Professional Documents

Culture Documents

Dropout PDF

Uploaded by

syedmuneebulhasanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dropout PDF

Uploaded by

syedmuneebulhasanCopyright:

Available Formats

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

Research Brief On

The Causes Of The High Rate Of Drop-Out Amongst

Micro-Finance Borrowers

Prepared by

Civil Society Human And Institutional Development Programme (CHIP)

For

Pakistan Financial Services Sector Reform Programme (PFSSRP)

Under

Contract Number PAK/AIDCO/2002/0382/06

December, 2005

Plot No. 5 (Fayyaz Market), Street No. 9, G-8/2,

Opposite National Institute for Handicapped,

Islamabad

(Ph. 92-51-2280151/2250012-14, 56, 111-111920

Fax 92-51-2280081)

Email: info@chip-pk.org

(PROJECT FUNDED BY EUROPEAN UNION)

House # 22 C, Street # 22, F-6/2, Islamabad,

Ph.92-51-2273690, 2273930

Fax 92-51Email:

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-APRIL 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

1.

Background

Civil Society Human and Institutional Development Programme (CHIP) was commissioned by

Pakistan Financial Services Sector Reform Programme (PFSSRP) to undertake a Research Study on the

causes of the high rate of dropout amongst micro-finance borrowers in selected areas of Pakistan. The

purpose of the study was to find out the causes of a high dropout rate amongst micro finance

borrowers of these MFI / NGO Programmes, relate and classify them into factors within and outside

the said MFI / NGO programmes and to prepare a report that (a) critically analyses the findings, (b)

prioritises the causes for high dropout rates, (c) recommends remedial measures and (d) proposes

innovative lending products.

2.

Significance of a High Drop Out Rate

A high dropout rate is a cause of concern to MF programmes, as recruitment of new clients requires

additional costs and efforts. At the same time, dropouts obligate MFIs to expand their lending base by

reaching new clients in itself a healthy attribute for such programmes. Quite frequently, in a market

where the demand for micro credit products is well in excess of their supply, MFIs face little or no

problems in recruiting new clients. This in turn contributes to an organisations lack of attention to

increase in dropout rate.

3.

Basis of Selection of MFIs for the Study

The MFIs / NGOs chosen for the study represent diversity amongst MFIs/ NGOs in terms of

geographical location, lending base, lending focus and size.

4.

Research Methodology

Basic research methodology used for the study involved:

a.

Collection of secondary data and already available research reports from within and

outside Pakistan.

b.

Primary Research involving structured and semi structured interviews, focused group

discussions and completion of questionnaires. A total of 379 persons were interviewed

and/or questionnaires completed. This included 251 dropout borrowers, 92 existing

borrowers and 36 MFI officials.

c.

Analysis, feedback and validation of data.

d. Preparation of the report.

5.

Definition of Drop Out Rate

For the purpose of this research, dropout was defined as those micro finance borrowers who do not

borrow again, at least for a year. The categories of dropouts are:

Voluntary Including Graduates

Involuntary or Rejects

6.

Computing the Drop Out Rate

For computing the rate of dropout, various formula were considered and after careful evaluation, it

was decided to use the Schreiner Formula that states that

Dropout Rate (DOR)

Retention Rate (RR)

ACend

ACbegin

NC

= 1 RR

= ACend / (ACbegin + NC)

= Number of active clients at the end of a year.

= Number of active clients at the beginning of a year.

= Number of new clients entering during the year

Based on Schrieners Formula, we found that annualized dropout rates (over a time period of a year

and more) ranged from 26.5% to 32% between the MFIs / NGOs subject to this research. While it will

not be fair to directly compare these rates with the experience elsewhere due to differences in

parameters used for computation, it is worth noting that rates disclosed by this study are fairly close

to the average dropout rate of 28% experienced by MFI/NGOs in Asia and well below the average

global dropout rate of 48%.

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

7.

Findings

This section presents the main findings regarding the causes of borrower dropout at the MFIs /

NGOs subject to this study in terms of causes internal to and causes external to the control of MFIs /

NGOs.

Figure 1:

Main Causes of Borrower Dropout

Main Causes of Borrower Dropout

1%

15%

5%

16%

63%

Organizational Design and Policy

Idiosyncratic Shocks

Market Driven Pull Factors

Competitive MFI Industry

Systemic Shocks

Figure 1 above and Table 1 below give an over-all / non organizational specific ranking of the factors

and causes of borrower dropout of MFI / NGO borrower in Pakistan according to this research. The

overall figures are averages derived from the percentage of respondents giving a specific response

for each MFI / NGO. It must be understood that overall figures do not represent % of total

respondents. This is because the average of percentages of the respective MFIs / NGOs reflects the

average weight each cause / factor holds for an MFI / NGO on average, regardless of its size.

It is relevant to state that it is more meaningful to look at causes for individual MFIs / NGOs and

avoid the tendency to generalize. For example, In Table 1 below, the weak communication strategy as

a cause of borrower dropout scores in the overall figures. However, this cause surfaced only in case

of NGO B. Again, Group Related causes for borrower dropout were cited by 31% of the

respondents at NGO A, but by none at NGO B and NGO C.

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

Table 1:

Overall Causes of Client Dropout (%)

Causes of Client Dropout

A.

A.1

A.1.1

A.1.2

A.2

A.2.1

A.2.2

A.3

A.3.1

A.3.2

A.3.3

A.3.4

A.3.5

A.4

A.4.1

Organizational Design and Policy

Loan Processing

Application Procedure and Formalities

Selection Criteria

Communication Strategy

Communication Gap regarding cost structure

Information dissemination about loan availability

Loan Product Design

Small Loan Size

Short Loan Length

Repayment schedule

Loan too Expensive

Interest Rate is Un-Islamic

Staff Related Causes

Inadequate attention to borrowers due to lack of

Competence, Workload, remuneration basis, etc.

Group Related Causes

Pushed out by Group due to Repayment

Problems

Conflicts within the Group

Group became inactive

Idiosyncratic Shocks

Inability to Repay due to weak business / other

reasons

Closed the business to do something else

Spent the money on crisis or celebration

A.5

A.5.1

A.5.2

A.5.3

B

B.1

B.2

B.3

B.4

B.5

B.6

C

C.1

C.2

D

D.1

E

E.1

Total

7.1

Lack of ability / time to continue business

Emigration

Stopped by Family member

Systemic Shocks

Poor economic condition of the target customer

Business is seasonal

Market Driven Pull Factors

Have Enough Working Capital for Business /

Have liquidity

Competitive MFI Industry

Found a better source of borrowing

NGO A

56

1

1

0

0

0

0

18

4

4

8

0

6

NGO B

83

8

5

3

24

17

7

51

0

0

12

23

16

0

NGO C

51

10

5

5

0

0

0

36

13

5

4

14

0

5

Overall

63

6

4

2

7

5

2

35

6

3

8

13

5

4

31

11

6

23

15

0

0

2

0

0

30

2

8

16

12

0

2

2

2

0

10

2

8

17

0

0

0

0

0

0

0

0

15

2

10

0

1

3

6

2

4

13

1

4

1

1

1

5

1

4

15

17

15

13

15

2

2

100

0

0

100

0

0

100

1

1

100

Comment on the Findings

Figure 1 shows that the main factors (for all individual MFIs / NGOs) for borrower dropout were

internal to the organization and related to the organizational design and policy. Idiosyncratic shocks

reflecting the vulnerability to shocks of the poor clients were the second main set of causes. A

significant share of factors (about 15% in terms of equalized frequency 1 ) to borrower dropout was the

lack of need to borrow again.

1 For the overall analysis of the causes of dropouts, overall weight to each cause is given by first equalizing factors as sample

size and unique factors related to each MFI / NGO. This is done for each cause by taking total of frequency number for all

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

This section is a commentary on the findings regarding causes of borrower dropout in this survey.

A.

Organizational Design and Policy

Sub Causes Under Organisational Design and Policy

40

35

30

25

20

Series1

15

10

5

0

Loan Processing

Communicat ion

St rat egy

Loan Product

Design

Staf f Relat ed

Causes

Group Relat ed

Causes

A1

Loan Processing

Loan processing formalities like presenting an Identity card or filling the forms and signing the

stamp-papers were not cited as a cause of dropping-out very frequently. For example, for MFIs /

NGOs operating in regions where women to men literacy ratio is only 0.34, five percent (5 %) women

borrowers (dropouts) cited paperwork as one of the reason of dropping out, and this was in cases

where men members refused to help the respondent to fill in the form due to their disapproval of the

respondent taking credit. In one region, about 5% of women borrowers found presenting their

Identity card as a barrier to borrowing. On an overall basis, 4% of the respondents cited loan

procedure and formalities as a cause of dropout.

Another aspect of loan processing is selection criteria used by MFI lenders that may debar a micro

finance borrower from applying for a fresh loan. For example, a person may generally not get a loan if

he / she is more than 65 years of age, or if he or she has not been able to make timely repayments of

the past loan. If a borrower fails to meet these conditions after completing one or more cycles of

borrowing, he/she is refused a fresh loan.

In case of one NGO, 5% of the drop out respondents attributed their failure to borrow again to this

factor. This factor is, however, somewhat mitigated by an attempt by lending officers to encourage

over-aged applicants to apply for a fresh loan in the name of a younger family member. In this case,

the lending volume of the MFI remains unaffected while technically a dropout is added to the

statistics. On an overall basis, only 2% of the respondents were barred from borrowing again due to

selection criteria.

Though loan processing formalities and selection criteria have not surfaced as a major factor of

dropping out, these formalities do constitute a factor of competitive disadvantage against local money

lenders who can provide instant access to loan without much regard for age of the borrower.

A 2.

Communication Strategy

Weak communication strategy of MFIs / NGOs as a factor for dropping out was not commonly cited

during this research. This factor was cited in case of only one MFI / NGO where it accounted for 24%

three MFIs / NGOs and dividing it by three. Hence, equalized frequencies are not frequencies with respect to total number of

responses in this survey.

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

of respondents. However, it reflects the significance of proper communication between the

organization and its clients and how communication deficit / weak customer mobilization can

negatively affect a micro finance programme.

The communication gaps cited by respondents (in case of one MFI / NGO) were in terms of the

failure of the MFI / NGO to communicate the cost structure of the loan. Many borrowers were not

even fully aware of the terms and conditions of their loans. They expressed their lack of information

on the deductions, extra installments and even the interest components of their loans. This type of

communication gap was proving to be quite detrimental as it created an impression of unfairness

amongst the borrowers who decided not to borrow again from the MFI / NGO. In a rural market

where communities are tight knit and word of mouth is a potent source of information dissemination,

the exact damage to the MFI / NGO in terms of first time borrowers forgone due to a negative

reputation can not be determined.

The second type of information gap was that some borrowers were not aware that they had the

option to borrow again from the MFI / NGO.

Both the above factors highly correlate to lack of staff training and staff work-load that will be

discussed separately later in this section.

A 3.

Loan Product Design

Factors related to loan product design, at 35% of the total, were the most commonly cited cause for

drop out. Loan product design refers to:

Loan size

Loan Length

Repayment Schedule

Cost of Loan

Loan Design Compatibility with local culture / religious taboos.

Loan Size:

Where loan size was a major factor for borrower dropout, the loan amounts were

considered inadequate to completely finance an income generating activity. Thus the loan was either

used for non-productive purpose or the borrower had to find other source of fund to augment the

loan for business / income generating purpose or when a business was being supported by

inadequate capital injection, its probability of failure was increased / or income generated was

sufficient only to repay the loan. 6% of respondents cited small loan size as reason for dropping out.

Repayment Pattern and Duration: Loan length and loan repayment schedule, along with the cost of

loan, affect the burden of repayment. Problems associated with repayment pattern and loan duration

were the most commonly cited reason for the dropout. Dropout borrowers found the frequency of

installments too high, the loan period too short and penalties too high. In many cases, amounts

borrowed were used for a purpose did not start paying back immediately whereas the loan

repayment commenced immediately after loan disbursement. This often made the borrower borrow

from elsewhere to meet the repayment obligation. This is indicative of how little research is done by

MFIs to tailor micro credit products according to the need of the borrowers. Frequency of repayment

schedule was cited as a cause by 12% to 4% of respondents. Overall, these two factors accounted for

11% (short duration 3%, inconvenient repayment pattern 8%) of the dropout cases.

Cost of the Loan: The components of the cost of loan are interest rate, initial fees, forced contribution to

savings and penalties. Where for one MFI/NGO, the frequency of cost of loan being cited as a cause

for borrower dropout was 23%, for another it was as low as 2%. On an overall basis, this factor

accounted for 13% of drop outs.

The finding in our survey regarding the cost of loan was that in cases where loan was used for nonproductive purpose or in an activity that failed to generate sufficient income, the cost of loan was a

contentious issue for borrowers.

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

However, in cases where the income generating activity took off because of the loan, thereby

increasing the ability of the borrowers to repay comfortably, the borrowers did not mind the financial

cost of the loan. In such cases, some responses regarding satisfaction / dissatisfaction with cost of

loan / interest are quoted in the Voice Box 1 below.

Voice Box 1: Satisfaction with the Cost of Loan

after all it (the MFI) has to earn as well..

. If we are earning more because of their loan, its only fair that we pay the interest they

charge

. If they dont charge us interest they wont be able to lend us the money...

Source: Individual interviews of dropout borrowers MFI C September 2005

This shows that as long as the consumer is attaining a net gain in terms of income out of the loan,

interest charge and cost of loan do not affect his / her decision until the point where the cost is so

high that the borrower prefers to switch to other sources of finance including self-financing by

foregoing other expenditure.

This identifies a need for MFIs to determine, within the economic profile of the target market, the

thresholds of interest rate beyond which a certain target group will choose not to borrow.

Loan Design Compatibility with Local Culture / Religious Taboos:

This refers to religious taboo in

Islam against usury that is generally associated with interest charging. In our survey, we discovered

this taboo having regional significance. The taboo is most effective in the case of one MFI/NGO,

where 16% of the respondents said they will not borrow again because interest is un-Islamic and

giving interest is a sin. On an overall basis, this factor accounted for 5% of dropouts.

The survey showed that MFIs in whose target operational zone the religious taboo against interest is

effective, must evolve new lending products compatible with the religious beliefs.

A 4.

Staff Related Causes

Dropout due to the attitude of / conflict with the staff is cited with an overall frequency of 4%. The

conflicts with staff usually arose due to borrower delinquency. In cases where staff misbehavior was

cited, the borrower was determined not to re-join the programme. Staff related factors of borrower

dropout can be related to following according to this survey:

Staff Competency:

Causes related to the competence and/or adequacy of the MFI / NGOs staff.

MFIs are not generally known to have the finest quality staff. Their poor pay structure and difficult

working conditions often force them to have less than desired level staff. This translates into a

number of administrative problems which, in turn, have an impact on, inter alia, dropout rates. Staff

incompetence or inadequacy (in terms of both quality and numbers) leads to lack of follow up

meetings with borrowers, absence of rapport building with potential dropout candidates, lapses in

credit appraisals etc. However, this is an area where dropout borrowers generally refrain from

commenting on. Our study team felt that causes relating to staff incompetence and inadequacy had a

big impact on dropout rates.

Staff Workload: All the MFIs / NGOs participating in this research are integrated social development

organizations where micro credit is only one of the many other programmes of the organization.

Furthermore, there was no evidence in the field of a dichotomy within the field staff in terms of social

organizers / field officers for micro credit programme and other social development programmes.

The same field workers were responsible for meeting targets not only for micro finance programme

but also for educational, health and other programmes. The work over-load and pressure to meet

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

targets appeared to be compromising the quality of not only the micro credit programmes but also the

other programmes of these MFIs / NGOs. Client follow-up and client appraisal are poor, loopholes

around the criteria for loan approval are being shown to potential borrowers by loan officers to meet

the latters targets.

System of Rewards and Penalties: System of rewards and penalties for the social organizers / credit

officers revolve around portfolio target and recoveries. The loan officers get penalized financially in

case of loan default. Thus, in the absence of any guidelines set by the MFIs / NGOs on how to treat

borrower/clients, staff tends to use threats and rudeness to get payments out from the borrower and

by doing so alienates the latter for ever.

A 5.

Group Related Causes

Lending technique adopted by all the MFIs / NGOs surveyed in this research was group lending.

However, the degree and spirit in which group lending methodology was being adopted tended to

vary across the MFIs / NGOs. The degree of implementation of group lending methodology ranged

from scenario where group lending system was being implemented in its spirit to the greatest degree

to that where groups existed but rarely met, the main purpose of the group was for loan

disbursement and repayment by the borrowers. In some MFIs / NGOs, group formation was very

sporadic. In many cases, groups existed only on paper and the borrowers themselves did not know

that they belonged to a group.

The research found that in latter two cases where the basis of groups were only loan disbursement

and repayment, the borrowers in rural areas tended to be indifferent to group lending methodology

while borrowers in urban areas preferred lending on individual basis. However, in either of these

cases no respondent cited group related causes e.g. disbandment of the group or conflicts within the

group as a cause for dropping out.

In the case where group lending methodology was being implemented to the greatest degree, the

major cause of dropping out in terms of frequency (31%) was related to group lending methodology.

Following are some of the findings regarding the effectiveness of group methodology and latter in

relation to client satisfaction:

A prerequisite to implement the group lending in its spirit is investment by the MFI in

terms of staff and time for group formation and group training methodology. An

overburdened staff under pressure to meet its targets can effectively turn group

methodology into individual lending methodology;

Effective group lending requires that the groups be based on self-help agenda rather than

for the sole purpose of accessing loan. In an MFI / NGO where group lending was being

implemented in its spirit, the cohesion of groups was based on their saving and internal

lending programme. In another MFI / NGO, the findings were that borrowers who took

advantage of trainings from being part of the group tended to have greater client loyalty

than those who did not or than those who did not even know that on paper at least they

belonged to a group. In the case of the former, the group members even continued to

participate in group based trainings despite Resting in terms of rejoining the micro

finance programme. In case of an MFI / NGO where the groups were solely for the

purpose of loan disbursement and payment of the installments, the borrowers in rural

areas were indifferent to the groups; they hardly ever had group meetings. The benefits

accrued were mainly in terms of facilitating each other in giving each other company

while going to the bank to deposit the installment;

Borrowers who preferred to be lent on individual basis were:

Those who lived in urban areas;

Whose groups tended to meet frequently;

Who had trouble in repayments and thus were talked down by the MFI / NGO staff

in front of the group members.

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

In cases where the group meetings did occur, some women in all MFIs / NGOs valued

group lending as it provided a socializing platform and tended to strengthen social

networks.

In cases where group meetings were not held regularly or not at all, no respondent cited

group related factors as direct cause of borrower dropout. In case of the MFI / NGO

where groups were effective and operational, intra-group conflicts and group collectively

deciding not to borrow from the MFI /NGO (due to general inability to make timely

repayments and due to alternative sources of credit) were a major reason for borrower

dropout.

Idiosyncratic Shocks

After organizational design and policy, idiosyncratic shocks score the highest in terms of factors of

borrower dropout. Idiosyncratic shocks identified in this survey were:

B 1.

B 2.

B 3.

B 4.

B 5.

Inability to repay due to weak business / or other reasons;

Closed the business to do something else;

Spent the money on crisis (illness, death) or celebration (marriage);

Emigration;

Stopped by family member

Idiosyncratic Shocks as a cause category (in terms of frequency of response) ranged from 30% for one

MFI / NGO to just 2% for another MFI / NGO. On an overall basis they account for 16% of dropouts.

Sub Causes Under Idiosyncratic Shocks

9

8

7

6

5

4

3

2

1

0

Inabilit y to Repay

due to weak

business / other

reasons

Closed t he

business t o do

somet hing else

Spent t he money on

crisis or

celebration

Lack of abilit y /

t ime to cont inue

business

Emigration

Stopped by Family

member

Series1

Within the factor of idiosyncratic shocks, the main reason for borrower dropout was the inability to

pay due to business failure or general economic condition of the borrower (ranging from 12% to 2%

from organization to organization). The latter fact reflects the inherent inability of the borrower to

repay due to poverty and insufficient income generation. This factor relates to the loan product

design matching the needs and profile of these borrowers, borrower appraisal before approving the

loan and the impact of the loan on the borrower. The vulnerability of the borrowers to negative

shocks like crisis / illness / death and overriding consumption need as social events was the second

main type of idiosyncratic shocks and related to ineffective utilization of loan (10% in case of one MFI

/NGO). An overall score of 16 % idiosyncratic shocks as factor behind borrower dropout reflects on

the borrower selection and loan approval criteria as well as the impact of the micro credit

programme.

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

C.

Systemic Shocks

Systematic shocks includes poor economic condition of the borrower and or in case where borrower

has seasonal business. Systemic shocks, though not within control of MFIs / NGOs, put greater

urgency on the MFIs / NGOs to re-evaluate and innovate on their services and products. On an

overall basis, 5% of dropouts cited these shocks as reason for not borrowing again. The degree to

which an MFI / NGO needs to bring innovation and fine tune its services depends on the length of

the impact of the systemic shock.

Sub Causes Under Systematic Shocks

4.5

4

3.5

3

2.5

Series1

2

1.5

1

0.5

0

Poor economic condition of the t arget cust omer

Business is seasonal

In our survey, the main systemic reason for borrower dropout is the seasonality of the income

generating activity. This factor was found to be significant for MFIs / NGOs operating in areas that

experience periodic draughts. For example, for one MFI / NGO, draught was an underlying reason

in many cases and this factor was explicitly referred to 10% of the times by the respondents. MFIs /

NGOs operating in areas where systemic shocks are periodic and acute must fine tune their credit

design to counter the seasonality effect. MFIs / NGOs operating in areas where seasonality of income

generating activities contributes to a smaller degree (4% in case of one MFI /NGO) must decide to fill

the gap for the borrowers (who dropout due to seasonal systemic shocks) based on cost and benefit

assessment.

D.

Market Driven Pull Factors

Market driven pull factors includes that borrowers have enough working capital for business and or

have liquidity. Absence of need to borrow as a cause expressed by the respondents was the most

frequently cited reason for dropping out (15% of total reasons cited). The respondents said that they

either did not need to borrow again or that they have enough liquidity being generated through their

income that they choose to self-finance their needs.

The following three general scenarios were observed in terms of absence of borrowing need cited as

factor of borrower dropout were:

o

o

The first / previous loan was utilized for income generating activity and the purpose of the loan

was served; or

The previous borrowing was for immediate non-productive purpose and was availed by

borrower who could afford to repay the loan without additional increase in income;

CHIP 6.17.0 PDC AM/LH

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

The previous loan had helped to create a base for income generating activity that allowed the

borrower the option to finance his / her needs through bank borrowing or through retained

earnings.

In this survey, the former two scenarios were most common. For borrowers who perceived the cost

of the loan as too high tended to prefer using their additional income generated through previous

loans to finance further needs in terms of working capital. In many cases, the loan was utilized for

non-productive purpose as buying sewing machines for the dowry of the daughter or payment of

educational fee. The main reason for borrowing was to bridge the cash-flow gap for imminent needs.

As the imminence of the need had passed and the need was non-repetitive, the need for borrowing

was no more.

o

E.

Competitive Micro Finance Industry

Competitive micro finance industry includes that borrowers have found a better source of

borrowing. There has been little evidence of borrowers of MFIs / NGOs dropping out due to

competitive forces within the MF industry. In case of one MFI / NGO where respondents referred (to

the greatest degree compared to dropout borrowers from other MFIs / NGOs) to their knowledge of,

to their access to and their preference for alternative sources of credit as a cause of dropping-out,

dropping out in favour of alternative credit suppliers (formal / informal) was cited only 1% of the

times. None of the respondents in majority of MFIs / NGOs surveyed cited competitive sources of

credit as a reason for dropping out. This reflects the nascent stage of MF industry and thus the lack of

competition / or the lack of information available to borrowers about competing MFIs / NGOs /

other sources of credit.

However, there was some evidence of informal lending sources as family, friends and moneylenders

being approached by borrowers for imminent needs.

8.

Significance of Findings

The micro finance sector in Pakistan has just moved out of the stage of nascence on to the market

development stage and is currently experiencing a significant escalation in the growth rate in terms of

outreach. This growth is largely donor pushed. However, there is little diversity in micro finance

products being offered across the sector and MFIs / NGOs as yet do not face any real competition

from each other. The sectors lifecycle can help MFIs / NGOs envision how the dropout rate for the

MFIs / NGOs may vary with different stages of development of the micro finance sector in Pakistan.

Given that the micro finance sector in Pakistan has just started to grow, unless checked, the dropout

rates for MFIs / NGOs are likely to be on the rise in the face of greater competition from greater

number of MFIs / NGOs / MFBs in the formal sector.

The dropout rates experienced by the MFIs / NGOs covered by this research study are near or above

the average dropout rate experienced by MFIs / NGOs in Asia. And this is despite the fact that in

Pakistan the competition between MFIs is rather low while the rest of the countries in Asia like India,

Sri Lanka and Bangladesh have much greater competition between the operating MFIs. The gravity of

this observation is enhanced by the fact that the micro finance sector in Pakistan is relatively younger

and should by the norms of this sector, not show a high dropout rate at this stage of its development.

9.

Lack of Concern Among MFIs

While we felt that this factor should have been of great concern to the practitioners in the micro

finance sector in Pakistan generally and the management and staff of the MFIs / NGOs specifically,

our study found a general lack of concern amongst the MFIs / NGOs for client retention. This lack of

concern was evident by the fact that:

o

The middle management and the field staff were not aware of the importance of retaining

clients / dropout rates;

CHIP 6.17.0 PDC AM/LH

10

[Research Brief Causes of Dropout-April 06]

Research Brief on The Causes of The High Rate of Dropout Amongst Micro-finance Borrowers-December 2005

Though the field staff was aware of the main causes of borrower dropout in their respective

MFIs / NGO and identified these causes to be related to organizational policies and product

design, the middle management was of the view that dropout rate was not a serious enough

issue to merit any special attention from the organization. The senior managers were content

in their theory that the main cause of borrower dropout was refusal of the organization to

give a repeat loan due to bad repayment history or age limit policies.

None of the MFIs / NGOs covered by this report (and others with whom the study team had

an interaction) had any formal reporting of borrowers dropout rate. Not surprisingly,

therefore, none had any formal record of reasons for borrowers dropout anywhere on the

client exit forms.

10.

Current Situation

The recently experienced growth in terms of outreach of micro finance has been largely donor

pushed. The current organizational systems and human resource capacity within the micro finance

sector to absorb continuous supply-pushed growth is being stretched beyond its limits. The donor

policies do not reflect, as yet, a concern for client retention (so that the availability of micro finance

can have its optimal impact on improving socio-economic condition of the borrowers). One proxy of

this lack of concern is that MFIs / NGOs benefiting from donor funds are not required to report their

respective client retention rates for the organization as a whole and for different loan cycles as part of

the set of the performance indicators required of the MFIs / NGOs by the donors. However, the

donor agencies have realized the need for institutional and organizational strengthening to support

the pressure for growth of the sector.

Thus while the donor paradigm is pushing for

commercialization and self-sustainability of the MFIs / NGOs, it is also supporting the development

of their Human Resource, MIS., etc and supporting research that can help the micro finance sector be

more responsive to the needs of the market.

11.

Some Recommendations

The drop out rate situation demands introduction of innovative micro credit products. The following

guidelines are provided:

a.

Suitability of the terms and conditions of the micro finance product against the use to which

the product will be put by the borrower;

b.

Conformity with the real need and repayment ability of the borrower;

c.

Security (in the form of guarantees or other means)

d.

Up to date and comprehensive accounting systems are needed to ensure timely notice of

lapses, thereby making follow up and remedial action possible.

e.

MFIs to be sustainable organizations have to make decisions on sound economic basis.

f.

Arrive at suitable drop out estimation method and include it as part of performance indicator;

g.

Business responsive products;

h.

Build client loyalty through range of services;

i.

Appropriate staff incentives and training;

j.

Developing and running a customized Management Information System to develop borrower

based data base.

CHIP 6.17.0 PDC AM/LH

11

[Research Brief Causes of Dropout-April 06]

You might also like

- 2013 Deutsche Bank Operational Due Diligence SurveyDocument48 pages2013 Deutsche Bank Operational Due Diligence SurveyRajat CNo ratings yet

- McGraw Hill Connect Question Bank Assignment 4Document2 pagesMcGraw Hill Connect Question Bank Assignment 4Jayann Danielle MadrazoNo ratings yet

- Certificate in Bookkeeping and Accounting Level 2Document38 pagesCertificate in Bookkeeping and Accounting Level 2McKay TheinNo ratings yet

- Money in The Nation's EconomyDocument18 pagesMoney in The Nation's EconomyAnne Gatchalian67% (3)

- Template For Accounting ManualDocument4 pagesTemplate For Accounting ManualKent TacsagonNo ratings yet

- KAMM Notes Taxation Bar 2021Document115 pagesKAMM Notes Taxation Bar 2021Bai MonadinNo ratings yet

- Psychology and Life 16th Edition Richard Gerrig and Philip ZimbardoDocument500 pagesPsychology and Life 16th Edition Richard Gerrig and Philip ZimbardoMomal Khawaja92% (12)

- An - Analytical - Study - of - Determinants - of - Non-Performing LoanDocument14 pagesAn - Analytical - Study - of - Determinants - of - Non-Performing LoanSpade AceNo ratings yet

- Performance Evaluation of NestleDocument4 pagesPerformance Evaluation of NestleMomal Khawaja100% (2)

- Pakistan Affairs Notes by Shakeel BabarDocument120 pagesPakistan Affairs Notes by Shakeel BabarMomal KhawajaNo ratings yet

- Non Performing Loan ThesisDocument4 pagesNon Performing Loan ThesisPaperWritingServiceSuperiorpapersSpringfield100% (2)

- Determinants of Credit Default Risk of Microfinance InstitutionsDocument9 pagesDeterminants of Credit Default Risk of Microfinance InstitutionsgudataaNo ratings yet

- Research Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) DOI: 10.7176/RJFA Vol.10, No.3, 2019Document12 pagesResearch Journal of Finance and Accounting ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) DOI: 10.7176/RJFA Vol.10, No.3, 2019daniel nugusieNo ratings yet

- Credit Finance Policy Report - EgyptDocument128 pagesCredit Finance Policy Report - EgyptMostafa El-HoshyNo ratings yet

- Dissertation BankingDocument4 pagesDissertation BankingPaperWriterLowell100% (1)

- Research Paper On NBFCDocument7 pagesResearch Paper On NBFCgw1nm9nb100% (1)

- The Varying Economic Impact of VillagebankingDocument20 pagesThe Varying Economic Impact of VillagebankingFanny Sylvia C.100% (4)

- CGAP Technical Guide Appraisal Guide For Microfinance Institutions Mar 2008Document86 pagesCGAP Technical Guide Appraisal Guide For Microfinance Institutions Mar 2008leekosalNo ratings yet

- Financial Analysis Dissertation PDFDocument8 pagesFinancial Analysis Dissertation PDFProfessionalCollegePaperWritersUK100% (1)

- Microfinance Around The World - Regional SWOT AnalysisDocument62 pagesMicrofinance Around The World - Regional SWOT AnalysischiranrgNo ratings yet

- Chapter FiveDocument11 pagesChapter FiveAmidu MansarayNo ratings yet

- Topic: Credit Assessment Process and Loan Repayment: A Case Study of Fidelity Bank (Head Office - Accra)Document75 pagesTopic: Credit Assessment Process and Loan Repayment: A Case Study of Fidelity Bank (Head Office - Accra)SayedSafiullahHashimiNo ratings yet

- Mba Banking and Finance Thesis TopicsDocument5 pagesMba Banking and Finance Thesis Topicsleanneuhlsterlingheights100% (1)

- Predicting The Insolvency of Smes Using Technological Feasibility Assessment Information and Data Mining TechniquesDocument17 pagesPredicting The Insolvency of Smes Using Technological Feasibility Assessment Information and Data Mining TechniquesAnnisa RisqiNo ratings yet

- Market Research On Cause of Client DropoutDocument25 pagesMarket Research On Cause of Client Dropouthailu letaNo ratings yet

- Finance Dissertation Report PDFDocument5 pagesFinance Dissertation Report PDFOrderCustomPaperUK100% (1)

- SME Loan Guarantee Scheme Recipient and Comparison Group Survey Results-UK-2010Document90 pagesSME Loan Guarantee Scheme Recipient and Comparison Group Survey Results-UK-2010dmaproiectNo ratings yet

- Dissertation Project Report On FinanceDocument5 pagesDissertation Project Report On FinanceGhostWriterForCollegePapersDesMoines100% (1)

- Internship Report On FSIBDocument135 pagesInternship Report On FSIBRashed55No ratings yet

- Dissertation On Non Performing LoansDocument4 pagesDissertation On Non Performing Loansriteampvendell1979100% (1)

- Research Paper - Evaluating Institutional Factors Contributing To Default in Loan Repayment Within Microfinance Institutions in JamaicaDocument68 pagesResearch Paper - Evaluating Institutional Factors Contributing To Default in Loan Repayment Within Microfinance Institutions in JamaicaCecile S CameronNo ratings yet

- An Overview of Microfinance Service Practices in Nepal: Puspa Raj Sharma, PHDDocument16 pagesAn Overview of Microfinance Service Practices in Nepal: Puspa Raj Sharma, PHDRamdeo YadavNo ratings yet

- Wis4.1 ProposalDocument13 pagesWis4.1 ProposalZVIKOMBORERONo ratings yet

- Banking and Finance Dissertation PDFDocument4 pagesBanking and Finance Dissertation PDFAcademicPaperWritingServicesGrandRapids100% (1)

- Literature Review On Sme FinancingDocument5 pagesLiterature Review On Sme Financingaflsimgfs100% (1)

- Alternative Credit Scoring: Concept, Practice, and Global DevelopmentsDocument11 pagesAlternative Credit Scoring: Concept, Practice, and Global DevelopmentsBasuraj TenginakaiNo ratings yet

- Title:-Capital Budgeting and Its Techniques in Prathi Solutions Private LimitedDocument76 pagesTitle:-Capital Budgeting and Its Techniques in Prathi Solutions Private LimitedabhishekNo ratings yet

- Apples Will Be ApplesDocument34 pagesApples Will Be ApplesmohnishdNo ratings yet

- Efficacy of Venture Capital Financing Process in India3966Document6 pagesEfficacy of Venture Capital Financing Process in India3966Vinnu BhardwajNo ratings yet

- Credit Rating Agencies DissertationDocument7 pagesCredit Rating Agencies Dissertationdipsekator1983100% (1)

- IJRSML 2015 Vol03 Issue 03 07Document6 pagesIJRSML 2015 Vol03 Issue 03 07Aftab HusainNo ratings yet

- Thesis On Loan DelinquencyDocument8 pagesThesis On Loan Delinquencysjfgexgig100% (2)

- Financial Management Dissertation ExamplesDocument4 pagesFinancial Management Dissertation ExamplesBuyCollegePaperOnlineAtlanta100% (1)

- Research Paper On Financial Performance Analysis of BanksDocument6 pagesResearch Paper On Financial Performance Analysis of BankspcppflvkgNo ratings yet

- Credit OperationsDocument4 pagesCredit OperationsGrace OpeketeNo ratings yet

- Identification of The Factors Impacting The Increase in Outstanding Claims at Melli and Mellat Banks in North Khorasan ProvinceDocument6 pagesIdentification of The Factors Impacting The Increase in Outstanding Claims at Melli and Mellat Banks in North Khorasan Provincebalal_hossain_1No ratings yet

- Literature Review On Microfinance Institutions in UgandaDocument9 pagesLiterature Review On Microfinance Institutions in UgandakbcymacndNo ratings yet

- Utilization & Operation of Swift: Bangladesh PerspectiveDocument8 pagesUtilization & Operation of Swift: Bangladesh PerspectiveMasud Khan ShakilNo ratings yet

- Impact AnalysisDocument39 pagesImpact AnalysisAndrea Amor AustriaNo ratings yet

- Thesis Sme FinancingDocument4 pagesThesis Sme Financingfjda52j0100% (2)

- Factors Affecting Non-Performing Loans: Case Study On Development Bank of Ethiopia Central RegionDocument15 pagesFactors Affecting Non-Performing Loans: Case Study On Development Bank of Ethiopia Central RegionJASH MATHEW67% (3)

- Sapm A 1 2013-15Document11 pagesSapm A 1 2013-15Amit UpadhyayNo ratings yet

- Project 26.05.2022Document56 pagesProject 26.05.2022Targget CafeNo ratings yet

- Gender Issues in Microfinance and Repayment PerforDocument26 pagesGender Issues in Microfinance and Repayment Perforfaiqul hazmiNo ratings yet

- 3) Banking Competition and Access To FinanceDocument32 pages3) Banking Competition and Access To FinanceMelat TNo ratings yet

- Capital Structure and EarningsDocument4 pagesCapital Structure and EarningsAlinaasirNo ratings yet

- Acknowledgements: Report - 2012 Study of The "Performance & Credit Rating Scheme For Micro & Small Enterprises"Document56 pagesAcknowledgements: Report - 2012 Study of The "Performance & Credit Rating Scheme For Micro & Small Enterprises"Pooja Singh SolankiNo ratings yet

- Survey On Corporate Investment Practices in NepalDocument12 pagesSurvey On Corporate Investment Practices in NepalkapildebNo ratings yet

- Introduction and Methodology: Determinants of GLP and Profitability of Selected MFI'sDocument112 pagesIntroduction and Methodology: Determinants of GLP and Profitability of Selected MFI'sskibcobsaivigneshNo ratings yet

- Determinants of Loan Repayment-Evidence From Group Owned Micro and Small Enterprises, Tigray, Northern EthiopiaDocument8 pagesDeterminants of Loan Repayment-Evidence From Group Owned Micro and Small Enterprises, Tigray, Northern EthiopiaAlexander DeckerNo ratings yet

- Promoting Competition and EntrepreneurshipDocument38 pagesPromoting Competition and EntrepreneurshipSuresh DevarajiNo ratings yet

- Financing SMEs in IndiaDocument3 pagesFinancing SMEs in Indiaram9261891No ratings yet

- Financing Decision Main PageDocument39 pagesFinancing Decision Main PageRajucomputer RajucomputerNo ratings yet

- Bank of Baroda ReportDocument62 pagesBank of Baroda ReportLakshya SharmaNo ratings yet

- Finance Dissertation Examples PDFDocument4 pagesFinance Dissertation Examples PDFNeedHelpWritingAPaperCanada100% (1)

- Research Proposal: Topic: Loan Delinquency: Causes, Effects and Exemption SchemesDocument4 pagesResearch Proposal: Topic: Loan Delinquency: Causes, Effects and Exemption SchemesNandini AlyaniNo ratings yet

- Peer To Peer Lending Risk Analysis: Predictions From Lending ClubDocument10 pagesPeer To Peer Lending Risk Analysis: Predictions From Lending Clubortegadelia810No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesNo ratings yet

- EpidemiologyDocument48 pagesEpidemiologyMomal KhawajaNo ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosMomal KhawajaNo ratings yet

- 83592481 (1)Document3 pages83592481 (1)MedhaNo ratings yet

- Investment Decision RulesDocument14 pagesInvestment Decision RulesprashantgoruleNo ratings yet

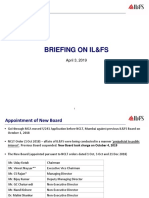

- ILFS Briefing (April 2019)Document15 pagesILFS Briefing (April 2019)Richard DierdreNo ratings yet

- Accounting PrinciplesDocument6 pagesAccounting Principlesmohamed rahilNo ratings yet

- Dipolog Rice Mill Journal EntriesDocument4 pagesDipolog Rice Mill Journal EntriesRenz RaphNo ratings yet

- Ssi FinancingDocument7 pagesSsi FinancingAnanya ChoudharyNo ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVara Prasad AvulaNo ratings yet

- Isb540 - HiwalahDocument16 pagesIsb540 - HiwalahMahyuddin Khalid100% (1)

- Central Banking and Financial RegulationsDocument9 pagesCentral Banking and Financial RegulationsHasibul IslamNo ratings yet

- Derivatives and Risk ManagementDocument5 pagesDerivatives and Risk ManagementabhishekrameshnagNo ratings yet

- Effects of A High CAD EssayDocument2 pagesEffects of A High CAD EssayfahoutNo ratings yet

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocument4 pagesLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNo ratings yet

- Kumkum YadavDocument51 pagesKumkum YadavHarshit KashyapNo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- 0450 m18 in 22Document4 pages0450 m18 in 22yoshNo ratings yet

- Quote - Q2045201Document2 pagesQuote - Q2045201makhanyasibusisiwe7No ratings yet

- Assignment - 2: Semester Spring 2021Document3 pagesAssignment - 2: Semester Spring 2021Amina HamidNo ratings yet

- Perpetual - Financial StatementsDocument4 pagesPerpetual - Financial StatementsJeon Cyrone CuachonNo ratings yet

- UaeDocument134 pagesUaeJad LouisNo ratings yet

- 15 Account Fo Partenership UDDocument35 pages15 Account Fo Partenership UDERICK MLINGWA60% (5)

- Act 3122 Intermediate Financial Accounting Ii: Lecturer: Dr. Mazrah Malek Room: A302Document10 pagesAct 3122 Intermediate Financial Accounting Ii: Lecturer: Dr. Mazrah Malek Room: A302Shahrul FadreenNo ratings yet

- Budget of Work EntrepDocument5 pagesBudget of Work EntrepHannah Joy LontayaoNo ratings yet

- Galgotias University Vishwajeet Singh S/O Kuldeep SinghDocument1 pageGalgotias University Vishwajeet Singh S/O Kuldeep SinghAashika SinghNo ratings yet

- Individual Corporate R2-52 R3-32Document8 pagesIndividual Corporate R2-52 R3-32Fang JiangNo ratings yet