Professional Documents

Culture Documents

Homestead Recind Form

Uploaded by

gernCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homestead Recind Form

Uploaded by

gernCopyright:

Available Formats

Instructions

Go to Forms Menu

Clear Form

Go to Main Menu

Issued under P.A. 237 of 1994.

Filing is required if you wish to adjust an exemption.

Michigan Department of Treasury

2602 (Rev. 6-99)

Formerly T-1067

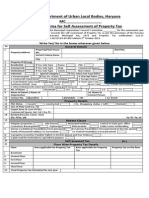

REQUEST TO RESCIND/WITHDRAW HOMESTEAD EXEMPTION

This form must be filed with the assessor for the city or township where the property is located.

Property Information (Always complete this section.)

Type or print legibly. Use a separate form for each property number.

3. Street address of property

1. Property tax identification number

4. Name of Township or City

Township

2. ZIP Code

5. County

City

6. Name of Owner (first, middle, last)

7. Owner's Social Security Number

8. Name of Co-Owner (first, middle, last)

9. Co-Owner's Social Security Number

10. Property owners daytime phone number.

PART A: Change an Existing Exemption

Complete this portion to rescind or change the percent of the exemption currently in place.

11. Check this box if you have sold, transferred or converted this property from your principal residence

to another use such as rental property, commercial property or property waiting to be sold

11.

12. If the portion of the property in number 1 above that you own and occupy

as your principal residence has changed, enter the new percentage here

12.

Month

Day

13. Enter the effective date of the change listed in either 11 or 12

13.

15. New Co-Owner's Name

14. New Owner's Name

PART B: Withdrawal

Complete this portion if the property is receiving an exemption in error and did not qualify.

Office Use Only

16. Enter the first year the exemption was received in error

16a.

16b.

Certification

I certify, under penalty of perjury, the information contained on this form is true and correct to the best of my knowledge.

17. Owner's Signature

Date

18. Co-Owner's Signature

Date

19. Mailing address if different than property address (street, or RR#, City and ZIP)

20. Closing Agent or Preparer's Name & Mailing Address

Do not write below this line - Local Government Use Only

22. Indicate property classification _____________________

21. What is the first year you will post the change in Part A to the tax roll?

21. Year

Year

You might also like

- HSRA Landlord Verification FormDocument1 pageHSRA Landlord Verification Formjohn yorkNo ratings yet

- HPD Registration Form and InstructionsDocument5 pagesHPD Registration Form and InstructionsAmit PatelNo ratings yet

- GST/HST New Housing Rebate Application For Houses Purchased From A BuilderDocument4 pagesGST/HST New Housing Rebate Application For Houses Purchased From A BuilderEffel PradoNo ratings yet

- Caution:: Schedule H or H-EZ Must Be Completed and Filed With This Rent CertificateDocument3 pagesCaution:: Schedule H or H-EZ Must Be Completed and Filed With This Rent CertificateVedvyasNo ratings yet

- Adriana VerificationDocument1 pageAdriana VerificationCandy CookiesNo ratings yet

- Description: Tags: Form1207InstDocument3 pagesDescription: Tags: Form1207Instanon-259442No ratings yet

- US Internal Revenue Service: f2119 - 1997Document2 pagesUS Internal Revenue Service: f2119 - 1997IRSNo ratings yet

- Boe 266Document2 pagesBoe 266Ohad Ben-YosephNo ratings yet

- A PS Form 8190 - Fillable PDFDocument3 pagesA PS Form 8190 - Fillable PDFAmanda MitchellNo ratings yet

- PRINT in BLACK INK. Ovals Must Be Filled in Completely.Document2 pagesPRINT in BLACK INK. Ovals Must Be Filled in Completely.mik2bgNo ratings yet

- Individual Income Tax ReturnDocument2 pagesIndividual Income Tax ReturnMNCOOhioNo ratings yet

- Ms Withholding ApplicationDocument4 pagesMs Withholding ApplicationBilal ChoudhryNo ratings yet

- RTB 27Document4 pagesRTB 27John DoeNo ratings yet

- A. Legal Owner Information: EIN - SSN 578-17-7124Document2 pagesA. Legal Owner Information: EIN - SSN 578-17-7124Trevor AlexanderNo ratings yet

- New Return 24 08 21 Final 1Document9 pagesNew Return 24 08 21 Final 1Rainbow Construction LtdNo ratings yet

- Self Declaration For Propertytax Self Assessment Pro Form ADocument2 pagesSelf Declaration For Propertytax Self Assessment Pro Form Aarchagg100% (1)

- US Internal Revenue Service: f8824 - 1999Document4 pagesUS Internal Revenue Service: f8824 - 1999IRSNo ratings yet

- Installment Agreement RequestDocument2 pagesInstallment Agreement Request0scarNo ratings yet

- US Internal Revenue Service: f5500 - 1994Document6 pagesUS Internal Revenue Service: f5500 - 1994IRSNo ratings yet

- Mortgage App Form 1003Document5 pagesMortgage App Form 1003api-305651288No ratings yet

- PTR EastDocument8 pagesPTR EastimachieverNo ratings yet

- 709 Form 2005 SampleDocument4 pages709 Form 2005 Sample123pratus91% (11)

- NSW Claim For Refund of Bond MoniesDocument2 pagesNSW Claim For Refund of Bond MoniesM J RichmondNo ratings yet

- Form22, ANNUAL RETURN 2022Document7 pagesForm22, ANNUAL RETURN 2022Skyview Travel LTD ManagementNo ratings yet

- US Internal Revenue Service: f8824 - 1992Document2 pagesUS Internal Revenue Service: f8824 - 1992IRSNo ratings yet

- US Internal Revenue Service: f5500 - 1996Document6 pagesUS Internal Revenue Service: f5500 - 1996IRSNo ratings yet

- Form 9465-PDF Reader ProDocument2 pagesForm 9465-PDF Reader ProEdward FederisoNo ratings yet

- Cra (2) DddaDocument14 pagesCra (2) DddadulmasterNo ratings yet

- Bond Refund FormDocument2 pagesBond Refund FormJofamu100% (1)

- Form 941 SummaryDocument5 pagesForm 941 SummaryCatori-Dakoda Eil100% (1)

- US Internal Revenue Service: f8824 - 1991Document2 pagesUS Internal Revenue Service: f8824 - 1991IRSNo ratings yet

- Amendment: Ucc Financing StatementDocument4 pagesAmendment: Ucc Financing StatementJason HenryNo ratings yet

- US Internal Revenue Service: f5500 - 1995Document6 pagesUS Internal Revenue Service: f5500 - 1995IRSNo ratings yet

- Uniform Residential Loan Application: I. Type of Mortgage and Terms of LoanDocument13 pagesUniform Residential Loan Application: I. Type of Mortgage and Terms of Loanmalinda_haneyNo ratings yet

- Renter's Certificate of Property Taxes Paid: How To Use This FormDocument1 pageRenter's Certificate of Property Taxes Paid: How To Use This FormMichael OluwaseunNo ratings yet

- Residential Tenancy Agreement: Form 1aaDocument11 pagesResidential Tenancy Agreement: Form 1aa历史见证No ratings yet

- 2015 CRP, Certificate of Rent Paid: R48.0908.000 Morrison 6Document1 page2015 CRP, Certificate of Rent Paid: R48.0908.000 Morrison 6bmptechnicianNo ratings yet

- Form 4 Joint Application Disposal Security BondDocument2 pagesForm 4 Joint Application Disposal Security BondEduardomelloNo ratings yet

- BilndDocument3 pagesBilndxabehe6146No ratings yet

- Adjusted Employer's Annual Federal Tax Return For Agricultural Employees or Claim For RefundDocument4 pagesAdjusted Employer's Annual Federal Tax Return For Agricultural Employees or Claim For RefundFrancis Wolfgang UrbanNo ratings yet

- Tenant Rent Record Template: PurposeDocument8 pagesTenant Rent Record Template: PurposeWanjiNo ratings yet

- De2 FormDocument4 pagesDe2 FormpradeepsinghagNo ratings yet

- Adjusted Annual Return of Withheld Federal Income Tax or Claim For RefundDocument2 pagesAdjusted Annual Return of Withheld Federal Income Tax or Claim For RefundFrancis Wolfgang UrbanNo ratings yet

- Notice of Rent Increase - Residential Rental Units: A. To The Tenant (S)Document2 pagesNotice of Rent Increase - Residential Rental Units: A. To The Tenant (S)Anonymous D50MEPwBNo ratings yet

- US Internal Revenue Service: f8824 - 2001Document4 pagesUS Internal Revenue Service: f8824 - 2001IRSNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNo ratings yet

- Like-Kind Exchanges: (And Section 1043 Conflict-Of-Interest Sales)Document2 pagesLike-Kind Exchanges: (And Section 1043 Conflict-Of-Interest Sales)Weiming LinNo ratings yet

- Form E-2 - For Initials+signaturesDocument4 pagesForm E-2 - For Initials+signaturesAlexa KarolinskiNo ratings yet

- Residential Tenancy Agreement: Form 1aaDocument11 pagesResidential Tenancy Agreement: Form 1aaTilan DissanayakeNo ratings yet

- Business Tax Application: Form BT-1Document12 pagesBusiness Tax Application: Form BT-1Wilber OrozcoNo ratings yet

- Bill Pay Request Form (New)Document2 pagesBill Pay Request Form (New)Anirudh VermaNo ratings yet

- Irs Form 9465 ExampleDocument2 pagesIrs Form 9465 ExampleScottNo ratings yet

- PTR Form of North Delhi Municipal Corporation For 2014-15Document5 pagesPTR Form of North Delhi Municipal Corporation For 2014-15rasiya49No ratings yet

- Sbi Home Loan Application FormDocument5 pagesSbi Home Loan Application FormDhawan SandeepNo ratings yet

- TaxStatement 2024Document3 pagesTaxStatement 202425268magdaNo ratings yet

- Adjusted Annual Return of Withheld Federal Income Tax or Claim For RefundDocument2 pagesAdjusted Annual Return of Withheld Federal Income Tax or Claim For RefundBilboDBagginsNo ratings yet

- Tenant Address: I, The Landlord, Am Hereby Giving You Two Months' Notice To Move Out of The Rental Unit Located atDocument2 pagesTenant Address: I, The Landlord, Am Hereby Giving You Two Months' Notice To Move Out of The Rental Unit Located atSimi CreationsNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Ontario Tax Sale Property Buyer's GuideFrom EverandOntario Tax Sale Property Buyer's GuideRating: 3 out of 5 stars3/5 (1)

- AGS Imager WoodDocument7 pagesAGS Imager WoodgernNo ratings yet

- 02 02 28Document1 page02 02 28gernNo ratings yet

- Minutes of Antwerp Township Zoning Board of Appeals Regular Meeting Thursday July 26, 2001Document1 pageMinutes of Antwerp Township Zoning Board of Appeals Regular Meeting Thursday July 26, 2001gernNo ratings yet

- Minutes of Antwerp Township Zoning Board of Appeals Regular Meeting THURSDAY MAY 24, 2001Document1 pageMinutes of Antwerp Township Zoning Board of Appeals Regular Meeting THURSDAY MAY 24, 2001gernNo ratings yet

- Minutes of Antwerp Township Zoning Board of Appeals Special Meeting Thursday August 16, 2001Document1 pageMinutes of Antwerp Township Zoning Board of Appeals Special Meeting Thursday August 16, 2001gernNo ratings yet

- Weatherization Assistant Update HistoryDocument11 pagesWeatherization Assistant Update HistorygernNo ratings yet

- Improved Cookstoves As A Pathway Between Food Preparation and Reduced Domestic Violence in UgandaDocument9 pagesImproved Cookstoves As A Pathway Between Food Preparation and Reduced Domestic Violence in UgandagernNo ratings yet

- Spread Voices - Mick Goodrick Cycles PDFDocument5 pagesSpread Voices - Mick Goodrick Cycles PDFAlexandreSantosNo ratings yet

- 02 07 25Document1 page02 07 25gernNo ratings yet

- 01 11 13Document2 pages01 11 13gernNo ratings yet

- 01 09 11Document2 pages01 09 11gernNo ratings yet

- Act CNT R ChargesDocument1 pageAct CNT R ChargesgernNo ratings yet

- Minutes of Antwerp Township Zoning Board of Appeals Regular Meeting Thursday January 25, 2001Document1 pageMinutes of Antwerp Township Zoning Board of Appeals Regular Meeting Thursday January 25, 2001gernNo ratings yet

- 02 05 14Document1 page02 05 14gernNo ratings yet

- Minutes of The Regular Meeting of The Antwerp Towhship Board Thursday June 12, 2001 7:00 PMDocument2 pagesMinutes of The Regular Meeting of The Antwerp Towhship Board Thursday June 12, 2001 7:00 PMgernNo ratings yet

- Permit NBSP FeesDocument1 pagePermit NBSP FeesgernNo ratings yet

- AC Floor PlanDocument1 pageAC Floor PlangernNo ratings yet

- Land Di VordDocument2 pagesLand Di VordgernNo ratings yet

- Building Permit NoticeDocument2 pagesBuilding Permit NoticegernNo ratings yet

- 02 01 08Document2 pages02 01 08gernNo ratings yet

- Antwerp Township, Van Buren County, Michigan Rezoning of PropertyDocument1 pageAntwerp Township, Van Buren County, Michigan Rezoning of PropertygernNo ratings yet

- 02 07 09Document2 pages02 07 09gernNo ratings yet

- 02 06 11Document2 pages02 06 11gernNo ratings yet

- 02 02 12Document2 pages02 02 12gernNo ratings yet

- 01 10 09Document2 pages01 10 09gernNo ratings yet

- Home Oc InfoDocument1 pageHome Oc InfogernNo ratings yet

- Home Oc AppDocument1 pageHome Oc AppgernNo ratings yet

- 02 12 05Document1 page02 12 05gernNo ratings yet

- Ac Rental ContractDocument1 pageAc Rental ContractgernNo ratings yet

- Minutes of The Regular Meeting of The Antwerp Towhship Board Thursday August 14, 2001 7:00 PMDocument2 pagesMinutes of The Regular Meeting of The Antwerp Towhship Board Thursday August 14, 2001 7:00 PMgernNo ratings yet