Professional Documents

Culture Documents

5 - Silkair V CIR PDF

5 - Silkair V CIR PDF

Uploaded by

Selynn CoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 - Silkair V CIR PDF

5 - Silkair V CIR PDF

Uploaded by

Selynn CoCopyright:

Available Formats

Silkair v.

CIR

FACTS: Silkair (Singapore) Pte. Ltd. filed with the BIR a written application for the refund of

P4,567,450.79 excise taxes it claimed to have paid on its purchases of jet fuel from Petron Corporation

from January to June 2000.

As the BIR had not yet acted on the application, Silkair filed a Petition for Review.

The CIR answered that petitioner failed to prove that the sale of the petroleum products was directly

made from a domestic oil company to the international carrier. The excise tax on petroleum products is

the direct liability of the manufacturer/producer, and when added to the cost of the goods sold to the

buyer, it is no longer a tax but part of the price which the buyer has to pay to obtain the article.

The Second Division of the CTA denied Silkairs petition on the ground that as the excise tax was

imposed on Petron Corporation as the manufacturer of petroleum products, any claim for refund should

be filed by the latter; and where the burden of tax is shifted to the purchaser, the amount passed on to it

is no longer a tax but becomes an added cost of the goods purchased. Since the excise tax was

imposed upon Petron Corporation as the manufacturer of petroleum products, pursuant to Section

130(A)(2), and that the corresponding excise taxes were indeed, paid by it, . . . any claim for refund of

the subject excise taxes should be filed by Petron Corporation as the taxpayer contemplated under

the law. The CTA En Banc dismissed Silkairs petition for review for having been filed out of time.

ISSUE: W/N Silkair is the proper party to claim a refund or tax credit? No.

HELD: Silkair bases its claim for refund or tax credit on Section 135 (b) of the NIRC of 1997 and Article

4(2) of the Air Transport Agreement between the Government of the Republic of the Philippines and the

Government of the Republic of Singapore, which exempts it from payment of taxes for fuel.

The proper party to question, or seek a refund of, an indirect tax is the statutory taxpayer, the

person on whom the tax is imposed by law and who paid the same even if he shifts the burden

thereof to another. Section 130 (A) (2) of the NIRC provides that "[u]nless otherwise specifically allowed,

the return shall be filed and the excise tax paid by the manufacturer or producer before removal of

domestic products from place of production." Thus, Petron Corporation, not Silkair, is the statutory

taxpayer which is entitled to claim a refund based on Section 135 of the NIRC of 1997 and Article 4(2) of

the Air Transport Agreement between RP and Singapore. Even if Petron Corporation passed on to Silkair

the burden of the tax, the additional amount billed to Silkair for jet fuel is not a tax but part of the price

which Silkair had to pay as a purchaser.

Silkair nevertheless argues that it is exempt from indirect taxes because the Air Transport Agreement

between RP and Singapore grants exemption "from the same customs duties, inspection fees and other

duties or taxes imposed in the territory of the first Contracting Party." It invokes Maceda v. Macaraig, Jr.

which upheld the claim for tax credit or refund by the National Power Corporation (NPC) on the ground

that the NPC is exempt even from the payment of indirect taxes. This argument does not persuade.

In CIR v. PLDT, the Court clarified that an exemption from "all taxes" excludes indirect taxes, unless the

exempting statute, like NPCs charter, is so couched as to include indirect tax from the exemption. The

exemption granted under Section 135 (b) of the NIRC of 1997 and Article 4(2) of the Air Transport

Agreement between RP and Singapore cannot, without a clear showing of legislative intent, be construed

as including indirect taxes. Statutes granting tax exemptions must be construed in strictissimi juris against

the taxpayer and liberally in favor of the taxing authority, and if an exemption is found to exist, it must not

be enlarged by construction.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Philippines A Century HenceDocument40 pagesThe Philippines A Century HenceTintin M89% (9)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sukuk An Inside Study of Its Background Structures Challenges and CasesDocument61 pagesSukuk An Inside Study of Its Background Structures Challenges and CasesTawheed Hussain50% (2)

- Martinez v. CA - CoDocument1 pageMartinez v. CA - CoSelynn CoNo ratings yet

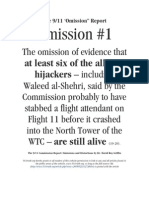

- The 9/11 Commission Report: Omissions and Distortions by Dr. David Ray GriffinDocument115 pagesThe 9/11 Commission Report: Omissions and Distortions by Dr. David Ray GriffinQuickSpin92% (13)

- Terex RT 230Document12 pagesTerex RT 230vpizarro_23100% (1)

- 71 - People v. Baldogo - CoDocument1 page71 - People v. Baldogo - CoSelynn CoNo ratings yet

- 11 - Herrera v. Sandiganbayan - Co PDFDocument1 page11 - Herrera v. Sandiganbayan - Co PDFSelynn CoNo ratings yet

- 23 - People v. Lazaro - CoDocument1 page23 - People v. Lazaro - CoSelynn CoNo ratings yet

- Article IV DigestsDocument26 pagesArticle IV DigestsSelynn CoNo ratings yet

- Antonio Bengson Iii, Petitioner, vs. House of Representatives Electoral Tribunal and Teodoro C. CRUZ, RespondentsDocument8 pagesAntonio Bengson Iii, Petitioner, vs. House of Representatives Electoral Tribunal and Teodoro C. CRUZ, RespondentsSelynn CoNo ratings yet

- Simon v. CHR - 229 SCRA 117Document2 pagesSimon v. CHR - 229 SCRA 117Selynn CoNo ratings yet

- Braga V AbayaDocument3 pagesBraga V AbayaSelynn CoNo ratings yet

- Santos v. DOJ - CoDocument2 pagesSantos v. DOJ - CoSelynn Co100% (1)

- BCDA V CIRDocument2 pagesBCDA V CIRSelynn CoNo ratings yet

- Vales or Chits and (2) P29,956.28 in The Possession of Petitioner Gomera, Also Representing Disallowed Vales or ChitsDocument1 pageVales or Chits and (2) P29,956.28 in The Possession of Petitioner Gomera, Also Representing Disallowed Vales or ChitsSelynn CoNo ratings yet

- 18 - RCPI V VerchezDocument2 pages18 - RCPI V VerchezSelynn CoNo ratings yet

- 49 - Ang V PacunioDocument2 pages49 - Ang V PacunioSelynn CoNo ratings yet

- 13 - IFFI v. ArgosDocument1 page13 - IFFI v. ArgosSelynn CoNo ratings yet

- 18 SCRA 247 Caltex V PalonarDocument14 pages18 SCRA 247 Caltex V PalonarSelynn CoNo ratings yet

- Salvador v. Mapa - G.R. No. 135080 (2008)Document1 pageSalvador v. Mapa - G.R. No. 135080 (2008)Selynn CoNo ratings yet

- 37 - Lambert V CastillonDocument1 page37 - Lambert V CastillonSelynn CoNo ratings yet

- Facts: Petitioners Are Employees of Procter and Gamble (PhilippineDocument10 pagesFacts: Petitioners Are Employees of Procter and Gamble (PhilippineSelynn CoNo ratings yet

- 1 Youmans ClaimsDocument3 pages1 Youmans ClaimsSelynn CoNo ratings yet

- 36 - Miciano V BrimoDocument1 page36 - Miciano V BrimoSelynn CoNo ratings yet

- 2 - Regalado V GoDocument2 pages2 - Regalado V GoSelynn CoNo ratings yet

- 25 - Republic of Indonesia V VinzonDocument2 pages25 - Republic of Indonesia V VinzonSelynn CoNo ratings yet

- 4 - Funa V MECODocument3 pages4 - Funa V MECOSelynn CoNo ratings yet

- Head Money CasesDocument3 pagesHead Money CasesSelynn CoNo ratings yet

- 6 - Marubeni Nederland v. Tensuan PDFDocument2 pages6 - Marubeni Nederland v. Tensuan PDFSelynn CoNo ratings yet

- Dissenting Opinion by Judge Tanaka On The South West Africa CasesDocument3 pagesDissenting Opinion by Judge Tanaka On The South West Africa CasesSelynn Co33% (3)

- 2 - Diversion of Waters From River MeuseDocument4 pages2 - Diversion of Waters From River MeuseSelynn CoNo ratings yet

- 7 - Caneland Sugar Corporation V AlonDocument2 pages7 - Caneland Sugar Corporation V AlonSelynn CoNo ratings yet

- 2 - CIR V Filinvest PDFDocument2 pages2 - CIR V Filinvest PDFSelynn CoNo ratings yet

- Talend DataIntegration IG Windows 6.4.1 ENDocument122 pagesTalend DataIntegration IG Windows 6.4.1 ENBhanu PrasadNo ratings yet

- Bomb DetectionDocument3 pagesBomb DetectionOarms AdvanceNo ratings yet

- Moot Court Tutorial 1Document8 pagesMoot Court Tutorial 1rushi sreedharNo ratings yet

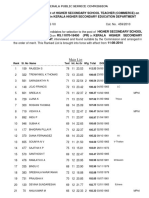

- University of Moratuwa Faculty of EngineeringDocument5 pagesUniversity of Moratuwa Faculty of EngineeringChiranjaya HulangamuwaNo ratings yet

- LGT ReviewerDocument6 pagesLGT ReviewerPhillip RosarioNo ratings yet

- Memorandum of Agreement: (Host Company/Institution and Student Intern Re: Internship)Document6 pagesMemorandum of Agreement: (Host Company/Institution and Student Intern Re: Internship)Aira AmorosoNo ratings yet

- University Search TemplateDocument60 pagesUniversity Search TemplateZahiya ElzuberNo ratings yet

- Application For Thesis Outline DefenseDocument2 pagesApplication For Thesis Outline DefenseJerard BalalaNo ratings yet

- HOMEWORK 2 Tax AdministrationDocument4 pagesHOMEWORK 2 Tax Administrationfitz garlitos100% (1)

- 13d97c PDFDocument11 pages13d97c PDFInam KhanNo ratings yet

- PRO-HSE 001 HSE Objective and Management System Rev.0ADocument6 pagesPRO-HSE 001 HSE Objective and Management System Rev.0ADesfrial DialNo ratings yet

- Tender Notice Promotional MaterialsDocument2 pagesTender Notice Promotional MaterialsGilbert KamanziNo ratings yet

- Islahi Movement at A GlanceDocument2 pagesIslahi Movement at A GlanceDr. ZULFIKER ALINo ratings yet

- Chemviron Clarcel CBLDocument13 pagesChemviron Clarcel CBLCardoso MalacaoNo ratings yet

- RL 490 14 StateDocument65 pagesRL 490 14 StateVishnu Suriya VishNo ratings yet

- Letter - Update Tax Exemption As of March 25, 2013Document10 pagesLetter - Update Tax Exemption As of March 25, 2013Jhoana Parica FranciscoNo ratings yet

- G048303 (Opposition Brief - Anaheim) Modiano v. City of Anaheim (California Disabled Persons Act) Opposition Brief - City of AnaheimDocument80 pagesG048303 (Opposition Brief - Anaheim) Modiano v. City of Anaheim (California Disabled Persons Act) Opposition Brief - City of Anaheimwilliam_e_pappasNo ratings yet

- Byzantine Monastic Foundation DocumentsDocument43 pagesByzantine Monastic Foundation DocumentsSan PNo ratings yet

- BuildHomeIssue20 3Document156 pagesBuildHomeIssue20 3Márcia BibianoNo ratings yet

- Dreamland Resort Case StudyDocument33 pagesDreamland Resort Case StudyChristine joy GacadNo ratings yet

- PNHS Main Const. and by Laws 2022Document5 pagesPNHS Main Const. and by Laws 2022angieNo ratings yet

- Fluid Mech. EFM Assignment 2 (Answers)Document4 pagesFluid Mech. EFM Assignment 2 (Answers)Tik HonNo ratings yet

- Advertisement For Lecturer West Bengal Ayurvedic Education Service 1Document4 pagesAdvertisement For Lecturer West Bengal Ayurvedic Education Service 1AnjanaNo ratings yet

- The Model Artificial Intelligence Law: MAIL v.2.0Document43 pagesThe Model Artificial Intelligence Law: MAIL v.2.0Leslie GordilloNo ratings yet

- 3c Case Study IDEKO Workbook - CASE STUDYDocument8 pages3c Case Study IDEKO Workbook - CASE STUDYTiffany SandjongNo ratings yet

- Global Governance: Amandio de Araujo Sarmento Dewinta Haryanti Hartanto Yudha KurniawanDocument13 pagesGlobal Governance: Amandio de Araujo Sarmento Dewinta Haryanti Hartanto Yudha KurniawanTet LopezNo ratings yet