Professional Documents

Culture Documents

Itr V Acknowledgement

Uploaded by

shivkumara270 ratings0% found this document useful (0 votes)

11 views1 pageItr v Acknowledgement

Original Title

Itr v Acknowledgement

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentItr v Acknowledgement

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageItr V Acknowledgement

Uploaded by

shivkumara27Itr v Acknowledgement

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

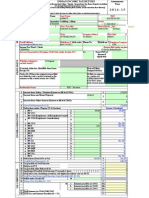

AY 2013-14

ACKNOWLEDGEMENT

ITR - V

Received with thanks from__________________________________________________________________________________a return of income in

ITR No. 9 ; 1(SAHAJ) 9 ; 2 9 ; 3 9 ; 4S(SUGAM) 9 ; 4 9 ; 5 9 ; 6 for assessment year 2012-13, having the following particulars

A2 MIDDLE NAME

A1 FIRST NAME

A3 LAST NAME

A4 PERMANENT ACCOUNT NUMBER

A7 INCOME TAX WARD/CIRCLE

A6 DATE OF BIRTH

A5 SEX

D D MM Y Y Y Y

; Male ; Female

A8 FLAT/DOOR/BUILDING

A9 ROAD/STREET

A10 AREA/LOCALITY

A11 TOWN/CITY/DISTRICT

A12 STATE

A13 PINCODE

A14 Fill only one: filed

Before due date-139(1)

After due date-139(4)

Revised Return-139(5) OR in response to notice

COMPUTATION OF INCOME AND TAX RETURN

142(1)

148

153A/153C

Whole-Rupee(`) only.

7 If showing loss, mark the negative sign in bracket at left

(-)

B1 Gross Total Income

B1

B2 Deductions under Chapter VI-A

B2

B3 Total Income

B3

(-)

B4 Current Loss if any

B4

(-)

B5 Net Tax Payable

B5

B6 Interest Payable

B6

B7 Total Tax and Interest Payable

B7

B8 Total Advance Tax Paid

B8

B9 Total Self Assessment Tax Paid

B9

B10 Total TDS Deducted

B10

B11 Total TCS Deducted

B11

B12 Total Prepaid Taxes (B8+B9+B10+B11)

B12

B13 Tax Payable ( B7-B12, If B7 > B12)

B13

B14 Refund ( B12-B7, If B12 > B7 )

B14

FOR OFFICIAL USE ONLY

STAMP RECEIPT NO. HERE

SEAL, DATE AND SIGNATURE OF

RECEIVING OFFICIAL

You might also like

- ITR-1 filing guide for AY 2012-13Document4 pagesITR-1 filing guide for AY 2012-13Manohj ViswanathanNo ratings yet

- ITR-V Acknowledgement for AY 2014-15Document1 pageITR-V Acknowledgement for AY 2014-15mohan11pavanNo ratings yet

- Karimnagar 8% Ranga Rao J PW/42859: Name DOB Treasury Int Rate DDO Dept. Code For IVRSDocument1 pageKarimnagar 8% Ranga Rao J PW/42859: Name DOB Treasury Int Rate DDO Dept. Code For IVRSPradeep JuvvadiNo ratings yet

- Ga 45798Document1 pageGa 45798Bhanu NarayanaNo ratings yet

- East Godavari 8.7% Madhu Sudhana Rao Meka PR/20888: Name DOB Treasury Int Rate DDO Dept. Code For IVRSDocument2 pagesEast Godavari 8.7% Madhu Sudhana Rao Meka PR/20888: Name DOB Treasury Int Rate DDO Dept. Code For IVRSGandara GandaduNo ratings yet

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDocument6 pagesIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiNo ratings yet

- ITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Document8 pagesITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Modin HorakeriNo ratings yet

- Fee Payment ChallanDocument1 pageFee Payment ChallanKarthikeya VeerubhotlaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNishant VermaNo ratings yet

- JUNE 2013 Tax ReminderDocument1 pageJUNE 2013 Tax ReminderArtjerjes Comendador PorrasNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument1 pageAssessment Year Sahaj Indian Income Tax ReturnAnit SharmaNo ratings yet

- Wealth Statement under Section 116Document10 pagesWealth Statement under Section 116nazakat2008No ratings yet

- Form PDF 525368370230922Document10 pagesForm PDF 525368370230922Vikash KumarNo ratings yet

- Form PDF 767221760080722Document13 pagesForm PDF 767221760080722Gaurav AtwalNo ratings yet

- Human Resources Department Employee Clearance FormDocument1 pageHuman Resources Department Employee Clearance Formkikomats2003No ratings yet

- Individual Income Tax ReturnDocument2 pagesIndividual Income Tax ReturnMNCOOhioNo ratings yet

- Adilabad 8.7% Ravinder Reddy P DR MEDL/59653: Name DOB Treasury Int Rate DDODocument2 pagesAdilabad 8.7% Ravinder Reddy P DR MEDL/59653: Name DOB Treasury Int Rate DDOPalthya SanthoshNo ratings yet

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Document2 pages2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimNo ratings yet

- NACE Registration Form-CP1 FILLED - Naveed AkhtarDocument1 pageNACE Registration Form-CP1 FILLED - Naveed AkhtarChintoo GeeNo ratings yet

- HRCPC - Te Da Claim ApplicationDocument2 pagesHRCPC - Te Da Claim ApplicationAtul Gupta100% (1)

- 2013 Tax Site:: What To Bring ChecklistDocument1 page2013 Tax Site:: What To Bring ChecklistanthonymenendezNo ratings yet

- Smart BroDocument2 pagesSmart Broalimoya13No ratings yet

- Payment Challan 02Document1 pagePayment Challan 02yashwanthakur02No ratings yet

- MR Raghul Sasidharan S: Invoice DetailsDocument1 pageMR Raghul Sasidharan S: Invoice DetailsPaul ShineNo ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationMd HumayunNo ratings yet

- IRS EIN NoticeDocument2 pagesIRS EIN Noticejessica messica100% (1)

- Form 16Document3 pagesForm 16annegirlNo ratings yet

- It 000037777275 2014 00Document2 pagesIt 000037777275 2014 00Muneer AfridiNo ratings yet

- XXXPD3353X Itrv PDFDocument1 pageXXXPD3353X Itrv PDFDaljeet KaurNo ratings yet

- Tax Invoice: Terms and ConditionsDocument2 pagesTax Invoice: Terms and ConditionsSanjay PatelNo ratings yet

- Tax Invoice for Vehicle Service and PartsDocument3 pagesTax Invoice for Vehicle Service and PartsSanjay PatelNo ratings yet

- 1 (3)Document21 pages1 (3)alicewilliams83nNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formdibyan dasNo ratings yet

- 6-9-20 - OH - Initial Filing - MUUYC LLC PDFDocument2 pages6-9-20 - OH - Initial Filing - MUUYC LLC PDFMARIA KAMELIS ARIZA SILVA50% (2)

- PAF College Sargodha Admission FormDocument3 pagesPAF College Sargodha Admission Formصدام حسینNo ratings yet

- (181666180) PF Withdrawal ApplicationDocument5 pages(181666180) PF Withdrawal ApplicationSrinivasa GarlapatiNo ratings yet

- Obligation Request: Republic of The Philippines Department of EducationDocument61 pagesObligation Request: Republic of The Philippines Department of EducationJenny Hugo MorenoNo ratings yet

- Joining ReportDocument2 pagesJoining ReportMayur GhoniyaNo ratings yet

- Aszpl1595q ItrvDocument1 pageAszpl1595q ItrvNitish JulkaNo ratings yet

- Trademark Snap Shot ITU Unit ActionDocument8 pagesTrademark Snap Shot ITU Unit ActionJames LindonNo ratings yet

- Georgia Employee Withholding Allowance CertificateDocument2 pagesGeorgia Employee Withholding Allowance CertificatebrennabaeNo ratings yet

- SSS Employer Contributions Payment FormDocument2 pagesSSS Employer Contributions Payment FormChristopher SantiagoNo ratings yet

- AMUxxxxx3A G11Document1 pageAMUxxxxx3A G11ishandutta2007No ratings yet

- Indian Income Tax Return Verification Form (ITR-VDocument1 pageIndian Income Tax Return Verification Form (ITR-Vbha_goNo ratings yet

- Shug Am 42223Document11 pagesShug Am 42223Daman SharmaNo ratings yet

- S/N O. Description Total (S$) (Before GST) GST (S$) Amount (S$) (After GST) Job RefDocument2 pagesS/N O. Description Total (S$) (Before GST) GST (S$) Amount (S$) (After GST) Job RefJiaqi ChuaNo ratings yet

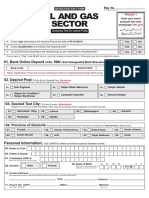

- OilGas Sec FormDocument4 pagesOilGas Sec FormYousuf Ali ShahNo ratings yet

- Itr 4 - Ay 2022-23 - VarunDocument10 pagesItr 4 - Ay 2022-23 - VarunAkash AggarwalNo ratings yet

- APPSC Junior Accounts ChecklistDocument3 pagesAPPSC Junior Accounts Checklistiqbal1439988No ratings yet

- Fed FormsDocument50 pagesFed Formsapi-259853705100% (1)

- Computation of Total Income Income From Business or Profession (Chapter IV D) 1011639Document2 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 1011639Sabitra RudraNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- Lawrence 1Document3 pagesLawrence 1prettycardi0No ratings yet

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- Dealer of Orissa To Whom Way Bill Is AssignedDocument1 pageDealer of Orissa To Whom Way Bill Is AssignedAnonymous vcadX45TD7No ratings yet

- Inos Sss Contribution FormDocument6 pagesInos Sss Contribution FormYeye TanNo ratings yet

- 1c-Onboarding Form JC v2Document6 pages1c-Onboarding Form JC v2Syerifaizal Hj. MustaphaNo ratings yet

- Cp575notice 1353009329267Document2 pagesCp575notice 1353009329267api-198173331No ratings yet

- Form BE2010 2Document9 pagesForm BE2010 2Teoh Zi JingNo ratings yet

- Nhai App Form 2015-16Document2 pagesNhai App Form 2015-16shivkumara27No ratings yet

- Solutions To Financial ReportingDocument7 pagesSolutions To Financial Reportingshivkumara27No ratings yet

- Mi3 Vs Moto G (2nd Gen) Vs Redmi 1S Vs Samsung Galaxy Grand 2 Compare Mobiles FlipkartDocument3 pagesMi3 Vs Moto G (2nd Gen) Vs Redmi 1S Vs Samsung Galaxy Grand 2 Compare Mobiles Flipkartshivkumara27No ratings yet

- Loan CancelDocument1 pageLoan Cancelshivkumara27No ratings yet

- Sample Operational Financial Analysis ReportDocument13 pagesSample Operational Financial Analysis Reportshivkumara27No ratings yet

- Madoff ScamDocument28 pagesMadoff Scamshivkumara27No ratings yet