Professional Documents

Culture Documents

Deduction Exemption and Reimburing of Expenses

Deduction Exemption and Reimburing of Expenses

Uploaded by

nishant1090Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deduction Exemption and Reimburing of Expenses

Deduction Exemption and Reimburing of Expenses

Uploaded by

nishant1090Copyright:

Available Formats

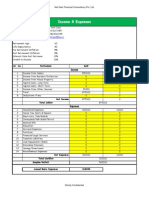

Deduction Exemption and Reimburing of Expenses

Basic Exemption

PPF, Insurance, ELSS, FD, NSC, ect (Sec 80 C Deduction)

Investment in NPS (Sec 80CCD 1B)

Contribution of NPS By Employer (Sec 80CCD 2)

Home Loan Interest or House Rent Allowance ( First time Buyer)

Tax Free Medical Allowance

Tax Free Transport Allowance

Medical Expenses For Self and Parents (80D)

Leave Travel Allowance (Sec 10{13} )

Travel and Fuel Reimbursement - Office Travel

Phone and Communication (Tele and Internet Expenses)

News Paper and Periodicals

Meal Coupons ( Up to Rs 50 per Meal is Tax Free)

Relief Under Sec 87 of Rs 50000/- (i.e 10% of Income)

f Expenses

uyer)

Amount

250000

150000

50000

150000

250000

15000

19200

50000

25000

120000

36000

24000

12000

50000

You might also like

- Income Tax Actual Proof Submission Form Fy 2021 - 2022Document3 pagesIncome Tax Actual Proof Submission Form Fy 2021 - 2022muralianand92No ratings yet

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- Taxation of Salary Income 2017 IndiaDocument19 pagesTaxation of Salary Income 2017 Indiarpiyer72No ratings yet

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023No ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- Investment Declaration Form-2Document2 pagesInvestment Declaration Form-2Pramod KumarNo ratings yet

- TaxBenefit Existing NPSDocument1 pageTaxBenefit Existing NPSjosekrNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Computation of Total Income of Dr. Chowdhury For The Assesment Year 2008-2009Document1 pageComputation of Total Income of Dr. Chowdhury For The Assesment Year 2008-2009Nazim ChowdhuryNo ratings yet

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18No ratings yet

- Household Budget SpreadsheetDocument1 pageHousehold Budget SpreadsheetnangaayissiNo ratings yet

- Financial AnalysisDocument2 pagesFinancial Analysisvnguyen5651No ratings yet

- Net Income How To Calculate Net Income in Income TaxDocument34 pagesNet Income How To Calculate Net Income in Income TaxSeetha SenthilNo ratings yet

- VRS NotesDocument82 pagesVRS NotesrisingiocmNo ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- Gols E-Learning Portal Live Virtual Classroom (LVC)Document24 pagesGols E-Learning Portal Live Virtual Classroom (LVC)Lokesh manglaNo ratings yet

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- Section 80 Deduction ListDocument6 pagesSection 80 Deduction ListMURALIDHARA S VNo ratings yet

- BudgetDocument17 pagesBudgetdinnubhatNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Income Tax Rate 2010Document6 pagesIncome Tax Rate 2010Vishal JwellNo ratings yet

- Bifurcation of Salary ArrearsDocument3 pagesBifurcation of Salary ArrearsSrikant SheelNo ratings yet

- Auto Income Tax Calculator Version 5.1 2010-11Document19 pagesAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNo ratings yet

- 2009 Tax Calculator-1Document2 pages2009 Tax Calculator-1Sandip S NagareNo ratings yet

- WT Tax RatesDocument2 pagesWT Tax RatesericbacsalNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11LordEnigma18No ratings yet

- Tax Facts For IndividualsDocument9 pagesTax Facts For Individualsred20055No ratings yet

- IT PPT For F.Y 2023-24Document24 pagesIT PPT For F.Y 2023-24pritesh.ks1409No ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- CAclubindia News - Income Tax Sections at A GlanceDocument3 pagesCAclubindia News - Income Tax Sections at A GlanceSmiju SukumarNo ratings yet

- 56 Incom Tax CalculatorDocument6 pages56 Incom Tax Calculatorspecky123No ratings yet

- Income Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011Document6 pagesIncome Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011jhancyNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Retirement TemplateDocument3 pagesRetirement Templateiyerv5No ratings yet

- ASSESSMENT YEAR 2014 Tax Rates and DetailsDocument6 pagesASSESSMENT YEAR 2014 Tax Rates and Detailsamit2201No ratings yet

- Milo TaxDocument5 pagesMilo TaxMilo LANo ratings yet

- Assignment TAX (21 AIS 039)Document18 pagesAssignment TAX (21 AIS 039)Amran OviNo ratings yet

- Arindam Das Salary For The Month of July 2008Document4 pagesArindam Das Salary For The Month of July 2008Bala MuruNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Document2 pagesArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050No ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- Deductions To Be Made in Computing Total IncomeDocument15 pagesDeductions To Be Made in Computing Total IncomeAbey FrancisNo ratings yet

- Income Tax Sheet Bmoi 2012 13Document2 pagesIncome Tax Sheet Bmoi 2012 13rincepNo ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Income Tax Calculator FY 2016 17Document6 pagesIncome Tax Calculator FY 2016 17raf1No ratings yet

- Chapter3 - 3 AnnualPast - ExpenseBreakDownDocument7 pagesChapter3 - 3 AnnualPast - ExpenseBreakDownChooseFinancialFreeNo ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- Swami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledDocument2 pagesSwami Samarth Tax Consultants: If You Miss This Vital Step, Your Return Will Be Treated As Not FiledmakamkkumarNo ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- Salary Budgetary and Taxation PlanningDocument1 pageSalary Budgetary and Taxation PlanningTobias Junior KatjireNo ratings yet

- Final-Investment Declaration Form FY 19 - 20Document12 pagesFinal-Investment Declaration Form FY 19 - 20Bhupender RawatNo ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- J.K. Lasser's Guide to Self-Employment: Taxes, Strategies, and Money-Saving Tips for Schedule C FilersFrom EverandJ.K. Lasser's Guide to Self-Employment: Taxes, Strategies, and Money-Saving Tips for Schedule C FilersNo ratings yet