Professional Documents

Culture Documents

Five Years' Financial Summary: REPORT 2015

Uploaded by

Rizwan ZisanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Five Years' Financial Summary: REPORT 2015

Uploaded by

Rizwan ZisanCopyright:

Available Formats

A N N U A L

REPORT 2015

grameenphone

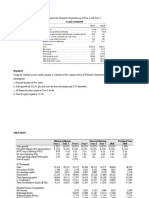

FIVE YEARS FINANCIAL SUMMARY

2015 2014 2013* 2012* 2011

Individual Consolidated

Operational Results in million BDT

Revenue 104,754 102,663 96,624 91,920 89,060

Operating Profit 36,964 36,896 33,199 33,675 32,572

Profit before tax 34,922 34,855 32,852 30,193 33,006

Net Profit after tax 19,707 19,803 14,702 17,505 18,891

Financial Position in million BDT

Paid-up Capital 13,503 13,503 13,503 13,503 13,503

Shareholders' equity 30,625 31,365 31,141 35,458 38,883

Total assets 132,450 130,673 135,221 117,665 108,905

Total liabilities 101,824 99,308 104,080 82,207 70,022

Current assests 11,928 14,865 16,993 14,005 32,421

Current liabilities 67,625 61,402 78,580 63,060 51,469

Non current assets 120,522 115,808 118,227 103,660 76,484

Non current liabilities 34,199 37,906 25,500 19,148 18,552

Financial Ratios

Current Asset to Current Liability 0.18 0.24 0.22 0.22 0.63

Debt to Equity 0.80 0.95 0.55 0.16 0.13

Operating Profit Margin 35% 36% 34% 37% 37%

Net Profit Margin 19% 19% 15% 19% 21%

Return on Equity 64% 63% 44% 47% 42%

Return on Total Assets 15% 15% 12% 15% 17%

Ordinary Shares Information

Ordinary Shares outstanding (in million) 1,350 1,350 1,350 1,350 1,350

Face Value per share 10 10 10 10 10

Cash Dividend on paid-up capital 1

140% 160% 140% 140% 205%

Dividend payout1 96% 109% 129% 108% 147%

NAV per Share 2

22.68 23.23 23.06 26.26 28.80

Net Operating Cash Flow per Share3 28.73 23.15 27.46 22.23 30.09

Earnings Per Share3 14.59 14.67 10.89 12.96 13.99

*Gain/loss on disposal of property, plant and equipment has been included in operating profit.

1 Including proposed dividend

2 Based on Tk. 10 equivalent ordinary shares outstanding at 31 December.

3 Based on weighted average number of shares of Tk. 10 each.

50 Five Years Financial Summary

A N N U A L

REPORT

grameenphone

2015

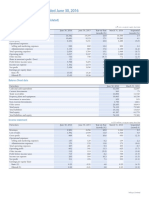

REVENUE (MILLION BDT) OPERATING PROFIT (MILLION BDT) NPAT (MILLION BDT)

+2.0 +0.2% -0.5%

Overview

104,754

102,663

19,803

36,896

19,707

36,964

18,891

17,505

33,199

33,675

32,572

96,624

14,702

91,920

89,060

2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015

Performance

CAPEX (MILLION BDT) TOTAL ASSETS (MILLION BDT) TOTAL EQUITY (MILLION BDT)

Business

+27.1% +1.4% -2.4%

42,508

135,221

132,450

130,673

38,883

29,925

35,458

117,665

31,141

30,625

31,365

108,905

19,269

15,164

12,963

2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015

Sustainability

NET OPERATING CASH FLOW/SHARE (BDT) NAV/SHARE (BDT) EARNINGS PER SHARE (BDT)

+24.1% -2.4% -0.5%

14.67

14.59

30.09

13.99

28.73

12.96

27.46

10.89

28.80

23.15

26.26

22.23

22.68

23.23

23.06

Governance

2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015

RETURN ON ASSETS % RETURN ON EQUITY % SUBSCRIBER ('000)

+0.1pp +0.2pp +10.0%

Financial Analysis

56,679

63.6%

63.4%

17.3%

51,504

15.5%

47,110

15.0%

14.9%

47.1%

44.2%

40,021

36,493

42.3%

11.7%

2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015

MARKET SHARE % ARPU* (BDT) AMPU** (MINUTES)

-0.4pp -6.2% +0.5%

Information

Additional

42.7%

42.8%

42.4%

41.2%

41.4%

258

214

249

243

244

191

236

176

165

155

2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015

* ARPU - Average Revenue Per User; ** AMPU - Average Minutes Per User

Five Years Financial Summary 51

You might also like

- RequiredDocument3 pagesRequiredKplm StevenNo ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Almarai Annual Report enDocument128 pagesAlmarai Annual Report enHassen AbidiNo ratings yet

- Mehak Bluntly MediaDocument18 pagesMehak Bluntly Mediahimanshu sagarNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- Go Rural FM AssignmentDocument31 pagesGo Rural FM AssignmentHumphrey OsaigbeNo ratings yet

- SGR Calculation Taking Base FY 2019Document38 pagesSGR Calculation Taking Base FY 2019Arif.hossen 30No ratings yet

- M.Sc. Microbiology Bio TechnologyDocument6 pagesM.Sc. Microbiology Bio Technologymmumullana0098No ratings yet

- Total Revenue: Income StatementDocument4 pagesTotal Revenue: Income Statementmonica asifNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic Treesara_AlQuwaifliNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- BTVN Chap 03Document14 pagesBTVN Chap 03Nguyen Phuong Anh (K16HL)No ratings yet

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanNo ratings yet

- 1.summary Financial Analysis EILDocument9 pages1.summary Financial Analysis EILrahulNo ratings yet

- Project EngieDocument32 pagesProject EngieVijendra Kumar DubeyNo ratings yet

- Financial Statement ACIFL 31 March 2015 ConsolidatedDocument16 pagesFinancial Statement ACIFL 31 March 2015 ConsolidatedNurhan JaigirdarNo ratings yet

- Fincial Atios of Coca ColaDocument3 pagesFincial Atios of Coca ColaAdovocate 4UNo ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- 9665 Total Nigeria q1 March 2015 Financial Statements May 2015Document44 pages9665 Total Nigeria q1 March 2015 Financial Statements May 2015ADEYEMI AZEEZ KakaNo ratings yet

- P191B044 - S11 BenchmarkingDocument21 pagesP191B044 - S11 BenchmarkingKshitij MaheshwaryNo ratings yet

- A Wholly-Owned Subsidiary of Philippine National Oil CompanyDocument4 pagesA Wholly-Owned Subsidiary of Philippine National Oil CompanyLolita CalaycayNo ratings yet

- DuPont AnalysisDocument5 pagesDuPont AnalysisHoàng TrầnNo ratings yet

- Report For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)Document7 pagesReport For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)ashokdb2kNo ratings yet

- DirectorsreportDocument13 pagesDirectorsreportSuri KunalNo ratings yet

- Etisalat Fact SheetDocument1 pageEtisalat Fact SheetAyaz Ahmed KhanNo ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Chocolat AnalysisDocument19 pagesChocolat Analysisankitamoney1No ratings yet

- A - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Document7 pagesA - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Mohamed Lamine SanohNo ratings yet

- ABSCBNDocument1 pageABSCBNalfe23No ratings yet

- Business - Valuation - Modeling - Assessment FileDocument6 pagesBusiness - Valuation - Modeling - Assessment FileGowtham VananNo ratings yet

- University of Bohol City of Tagbilaran: Case Analysis # 2Document7 pagesUniversity of Bohol City of Tagbilaran: Case Analysis # 2Jonie Ann BangahonNo ratings yet

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- Annual Report 2010: Year Ended August 31, 2010Document92 pagesAnnual Report 2010: Year Ended August 31, 2010natsume_shin0913No ratings yet

- Bajaj AnalysisDocument64 pagesBajaj AnalysisKetki PuranikNo ratings yet

- CHB Jun19 PDFDocument14 pagesCHB Jun19 PDFSajeetha MadhavanNo ratings yet

- Financial Information Disney Corp: Millons of Dollars Except Per ShareDocument12 pagesFinancial Information Disney Corp: Millons of Dollars Except Per ShareFernando Martin VallejosNo ratings yet

- Cap 1 TablasDocument18 pagesCap 1 TablasWILDER ENRIQUEZ POCOMONo ratings yet

- DCF Case Sample 1Document4 pagesDCF Case Sample 1Gaurav SethiNo ratings yet

- Millat Tractors - Final (Sheraz)Document20 pagesMillat Tractors - Final (Sheraz)Adeel SajidNo ratings yet

- Bandhan BankDocument38 pagesBandhan BankJapish MehtaNo ratings yet

- Deleum Q2 2019Document43 pagesDeleum Q2 2019DiLungBanNo ratings yet

- Financial Highlights Dec 2015Document18 pagesFinancial Highlights Dec 2015Mubbasher HassanNo ratings yet

- Annual Report - PadiniDocument23 pagesAnnual Report - PadiniCheng Chung leeNo ratings yet

- Tarea Heritage Doll CompanyDocument6 pagesTarea Heritage Doll CompanyFelipe HidalgoNo ratings yet

- Chapter 3. Exhibits y AnexosDocument24 pagesChapter 3. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Annual Report 2016: Financial SectionDocument39 pagesAnnual Report 2016: Financial SectionAlezNgNo ratings yet

- Unitedhealth Care Income Statement & Balance Sheet & PE RatioDocument8 pagesUnitedhealth Care Income Statement & Balance Sheet & PE RatioEhab elhashmyNo ratings yet

- Analisis ProspektifDocument9 pagesAnalisis ProspektifEvelDerizkyNo ratings yet

- Nasdaq Aaon 2014Document76 pagesNasdaq Aaon 2014gaja babaNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document3 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaNo ratings yet

- Financial Statement of JS Bank: Submitted ToDocument22 pagesFinancial Statement of JS Bank: Submitted ToAtia KhalidNo ratings yet

- 11-Year Financial SummaryDocument25 pages11-Year Financial SummaryutsavmehtaNo ratings yet

- Financial Ratios of Home Depot and Lowe'sDocument30 pagesFinancial Ratios of Home Depot and Lowe'sM UmarNo ratings yet

- Running Header: Case Study Report-Woolworths Group LTDDocument22 pagesRunning Header: Case Study Report-Woolworths Group LTDCalcutta PeppersNo ratings yet

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet

- Accounts AssignsmentDocument8 pagesAccounts Assignsmentadityatiwari8303No ratings yet

- CW 221025015738Document2 pagesCW 221025015738Nundu AntoneyNo ratings yet

- Sales 10 ITO 2 ITO (New) 5 ITO Sales/Inventory Inventory (Old) 5 Inventory (New) 2Document55 pagesSales 10 ITO 2 ITO (New) 5 ITO Sales/Inventory Inventory (Old) 5 Inventory (New) 2Sunaina MandhwaniNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- 1 Question-1Document5 pages1 Question-1Varchas0% (2)

- Handout PP R. Roumen ATAD3Document14 pagesHandout PP R. Roumen ATAD3bacha436No ratings yet

- JP Morgan Chase & Co.: Abhinav Kumar Singh Simsree PGDBM-855Document25 pagesJP Morgan Chase & Co.: Abhinav Kumar Singh Simsree PGDBM-855api-19592137No ratings yet

- Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument46 pagesMeasuring and Evaluating The Performance of Banks and Their Principal CompetitorsyeehawwwwNo ratings yet

- Class 11 Business Studies 1009 2019Document15 pagesClass 11 Business Studies 1009 2019Suraj RajputNo ratings yet

- Notes of 3. Issue of SharesDocument21 pagesNotes of 3. Issue of SharesatuldipsNo ratings yet

- CUTE Tutorial - Zoom Training - 11.03.21Document146 pagesCUTE Tutorial - Zoom Training - 11.03.21Hema KrishnanNo ratings yet

- CH 4 and 5 Sanjay Ind Sol Finacman 6th EdDocument8 pagesCH 4 and 5 Sanjay Ind Sol Finacman 6th EdAnshika100% (2)

- VCE Summer Internship Program 2021: Rishav Raj Gupta 1 Financial Modeling and AnalysisDocument6 pagesVCE Summer Internship Program 2021: Rishav Raj Gupta 1 Financial Modeling and AnalysisRISHAV RAJ GUPTANo ratings yet

- Interest (1 - (1+r) - N/R) + PV of The Principal AmountDocument2 pagesInterest (1 - (1+r) - N/R) + PV of The Principal AmountBellapu Durga vara prasadNo ratings yet

- LTCGDocument1 pageLTCGRahul SatyakamNo ratings yet

- Accounting ReviewDocument76 pagesAccounting Reviewjoyce KimNo ratings yet

- Management Accounting - Assignment - Iv (Unit-Iv)Document13 pagesManagement Accounting - Assignment - Iv (Unit-Iv)Ujwal KhanapurkarNo ratings yet

- IAS 33 Earnings Per Share: (Conceptual Framework and Standards)Document8 pagesIAS 33 Earnings Per Share: (Conceptual Framework and Standards)Joyce ManaloNo ratings yet

- Redemption OF Preference Shares: Learning OutcomesDocument45 pagesRedemption OF Preference Shares: Learning OutcomesHimanshu RaghuwanshiNo ratings yet

- Stock ValuationDocument30 pagesStock ValuationsanchiNo ratings yet

- Declaration and Payment On DividendDocument12 pagesDeclaration and Payment On DividendChiranjeev RoutrayNo ratings yet

- Snapchat Going IpoDocument14 pagesSnapchat Going Ipoplayjake18No ratings yet

- St-Quiz 2.1 - Chap 2Document5 pagesSt-Quiz 2.1 - Chap 2Quynh Chau TranNo ratings yet

- Tài Chính Doanh Nghiệp MTDocument10 pagesTài Chính Doanh Nghiệp MTBao Han HuynhNo ratings yet

- Afm AssignmentDocument6 pagesAfm AssignmentShweta BhardwajNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Full Credit Report - EXAMPLEDocument1 pageFull Credit Report - EXAMPLEChris PearsonNo ratings yet

- Dow's Bid For Rohm and HaasDocument2 pagesDow's Bid For Rohm and HaasPavitraNo ratings yet

- Steel Authority of India Limited SAILDocument21 pagesSteel Authority of India Limited SAILShambhavi SinhaNo ratings yet

- Exercise Set 9Document2 pagesExercise Set 9Elia ScagnolariNo ratings yet

- Lecture 5 - Financial Statement AnalysisDocument36 pagesLecture 5 - Financial Statement AnalysisIsyraf Hatim Mohd TamizamNo ratings yet

- Self Study Quizzes Chapter 1 12Document54 pagesSelf Study Quizzes Chapter 1 12Minh HảiNo ratings yet

- Intermediate Accounting 1st Edition Gordon Test Bank DownloadDocument60 pagesIntermediate Accounting 1st Edition Gordon Test Bank DownloadKenneth Travis100% (22)