Professional Documents

Culture Documents

Fim01-Ratio Analysis Example

Uploaded by

Jomar VillenaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fim01-Ratio Analysis Example

Uploaded by

Jomar VillenaCopyright:

Available Formats

FIM01- FUNDAMENTAL OF FINANCIAL MANAGEMENT

FINANCIAL MIX RATIO ANALYSIS

J. VILLENA, CPA

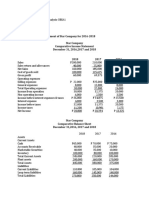

The data given below were obtained from the financial records of BAGSAK

Corporation for the year ended December 31, 2016.

BAGSAK Corporation

Statement of Financial Position

December 31 2015 and 2016

ASSETS 2016 2015

Cash 85,000 95,000

Marketable Securities 25,000 10,000

Trade Receivable, net 245,000 265,000

Inventory, at cost 220,000 250,000

Prepaid Expenses 10,000 15,000

Equipment, net 320,000 380,000

Other Assets 15,000 5,000

Total Assets 920,000 1,020,000

EQUITY

Trade payables 165,000 200,000

Accrued Expenses 25,000 50,000

Other Current liabilities 10,000 50,000

Mortgage Payable 120,000 140,000

Share capital, P100 par 300,000 300,000

Share Premium 30,000 30,000

Retained Earnings, appropriated 80,000 120,000

Retained Earnings, unappropriated 190,000 130,000

Total Equities 920,000 1,020,000

BAGSAK Corporation

Income Statement

December 31, 2016

Net Sales 1,000,000

Cost of goods sold 750,000

Gross profit 250,000

Selling, administrative and other expenses 125,000

Income before tax 125,000

Provision for income taxes 35,000

Net income for the year 90,000

Retained Earnings, beginning 130,000

Total 220,000

Dividends paid 30,000

Retained Earnings, end 190,000

Page 1 of 1 BAFM2B

You might also like

- SS Number SlipDocument1 pageSS Number SlipJomar Villena0% (1)

- 4-2 Endless CompanyDocument3 pages4-2 Endless CompanyyayayaNo ratings yet

- Business Enhancement 2nd Summative TextDocument16 pagesBusiness Enhancement 2nd Summative TextCams DlunaNo ratings yet

- Financial Statement Analysis ExerciseDocument5 pagesFinancial Statement Analysis ExerciseMelanie SamsonaNo ratings yet

- ESubmission Validation ReportDocument2 pagesESubmission Validation ReportJomar Villena100% (1)

- Audit Report Real Property TaxDocument6 pagesAudit Report Real Property TaxJomar Villena0% (1)

- Quiz BM4Document2 pagesQuiz BM4Jomar Villena100% (1)

- Revision Questions - 2 Statement of Cash FlowsDocument5 pagesRevision Questions - 2 Statement of Cash FlowsNadjah JNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- Polly's Pet Products Balance Sheet As of December 31, 2018 AssetsDocument5 pagesPolly's Pet Products Balance Sheet As of December 31, 2018 AssetsTempoNo ratings yet

- 105 - Activity 1 - Cash FlowDocument11 pages105 - Activity 1 - Cash FlowElla DavisNo ratings yet

- 6jamolod Week6Document15 pages6jamolod Week6Jatha JamolodNo ratings yet

- Malik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F RDocument1 pageMalik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F R.No ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Comprehensive IncomeDocument9 pagesComprehensive IncomeJesiah PascualNo ratings yet

- Common Size Statement AnalysisDocument2 pagesCommon Size Statement AnalysisRevati ShindeNo ratings yet

- Tutorial 11 QsDocument3 pagesTutorial 11 QsDylan Rabin PereiraNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- 2 - Income Statement & Closing Entries AnsweredDocument2 pages2 - Income Statement & Closing Entries Answeredbolaemil20No ratings yet

- REG.A - Laras Sukma N.T - 0320101001 - Tugas Pertemuan Ke 4Document9 pagesREG.A - Laras Sukma N.T - 0320101001 - Tugas Pertemuan Ke 4Laras sukma nurani tirtawidjajaNo ratings yet

- 5110u1-Financial TRDocument4 pages5110u1-Financial TRapi-372394631No ratings yet

- Statement of Financial Position/Retained EarningsDocument5 pagesStatement of Financial Position/Retained EarningsShane TabunggaoNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Spring Day Company Statement of Financial Position For 20x1 and 20x2Document2 pagesSpring Day Company Statement of Financial Position For 20x1 and 20x2Printing PandaNo ratings yet

- Lape - ACP312 - ULOa - Let's Check Week6Document2 pagesLape - ACP312 - ULOa - Let's Check Week6Bryle Jay LapeNo ratings yet

- Financial Ratio QuizDocument1 pageFinancial Ratio QuizMylene SantiagoNo ratings yet

- Group 6 05 Quiz 1Document4 pagesGroup 6 05 Quiz 1Angela Fye LlagasNo ratings yet

- De Jesus, Zephaniah - (Finals)Document4 pagesDe Jesus, Zephaniah - (Finals)Zephaniah De JesusNo ratings yet

- Sample Income Statement ManufacturingDocument1 pageSample Income Statement ManufacturingIrish Kit SarmientoNo ratings yet

- Quiz 1Document2 pagesQuiz 1jevieconsultaaquino2003No ratings yet

- Written AssignmentDocument11 pagesWritten AssignmentJoseph KamaraNo ratings yet

- AK Personal 1Document13 pagesAK Personal 1erniNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- BuscomDocument5 pagesBuscomdmangiginNo ratings yet

- AaaaaDocument2 pagesAaaaaMondays AndNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- The Deluxe Store Income Statement For The Year Ended November 30, 2020Document2 pagesThe Deluxe Store Income Statement For The Year Ended November 30, 2020Charisa BenjaminNo ratings yet

- 10Document1 page10Bryan KenNo ratings yet

- Anya Forger CorporationDocument2 pagesAnya Forger CorporationMondays AndNo ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- Lobrigas - Week6 Ia3Document18 pagesLobrigas - Week6 Ia3Hensel SevillaNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- Other Comprehensive Income: Items That Will Not Be Reclassified Subsequently To Profit or LossDocument6 pagesOther Comprehensive Income: Items That Will Not Be Reclassified Subsequently To Profit or LossKeahlyn BoticarioNo ratings yet

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.eNo ratings yet

- Homework N3Document24 pagesHomework N3Maiko KopadzeNo ratings yet

- Novelyn AIDocument3 pagesNovelyn AInovyNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Stage 1 Ffa3Document3 pagesStage 1 Ffa3Khalid AzizNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Non Deductability of Mandatory ContributionsDocument1 pageNon Deductability of Mandatory ContributionsJomar VillenaNo ratings yet

- Schedule of PaymentDocument1 pageSchedule of PaymentJomar VillenaNo ratings yet

- Letter of RequestDocument1 pageLetter of RequestJomar VillenaNo ratings yet

- Lorilei Avian Mark Jane Glenice Adrian Alfred Christine Jarriane AngelicaDocument5 pagesLorilei Avian Mark Jane Glenice Adrian Alfred Christine Jarriane AngelicaJomar VillenaNo ratings yet

- Confirmation Vat Relief 1st QDocument13 pagesConfirmation Vat Relief 1st QJomar VillenaNo ratings yet

- Ebirforms-Noreply@bir - Gov.ph: 14 May at 12:53 PMDocument1 pageEbirforms-Noreply@bir - Gov.ph: 14 May at 12:53 PMJomar VillenaNo ratings yet

- Memory: Asian Institute of Science and Technology Psy101: General Psychology Jomar V. Villena, CpaDocument1 pageMemory: Asian Institute of Science and Technology Psy101: General Psychology Jomar V. Villena, CpaJomar VillenaNo ratings yet

- Bir PenaltiesDocument4 pagesBir PenaltiesJomar Villena100% (1)

- Revenue District Office No. 21B - City of San Fernando, South PampangaDocument2 pagesRevenue District Office No. 21B - City of San Fernando, South PampangaJomar VillenaNo ratings yet

- Ang Mas Malupit, HINAHANAP Ako Kasi BAGSAK Ka, EH Noong NAGTUTURO Ako, NASAAN Ka?"Document1 pageAng Mas Malupit, HINAHANAP Ako Kasi BAGSAK Ka, EH Noong NAGTUTURO Ako, NASAAN Ka?"Jomar VillenaNo ratings yet

- Request For ContriDocument1 pageRequest For ContriJomar VillenaNo ratings yet

- BukluRun 2017Document1 pageBukluRun 2017Jomar VillenaNo ratings yet

- Learners' Names: Input Data Sheet For SHS E-Class RecordDocument22 pagesLearners' Names: Input Data Sheet For SHS E-Class RecordJomar VillenaNo ratings yet

- Bir Tax DeadlinesDocument1 pageBir Tax DeadlinesJomar VillenaNo ratings yet

- Second Quarter Distribution of CardDocument2 pagesSecond Quarter Distribution of CardJomar VillenaNo ratings yet

- Jaime Trinidad Percentage TaxDocument3 pagesJaime Trinidad Percentage TaxJomar VillenaNo ratings yet

- Rank Name Signature of Parents General AverageDocument2 pagesRank Name Signature of Parents General AverageJomar VillenaNo ratings yet

- COGSDocument4 pagesCOGSJomar VillenaNo ratings yet

- Francis Pamintuan Value Added Tax / Quarterly / Income Tax: JMV Accounting Services Filing of Tax ReturnsDocument3 pagesFrancis Pamintuan Value Added Tax / Quarterly / Income Tax: JMV Accounting Services Filing of Tax ReturnsJomar VillenaNo ratings yet

- Practical Accounting 1Document11 pagesPractical Accounting 1Jomar VillenaNo ratings yet

- List of Students Who Failed in Act 01 Name SectionDocument1 pageList of Students Who Failed in Act 01 Name SectionJomar VillenaNo ratings yet

- Taxation: Multiple ChoiceDocument16 pagesTaxation: Multiple ChoiceJomar VillenaNo ratings yet

- Key To Correction FABM2Document4 pagesKey To Correction FABM2Jomar Villena100% (1)

- Thank You LetterDocument2 pagesThank You LetterJomar VillenaNo ratings yet