab 4 Kelompok 7Nadiyah ShofwahNo ratings yet

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- Chapter 17Document8 pagesChapter 17moonaafreenNo ratings yet

- Millennium Company - Projected Financial StatementDocument2 pagesMillennium Company - Projected Financial StatementKathleenCusipagNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Steps to consolidate financial statements for PT A and PT BDocument5 pagesSteps to consolidate financial statements for PT A and PT BMega RefiyaniNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Systems Understanding AidDocument12 pagesSystems Understanding AidPayton CraigNo ratings yet

- In Class Excel - 825 - WorkingDocument98 pagesIn Class Excel - 825 - WorkingIanNo ratings yet

- P4-3 WPDocument4 pagesP4-3 WPAna LailaNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- Chapter 3 PDFDocument15 pagesChapter 3 PDFJay BrockNo ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- Chapter 14Document6 pagesChapter 14Mychie Lynne MayugaNo ratings yet

- Spartan Inc - German MotorsDocument4 pagesSpartan Inc - German MotorsFavian Maraville YadisaputraNo ratings yet

- Fin2001 Pset3Document8 pagesFin2001 Pset3Valeria MartinezNo ratings yet

- Solutions To ProblemsDocument22 pagesSolutions To ProblemsSyeed AhmedNo ratings yet

- Sunrise Bakery NPV AnalysisDocument4 pagesSunrise Bakery NPV Analysisrutvik55% (11)

- Solutions Chapter 8Document6 pagesSolutions Chapter 8Carmella DismayaNo ratings yet

- Chapter 4 Problems SolutionsDocument7 pagesChapter 4 Problems SolutionsRosShanique ColebyNo ratings yet

- Tutorial_11_Interco_transactions.docxDocument15 pagesTutorial_11_Interco_transactions.docxBình QuốcNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Problems: Problem 12 - 2Document9 pagesProblems: Problem 12 - 2Jein PNo ratings yet

- Chapter-2 Solution For 27 and 28Document6 pagesChapter-2 Solution For 27 and 28Tarif IslamNo ratings yet

- FM II Assignment 3 Solution W22Document3 pagesFM II Assignment 3 Solution W22Farah ImamiNo ratings yet

- Financial AnalyticsDocument10 pagesFinancial AnalyticsBiltush Khan100% (2)

- P6-18 Unrealized Profit On Upstream SalesDocument4 pagesP6-18 Unrealized Profit On Upstream Salesw3n123No ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Cashflow Exercise - RocastleDocument1 pageCashflow Exercise - RocastleAbrashiNo ratings yet

- BUSN AssigmentDocument4 pagesBUSN AssigmentMalik Khurram AwanNo ratings yet

- Practice Exam Chapters 1-8 Solutions: Problem 1Document7 pagesPractice Exam Chapters 1-8 Solutions: Problem 1Atif RehmanNo ratings yet

- AFAR JNDocument2 pagesAFAR JNjasonnumahnalkelNo ratings yet

- 1 Bearden Dan Maris Corp + Fin Ratio Analysis Okt - Nov. 2022Document2 pages1 Bearden Dan Maris Corp + Fin Ratio Analysis Okt - Nov. 202231 Sri RizkillahNo ratings yet

- Pickins Mining Case Analysis - NPV, IRR, PaybackDocument5 pagesPickins Mining Case Analysis - NPV, IRR, PaybackWarda AhsanNo ratings yet

- Inter II GENAP - Session 11 - Income TaxesDocument6 pagesInter II GENAP - Session 11 - Income Taxesnathania kNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- About Study_Performance Dataset & Group assignmentDocument2 pagesAbout Study_Performance Dataset & Group assignmentKotoru HanoelNo ratings yet

- ---Vegetable ? --24-Document27 pages---Vegetable ? --24-Kotoru HanoelNo ratings yet

- ---Stripes--24-Document4 pages---Stripes--24-Kotoru HanoelNo ratings yet

- Tigresito Llavero FreeDocument10 pagesTigresito Llavero FreeCatalina IgnaciaaNo ratings yet

- ---Sakura--24-Document15 pages---Sakura--24-Kotoru HanoelNo ratings yet

- ---Torte--24-englisch---Document2 pages---Torte--24-englisch---Kotoru HanoelNo ratings yet

- Kiểm tra LMS - lần 2Document17 pagesKiểm tra LMS - lần 2Kotoru HanoelNo ratings yet

- --- Bunny Toy Outfit --24-Document37 pages--- Bunny Toy Outfit --24-Kotoru HanoelNo ratings yet

- Taxation Ii Notes PDFDocument16 pagesTaxation Ii Notes PDFAudrey Kristina MaypaNo ratings yet

- E-Commerce in Afghanistan: Department of Management SciencesDocument12 pagesE-Commerce in Afghanistan: Department of Management SciencesEnamNo ratings yet

- Retention Strategies To Control Attrition Rate With Special Reference To BPO SectorDocument5 pagesRetention Strategies To Control Attrition Rate With Special Reference To BPO SectorInternational Journal in Management Research and Social ScienceNo ratings yet

- Brochure - AutomationDocument4 pagesBrochure - AutomationMuhammad NawazNo ratings yet

- Bruh KitchenDocument1 pageBruh KitchenNur HanyNo ratings yet

- Basics of Media Writing A Strategic Approach 2nd Edition Kuehn Test BankDocument10 pagesBasics of Media Writing A Strategic Approach 2nd Edition Kuehn Test BankDanDoylexdjcs100% (11)

- Health Care Waste ManagementDocument5 pagesHealth Care Waste ManagementJessa YlaganNo ratings yet

- Award Letter For Contract Dec 21, 2009Document1 pageAward Letter For Contract Dec 21, 2009massieguy0% (1)

- Fifo, Lifo, Simple and Weighted AverageDocument12 pagesFifo, Lifo, Simple and Weighted AverageSanjay SolankiNo ratings yet

- Introduction To Business ImplementationDocument31 pagesIntroduction To Business ImplementationDumplings DumborNo ratings yet

- Answers - Test - Strategic Management Class 0322Document5 pagesAnswers - Test - Strategic Management Class 0322Kuzi TolleNo ratings yet

- IPN Mexico School Marketing Strategy SWOT AnalysisDocument5 pagesIPN Mexico School Marketing Strategy SWOT AnalysisPedro ArroyoNo ratings yet

- 5S mottos and methods for workplace organizationDocument2 pages5S mottos and methods for workplace organizationJsham100% (1)

- Buisness StrategyDocument3 pagesBuisness Strategyrajaroma45No ratings yet

- Virtual Energy Audit Identifies Cost-Effective RetrofitsDocument1 pageVirtual Energy Audit Identifies Cost-Effective RetrofitsAlejandra LopNo ratings yet

- Project: Restaurant at Thamel Designer: Needle Weave L Architects Job Address: Thamel, KathmanduDocument1 pageProject: Restaurant at Thamel Designer: Needle Weave L Architects Job Address: Thamel, KathmanduKiran BasuNo ratings yet

- Aftermarket in The Automotive IndustryDocument3 pagesAftermarket in The Automotive IndustryP LAKSHMI NARAYAN PATRONo ratings yet

- Impact of E-commerce in Indian Economy[1]Document11 pagesImpact of E-commerce in Indian Economy[1]kgourab1184No ratings yet

- Chapter 7 Customer-Driven Marketing Strategy: Creating Value For Target CustomersDocument9 pagesChapter 7 Customer-Driven Marketing Strategy: Creating Value For Target CustomersNhi ThuầnNo ratings yet

- Crisis Management Final Examination: "PT. Freeport Indonesia Big Gossan Collapsed"Document16 pagesCrisis Management Final Examination: "PT. Freeport Indonesia Big Gossan Collapsed"PavelBondarNo ratings yet

- Construction Books & ResourcesDocument2 pagesConstruction Books & Resourcesمحمد إسلام عبابنهNo ratings yet

- AMAZIOUS - Appeal & Plan of ActionDocument4 pagesAMAZIOUS - Appeal & Plan of ActionjhoneNo ratings yet

- Black & Veatch Pltu Tanjung Jati B Pltu Tanjung Jati B JeparaDocument1 pageBlack & Veatch Pltu Tanjung Jati B Pltu Tanjung Jati B Jeparabass_121085477No ratings yet

- UAE-All Companies Addresses and Contact DetailsDocument9 pagesUAE-All Companies Addresses and Contact Detailswafaa al tawil100% (1)

- Business Advantages and DisadvantagesDocument2 pagesBusiness Advantages and DisadvantagesTYA HERYANINo ratings yet

- Astm E1187Document4 pagesAstm E1187AlbertoNo ratings yet

- Digital Marketing Campaign Plan For Lloyds BankDocument23 pagesDigital Marketing Campaign Plan For Lloyds BankOkikioluwa FajemirokunNo ratings yet

- Audit ScheduleDocument3 pagesAudit ScheduleQuality ManNo ratings yet

- Caste and Economy Munshi - JEL1Document72 pagesCaste and Economy Munshi - JEL1dr.s.mariappan sakkananNo ratings yet

- AFAR IFRS SME Quizzers Acoldnerdlion PDFDocument10 pagesAFAR IFRS SME Quizzers Acoldnerdlion PDFCarl Emerson GalaboNo ratings yet

![Impact of E-commerce in Indian Economy[1]](https://imgv2-2-f.scribdassets.com/img/document/720874275/149x198/b0ee1ccfe4/1712504211?v=1)