Professional Documents

Culture Documents

7lol Chapter 14 PDF

7lol Chapter 14 PDF

Uploaded by

Ahmad RahhalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7lol Chapter 14 PDF

7lol Chapter 14 PDF

Uploaded by

Ahmad RahhalCopyright:

Available Formats

Chapter 14

Working Capital and Current Assets Management

Solutions to Problems

P14-1. LG 2: Cash Conversion Cycle

Basic

(a) Operating cycle (OC) = Average age of inventories

+ Average collection period

= 90 days + 60 days

= 150 days

(b) Cash Conversion Cycle (CCC) = Operating cycle Average payment period

= 150 days 30 days

= 120 days

(c) Resources needed = (total annual outlays 365 days) CCC

= [$30,000,000 365] 120

= $9,863,013.70

(d) Shortening either the average age of inventory or the average collection period, lengthening

the average payment period, or a combination of these can reduce the cash conversion cycle.

P14-2. LG 2: Changing Cash Conversion Cycle

Intermediate

(a) AAI = 365 days 8 times inventory = 46 days

Operating Cycle = AAl + ACP

= 46 days + 60 days

= 106 days

Cash Conversion Cycle = OC APP

= 106 days 35 days = 71 days

(b) Daily Cash Operating Expenditure = Total outlays 365 days

= $3,500,000 365

= $9,589

Resources needed = Daily Expenditure CCC

= $9,589 71

= $680,819

356 Part 5 Short-Term Financial Decisions

(c) Additional profit = (Daily expenditure reduction in CC)

financing rate

= ($9,589 20) 0.14

= $26,849

P14-3. LG 2: Multiple Changes in Cash Conversion Cycle

Intermediate

(a) AAI = 365 6 times inventory = 61 days

OC = AAI + ACP

= 61 days + 45 days

= 106 days

CCC = OC APP

= 106 days 30 days

= 76 days

Daily Financing = $3,000,000 365

= $8,219

Resources needed = Daily financing CCC

= $8,219 76

= $624,644

(b) OC = 55 days + 35 days

= 90 days

CCC = 90 days 40 days

= 50 days

Resources needed = $8,219 50

= $410,950

(c) Additional profit = (Daily expenditure reduction in CCC)

financing rate

= ($8,219 25) 0.13

= $26,712

(d) Reject the proposed techniques because costs ($35,000) exceed savings ($26,712).

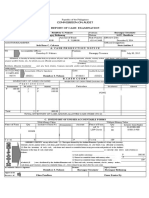

P14-4. LG 2: Aggressive versus Conservative Seasonal Funding Strategy

Intermediate

(a)

Total Funds Permanent Seasonal

Month Requirements Requirements Requirements

January $2,000,000 $2,000,000 $0

February 2,000,000 2,000,000 0

March 2,000,000 2,000,000 0

April 4,000,000 2,000,000 2,000,000

May 6,000,000 2,000,000 4,000,000

Chapter 14 Working Capital and Current Assets Management 357

June 9,000,000 2,000,000 7,000,000

July 12,000,000 2,000,000 10,000,000

August 14,000,000 2,000,000 12,000,000

September 9,000,000 2,000,000 7,000,000

October 5,000,000 2,000,000 3,000,000

November 4,000,000 2,000,000 2,000,000

December 3,000,000 2,000,000 1,000,000

Average permanent requirement = $2,000,000

Average seasonal requirement = $48,000,000 12

= $4,000,000

(b) (1) Under an aggressive strategy, the firm would borrow from $1,000,000 to $12,000,000

according to the seasonal requirement schedule shown in (a) at the prevailing short-term

rate. The firm would borrow $2,000,000, or the permanent portion of its requirements, at

the prevailing long-term rate.

(2) Under a conservative strategy, the firm would borrow at the peak need level of

$14,000,000 at the prevailing long-term rate.

(c) Aggressive = ($2,000,000 0.17) + ($4,000,000 0.12)

= $340,000 + $480,000

= $820,000

Conservative = ($14,000,000 0.17)

= $2,380,000

(d) In this case, the large difference in financing costs makes the aggressive strategy more

attractive. Possibly the higher returns warrant higher risks. In general, since the conservative

strategy requires the firm to pay interest on unneeded funds, its cost is higher. Thus, the

aggressive strategy is more profitable but also more risky.

P14-5. LG 3: EOQ Analysis

Intermediate

(2 S O) (2 1,200,000 $25)

(a) (1) EOQ = = = 10,541

C $0.54

(2 1,200,000 0)

(2) EOQ = =0

$0.54

(2 1,200,000 $25)

(3) EOQ = =

$0.00

EOQ approaches infinity. This suggests the firm should carry the large inventory to minimize

ordering costs.

(b) The EOQ model is most useful when both carrying costs and ordering costs are present. As

shown in part (a), when either of these costs are absent the solution to the model is not realistic.

With zero ordering costs the firm is shown to never place an order. When carrying costs are zero

the firm would order only when inventory is zero and order as much as possible (infinity).

358 Part 5 Short-Term Financial Decisions

P14-6. LG 3: EOQ, Reorder Point, and Safety Stock

Intermediate

(2 S O)

(2 800 $50)

(a) EOQ = = = 200 units

C 2

200 units 800 units 10 days

(b) Average level of inventory = +

2 365

= 121.92 units

(800 units 10 days) (800 units 5 days)

(c) Reorder point = +

365 days 365 days

= 32.88 units

(d) Change Do Not Change

(2) carrying costs (1) ordering costs

(3) total inventory cost (5) economic order quantity

(4) reorder point

P14-7. LG 4: Accounts Receivable Changes without Bad Debts

Intermediate

(a) Current units = $360,000,000 $60 = 6,000,000 units

Increase = 6,000,000 20% = 1,200,000 new units

Additional profit contribution = ($60 $55) 1,200,000 units

= $6,000,000

total variable cost of annual sales

(b) Average investment in accounts receivable =

turnover of A/R

365

Turnover, present plan = = 6.08

60

365 365

Turnover, proposed plan = = = 5.07

(60 1.2) 72

Marginal Investment in A/R:

Average investment, proposed plan:

(7,200,000 units* $55)

= $78,106,509

5.07

Average investment, present plan:

(6, 000, 000 units $55)

= 54,276,316

6.08

Marginal investment in A/R = $23,830,193

*

Total units, proposed plan = existing sales of 6,000,000 units + 1,200,000 additional units.

(c) Cost of marginal investment in accounts receivable:

Marginal investment in A/R $23,830,193

Required return 0.14

Cost of marginal investment in A/R $3,336,227

Chapter 14 Working Capital and Current Assets Management 359

(d) The additional profitability of $6,000,000 exceeds the additional costs of $3,336,227.

However, one would need estimates of bad debt expenses, clerical costs, and some

information about the uncertainty of the sales forecast prior to adoption of the policy.

P14-8. LG 4: Accounts Receivable Changes and Bad Debts

Challenge

(a) Bad debts

Proposed plan (60,000 $20 0.04) $48,000

Present plan (50,000 $20 0.02) 20,000

(b) Cost of marginal bad debts $28,000

(c) No, since the cost of marginal bad debts exceeds the savings of $3,500.

(d) Additional profit contribution from sales:

10,000 additional units ($20 $15) $50,000

Cost of marginal bad debts (from part (b)) (28,000)

Savings 3,500

Net benefit from implementing proposed plan $25,500

This policy change is recommended because the increase in sales and the savings of $3,500

exceed the increased bad debt expense.

(e) When the additional sales are ignored, the proposed policy is rejected. However, when all the

benefits are included, the profitability from new sales and savings outweigh the increased

cost of bad debts. Therefore, the policy is recommended.

P14-9. LG 4: Relaxation of Credit Standards

Challenge

Additional profit contribution from sales = 1,000 additional units ($40 $31) $9,000

Cost of marginal investment in A/R:

11, 000 units $31

Average investment, proposed plan = $56,055

365

60

10,000 units $31

Average investment, present plan = 38,219

365

45

Marginal investment in A/R $17,836

Required return on investment 0.25

Cost of marginal investment in A/R (4,459)

Cost of marginal bad debts:

Bad debts, proposed plan (0.03 $40 11,000 units) $13,200

Bad debts, present plan (0.01 $40 10,000 units) 4,000

Cost of marginal bad debts (9,200)

Net loss from implementing proposed plan ($4,659)

The credit standards should not be relaxed since the proposed plan results in a loss.

360 Part 5 Short-Term Financial Decisions

P14-10. LG 5: Initiating a Cash Discount

Challenge

Additional profit contribution from sales = 2,000 additional units ($45 $36) $18,000

Cost of marginal investment in A/R:

42, 000 units $36

Average investment, proposed plan = $124,274

365

30

40, 000 units $36

Average investment, present plan = 236,712

365

60

Reduced investment in A/R $112,438

Required return on investment 0.25

Cost of marginal investment in A/R 28,110

Cost of cash discount = (0.02 0.70 $45 42,000 units) (26,460)

Net profit from implementing proposed plan $19,650

Since the net effect would be a gain of $19,650, the project should be accepted.

P14-11. LG 5: Shortening the Credit Period

Challenge

Reduction in profit contribution from sales = 2,000 units ($56 $45) ($22,000)

Cost of marginal investment in A/R:

10,000 units $45

Average investment, proposed plan = $44,384

365

36

12,000 units $45

Average investment, present plan = 66,575

365

45

Marginal investment in A/R $22,191

Required return on investment 0.25

Benefit from reduced

Marginal investment in A/R 5,548

Cost of marginal bad debts:

Bad debts, proposed plan (0.01 $56 10,000 units) $5,600

Bad debts, present plan (0.015 $56 12,000 units) 10,080

Reduction in bad debts 4,480

Net loss from implementing proposed plan ($11,972)

This proposal is not recommended.

P14-12. LG 5: Lengthening the Credit Period

Challenge

Preliminary calculations:

($450,000 $345,000)

Contribution margin = = 0.2333

$450,000

Chapter 14 Working Capital and Current Assets Management 361

Variable cost percentage = 1 contribution margin

= 1 0.233

= 0.767

(a) Additional profit contribution from sales:

($510,000 $450,000) 0.233 contribution margin $14,000

(b) Cost of marginal investment in A/R:

$510, 000 0.767

Average investment, proposed plan = $64,302

365

60

$450, 000 0.767

Average investment, present plan = 28,368

365

30

Marginal investment in A/R ($35,934)

Required return on investment 0.20

Cost of marginal investment in A/R ($7,187)

(c) Cost of marginal bad debts:

Bad debts, proposed plan (0.015 $510,000) $7,650

Bad debts, present plan (0.01 $450,000) 4,500

Cost of marginal bad debts (3,150)

(d) Net benefit from implementing proposed plan ($3,663)

The net benefit of lengthening the credit period is minus $3,663; therefore the proposal is not

recommended.

P14-13. LG 6: Float

Basic

(a) Collection float = 2.5 + 1.5 + 3.0 = 7 days

(b) Opportunity cost = $65,000 3.0 0.11 = $21,450

The firm should accept the proposal because the savings ($21,450) exceed

the costs ($16,500).

P14-14. LG 6: Lockbox System

Basic

(a) Cash made available = $3,240,000 365

= ($8,877/day) 3 days = $26,631

(b) Net benefit = $26,631 0.15 = $3,995

The $9,000 cost exceeds $3,995 benefit; therefore, the firm should not accept the lockbox

system.

P14-15. LG 6: Zero-Balance Account

Basic

Current average balance in disbursement account $420,000

Opportunity cost (12%) 0.12

Current opportunity cost $50,400

362 Part 5 Short-Term Financial Decisions

Zero-Balance Account

Compensating balance $300,000

Opportunity cost (12%) 0.12

Opportunity cost $36,000

+ Monthly fee ($1,000 12) 12,000

Total cost $48,000

The opportunity cost of the zero-balance account proposal ($48,000) is less than the current

account opportunity cost ($50,000). Therefore, accept the zero-balance proposal.

P14-16. Ethics Problem

Intermediate

Controlled disbursement accounts located at banks very distant from the companys payables

staff, headquarters, and other offices are suspect. This really puts it into the realm of remote

disbursement, especially when the account is located in an out-of-the-way locale such as Grand

Junction, CO (which is where one banks controlled disbursement accounts are located). It takes

the Fed longer to present checks to this remote location.

You might also like

- Ch. 13 Leverage and Capital Structure AnswersDocument23 pagesCh. 13 Leverage and Capital Structure Answersbetl89% (27)

- Tutorial 3 WCM Updated fnc3101Document4 pagesTutorial 3 WCM Updated fnc3101Trick1 Haha100% (1)

- Chapter 11 SolutionsDocument22 pagesChapter 11 SolutionsChander Santos Monteiro100% (3)

- Pest Analysis of LibyaDocument14 pagesPest Analysis of LibyaHarshada ChavanNo ratings yet

- Chapter 4 SolutionsDocument14 pagesChapter 4 Solutionshassan.murad82% (11)

- Chapter 14 SolutionsDocument10 pagesChapter 14 SolutionsAmanda Ng100% (1)

- Chapter 10 SM Principles of Managerial FinanceDocument42 pagesChapter 10 SM Principles of Managerial FinanceMajd Ayman83% (6)

- Chapter 12 SolutionsDocument10 pagesChapter 12 Solutionshassan.murad100% (2)

- Chapter 8 Solutions GitmanDocument22 pagesChapter 8 Solutions GitmanCat Valentine100% (3)

- Test Bank 3 - GitmanDocument62 pagesTest Bank 3 - GitmanCamille Santos20% (5)

- Chapter 9 SolutionsDocument11 pagesChapter 9 Solutionssaddam hussain80% (5)

- Capital Structure & Leverage - ExercisesDocument11 pagesCapital Structure & Leverage - ExercisesDrehfcie100% (1)

- CH2 Practice QuestionsDocument11 pagesCH2 Practice QuestionsenkeltvrelseNo ratings yet

- Chapter 15Document6 pagesChapter 15Rayhan Atunu100% (1)

- Chapter 6 SolutionsDocument7 pagesChapter 6 Solutionshassan.murad85% (13)

- Chapter 12 SolutionsDocument13 pagesChapter 12 SolutionsCindy Lee75% (4)

- Tugas GSLC Corp Finance Session 17 & 18Document8 pagesTugas GSLC Corp Finance Session 17 & 18Javier Noel Claudio100% (1)

- Chapter 10 Solutions - EugeneDocument8 pagesChapter 10 Solutions - EugeneNabiha KhattakNo ratings yet

- CH16HW TrierweilerDocument5 pagesCH16HW TrierweilerMax Trierweiler100% (1)

- Working Capital (P15)Document13 pagesWorking Capital (P15)John Samonte100% (2)

- Chapter 16Document13 pagesChapter 16Andi Luo100% (1)

- Chapter-6 GITMAN SOLMANDocument24 pagesChapter-6 GITMAN SOLMANJudy Ann Margate Victoria67% (6)

- Gitman 12e 525314 IM ch11r 2Document25 pagesGitman 12e 525314 IM ch11r 2jasminroxas86% (14)

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Chapter 12Document34 pagesChapter 12LBL_Lowkee100% (1)

- Chapter 3 SolutionsDocument7 pagesChapter 3 Solutionshassan.murad63% (8)

- Chapter 16Document11 pagesChapter 16Aarti J50% (2)

- Solutions Manual Chapter Twenty: Answers To Chapter 20 QuestionsDocument6 pagesSolutions Manual Chapter Twenty: Answers To Chapter 20 QuestionsBiloni KadakiaNo ratings yet

- Chapter 7 Bonds and Their ValuationDocument8 pagesChapter 7 Bonds and Their Valuationfarbwn50% (2)

- AnswerDocument13 pagesAnswerEhab M. Abdel HadyNo ratings yet

- Chapter10 Test Bank in Manegerial FinanceDocument37 pagesChapter10 Test Bank in Manegerial FinanceShealalyn1100% (8)

- Chapter 9 SolutionsDocument16 pagesChapter 9 SolutionsIsah Ma. Zenaida Felisilda50% (2)

- Gitman Chapter 15 Working CapitalDocument67 pagesGitman Chapter 15 Working CapitalArif SharifNo ratings yet

- Tutorial 8 AnswerDocument3 pagesTutorial 8 AnswerHaidahNo ratings yet

- Casa de DisenoDocument8 pagesCasa de DisenoMarilou Broñosa-PepañoNo ratings yet

- Current Asset ManagementDocument3 pagesCurrent Asset ManagementGenre FloresNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementDewanti Almeera100% (1)

- Chapter 14working Capital and Current Assets ManagementDocument1 pageChapter 14working Capital and Current Assets ManagementMaricris RellinNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Working Capital and Current Assets Manag PDFDocument13 pagesWorking Capital and Current Assets Manag PDFNorman DelirioNo ratings yet

- Working Capital and Current Assets Management: Answers To Warm-Up ExercisesDocument13 pagesWorking Capital and Current Assets Management: Answers To Warm-Up ExercisesNorman DelirioNo ratings yet

- Working Capital Manageme NT: Weekend Assignment: 3Document10 pagesWorking Capital Manageme NT: Weekend Assignment: 3Ankit KhandelwalNo ratings yet

- Corporate Finance Week 5 Slide SolutionsDocument3 pagesCorporate Finance Week 5 Slide SolutionsKate BNo ratings yet

- Corporate Finance Week 4 Slide SolutionsDocument4 pagesCorporate Finance Week 4 Slide SolutionsKate BNo ratings yet

- Capital Budgeting Cash Flows: Solutions To ProblemsDocument20 pagesCapital Budgeting Cash Flows: Solutions To ProblemsRau MohdNo ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- Tut6 AR WCMDocument5 pagesTut6 AR WCMrodamay.rdmNo ratings yet

- Gitman - IM - ch11 (CFM)Document19 pagesGitman - IM - ch11 (CFM)jeankoplerNo ratings yet

- Module 6 ActivitiesDocument12 pagesModule 6 ActivitiesArnelli GregorioNo ratings yet

- Chapter 16 - Management of Current AssetsDocument7 pagesChapter 16 - Management of Current Assetslou-924No ratings yet

- P1 - Performance Operations: Operational Level PaperDocument14 pagesP1 - Performance Operations: Operational Level PapermavkaziNo ratings yet

- CH 15 Solutions To Selected End of Chapter ProblemsDocument5 pagesCH 15 Solutions To Selected End of Chapter Problemsbobhamilton3489No ratings yet

- ... Latihan Bab 14Document6 pages... Latihan Bab 14ScribdTranslationsNo ratings yet

- Engineering Economics Take Home Quiz QuiDocument5 pagesEngineering Economics Take Home Quiz QuiMUHAMMAD WAJID SHAHZADNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions ManualDocument26 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (17)

- Managerial Finance GitmanDocument3 pagesManagerial Finance GitmanjessicaNo ratings yet

- Introduction To Managerial Accounting Canadian 5th Edition Brewer Solutions Manual 1Document36 pagesIntroduction To Managerial Accounting Canadian 5th Edition Brewer Solutions Manual 1warrenbakerrofjngwkia100% (27)

- CF Final 2020 Preparation Answers: B. Payback PeriodDocument5 pagesCF Final 2020 Preparation Answers: B. Payback PeriodXatia SirginavaNo ratings yet

- WEDocument27 pagesWENgenoh ArnoldNo ratings yet

- Answer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)Document4 pagesAnswer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)erijfNo ratings yet

- Solution Cost and Management Nov 2010Document7 pagesSolution Cost and Management Nov 2010Samuel DwumfourNo ratings yet

- Chapter 6 Bank Reports Commercial BankDocument13 pagesChapter 6 Bank Reports Commercial BankBoRaHaENo ratings yet

- BisleriDocument37 pagesBislerialan simonNo ratings yet

- Object Types in SAP B1Document21 pagesObject Types in SAP B1guhandoss100% (1)

- Summary of Angelina Hernandez Defendant Estafa CaseDocument1 pageSummary of Angelina Hernandez Defendant Estafa CaseJay Mark Albis SantosNo ratings yet

- MDFDocument2 pagesMDFSol RecuerdoNo ratings yet

- Fixed-Income Markets - Issuance, Trading and FundingDocument32 pagesFixed-Income Markets - Issuance, Trading and FundingShriya JanjikhelNo ratings yet

- Financial Statement AnalysisDocument96 pagesFinancial Statement AnalysisArun Kumar100% (1)

- SFD-Works Bidding Document - Revised-Final PDFDocument67 pagesSFD-Works Bidding Document - Revised-Final PDFsolebNo ratings yet

- Alexander Macfarlane - Physical MathematicsDocument410 pagesAlexander Macfarlane - Physical MathematicsanonkidNo ratings yet

- Ashok Leyland Ltd-FY15Document157 pagesAshok Leyland Ltd-FY15Gautam DNo ratings yet

- Federal Deposit Insurance Corporation Washington, D.CDocument15 pagesFederal Deposit Insurance Corporation Washington, D.CNye LavalleNo ratings yet

- AP.05 Intangible Assets.Document5 pagesAP.05 Intangible Assets.Leslie De Los Santos100% (1)

- Corporate Liquidation P18-1 To P18-6Document7 pagesCorporate Liquidation P18-1 To P18-6alfiNo ratings yet

- Consumer MathDocument60 pagesConsumer MathJazz100% (3)

- Equitable PCI Bank vs. NG Sheung NgorDocument7 pagesEquitable PCI Bank vs. NG Sheung NgorGeenea VidalNo ratings yet

- Non-Banking Financial InstitutionDocument14 pagesNon-Banking Financial InstitutionPhil Raeken FornollesNo ratings yet

- International Macroeconomics: Slides For Chapter 7: Twin Deficits: Fiscal Deficits and Current Account ImbalancesDocument74 pagesInternational Macroeconomics: Slides For Chapter 7: Twin Deficits: Fiscal Deficits and Current Account ImbalancesM Kaderi KibriaNo ratings yet

- Chap 02Document25 pagesChap 02amatulmateennoorNo ratings yet

- Group I Letters of CreditDocument9 pagesGroup I Letters of CreditYvetteNo ratings yet

- Cash Tickets MonitoringDocument8 pagesCash Tickets MonitoringSeth Cabrera0% (1)

- Monetary Policy of State Bank of PakistanDocument16 pagesMonetary Policy of State Bank of PakistanAli Imran JalaliNo ratings yet

- Rogon, John Carlo A. BSA 2-1Document69 pagesRogon, John Carlo A. BSA 2-1joulNo ratings yet

- Accounting NotesDocument20 pagesAccounting NotesRoshniNo ratings yet

- Cash Flow Statement TemplateDocument5 pagesCash Flow Statement Templatewaqas001No ratings yet

- Title Xvi. - Pledge, Mortgage and Antichresis Chapter 1-Provisions Common To Pledge and MortgageDocument3 pagesTitle Xvi. - Pledge, Mortgage and Antichresis Chapter 1-Provisions Common To Pledge and MortgageAmiel SaquisameNo ratings yet

- Reen LawnsDocument8 pagesReen LawnsAshish BhallaNo ratings yet

- Payroll Schemas and Personnel Calculation RulesDocument23 pagesPayroll Schemas and Personnel Calculation Rulesananth-jNo ratings yet

- PW and PPTWDocument37 pagesPW and PPTWDavidNo ratings yet

- Loan Classfication, Rescheduling, WriteOffDocument21 pagesLoan Classfication, Rescheduling, WriteOffsagortemenosNo ratings yet