Professional Documents

Culture Documents

India's Best Market Minds

Uploaded by

Syed M Shameel0 ratings0% found this document useful (0 votes)

13 views6 pagesShankar Sharma and Devina Mehra

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentShankar Sharma and Devina Mehra

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views6 pagesIndia's Best Market Minds

Uploaded by

Syed M ShameelShankar Sharma and Devina Mehra

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

Pr OUTLOOK ofi i PO 2

EES eo rt

TRAE ae

Pre eect

What |

ead

Tiel ecm els

market minds

Devina Mehra

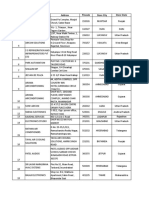

ge 45

Organisation: First Global, co-founder

research head

Number of years in the market : 24

‘The first stock that | ever looked at

Reliance (Case study at IN-A)

‘The only reason | come to work

‘everyday : This is the only jb wh

yo am

I notin the stock markets then |

would have been : A professor/cura:

tor/travel & food writ

‘The book that inspired me the most

gainst the Gods by Peter Bernstein

One must read market classic

Valuation by Tom Copeland

‘Number of times have watched the

movie “Wall Street”: Thrice

What | do to unwind : Reading travel,

playing with my daughter

My kind of food : Seafood

My kind of music: Oid Hindi-prefered

Igrcist - Sahir& Kai, earty Beatles

She’s been with him when they started out; she stood by him when they were

hounded by the authorities, she’s been there every step of the way th

stitutional brokerage. She is Devina Mehra, he is Shankar

fensely focused, yet down to earth, she spearheads and oversees all the research that st

their institutional brokerage. But for her, the achie!

1 they have built a world class in-

harma. Together they are First Global. In

sams out from

re till a work in progress as they

meticulously work on deepening their global footp t home for their more than

2,000 books, there surely must be dedicated shelf space for all the gold medals she bagged during her

‘exceptional” academic career. Until she joined ITMA,

had she studied economics or knew what a debenture was, But now she doesn’t bat an eyelid

questioning mainstream mark it, bu

Devina had not looked at a balance sheet nor

ind hold for her is something that used to

work in the past and is irrelevant in today’s rapidly discounting markets. She also finds it amusi

that business schools still can’t get out of teaching CAPM and Beta despite it being hardly useful f

any kind of predictive work. In fact, right now, as you are reading this, her hyperactive cortex might

just be questioning if stocks have indeed outperformed bonds over the years,

1 1986 I joined Citibank and

‘worked there for seven years, but

felt like moving out after three

years as I had learnt what there was

to learn. Then within the bank Ire-

ally liked the job of a credit analyst

and Thad to fight my way to get into

it. What was driving me then was the

quest to learn and, now, that is what I

tell recruits who come in. That unless

‘you have that fire in you, to the degree

‘that you are willing to doit for free,

‘you will just not be able to different

‘ate yourself from the rest out there.

Research is a lat of work; you have to

keep thinking about how you can pre-

dict things better. There is opportuni-

ty everywhere as both the quality and

integrity of the analysis are not what it,

should be in terms of how much work

gets put in and whether you are actu-

ally told what you should be.

‘Becoming a credit analyst in hind-

sight was pretty good training for be-

‘coming an equity analyst. That was

where I learnt the most: what cash

flows was all about; what could go

‘wrong; that equity analysts tend to

focus on the upside and credit ana-

lysts, usually, don’t participate in the

upside and have to be careful on the

downside. Itneeds a whole different

mindset and the whole diseipline of |

meeting companies in your portfolio

or plant visits, which was something.

that I enjoyed the most and other ana-

lysts hated. SoI ended up doing plant

visits for other analysts as well.

‘The other obsession was, if Twas

working ona particular industry or

sector, people should not be able to

ask me a question I can't answer. It

‘was also good training in terms of

getting information out of people, at

times company tended to be closed

even to their bankers, The trick was

tobe very well prepared; the whole

thing had to be absolutely clear in

‘your mind, so that you could have that

interaction on a very conversation-

allevel.

In the 1993 budget they allowed FIIs

inand that is when I took that leap of,

faith, We had a feeling that the mar-

‘kets would get professionalised and

there wil be an opportunity for peo-

ple who understand things better to

service professional investors. From

thereon much of the learning was on

my own. Even the MBA course just,

had a general grounding in finance

and economies. It had not taught me

‘what was precisely required in the

Ty learnin 1g

In many cyclical

industries when

the upturn comes,

the big bang comes

in relatively

poorer quality

stocks

markets. Cash flow analysis was not

something that was greatly empha-

sised nor were valuations, so'Tom

Copeland’s book was highly useful.

Fortunately, by that time because I

was a credit analyst I understood a lot

of big companies like HPCL to Gu-

jarat Ambuja, to Tata Steel and that

gave mea headstart, In the beginning

as we did not have a large team of an-

alysts, Idid a lot of traveling meet-

ing companies all around the country.

At that time companies did not know

‘what an equity research analyst was,

and they would say why should I

meet you? I did a lot of intense com-

pany meetings and number crunch-

ing and I used be quite disciplined in

that because I did not like taking a lot

of notes during meetings because I

felt that way you do not get much in-

formation and so everyday no mat-

ter how late it was I used to make my

‘complete notes so that I don't lose in-

formation, Soit is interesting from a

point of view of what someone tells.

you at a point in time and what hap-

pens three months later. And unlike in

a bank credit report where what you

write never gets shown to the client,

with a stock research note, because it

gets public, companies used to get a

little upset with a negative report.

‘The main thing is that there is a sto-

ry that the numbers tell you, so itis al-

‘ways useful to look at the long term.

history of a company’s numbers,

Like last time you had a recession,

‘Tata Motors had this pattern through

several ups and downs, they would

build up inventory into the recession

and suppliers would not get paid, so

that comes through very clearly in the

numbers and again you have to ques-

tion management, That's another im-

portant thing I tell my analysts - you

think that management has been do-

ing this for 20 years or 50 years and

they will know better but that is not

the case Ifyou come with a broader

perspective you probably know what

ishappening in other industries as

‘well. You can have insights which the

management might be missing out

because they are too close to the ac-

tion. Very often they might just proj-

ect the immediate past and that we

find repeatedly on both sides. Of

course there is a tendency to be opti-

mistic but we found this on the other

side also,

In the late 1990s commercial vehi-

cle (CV) recession, we had adone a

regression model projecting CV de-

mand and this was after two years of

recession, and we had said that this

year we will see 25 per cent volume

growth, and we got calls both from

‘Tata Motors and Ashok Leyland that

this is too optimistic and you should

not work with more than 10 per cent.

Butwe stuck to it and the number

‘was almost half'a per cent point of

that. So both ways, you tend to get

stuck in the past, so if things are go-

ing badly you think they will contin-

ue to do badly and vice versa.

Understanding the business as

well as understanding the numbers

are very critical as a base. We have

found that the deeper you go in any-

thing, whether itis financial or mac-

ro-economic projections, the more

you break it up the better your esti-

‘mates are,

Again, we can all make models but it

depends on what you put in that mod-

el. You have to keep an eye out on the

alternative scenario that can play out.

For example if Hero Honda is taking

away market share, you have to ask,

will itindeed continue to be that way?

Back a few years ago it was vice versa

when Bajaj Auto was going ahead and

people were writing off Hero Honda,

Again you have toask; is that how itis

going to be? Then you also need to un-

derstand the impact that topline and

bottomline growth will have on the

balance sheet and cash flow. In many

cyclical industries when the upturn

‘comes, the big bang comes in the rel-

atively poorer quality stocks, for they

are the ones with the higher leverag-

ing.

So then your auto-deduction says

- fine, this company has a negative

net profit margin (NPM) or I per cent

NPM but ifthe EBIDTA goes from

March 2010. Outlook PROFIT

(eee) ad

just 8 per cent to 10 per cent, the 1 per

cent becomes 3 per cent. The tripling

effec, if it continues over the next two

quarters, the cash flow goes up and

the debt gets repaid, then that reflex-

ivity comes into being, as the stock

does well in the market and the com-

pany is able to raise money. So those

are the things that you have to think

through,

‘We have never felt that markets

‘were that efficient, for ifthat were

the case, none of us would have a job

but besides that how can you justify a

stock doubling or tripling within two

‘months or halving when in the funda-

mentals nothing could have changed

so drastically forat least 95 per cent

of the cases. But you will go wrong

and at times if you are in the market

‘you could be running up losses for

‘yourself'as well. So you thought that

something was overvalued and yet it

continues to run as we found out dur-

ing the Internet boom.

‘We tumed bearish on Infosys in 1998

end and from there-on it went up 10

times. Atthat time, it was 100 times

earnings which we thought was too

‘much. At 100 times earnings any qual-

ity of company is expensive and Y2K

was the main reason why the stocks

vere running and we thought be-

yond this there has to be a lll in the

‘business. 2001 cannot be the same

as 2000, but the market in 1999 was

very strong and we were probably too

ahead. Amazon is an example that I

‘remember. For 2000 end last quarter,

beginning of 2001 when the results

came out, for the first time it hada

positive cash flow and we made a buy

recommendation on Amazon. That

too did not work out. The big learning

experience was that you don't have

20-20 foresight, so a times you could

be way-of on how the company will

eventually execute. Even if you are

righton that, you could be offon the

timing

We started out more orless as a pure-

ly fundamental house, but we found

just because something was not fun-

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MK Gupta TaxDocument395 pagesMK Gupta TaxGaurav Gang100% (2)

- A Colossal Eleven-Faced Kuan-Yin of The T'Ang DynastyDocument5 pagesA Colossal Eleven-Faced Kuan-Yin of The T'Ang DynastyVinod S RawatNo ratings yet

- Spiritual Teachings of Swami BrahmanandaDocument248 pagesSpiritual Teachings of Swami BrahmanandaEstudante da Vedanta100% (7)

- The Eighth ChakraDocument3 pagesThe Eighth Chakraanon_41464569No ratings yet

- Vizag Navaratnalu Housing Data PDFDocument5,815 pagesVizag Navaratnalu Housing Data PDFvasu112100% (1)

- Store Daikin June PDFDocument677 pagesStore Daikin June PDFraghavaNo ratings yet

- Sri Charitropakhyan An Analysis of The Writings of Sri Guru Gobind Singh JiDocument45 pagesSri Charitropakhyan An Analysis of The Writings of Sri Guru Gobind Singh Jidasamgranth.com100% (1)

- Adyashanti's TeachingsDocument16 pagesAdyashanti's Teachingsapi-26215296100% (1)

- Nama Cowok 4-5 HurufDocument83 pagesNama Cowok 4-5 HurufSinga PoreNo ratings yet

- Police Verification Letter-Deviprasana 1Document5 pagesPolice Verification Letter-Deviprasana 1bmengg faculty2No ratings yet

- North 24 Pgs (Buffer) PDFDocument6 pagesNorth 24 Pgs (Buffer) PDFGarima RaijadaNo ratings yet

- Name: - Bhagyashree Parab Subject:-Literature Fy BMM 2 SemesterDocument16 pagesName: - Bhagyashree Parab Subject:-Literature Fy BMM 2 Semester'Laveena ShindeNo ratings yet

- Is 12776 2002 PDFDocument12 pagesIs 12776 2002 PDFVenkataLakshmiKorrapatiNo ratings yet

- S.No. Date Month Week RM Name Channel Partner Name (Company Name)Document6 pagesS.No. Date Month Week RM Name Channel Partner Name (Company Name)Chirag ChadhaNo ratings yet

- Kanthapura FinalDocument3 pagesKanthapura Finalsonjoy0% (1)

- Andhra Bharatam Short Study PDFDocument26 pagesAndhra Bharatam Short Study PDFsrivatsaNo ratings yet

- AnuDocument2 pagesAnuAnupriyaNo ratings yet

- Sanskrit CC 2.1Document122 pagesSanskrit CC 2.1Sumanta BanerjeeNo ratings yet

- List of Attendance StyleDocument2 pagesList of Attendance StyleManeendra StarkNo ratings yet

- The Vastu-Purusha-Mandala in Temple ArchDocument6 pagesThe Vastu-Purusha-Mandala in Temple ArchMudita PiseNo ratings yet

- Contact Number Hisar Police PDFDocument2 pagesContact Number Hisar Police PDFPawan100% (1)

- Sabarkantha Ferti PDFDocument37 pagesSabarkantha Ferti PDFHarsh PatelNo ratings yet

- 20 8Document3 pages20 8bogiriNo ratings yet

- Kashmeregateisbt 140914100001 Phpapp01Document8 pagesKashmeregateisbt 140914100001 Phpapp01Iqra QaziNo ratings yet

- Pranayama - Breathing Exercises: Register LoginDocument9 pagesPranayama - Breathing Exercises: Register Loginmaddy mNo ratings yet

- Chapter 5 HinduismDocument48 pagesChapter 5 HinduismEdwardJohnG.CalubIINo ratings yet

- 2015.98225.annals of The Bhandarkar Oriental Research Institutevol32part1!4!1951 TextDocument404 pages2015.98225.annals of The Bhandarkar Oriental Research Institutevol32part1!4!1951 TextPRATIK GANGULY100% (1)

- India S Anthem Jana Gana ManaDocument2 pagesIndia S Anthem Jana Gana Manabdalcin5512No ratings yet

- M3M SCO 113 MarketDocument33 pagesM3M SCO 113 MarketLuxe HabitatNo ratings yet

- The Constitution One Hundred and Thirteenth Amendment Bill 2010Document4 pagesThe Constitution One Hundred and Thirteenth Amendment Bill 2010ayomipNo ratings yet