Professional Documents

Culture Documents

The Consumption Function PDF

The Consumption Function PDF

Uploaded by

Suniel Chhetri0 ratings0% found this document useful (0 votes)

19 views21 pagesOriginal Title

The-Consumption-Function.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views21 pagesThe Consumption Function PDF

The Consumption Function PDF

Uploaded by

Suniel ChhetriCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 21

Chapter 4

The Consumption Function

Principal Determinants of

Consumption (Slide 1)

Recent average disposable income (DI)

Expected average DI

Changes in income tax rates

Cost and availability of credit

Demographic factors and age distribution

of consumers

Principal Determinants of

Consumption (Slide 2)

Expected rate of return on assets: debt,

equity, and real estate

Changes in spendable income not

included in DI caused by fluctuations in

asset prices

Exogenous shifts in consumer attitudes

not related to any of the above variables

Recent Average Disposable

Income (DI)

Income from All Sources

Wages, Income from Capital, and Transfer

payments

Income and social security taxes are

deducted, but not sales and excise taxes

Some income is not included, primarily

from capital gains and home refinancing

Expected or Average DI

Most people base their spending on average or expected

income, rather than the most recent paycheck. This is

usually known as the permanent income hypothesis.

A few examples:

You win the lottery, but you dont spend all of it that

month.

You become unemployed, but your consumption doesnt

drop to zero.

You save in anticipation of the childrens college

education, then dissave during the years they are

actually in college

Changes in Income Tax Rates

This remains a politically charged issue, but

most economists agree that:

A permanent change in tax rates has a larger

impact on consumption than a temporary

change.

Consumers are likely to spend a larger

proportion of any tax cut if they are optimistic

about the future

It is possible that while consumption rises

because of a tax cut, imports also rise, so the

net effect on real GDP is much smaller.

Demographic factors and age

distribution of consumers

The Life Cycle Hypothesis states that young

people will dissave when they are just

starting their careers, will maximize their

saving rate shortly before retirement age,

and then dissave again during retirement

years.

That implies that the general aging of the

population would reduce the personal saving

rate.

Cost and Availability of Credit

A key determinant, especially with the

proliferation of credit cards, home equity

loans, and other sources of borrowing.

Imposing actual credit controls has an

immediate and drastic impact on

consumer spending, but for that very

reason probably would not be utilized

again except in extreme circumstances.

Excessive Credit Sensitivity

The PIH and LCH state that when income

declines, consumption does not decline as

much. Hence the personal saving rate would

decline in recessions

However, we find empirically that the saving rate

rises during recessions.

This is usually referred to as excessive credit

sensitivity. Even if consumers plan to spend

based on their permanent income, they may

have to cut back if borrowing sources are

diminished. This applies mainly to purchases of

durable goods.

Cost of Credit

Five possible reasons why the personal saving

rate is positively correlated with interest rates.

When interest rates rise, people save more now

so income and consumption can be higher later.

Average monthly payment rises, reducing

demand.

Stock market declines

Housing prices rise less rapidly, so less home

equity financing and refinancing

Yield spread narrows, so credit availability

diminishes.

Expected Real Rate of Interest

Argument is complicated by fact that when

interest rates rise, it is usually because inflation

rises, so the expected real rate of interest may

not increase.

Suppose interest rates went from 5% to 15% at

the same time that inflation went from 2% to

12% (as in the late 1970s). People would have

no additional incentive to save.

As a result, this is the weakest empirical link

between interest rates and the saving rate.

Cost of Time Payments

This applies mainly to purchases of motor

vehicles.

Higher interest rates raise the monthly time

payment or lease payment substantially.

Zero interest rate financing boosted motor

vehicle sales sharply even though the average

reduction in the monthly payment was only

about 2%, since low interest rates enabled

manufacturers and dealers to absorb some

losses on existing leases when consumers

bought new motor vehicles.

Changes in Stock Market

Of course stock prices depend on many

factors other than interest rates, yet it is true

that lower interest rates will lead to higher

stock prices, ceteris paribus.

Since a rising stock market boosts

consumption relative to disposable income,

there is a positive correlation between the

saving rate and interest rates for this reason.

Impact on Housing Financing

Housing prices show a strong negative

correlation with interest rates.

As rates decline, housing prices rise faster, so

more homeowners can cash out some of this

increased equity.

Lower interest rates also permit more people to

refinance, hence reducing their monthly

mortgage payment which is not counted as

part of consumption and increase purchases

of other goods and services.

Yield Spread

The yield spread between long and short-term

interest rates is a major determinant of

consumer spending and total GDP.

Usually, long-term rates are higher than short-

term rates. However, when the reverse is true

known as an inverted yield curve the U.S.

economy has always headed into a recession

the following year.

When the yield spread becomes inverted, banks

will reduce the amount of loans made to

consumers, hence diminishing purchases.

Expected rate of return on assets:

debt, equity, and real estate

If consumers expect the rate of return on

assets to rise, they will generally spend a

higher proportion of their income. That is

particularly true for housing, where rising

prices cause many people to cash out

some of their increased equity.

A rising stock market generally leads to an

increase in the ratio of consumption to

disposable income

Changes in spendable income caused by

fluctuations in asset prices not included in DI

This has become an increasingly important

factor in recent years. Capital gains are not

included in disposable income even if they are

realized. Thus during a rising stock market, part

of the reported decline in the personal saving

rate could be due to an increase in realized

capital gains.

Also, many people cash out some of their

increased equity when housing prices rise.

When interest rates decline, homeowners may

refinance, hence boosting the amount of income

they have to spend on other items.

Exogenous shifts in consumer attitudes not

related to any of the above variables

Consumers will spend a higher proportion

of their income if they are optimistic about

the future, and spend less if they are

pessimistic. Virtually all economists and

retailers agree with that statement.

However, measuring these exogenous

shifts is often quite difficult, and

economists have not been successful in

anticipating these shifts.

Which is More Important Income

or Credit ?

Both real disposable income and the cost and

availability of credit are key determinants of

consumer spending.

Most short-term fluctuations in consumption are

related to changes in credit rather than income.

Temporary changes in tax rates do not affect

consumption very much. Permanent changes

are more likely to affect spending in the longer

term.

Impact of Consumer Confidence

Many business managers use the index of

consumer confidence as a useful shorthand for

how much consumers will spend in the near

future.

The key determinants are:

Level of the unemployment rate

Change in unemployment rate

Change in rate of inflation

Change in stock market

Change in implicit wage rate (a measure of

overtime and good jobs).

How Useful Is It?

The index of consumer confidence accurately

tracks the major changes in the ratio of

consumer spending to income.

However, short-term fluctuations in this index,

which are often tied to exogenous events such

as wars, elections, and natural disasters, are not

reflected in changes in consumer spending.

Conversely, very short-term changes in

consumer spending often appear to be random

in nature (weather, etc.) and are not tied to

either economic or attitudinal variables.

You might also like

- UCC-1 Financing StatementDocument94 pagesUCC-1 Financing StatementVincent J. Cataldi85% (34)

- Chapter 7 External Economic Influences On Business ActivityDocument12 pagesChapter 7 External Economic Influences On Business ActivityHassaan UmerNo ratings yet

- Economic Factors Affecting BusinessDocument17 pagesEconomic Factors Affecting BusinessFadzillah Ahmad100% (1)

- Financial Markets and Institutions: Ninth EditionDocument59 pagesFinancial Markets and Institutions: Ninth EditionShahmeer KamranNo ratings yet

- BAJAJ Statement of AccountDocument1 pageBAJAJ Statement of AccountSurya Prakash100% (1)

- Solved Anne and Michael Own and Operate A Successful Mattress Business PDFDocument1 pageSolved Anne and Michael Own and Operate A Successful Mattress Business PDFAnbu jaromiaNo ratings yet

- Chap 5Document24 pagesChap 5Hisham JawharNo ratings yet

- Economic Development: Capistrano, Karen Dumdum, Christine Maraño, Mary Rose Milario, AngeloDocument14 pagesEconomic Development: Capistrano, Karen Dumdum, Christine Maraño, Mary Rose Milario, AngeloRAMIREZ, KRISHA R.No ratings yet

- Introduction To Monetary PolicyDocument21 pagesIntroduction To Monetary PolicyHisham JawharNo ratings yet

- Interest Rate and InflationDocument4 pagesInterest Rate and InflationjayanjosephNo ratings yet

- 3.2 Real Estate FinanceDocument14 pages3.2 Real Estate Financegore.solivenNo ratings yet

- Causes and Cures For InflationDocument21 pagesCauses and Cures For InflationHisham JawharNo ratings yet

- Five DebatesDocument12 pagesFive DebatesraviNo ratings yet

- ConsumptionDocument16 pagesConsumptionLeah BrocklebankNo ratings yet

- P.G. II Social Cost of Inflation by Pranav ShekharDocument9 pagesP.G. II Social Cost of Inflation by Pranav ShekharMohit BhandariNo ratings yet

- 2.6. Macroeconomic Objectives and PoliciesDocument19 pages2.6. Macroeconomic Objectives and Policiesclaire zhouNo ratings yet

- 12.5 Evaluating Government Policies: Important ImportantDocument27 pages12.5 Evaluating Government Policies: Important ImportantSyed HaroonNo ratings yet

- Public Finance Lecture Notes Gruber Chapter 2Document22 pagesPublic Finance Lecture Notes Gruber Chapter 2Hiram CortezNo ratings yet

- The Intelligent Investor Chapter 2Document2 pagesThe Intelligent Investor Chapter 2Michael PullmanNo ratings yet

- The Determinants of Interest RatesDocument4 pagesThe Determinants of Interest RatesEkjon Dipto100% (1)

- Bullets For LOMA 307Document15 pagesBullets For LOMA 307Nutt ChanchalitNo ratings yet

- Consumer Spending - Tutor2uDocument7 pagesConsumer Spending - Tutor2utheone1998No ratings yet

- Chaopte r34 NotesDocument5 pagesChaopte r34 Noteschinsu6893No ratings yet

- This Line Is Only For CommerceDocument23 pagesThis Line Is Only For CommerceSourav SsinghNo ratings yet

- RecessionDocument3 pagesRecessionBharathi SivaNo ratings yet

- Consumption Savings Investment. ParadoxDocument46 pagesConsumption Savings Investment. ParadoxChristine Joy LanabanNo ratings yet

- UNIT 9 The MacroeconomyDocument5 pagesUNIT 9 The MacroeconomyMahnoor AleemNo ratings yet

- 4 Classical Theory of The Interest RateDocument28 pages4 Classical Theory of The Interest RateAYUSHI PATELNo ratings yet

- 14 Ch36-Six Debates Over Macroeconomic Policy-KeyDocument15 pages14 Ch36-Six Debates Over Macroeconomic Policy-KeyChen JunhaoNo ratings yet

- Lecture 7 PDFDocument44 pagesLecture 7 PDFAmna NoorNo ratings yet

- Lall Interest Rate ProjectDocument19 pagesLall Interest Rate ProjectSourav SsinghNo ratings yet

- Monetary Policy - MidtermDocument56 pagesMonetary Policy - MidtermCA's HobbyNo ratings yet

- Macroeconomic Policy Instruments - IDocument35 pagesMacroeconomic Policy Instruments - IAbdoukadirr SambouNo ratings yet

- Interest RateDocument19 pagesInterest RateGEJOR_ZNo ratings yet

- Session 13 The Government BudgetDocument22 pagesSession 13 The Government BudgetSourabh AgrawalNo ratings yet

- External Analysis: Industry Structure, Competitive Forces, and Strategic GroupsDocument36 pagesExternal Analysis: Industry Structure, Competitive Forces, and Strategic Groupsjunaid_256No ratings yet

- Monetary PolicyDocument5 pagesMonetary Policyxf48qwb9gcNo ratings yet

- Economic Influences: Learning ObjectivesDocument40 pagesEconomic Influences: Learning Objectivessk001No ratings yet

- IGCSE Economics Self Assessment Chapter 27 AnswersDocument3 pagesIGCSE Economics Self Assessment Chapter 27 AnswersDesreNo ratings yet

- M06 Gitman50803X 14 MF C06Document16 pagesM06 Gitman50803X 14 MF C06Levan TsipianiNo ratings yet

- Economic GrowthDocument23 pagesEconomic GrowthZaid ZubairiNo ratings yet

- Macro EconomicsDocument53 pagesMacro Economicsgetcultured69No ratings yet

- Am - 2-1Document18 pagesAm - 2-1Pratibha JaiswalNo ratings yet

- The Importance of MacroeconomicsDocument17 pagesThe Importance of MacroeconomicsHisham JawharNo ratings yet

- Consumer Price Index CPIDocument3 pagesConsumer Price Index CPIdayanarshad1337No ratings yet

- Analysis of The Yield Curve: Assignment IDocument6 pagesAnalysis of The Yield Curve: Assignment IIyLiaorohimaru SamaNo ratings yet

- Week 9 - SII2013 PDFDocument67 pagesWeek 9 - SII2013 PDFGorge SorosNo ratings yet

- 4.2.4. Interest Rate DeterminationDocument21 pages4.2.4. Interest Rate DeterminationGuy WilkinsonNo ratings yet

- Interest Rates Affect The Ability of Consumers and Businesses To Access CreditDocument4 pagesInterest Rates Affect The Ability of Consumers and Businesses To Access CreditKurt Del RosarioNo ratings yet

- Interest RateDocument19 pagesInterest RatenzlNo ratings yet

- Interest Rate Good Things or Bad Things?Document8 pagesInterest Rate Good Things or Bad Things?noraNo ratings yet

- Krugman Unit 6 Modules 30-36Document112 pagesKrugman Unit 6 Modules 30-36derengungorNo ratings yet

- Financial E Chapter TwoDocument25 pagesFinancial E Chapter TwoGenemo FitalaNo ratings yet

- Business Cycles: The TheoryDocument39 pagesBusiness Cycles: The TheorySagar IndranNo ratings yet

- Chapter 9 - External Economic EfffectsDocument71 pagesChapter 9 - External Economic Efffectstaona madanhireNo ratings yet

- Keynes Theory of Deficit SpendingDocument14 pagesKeynes Theory of Deficit Spendingdipu francyNo ratings yet

- Unit2 IapmDocument43 pagesUnit2 IapmAshish SinghNo ratings yet

- Lecture 5 - Cyclical InstabilityDocument66 pagesLecture 5 - Cyclical InstabilityTechno NowNo ratings yet

- 3.5 Inflation and Financial Appraisal - ADJT LECTUREDocument58 pages3.5 Inflation and Financial Appraisal - ADJT LECTUREDina AyundariNo ratings yet

- Budget Balance (Chapter 12) + Calculating Different Types of Budget Deficit in EgyptDocument24 pagesBudget Balance (Chapter 12) + Calculating Different Types of Budget Deficit in EgyptEl jokerNo ratings yet

- Bernanke and Gertler: Inside The Black Box of Monetary Policy TransmissionDocument22 pagesBernanke and Gertler: Inside The Black Box of Monetary Policy TransmissionVasu VijayraghavanNo ratings yet

- MECO121 UM S2024 Session18Document25 pagesMECO121 UM S2024 Session18rizwanf026No ratings yet

- Macroeconomy: Reflects Condition Overall Economy: Microeconomy Reflects On Condition Industry, Its Markets and PlayersDocument21 pagesMacroeconomy: Reflects Condition Overall Economy: Microeconomy Reflects On Condition Industry, Its Markets and PlayersRosella FernandoNo ratings yet

- PGPM 2023 Time Value Problem Set v1.2Document20 pagesPGPM 2023 Time Value Problem Set v1.2Jayanth DeshmukhNo ratings yet

- Macdonald v. National City Bank of NY (1956)Document3 pagesMacdonald v. National City Bank of NY (1956)Ianna Carmel QuitayenNo ratings yet

- BDO PersonalLoanAKAppliFormDocument4 pagesBDO PersonalLoanAKAppliFormAirMan ManiagoNo ratings yet

- 2 - Tan v. Valdehueza (1975)Document6 pages2 - Tan v. Valdehueza (1975)StrugglingStudentNo ratings yet

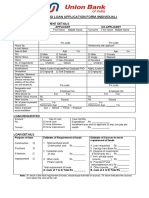

- Union Home Application FormDocument3 pagesUnion Home Application FormHAINDAVI REDDY GUDDETINo ratings yet

- Garcia V VillarDocument6 pagesGarcia V Villartin CABANCLANo ratings yet

- Sale Ageement Part CompressedDocument4 pagesSale Ageement Part CompressedMOHIB100% (1)

- "Recto Law". Recto Law Laid Down The Remedies Available To The Vendor in Sale of PersonalDocument4 pages"Recto Law". Recto Law Laid Down The Remedies Available To The Vendor in Sale of PersonalMounicha AmbayecNo ratings yet

- Rights and Liabilities of Mortgagee. 1650257. 1650264. 1650217Document15 pagesRights and Liabilities of Mortgagee. 1650257. 1650264. 1650217Sakshi AnandNo ratings yet

- 03 M2Document36 pages03 M2PalaniyappanNo ratings yet

- Functions of Commercial BankingDocument22 pagesFunctions of Commercial Bankingparth sharmaNo ratings yet

- Credit Scoring: Beyond The NumbersDocument34 pagesCredit Scoring: Beyond The NumbersramssravaniNo ratings yet

- Hire Purchase & LeasingDocument67 pagesHire Purchase & LeasingImran AliNo ratings yet

- Gbrar Roster Q2 20201Document101 pagesGbrar Roster Q2 20201brightNo ratings yet

- BP 220 - Registration & License To SellDocument6 pagesBP 220 - Registration & License To SellKLASANTOSNo ratings yet

- New Borrowers Validation SheetDocument1 pageNew Borrowers Validation SheetalecksgodinezNo ratings yet

- An Analysis On The Role of Lending Companies in The Philippines Financial SystemDocument11 pagesAn Analysis On The Role of Lending Companies in The Philippines Financial SystemMaria Cristina MorfiNo ratings yet

- Mahamana Malaviya National Moot Court Competition 2015: Case Concerning The Possesion of Suit Schedule PropertyDocument25 pagesMahamana Malaviya National Moot Court Competition 2015: Case Concerning The Possesion of Suit Schedule PropertyPreeminentPriyankaNo ratings yet

- GM-Q2-Module 2bDocument17 pagesGM-Q2-Module 2bZandria Camille Delos Santos100% (3)

- Banking LawsDocument27 pagesBanking LawsGrace Managuelod GabuyoNo ratings yet

- DMSS Final Project - v2Document20 pagesDMSS Final Project - v2CarlosSandovalMedinaNo ratings yet

- Barbri - UCCDocument16 pagesBarbri - UCCsfaris07No ratings yet

- Excel Loan CalculatorDocument11 pagesExcel Loan CalculatorramcharanNo ratings yet

- Understanding RCEF and Implication To Rice FarmersDocument51 pagesUnderstanding RCEF and Implication To Rice FarmersCLARIZZE JAINE MANALONo ratings yet

- Law On Pledge and MortgageDocument41 pagesLaw On Pledge and MortgageEmzNo ratings yet

- Classification of Obligations PDFDocument16 pagesClassification of Obligations PDFPaula BautistaNo ratings yet