Professional Documents

Culture Documents

8.essentials of Econometrics Chapter1-8 PDF

Uploaded by

Druthi Kola100%(1)100% found this document useful (1 vote)

477 views248 pagesOriginal Title

8.Essentials of econometrics chapter1-8.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(1)100% found this document useful (1 vote)

477 views248 pages8.essentials of Econometrics Chapter1-8 PDF

Uploaded by

Druthi KolaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 248

ESSENTIALS OF

ECONOMETRICS.

THIRD EDITION

Damodar N. Gujarati

United States Military Academy, West Point

EM McGraw ye 3 3k

ia Tirwin +

Boston Burr Ridge, IL Dubuque, 1A Madison, Wi New York

‘San Francisco St.Louis Bangkok Bogoté Caracas Kuala Lumpur

Lisbon London Madrid MexicoCity Milan Montreal New Delhi

Santiago Seoul Singapore Sydney Taipei Toronto

CHAPTER

THE NATURE

AND SCOPE

OF ECONOMETRICS

Research in economics, finance, management, marketing, and related disci-

plines is becoming increasingly quantitative. Beginning students in these fields

are encouraged, if not required, to take a course or two in econometrics—a field

of study that has become quite popular. This chapter gives the beginner an

overview of what econometrics is all about.

1.1 WHAT IS ECONOMETRICS?

Simply stated, econometrics means economic measurement. Although quan-

titative measurement of economic concepts such as the gross domestic prod-

uct (GDP), unemployment, inflation, imports, and exports is very important,

the scope of econometrics is much broader, as can be seen from the following

definitions:

Econometrics may be defined as the social science in which the tools of economic the-

‘ory, mathematics, and statistical inference ase applied to the analysis of economic

phenomena.?

Econometrics, the result of a certain outlook on the role of economics, consists of the

application of mathematical statistics to economic data to lend empirical support to

the models constructed by mathematical economics and to obtain auumerical results

Yarthur 8. Goldberger, Econometric Theory, Wiley, New York, 1964,

°P. A. Samuelson, TC. Koopmans, and J, R.N. Stone, “Report of the Evaluetive Committee for

Etonometrica," Econometrica, vol. 22, 0.2, Apri 1954, pp. 141-146,

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS.

2 WHY STUDY ECONOMETRICS?

maa

2

[As the preceding definitions suggest, econometrics makes use of economic the-

ory, ‘mathematical economics, economic statistics (i., economic data), and

mathesnatical statistics. Yet, it is a subject that deserves to be studied in its own

rright for the following reasons.

Economic theory makes statements or hypotheses that are mostly qualitative

in nature. For example, microeconomic theory states thi, other things remain-

ing the same (the famous ceteris paribus clause of economics), an increase in the

price of a commodity is expected to decrease the quantity demanded of that

commodity. Thus, economic theory postulates a negative or inverse relation-

ship between the price and quantity demanded of a commodity—this is the

widely known law of downward-stoping demand or simply the law of demand.

But the theory itself does not provide any numerical measure of the strength of

the relationship between the two; that is, it does not tell by how much the quan-

tity demanded will go up or down as a result of a certain change in the price of

the commodity. It is the econometrician’s job to provide such numerical esti-

mates. Econometrics gives empirical (ie., based on observation or experiment)

content to most economic theory. If we find in a study or experiment that when

the price of a unit increases by a dollar and the quantity demanded goes down

by, say, 100 units, we have not only confirmed the law of demand, but in the

process we have also provided a numerical estimate of the relationship between

“tio two variables—price and quantity.

"he main concern of mathematical economics is to express economic theory

in mathematical form or equations (or models) without regard to measurability

ov evapitical verification of the theory. Econometrics, as noted earlier is primar-

ily interested in the empirical verification of economic theory. As we will show

shortly, the econometrician often uses mathematical models proposed by the

mathematical economist but puts these models in forms that lend uiemselves to

empirical testing.

Economic statistics is mainly concerned with collecting, processing, and pre-

senting economic data in the form of charts, diagrams, and tables. This is the

economic statistician’s job. He or she collects data on the GDP, employment, un-

employment, prices, etc. This data constitutes the raw data for econometric

work. But the economic statistician does not go any further because he or she is.

not primarily concerned with using the collected data to test economic theories.

Although mathematical statistics provides many of the'tools employed in the

trade, the econometrician often needs special methods because of the unique

nature of most economic data, namely, that the data are not usuelly generated

as the result of a controlled experiment. The econometrician, like the meteorol-

ogist, generally depends on data that cannot be controlled directly. Thus, data

on consumption, income, investments, savings, prices, etc,, which are colllected

by public and private agencies, are nonexperimentai in nature. The econometri-

cian takes these data as given. This creates special problems not normally dealt

with in mathematical statistics. Moreover, such data are likely to contain errors

of measurement, of either omission or commission, and the econometrician

CHAPTER ONE: ‘THE NATURE AND-SCOPE OF ECONOMETRICS 3

may be called upon to develop spetial methods of analysis to.deal with such

errors of measurement,

For students majoring in economics and business there is a pragmatic reason

for studying econometrics. After graduation, in their employment, they may be

called upon to forecast sales, interest rates, and money supply or to estimate de-

mand and supply.functions or price elasticities for products. Quite often, econo-

mists appear as expert witnesses before federal and state regulatory agencies on

behalf of their clients or the public at lange. Thus, an economist appearing before

asstate regulatory commission that controls prices of gas and electricity may bere-

quired to assess the impact of a proposed price increase on the quantity de-

marided of electricity before the comunission will approve the price increase, In

situations like this the economist may need to develop a demand function for

electricity for this purpose. Such a demand function may enable the economist to

estimate the price elasticity of demand; thats, the percentage change in the quan-

tity demanded for a percentage change in the price. Knowledge of econometrics

is very helpful in estimating such demand functions,

It is fair to say that econometrics has become an integral part of training in

economics arid business.

1.3. THE METHODOLOGY OF ECONOMETRICS

How does one actually do-an econometric study? Broadly speaking, economet-

sic analysis proceeds along the following fines.

1. Creating a statement of theory or hypothesis,

2, Collecting data.

3. Specifying the mathematical model of theory

4, Specifying the statistical, or econometric, model of theory.

5, Estimating the parameters ofthe chosen econometric model.

6. Checking for model adequacy: Model specification testing.

7. Testing the hypothesis derived from the model.

8, Using the model for prediction or forecasting,

Tp illustrate the methodology, consider this question: Do economic condi-

tions affect people's decisions to enter the labor force, that is, their willingness

to work? As a measure of economic conditions, suppose We use the unemploy-

intent rate (UNR), and asa measure of labor force participation we use the labor

force patticipation rate (LPR). Data on UNR and LEPR are tegularly published

by the government. So to answer the question we proceed as follows.

Creating a Statement of Theory or Hypothesis

‘The starting point isto find out what economic theory has to say on the subject

you want to study In labor economics, there are two rival hypotheses about the

effect of economic conditions on people's willingness to work, The discouraged

worker hypothesis (effect) states that when economic conditions worsen, as

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS

oliecting Data

reflected in a higher unemployment rate, many unemployed workers give up

hope of finding a job ard drop out of the labor force. On the other hand, the

added-worker hypothesis (effect) maintains that when economic conditions

worsen, inany secondary workers who are not currently in the labor market

(eg, mothers with children) may decide to join the labor force if the main

breadwinner in the family loses his or her job. Even if the jobs these secondary

workers get are low paying, the earnings will make up some of the loss in in-

come suffered by the primary breadwinner.

Whether, on balance, the labor force participation rate will increase or decrease

will depend on the relative strengths of the added-worker and discouraged-

worker effects, If the added-worker effect dominates, LFPR will increase even

when thé unemployment rate shigh. Contratily ifthe discouraged-worker effect

dominates, LFPR will decrease. How do we find this out? This now becomes our

empirical question,

For empirical purposes, therefore, we need quantitative information on the {wo

variables. There are three types of data that are generally available for empirical

analysis,

4. Time series,

2. Cross-sectional.

3. Pooled (a combinatic:: of time series and cross-sectional).

‘Times series data are colle-ted over a period of time, such as the data on

GDP, employment, unemployment, money supply, or government deficits.

Such data may be collected at regular intervals—daily (e.g,, stock prices),

weekly (e.g, money supply); monthly (e.g,, the unemployment rate), quarterly

(eg, GDP), or annually (e.g,, government budget). These data may be quanti-

tative in nature (e.g, prices, income, money supply) or qualitative (e.g., male or

female, employed ot unemployed, married or unmarried, white or black). As

wwe will show, qualitative variabies, also called dummy or categorical variables,

can be every bit as important as quantitative variables,

Cross-sectional data are data on one or more variables collected at one point

in time, such as the census of population conducted by the U.S. Census Bureau

every 10 years (the most recent was.on April 1, 2000); the surveys of consumer

expenditures conducted by the University of Michigan; and the opinion polls

suich.as those conducted by Gallup, Haris, and other polling organizations.

In pooled data we have elements of both time series and cross-sectional data.

For example, if we were to collect data on the unemployment rate for 10 coun-

tries for a period of 20 years, the data will constitute an example of pooled data—

data on the unemployment rate for each country for the 20-year period will form.

“time series data, whereas data on the unemployment rate for the 10 countries for

any single year will be cross-sectional data, In pooled data we will have 200

observations—20 annual observations for each of the 10 countries.

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOWETRICS 5

‘There is a special type of pooled data, panel data, also called longitudinal or

micropanel data, in which the same cross-sectional unit, say, a family or firm, is

surveyed over time, For example, the US. Department of Commerce conducts

a census of housing at periodic intervals. At each periodic survey the same

household (or the people living at the seme address) is interviewed to find out

if there has been any change in the housing and financial conditions of that

household since the last survey. The panel data that results from repeatedly in-

terviewing the same household at periodic intervals provide very useful infor-

mation on the dynamics of household behavior.

Sources of Data A word is in order regarding data sources, The success of

“any econometric study hinges on the’ quality, as well as the quantity, of data.

Fortunately, the Internet has opened up a veritable wealth of data. In Appendix A1

we give addresses of several Web sites that have all kinds of microeconomicand

macroeconomic data. Students should be familiar with such sources of data, as

well as how to access or download them. Of course, these data aré continually

updated so the reader may find the latest available data.

For our analysis, we obtained the time series data shown in Table 1-1. This

table gives data on the civilian labor force participation rate (CLEPR) and the

civilian unemployment rate (CUNR), defined as the number of civilians unem-

ployed as a percentage of the civilian labor force, for the United States for the

period 1980-20025

Unlike physical sciences, most data collected in economics (e.g., GDP, money

supply, DowJones index, car sales) are nonexperimental in that the data-

collecting agency (e.g,, government) may not have any direct control over the

data, Thus, the data on labor force participation and unentployment are based on

the information provided to the government by participants in the labor market.

Ina sense, the government is a passive collector of these data and may not be

aware of the added- or discouraged-worker hypotheses, or any other hypothesis,

for that matter. Therefore, the collected data may be the result of several factors

affecting the labor force participation decision made by the individual person.

Thatis, the same data may be compatible with more than one theory.

Specttying the Mathematical Model of Labor Force Participation

‘To see how CLEPR behaves in relation to CUNR, the first thing we should do is

plot the data for these variables in a scatter diagram, or scattergram, as shown.

in Figure 1-1.

‘The scattergram shows that CLEPR and CUNR are inversely related, perhaps

suggesting that, on balance, the discouraged-worker effect is stronger than the

added-worker effect! As a first approximation, we can draw. a straight line

2We consider here only the aggregate CLFPR and CUNR, but data ane available by age, sex and

ethnic composition.

Qn this, see Shelly Lundberg, “The Added Worker Effect,” Journal of Labor Economics, vol. 3,

January 1985, pp. 1-37

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS

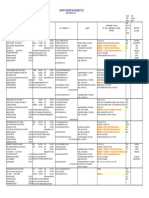

TABLE 1-1 U.S. CIVILIAN LABOR FORCE PARTICIPATION RATE

(CLFPR), CIVILIAN UNEMPLOYMENT RATE (CUNR),

‘AND REAL AVERAGE HOURLY EARNINGS (AHEB2)*

FOR THE YEARS 1980-2002. .

Year CLFPR (%) CUNR(%) —-AHEB2 ($)

1980 638 7A 778

198 63.9 76 7.69

1982 64.0 a7 7.68

1983 64.0 96 779

1984 e44 75 7.80

1985 648. 72 77

1986 65.3 70 781

1987 658 62 773

1988, 659 55 7.69

1989 665 53 764

1990 665 56 752

1991 662 68 745

1992 664 75 7a

1998 663 69 7.39

1994 666 64 7.40

1995 668 56 7.49

1996 66.8 54 7.43,

1997 era 49 7.58

1998 era 45 795

1999 674 42 7.88

+2000 672 49 7.29

2001 669 48 7.99

2002 668 58 cary

“AHEB2 represents averdge houty eamings in 1982 dolars.

‘Source: Economie Repor ofthe Proident, 2002, CLEPR tom

Table 6-40, CUNA fom Table B49, and AHES? fom Table B47,

Data for 2002 are from more recent govemment publications.

Filed Line Plot

os

670

665

Roo

ge:

dao

os

640

65

Cr rT)

6 7

CUNR (%)

FIGURE 1-1 Regression plot for chill labor force participation

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS 7

through the scatter points and write.the relationship between CLFPR and

CUNR by the following simple mathematical model:

CLFPR = B, + B,CUNR (1.1)

Equation (1.1) states that CLFPR is linearly related to CUNR. By and By are

known as the parametets of the linear function B is also known as the inter-

cept it gives the value of CLEPR when CUINR is zero And B; is known as the

slope. The slope measures the rate of change in CLFPR fora unit change in CUNR, or

‘more generally the rate of change in the value of the variable on the left-hand

side of the equation for a unit change in the value of the variable on the right-

hand side, The slope coefficient By can be positive (if the added-worker effect

dominates the discouraged-worker effect) or negative (if the discouraged

worker effect dominates the added-worker effect), Figure 1-1 suggests that in

the present case it is negative.

Specifying the Statistical, or Econometric,

Model of Labor Force Participation

The purely mathematical model of the relationship between CLFPR and CUNR

given in Eq, (1.1), although of prime interest to the mathematical economist, is

of limited appeal to the econometrician, for such a model assumes an exact, or

deterministic, relationship between the two variables; that is, fox a given CUNR,

there is a unique value of CLFPR. In reality, one tarely finds such neat relation-

ships between economic variables. Most often, the relationships are inexact, or

statistical, in nature.

‘This is seen clearly from the scattergram given in Figure 1-1. Although the two

variables are inversely related, the relationship between them is not perfectly or

exactly linear, for if we draw a straight line through the 23 data points, not all the

data points will lie exactly on that straight line. Recall that to draw astraight line

‘weneed only two points.’ Why don’t the 23 data points lie exactly on the straight

line specified by the mathematical model, Eq, (1.1)? Remember that our data on

labor force and unemployment are nonexperimentally collected. Therefore, as

noted earlier, besides the added- and discouraged-worker hypotheses, there

may be other forces affecting labor force participation decisions, As a result, the

observed relationship betweeri CLFPR and CUNR is likely to be imprecise.

Let us allow for the influence of all other variables affecting CLFPR in a

catchall variable u and write Eq, (1.1) as follows:

CLEPR = By + ByCUNR+u (1.2)

SBroadly speeking, a paremeter is an unknown quantity that may vary over a certain set of val-

ues. In statistics a probability distribution function (PDE) of a random variable is often character-

ied by its parameters, such as its mean and variance. This topic is discussed in greater detail in

ters and 3,

in. Chapter 6 we give a more precise interpretation of the intercept in the context of regression

a

"he even ted to ft parabola othe ster points given in Fig 1, but the ress were not

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS

where u represents the random error term, or simply the error term. We let #

represent all those forces (besides CLINR) that affect CLEPR but are not explic-

itly introduced in the model, as well as purely random forces. As we will see in

Paxt Ul, the ertor term distinguishes econometrics from purely mathematical

economics.

Equation (1.2) is an example of a statistical, or empirical or econometric, mode

More precisely, itis an example of what is known asa linear regression model,

| which isa prime subject of thisbook. In such a model, the variable appearing on

the left-hand side of the equation is called the dependent variable, and the vari-

able on the right-hand side is called the indépendent, or explanatory, variable.

In linear regression analysis oisr primary objective is to explain the behavior of

one variable (the dependent variable) in relation to the behavior of one or more

other variables (the explanatory variables), allowing for the fact that the rela-

tionship between them is inexact.

Notice that the econometric model, Eq. (1.2), is derived from the mathemati-

cal model, Eq. (1.1), which shows that mathemtatical economics and economet-

rics are mutually complementary disciplines. This is clearly reflected in the de-

finition of econometrics given at the outset.

Before proceeding further, a warning regarding causation is in order. In the

regression model, Eq, (1.2), we have stated that CLFPR is the dependent vari-

able and CUNRis theindependent, or explanatory, variable, Does that mean that

the two variables are causally related; that is, is CUINR the cause and CLEPR the

effect? In other words, does regression imply causatioa? Not xecessarily. As

Kendall and Stuart note, “A statistical relationship, however strong and however

suggestive, can never establish causal connection: out ideas of c:::sation must

come from outside statistics, ultimately from some theory or other.”8 In our ex-

ample, itis up to economic theory (e.g,, the discouraged-worker hypothesis) to

establish the cause-and-effect relationship, if any, between the dependent and

explanatory variables. If causality cannot be established, itis better to call the re-

lationship, Eq. (1.2), predictive relationship: Given CUINR, can we predict CLFPR?

stimating the Parameters of the Chosen Econometric Model

Given the data on CLEPR and CUNR, such as that in Table 1-1, how do we esti-

mate the parameters of the model, Eq, (1.2), namely, By and By? That is, how do

we find the numerical values (ie,, estimates) of these parameters? This will be

the focus of our attention in Part I, where we develop the appropriate methods

of computation, especially the method of ordinary least spares (OLS). Using OLS

and the data given in Table 1.1, we obtairied the following results:

CLEDR = 69,9963 ~ 0.6513CUNR 3)

‘In statistical lingo, the random error term is known as the stochastic error term.

°M. G. Kendall and A, Stuart, The Advanced Theory of Sttistcs, Charles Grifin Publishers, New

York, 1961, vol.2, Chap. 26,p. 279

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS 9

Note that we have put the symbol «on CLFPR (read as “CLFPR hat”) to remind

us that Eq. (1.3) is an estimate of Bq, (1.2). The estimated regression line is shown

in Figure 1-1, along with the actual data points,

‘ASEq, (1.3) shows, the estimated value of By is ~ 70 and that of By is * - 0.65,

where the symbol © means approximately. Thus, if the unemployment rate

goes up by one unit (ie., one percentage point, ceteris paribus, CLEPR is ex-

pected to decrease on the average by about 0.65 percentage points; that is, as eco-

nomic conditions worsen, on average, there is a net decrease in the labor force

participation rate of about 0.65 percentage points, perhaps suggesting that the

discouraged-warker effect dominates. We say “on the average” because the

presence of the error term w, as noted eatlier, is likely to make the relationship

somewhat imprecise. This is vividly seen in Figure 1-1 where the points not on

the estimated regression line are the actual participation rates and the (vertical)

distance between them and the points on the regression line are the estimated

1's. As we will see in Chapter 6, the estimated n’s are called residuals. In short,

the estimated regression line, Eq: (1.3), gives the relationship between average

CLEPR and CUNK; thatis, on average how CLFPR responds to a unit change in

CUNR. The value of about 69.9963 suggests that the average value of CLFPR

will be about 69.99 percent ifthe CUNR were zer0; that is, about 69,99 percent

of the civilian working-age population would participate in the labor force if

there were full employment (i.e,, zeto unemployment).

Checking for Model Adequacy: Model Specification Testing

How adequate is out model, Eq, (1.3)? Itis true thata person will take into account

labor market conditions as measured by, say, the unemployment rate before

entering the labor market, For example, in 1982 (a recession year) the civilian un-

employment rate was about 9.7 percent. Compared to that, in 2001 it was only

4.8 percent. A persons more likely to be discouraged from entering the labor mat

ket when the unemployment rate is9 percent than when itis 5 percent. But there

are other factors that also enter into labor force participation decisions. For exam-

ple, hourly wages, or earnings, prevailing in the labor market also will be an im-

portant decision variable. In the short-run at least, a higher wage may attractmore

workers to the labor market, other things remaining the same (ceteris paribus). to

see its importance, in Table 1-1 we have also given data on real average hourly

‘earnings (AHE82), where real earnings are measured in 1982 dollars. To take into

o account the influence of AHE82, we now consider the following model:

CLFPR = B; + B)CUNR + BsAHE82 + u (1.4)

Equation (1.4) is an example of a multiple linear regression model, in contrast to

Eq. (1.2), which is an example of asinipe (txvo-variable or bivariate) linear regression

This is, however, a mechanical interpretation of the intercept. We will see in Chapter 6 how to

interpret the intercept term meaningfully ina given context.

0° CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS

‘model: In the two-variable model there is a single explanatory variable, whereas

in a multiple regression there are several, or multiple, explanatory variables.

Notice that in the multiple regression, Eq. (1.4), we also have included the error

term, u, for no matter how many explanatory variables one introduces in the

model, one cannot fully explain the behavior of the dependent variable, How

many variables one introduces in the multiple regression is a decision that the

researcher will have to make in a given situation. Of course, the underlying

economic theory will often tell what these variables might be. However, keep in

mind the warning given earlier that regression does not mean causation, the

relevant theory must determine whether one or more explanatory variables are

causally related to the dependent variable.

How do we estimate the parameters of the multiple regression, Eq, (1.4)? We

‘over this topic in Chapter 8, after we discuss the two-variable model in

Chapters 6 and 7. We consider the two-variable case first because it is the build-

ing block of the multiple regression model. As we shall see in Chapter 8, the

multiple regression model is in many ways a stcaightforward extension of the

two-variable model.

For our illustrative example, the empirical counterpart of Eq, (1.4) is as fol

lows (these resulls are based on OLS):

CLEPR 80.9013 — 0.6713CUNR — 1.4042AHE82, (15)

‘These results are interesting because both the slope coefficients are negative

‘The negative coefficient of CLINR suggests that, ceteris paribils (ie, holding the

influence of AHES82 constant), a one-percentage-point increase in the unem-

ployment rate leads, on average, to about a 0.67-percentage-point decrease in

CLFPR, pethaps once again supporting the discouraged-worker hypothesis. On

the other hand, holding the influence of CLINR constant, an increase in real av-

erage hourly earnings of one dollar, on average, leads to about a 1.40 petcentage-

point decline in CLEPR." Does the negative coefficient for AHE82 make eco-

nomic sense? Would one not expecta positive coefficient—the higher the hourly

earnings, the higher the attraction of the labor market? However, one could jus-

tify the negative coefficient by recalling the twin concepts of microeconomics,

namely, the income effect and the substitution effect."

Which model do we choose, Bq. (1.3) or Eq, (1.5)? Since Eq, (1.5) encompasses

Eq. (1.3) and since it adds an additional dimension (easnings) to the analysis, we

aay choose Eq, (1.5). After all, Eq. (1.2) was based implicitly on the assumption

that variables other than the unemployment rate were held constant. But where

“TAs we will discuss in Chapter 8, the coefficients of CUNR and AHES2 given in Eq. (1.5) are

known as partial regression cogficents. in that chapter we will discuss the precise meaning of parti

regression coelficents.

Consult any standard textbook on microeconomics, One intuitive justification of this result is

2s follows. Suppose both spouses are in the labor force and the earings of one spouse rises sub-

stantially. This may prompt the other spouse to withdraw from the labor force without substantially

alfecting the family income.

CHAPTER ONE: THE NATURE AND SOOPE OF ECONOMETRICS 11.

do.we stop? For example, labor force patticipation may also depend on family

wealth, number of children under age 6 (this is especially critical for married

‘women thinking of oiting the labor market), availability of day-care centers for

young children, religious beliefs, availability of welfare benefits, unemploy-

ment insurance, and so on. Even if data on these variables are available, we may

not want to introduce them all in the model because the purpose of developing

an econometric model is not to capture total reality, but just its salient features,

If we decide to include every conceivable variable in the regression model, the

model will be so unwieldy that it will be of little practical use. The model ulti-

mately chosen should be a reasonably good replica of the underlying reality. In

Chapter 11 we will discuss this question further and find out how one can go

about developing a model.

Testing the Hypothesis Derived from the Model

Having finally settled on a model, we may want to perform hypothesis testing.

‘That is, we may want to find out whether the estimated model makes economic

sense and whether the results obtained conform with the underlying economic

theory. For example, the discouraged-worker hypothesis postulates a negative

relationship between labor force participation and the unemployment rate. Is this

hypothesis borne out by our results? Our statistical results seem to be in confor-

mity with this hypothesis because the estimated coefficient of CUNR is negative.

However, hypothesis testing can be complicated. In our illustrative example,

suppose someone told us that in a prior study the coefficient of CUNR was

found to be about -1. Are our results in agreement? If we'rely on the model,

Bq. (1.3}, we might get one answer; but if we rely on Eq, (1.5), wemightget another

answer. How do we resolve this question? Although we will develop the neoes-

sary tools to answer such questions, we should keep in mind that the answer toa

particulas hypothesis may depend on the model we finally choose.

‘The point worth remembering is that in repression analysis we may be inter-

‘ested not only in estimating the parameters of the regression model but also in

testing certain hypotheses suggested by economic theory and/or prior empiri-

cal experience.

Using the Model for Prediction or Forecasting

Having gone through this multistage procedure, you can legitimately ask the

question: What do we do with the estimated model, such as Eq, (1.5)? Quitenat-

urally, we would like to use it for prediction, or forecasting. For instance, sup-

Bose we have 2004 data on the CLINR and AHE82, Assume these values are 6.0

and 10, respectively. If we put these values in Eq, (1.5), we obtain 62.8315 per-~

cent as the predicted value of CLFPR for 2004. That is, ifthe unemployment

rate in 2004 were 6.0 percent and the real hourly earnings were $10, the civilian

labor force participation rate for 2004 would be about 63 percent. Of course,

when data on CLFPR for 2004 actually become available, we can compare the

12 CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS

predicted value with the actual value, The discrepancy between the two will

represent the prediction errr. Naturally, we would like to keep the prediction

error as small as possible. Whether this is always possible is a question that we

will answer in Chapters 6 and 7.

Let us now summarize the steps involved in econometric analysis.

‘Step Example

4. Statement of theory ‘The Added- /Dsoouraged-Worker Hypothests

2. Collection of Data Table 1-1

‘3, Mathematical Model of Theory: CLFPR = B; + &:CUNA

4 Egonometlc Model of Theory: CLEPR = B, + B,CUNA + u

5. Parameter Estimation: CLFPR = 69,9963 — 0.6513CUNR

8. Model Adequacy Check: CLFPR = 80.9 ~ 0.671CUNR — 1.4AHE@2

7. Hypothesis Test: &<00rB,>0

8. Prediction: ‘What is CLFPR, given values of CUNA and AHEB2?

Although we examined econometric methodology using an example from

labor economics, we should point out that a similar procedure can be employed

to analyze quantitative relationships between variables in any field of knowl-

edge. As a matter of fact, regression analysis has been used in politics, interna-

tional relations, psychology, sociology, meteorology, and many other disciplines.

1.4 THE ROAD AHEAD

Now that we have provided a glimpse at the nature and scope of econometrics,

let us see what lies aliead. The book is divided into four paris.

Partl, consisting of Chapters 2,3,4,and5, reviews the basics of probability and

statistics for the benefit of those readers whose knowledge of statistics has become

rusty. Reader should have some previous background in introductory stati

Part II introduces the reader to the bread-and-butter tool of econometrics,

namely, the classical linear regression model (CLRM). A thorough understanding

of CLRM is a must in order to follow research in the general areas of economics

and business.

Part Ill considers the practical aspects of regression analysis and discusses a

variety of problems that the practitioner will have to tackle when one ot more

assumptions of the CLRM do not hold.

Part IV discusses two comparatively advanced topic—simultaneous equa-

tion regression models and time series econometrics.

This book keeps the needs of the beginner in mind, The discussion of most top-

ics is straightforward and unencumbered with mathematical proofs, derivations,

etc’ firmly believe that the apparently forbidding subject of econometrics can

be taught to beginners in such a way that they can see the value of the subject

without getting bogged down in mathematical and statistical minutiae. The

"Some ofthe proofs and derivations are presented in my Basic Econometrics, Ath ed, MeGraw-

Hill, New York, 2003.

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS 13

student should keep in mind that an introductory econometrics courses just like

the introductory statistics course he or she has already taken, As in statistics,

econometrics is primarily about estimation and hypothesis testing. What is dif-

ferent, and generally much more interesting and useful, is that the parameters

being estimated or tested are not just means and variances, but relationships be-

tween variables, which is what much of economics and other social sciences are

all about.

A final word. The availability of comparatively inexpensive computer soft-

ware packages has now made econometrics readily accessible to beginners. In

this book we will largely use three software packages: Euiews, Excel, and

Minitab, These packages are readily available and widely used. Once students

get used to using such packages, they will soon realize that learning economet=

tics is really great fun, and they will have a better appreciation of the much

maligned “dismal” science of economics.

KEY TERMS AND CONCEPTS

QUESTIONS

‘The key terms and concepts introduced in this chapter are

Econometrics Random error term (error term)

Mathematical economics Linear regression model:

Discouraged-worker hypothesis dependent variable

(effect) independent (or explanatory)

Added-worker hypothesis (effect) variable

Time series data Deterministic vs. statistical

a) quantitative relationship

b) qualitative Causation

Cross-sectional data Parameter estimates

Pooled data Hypothesis testing

Panel (ot longitudinal or micropanel _ Prediction (forecasting)

data)

Scatter diagram (scattergram)

a) parameters

b) intercept

6) slope

141, Suppose a local government decides to increase the tax sate on sesidential prop-

erties under its jurisdiction. What will be the effect of this on the prices of resi-

dential houses? Follow the eight-step procedure discussed in the text toanswer

this question.

1.2. How do you perceive the role of econometrics in decision making in business

and economics?

13. Suppose you are an economic adviser to the Chairman of the Federal Reserve

Board (the Fed), and he asks you whether it is advisable to increase the money

13

4 CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS

PROBLEMS

TABLE 1-2

ie

supply to bolster the-economy. What factors would you take into account in

your advice? How would you use econometrics in your advice?

14. ‘To reduce the dependence on foreign oil supplies, the government is thinking

of increasing the federal taxes on gasoline. Suppose the Ford Motor Company

has hired you to assess the impact of the tax increase on the demand for its cars.

How would you go about advising the company?

1.5, Suppose the president of the United States is thinking of imposing tariffs on im-

ported steel to protect the interests of the domestic steel industry. As an economic

advisor to the president, what would be your recommendations? How would you

set up an econometric study to assess the consequences of imposing the tariff?

16, Table 1-2 gives data on the Consumer Price Index (CPI), S&P 500 stock index,

and three-month Treasury bill rate for the United States for the years 1980-2001.

a. Plot these data with time on the horizontal axis and the three variables on the

vertical axis. If you prefer, you may use a separate figure for each variable

. What relationships do you expect between the CPI and the S&P index and

between the CPT and the three-month Treasury bill rate? Why?

«. Foreach variable, “eyeball” a regression line from the scattergram.

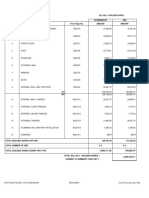

CONSUMER PRICE INDEX (CPI, 1982-1984 = 100),

‘STANDARD AND POOR'S COMPOSITE INDEX (S8P 500,

{941-1943 = 100), AND THREE MONTH TREASURY BILL

RATE (3-mT BILL, %).

Year orl ‘S&P 500 3-mT bill

1980 824 118.78 1151

1981 90.9. 128.05 14.03

1982 96.5 119.71 10.68

1983 99.6 160.41 8.63

1984 103.9 160.48 9.58

1985 1076 106.84 ow

1986 108.6 23634 8.98

1987 1136 286.83, 5.82

1988 1183 265.79 6.69

1989 124.0 322.84 812

1990 1907 334,59 751

4991 136.2 376.18 5a2

1992 1403 415.74 345

1998 1445 451A 302

1994 1482 490.42 429

1095 1824 54172 551

1996. 156.9 670.50 5.02

1997 1605 873.43 507

1998 163.0 1085.50 481

1999 168.6 1827.33 468

2000 1722 1427.22 585

2001 aA 1194.18 3.45

‘Source: Economic Report ofthe President, 2002, Tabos B-60,

CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS 15,

TABLE 4-3 GMS EXCHANGE RATE BETWEEN GERMAN MARK AND

U.S, DOLLAR AND THE OP| IN THE UNITED STATES AND

GERMANY, 1980-1998,

Year ews oPius, CPI Germany

1980 1.8175 824 86.7

1981 2.2692 90.9 922

1982 2.4281 965 974

1983 2.5599 99.6 1003

1984 2.8455 1080 4027,

1985 2.9420 107.6 104.8

1986, 24705, 1096 104.6

1987 4.7981 1136 1049

1988 4.7570 118.3 1063

1989 1,8808 1240 1092

1990 1.6166 130.7 1122

1991 1.8610 1362. 1163

1992 4.5618 1403, 122.2

1998 1.8545 1445 1278

1994 1.6216 1482 1314

1995 1.4321 1824 1935

1996 1.8049 156.9 1855

1997 1.7948 160.5 1978

1998, 4.1879 183.0 1984

‘Source: Ecencmlc Report of te President, 2002. GM trom

‘Table 8-110; OPI (1862-1884 = 100) from Yabo 8-408,

17, Table 1-8 gives you data on the exchange tate between the German mark and

the US. dollar (number of German marks per US. dollar) ag well as the con-

sumer price indexes in the two countries for the period 1980-1998.

4. Plotthe exchange rate (ER) and the two consumer price indexes against time,

measured in years. : .

b. Divide the US, CPIby the German CPi and calli the relative price ratio (RPR).

¢. Plot ER against RPR.

4. Visually sketch a regression line through the scatterpoints,

APPENDIX 1A: Economic Data

on the World Wide Web’

Economic Statistics Briefing Room: An excellent source of data on output, income,

employment, unemployment, earnings, production and business activity, prices

and money, credits and security markets, and intemational statistics,

http//wwwwhitehouse.govifsbr/esbrhtm

4 should be noted that this ist is by no means exhaustive. The sources listed here are up-

dated continually. The best way to get information om the Internet isto search using a key word

(ec. unemployment rate), Don't he surnrised vant e=t a mlthiors af infnematinn on fhe

16 CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS

Federal Reserve System Beige Book: Gives a suntmary of current economic con-

ditions by the Federal Reserve District. There are 12 Federal Reserve Districts.

hitp//wwwhbog.fth fed.us/fome/bb/current

Government Information Sharing Project: Provides regional economic informa-

tion; 1990 population and housing census; 1992 economic census; agriculture

census for 1982, 1987, 1992; data on US. imports and exports 1991-1995; 1990

Equal Employment Opportunity information,

hitp’//govinfo.kerrorst.edu

National Bureau of Economic Research (NBER) Home Page: This highly regarded

private economic research institute has extensive data on asset prices, labor,

‘productivity, money supply, business cycle indicators, etc,-NBER has many

links to other Web sites,

. httpeiwwwanberorg

Panel Study: Provides data on longitudinal survey of representative sample of

US. individuals and families. These data have been collected annually since 1968.

http://www.umich.edu/~psid

Resources for Economists ont the Internet: Very comprehensive source of infor-

mation and data on many economic activities with links to many Web sites. A

very valuable source for academic and nonacademic economists.

Aitp://econwpa.wwstl.edu/EconFAQ/EconFaq-html

‘The Federal Web Locator: Provides information on almost every sector of the

federal government; has international links,

http:/erwwdaw.villedu/Fed-Agency/fedwebloc.html

WebEC:WWW Resources in Economics: A most comprehensive library of eco-

nomic facts and figures.

http://wuecon.wustl.edu/~adneteciWebHo/WebEc.himt

‘Ameriéan Stock Exchange: Information on ome 700 ‘companies listed on the

second largest stock market.

httpy/www.amex.com/

Bureau of Economic Analysis (BEA) Home Page: This agency of the US.

Department of Commerce, which publishes the Survey of Current Business, is an

excellent source of data on all kinds of economic activities.

hitp:lwww.bea.dac.gov!

Business Cycle Indicators: You will find data on about 256 economic time series.

Attpswwwglobalexposure.convbei.html

CIA Publication: You will find the World Fact Book (anwial) and Handbook of

International Statistics,

hitp//www.odic.gow/cia/publications/pubs.html

Energy Information Administration (Department of Energy [DOE]): Economic

information and data on each fuel category.

hitpulwwweiadoe.gov/

FRED Database: Federal Reserve Bank of St. Louis publishes historical eco-

nomic and social data, which include interest rates, monetary and business

indicators, exchange rates, etc.

hitpu/wwwestls.frb.org/fred/fred.html

(OVO CHAPTER ONE: THE NATURE AND SCOPE OF ECONOMETRICS 17

wag74718

International Trade Administration: Offers many Web links to trade statistics,

cross-country programs, etc.

httpulwwwiita.docgov/

STAT-USA Databases: ‘The National Trade Data Bank provides the most com-

prehensive source of international trade data and export promotion informa-

tion. It also contains extensive data on demographic, political, and sociveco-

nomic conditions for several countries.

http:/www.stat-usa.gov/BEN/databases.html

‘Statistical Resources on the Web/Economics: An excellent source of statistics col-

lated from various federal bureaus, economic indicators, the Federal Reserve

Board, data on consumer prices, and Web links to other sources.

httpy/wwwlib.umich.edu/libhome/Documents.centers/stecon.html

Buren of Labor Statistics: The home page contains data related to various as-

pects of employment, unemployment, and earnings and provides links to other

statistical Web sites.

hitp://stats.bls.gov:80/

U.S. Census Bureau Home Page: Prime source of social, demographic, and

economic data on income, employment, income distribution, and poverty.

hittp:l/www.census.govi

General Social Surcey: Annual personal interview survey data on U.S. house-

holds that began in 1972. More than 35,000 have responded to some 2500 different

questions covering a variety of data.

http//www.iepstumich.edw/GSS/

Institute for Research on Poverty: Data collected by nonpartisan and nonprofit

university-based research center on a variety of questions relating to poverty

and social inequality,

hitpywwwesscawisc.edwirp/

Social Security Administration: The official Web site of the Social Security

Administration with a variety of data,

hitpuhrww.sa.gov!

Federal Deposit Insurance Corporation, Bank Data and Statistics:

http:fwww {dic gov/bank/statisticallindex html

Federal Reserve Board, Economic Research and Data:

http:}www.federalreserve.govima.him

US. Census Bureau, Home Page:

httpywww.census.gov

U.S. Department of Conimerce, Bureau of Economic Analysis:

httpuwww.bea.gov :

US. Department of Energy, Energy Information Administration:

httpy/wwweia.doe.govineichistorichistorichtm

U.S. Department of Health and Human Services, National Center for Health -

Statistics:

Ritpdfeewwede.gowinchs

U.S, Department of Housing and Urban Development, Data Sets:

pulwrwwhudusenorg/datasets/pdrdatas.html

1]

18 CHAPTER ONE: THENATURE AND SCOPE OF ECONOMETRICS

18

ULS. Department of Labor, Bureau of Labor Statistics:

hitpd/wwwobls.gov

USS. Department of Transportation, TranStats:

hitp:/wwwéranstats.bts.gov.

U.S. Department of the Treasury, Internal Revenue Service, Tax Statistics:

hitp//wwwirs.gov/taxstats

Rockefeller Institute of Government, State and Local Fisoal Data:

hitp:/stateandlocalgateway.rockinst.org/fiscal_trends

Arierican Economic Association, Resources for Economists:

hitpshwwwafe.org,

Anterican Statistical Association, Business and Economic Statistics:

hitp//www.econ-datalinks.org

American Statistical Association, Statistics in Sports:

http//www.amstat.org/sections/sis/sports.htm!

European Central Bank, Statistics:

hittp:/wwwecb.int/stats

World Bank, Data and Statistics:

hitpdlwww.worldbankorgidata

International Monetary Fund, Statistical Topics:

httpu/www.mgorg/external/np/sta/indexhtm

International Monetary Fund, World Economic Outlook:

hittp//www.imf.org/external/pubs/ft/weo/2003/02/datalindex.htm.

Penn World Tables:

hitp?//pwrtecon.upenn.edu

Current Population Survey:

httpulwwwbls.census.gov/cps/epsmain.htm

Consumer Expenditure Survey:

hittpv/www.bls.gov/cexfhome.htm

Survey of Consumer Finances:

httpviwww.federalreserve.gov/pubs/oss/oss2/scfindex.html

City and Countty Data Book:

itp/fwww.census.gov/prod/wwwicedb.html

Panel Study of Income Dynamics:

http:/psidonline.isr.umich.edu

‘National Longituidinal Surveys:

hittpyiwwwbls.gov/nlshhome.htm

National Association of Home Builders, Economic and Housing Data:

http:/www.nahb.org/category.aspx?sectionID=113

National Science Foundation, Division of Science Resources Statistics:

hittpywww.nsf govisbelsrsistats htm

PART {

BASICS OF PROBABILITY

AND STATISTICS

This part consists of four chapters that review the essentials of statistical theory

that are needed to understand econometric theory and practice discussed in the

remainder of the book.

‘Chapter 2 discusses the fundamental concepts of probability, probability dis-

tributions, and random variables.

Chapter 3 discusses the characteristics of probability distributions such as

the expected value, variance, covariance, correlation, conditional expectation,

conditional variance, skewness, and kurtosis. This chapter shows how these

characteristics are measured in practice.

Chapter 4 discusses four important probability distributions that are used

extensively in practice: (1) the normal distribution, (2) the t distribution, (3) the

chi-square distribution, and (4) the F disttibution. In this chapter the main fea-

tures of these distributions are outlined. With several examples, this chapter

shows how these four probability distributions form the foundation of most

statistical theory and practice.

Chapter 5is devoted to a discussion of the two branches of classical statistics—

estimation and hypothesis testing. A firm understanding of these two topics will

considerably make our study of econometrics in subsequent chapters easier.

‘These four chapters are written in a very inforntal yet informative style so

readers can brush up on their knowledge of elementary statistics. Since stu-

dents coming to econometrics may have different statistics backgrounds, these

four chapters provide a fairly self-contained introduction to the subject.

All the concepts introduced in these chapters are well illustrated with several

practical examples,

19

CHAPTER 2

REVIEW OF STATISTICS |:

PROBABILITY AND

PROBABILITY

DISTRIBUTIONS

‘The purpose ofthis and the following three chaptersis to review somefundamen-

tal statistical concepts that are needed to understand Essentials of Econometric.

‘These three chapters will serve as a refresher course for those students who

have had a basic course in statistics and will provide a unified framework for

following discussions of the material in the remaining patts of this book for

those whose knowledge of statistics has become somewhat rusty. Students

who have had very little statistics should supplement these three chapters with

a good satistics book. (Gome references are given at the end of this chapter)

Note that the discussion in Chapters 2 through 5 is nonrigorous and is by no

micans a substitute for a basic course in statistics, It is simply an overview that

is intended as a bridge to econometrics.

2.1 SOME NOTATION

Inthis chapter we come across several mathematical expressions that often can

be expressed more conveniently in shorthand forms.

The Summation Notation

‘The Greck capital letter E(sigma) is used to indicate summation or addition,

Thus,”

Sama Ke tbh

ist

22 PART ONE: BASICS OF PROBABILITY AND STATISTICS

where fis the index of summation and the expréssion on the left-hand sides the

shorthand for “take the sum of the variable X from the first value ({= 1) to the

nth value (i =)"; X stands for the ifh value ofthe X variable.

re oy X)

is often abbreviated as

‘ Ls

' where the upper and lower limits of the sum are known or can be easily deter-

ined or also expressed as

yx

x

which simply means take the sum ofall the relevant values of X. We will use all

these notations interchangeably.

Properties of the Summation Operator

Some important properties of © are as follows:

1, Where kis a constant

Dk=nk

ist

That is, a constant summed n times is m times that constant. Thus,

4

Y3=4x3=12

a

In this example n = 4 and k= 3.

2, Where k is a constant

DRX SED X

That is, a constant can be pulled out of the summation sign and put in

front of it,

3 Lith) =CX+ LY

Thats, the summation of the sum of two variables is the sum of their in-

dividual summations.

4, La + bX) =a +b YX;

wheres and b are constants and where use is made of properties 1,2,and3.

‘We will make extensive use of the summation notation in the remainder of

this chapter and in the rest of the book.

We now discuss several important concepts from probability theory.

CHAPTER TWO: REVIEW OF STATISTICS |: PROBABILITY AND PROBABILITY DISTRIBUTIONS "23

2.2 EXPERIMENT, SAMPLE SPACE, SAMPLE POINT, AND EVENTS

Experiment

The first important concept is that of a statistical or random experiment. In sta-

tistics this term generally refers to any process of observation or measurement

that has more than one possible outcome and for which there is uncertainty

about which outcome will actualy materialize,

Example 2.1,

Tossing a coin, throwing a pair of dice, and drawing a card from a deck of

cards are all experiments. It is implicitly assumed that in performing these

experiments certain conditions are fulfilled, for example, that the coin or

the dice are fair (not loaded). The outcomes of such experiments could be

ahead or a tail if a coin is tossed or any one of the numbers 1, 2,3, 4,5, or 6

if a die is thrown, Note that the outcomes are unknown before the experi-

ment is performed. The objectives of such experiments may be to estab-

lish a law (eg,, How many heads are you likely to obtain in a toss of, say,

1000 coins?) or to test the proposition that the coin is loaded (e.g., Would

you regard coin as being loaded if you obtain 70 heads in 10 tosses of

acoin?).

Sample Space or Population

‘The set of all possible outcomes of an experiment is called the population or

sample space, The concept of sample space wss frst introduced by von Mises,

an Austrian mathematician and engineer, in 1931.

Example 2.2,

Consider the experiment of tossing two fair coins. Let H denote a head and

Ta tail. Then we have these outcomes: HH, HT, TH, TT, where HH means a

head on the first toss and a head on the second toss, HT means a head on the

first toss and a tail on the second toss, etc.

In this example the totality of the outcomes, or sample space or popula-

tion, is 4—no other outcomes are logialy possible. (Don’t worry about the

coin landing on its edge.)

Example 23.

‘The New York Mets are scheduled to play a doubleheader, Let O; indicate the

outcome that they win both games, Q, that they win the first game but lose

the second, Os that they lose the first game but win the second, and O, that

they lose both games, Here the sample space consists of fouir owtcomes: Os,

0s. Ox, and Ox

24 PARTONE: BASICS OF PROBABILITY AND STATISTICS

Sample Point

Events

Venn Diagrams

24

Each member, or outcome, of the sample space or population is called a sample

point. In Example 22 each outcome, HH, HT, TH, and TT, ise sample point. In

Example 23 each outcome, 01, Ox, Os, and Oy is a sample point.

An event isa particular collection of outcomes and is thus a subset of the sam-

ple space.

Example 24,

Letevent be the occurrence of one head and one tail in the coin tossing ex-

periment, From Example2.2 we see that only outcontes HT and TH belong to

event A, (Note: HT and TH are a subset of the sample space HH, HT, TH, and

TT). Let B be the event that two heads occur in a toss of two coins. ‘Then, ob-

‘viously, only the outcome HH belongs to event B. (Again, note that HH is a

subset of the sample space HH, HT, TH, and TT).

Events are said to be mutually exclusive if the occurrence of one event pre-

vents the occusrence of another event at the same time. In Example 2.3, if 0; oc-

curs, thatis, the Mets win both the games, itrules out the occurrence of any of the

other three outcomes. Two events are said to be equally likely if we are confident

that one event is as likely to occur as the other event, In 4 single toss of a coin a

head is as likely to appeas as a tail. Events are said to be collectively exhaustive

if they exhaust all possible outcomes of an experiment. In our two coin-tossing

example, since HH, HT, TH, and TT are the only possible outcomes, they are(col-

lectively) exhaustive events. Likewise, in the Mets example, 01, Oz, O3, and Ox

are the only possible outcornes, barring, of course, rain or natural calamities such

as the earthquake that occurred during the 1989 World Series in San Francisco.

‘Asimple graphic device, called the Venn diagram, originally introduced by

‘Venn in his book, Symbolic Logic, published in 1861, can be used to depict sam-

ple point, sample space, events, and related concepts, as shown in Figure 2-1.

In this figure each rectangle represents the sample space § and the two circles rep-

resent two events A and B. If there are more events, we can draw more circles to

represent all those events. The various subfigures in this diagram depict various

situations,

Figure 2-1(@) shows outcomes that belong to A and the outcomes that doniatbe-

long to, which are denoted by thesymbol A, whichis called the complement of A.

Figure 2-1(b) shows the union (ie., sum) of A and B, that is the event whose

outcomes belong to set A or set B. Using set theory notation, it is often denoted

as AUB (read as A union B), which is the equivalent of A + B.

CHAPTER TWO: REVIEW OF STATISTICS I: PROBABILITY AND PROBABILITY DISTRIBUTIONS 25

oe ®

@ @

FIGURE 21 Vern diagram,

‘The shaded area in Figure 2-1(c) denotes events whose outcomes belong to

both set A and set B, which is represented as AN B(read.as A intersects B), and

is the equivalent of the product AB,

Finally, Figure 2-1(d) shows that the two events are mutually exclusive because

they have no outcomes in common. In set notation, this means ANB = 0 (or

that AB = 0).

2.3 RANDOM VARIABLES

Although the outcome(s) of an experiment cant be described verbally, stich as a

head or a tail, or the ace of spades, it would be much simpler if the results of all

experiments could be described numerically, that is, in terms of numbers. As we

will see late, for statistical putposes such representation is very useful,

Example 25.

Reconsider Example 2.2. Instead of describing the outcomes of the experi

ment by HH, HT, TH, and TT, consider the “variable” number of heads in a

toss of two coins. We have the following situation:

Fitstccin —_-Sgcond.¢oin Number of heads

T T 0

a H 1

H i 1

H H 2

os

26 PART ONE: BASICS OF PROBABILITY AND STATISTICS

‘We call the variable “number of heads” a stochastic or random variable (r.v.,

for short). More generally, a variable whose (numerical) value is determined by the

outcome of an experiment is called a random variable. In the preceding example the

xv, number of heads, takes three different values, 0, 1, or 2, depending on

whether no heads, one head, or two heads were obtained in a toss of two coins.

In the Mets example the rv, the number of wins, likewise takes three different

values; 0, 1, or 2.

By convention, random variables are denoted by capital letters, X, Y, Z, etc.,

and the values taken by these variables are often denoted by small letters. Thus,

if X is an rv, x denotes a particular value taken by X.

_An ry. may be either discrete or continuous. A discrete random variable

takes on only a finite number of values or countably infinite number of values

(ce. as many values as there are whole numbers). Thus, the number of heads in

a toss of two coins can take on only three values, 0, 1; or 2. Hence, it is a’discrete

rv. Similarly, the number of wins in a doubleheader is also a discrete rv. since it

can take only three values, 0, 1, or 2 wins. A continuous random variable, on

the other hand, is an tv. that can take on any value in some interval of values.

‘Thus, the height of an individual is a continuous variable—in the range of, say,

60 to 72 inches it can take any value, depending on the precision of measure-

ment. Similar factors such as weight, rainfall, or temperature also can be re-

garded as continuous random variables.

24 PROBABILITY

Having defined experiment, sample space, sample points, events, and random

variables, we now consider the important concept of probability. First, we define

the concept of probability of an event and then extend it to random variables.

Probability of an Event: The Classical or A Priori Definition

If an experiment can result inn mutually exclusive and equally likely outcomes,

and if mz of these outcomes are favorable to event A, then P(A), the probability

that A occurs, is the ratio m/n, That is,

umber of outcomes favorable toA en

total number of outcomes

Note the two features of this definition: The outcomes must be mutually exclusive

(that is, they cannot occur at the same time), and each outcome must have an

equal chance of occurring (for example, ina throw of adie, any one of the six numbers

has an equal chance of appearing).

P(A) =

Example 26.

Ina throw of adie numbered 1 through 6, there ae six possible outcomes: 1,

2,3,4,5,0r 6. These outcomes are mutually exclusive since, ina single throw

(CHAPTER TWO: REVIEW OF STATISTICS |: PROBABILITY AND PROBABILITY DISTRIBUTIONS 27

of the die, two or more numbers cannot tun up simultaneously. These six

outcomes are also equally likely. Hence, by the classical definition, the prob-

ability that any of these six numbers will show up is 1/6—there are six total

outcomes and eaich outcome has an equal chance of occurring, Here n = 6

and m=1,

Similarly, the probability of obtaining a head in a sirigle toss of a coin is 1/2

since there are two possible outcomes, Hand T, and each has an equal chance of

coming up. Likewise, in a deck of 52 cards, the probability of drawing any sin-

gle card is 1/52. (Why?) The probability of drawing a spade, however, is 13/52.

(Why?)

The preceding examples show why the classical definition is called an a pri-

ori definition since the probabilities are derived from purely deductive reason-

ing. One doesn’t have to throw a coin to state that the probability of obtaining a

head ora tail is 1/2, since logically, these are the only possible outconies.

But the classical definition has some deficiencies, What happens if the out-

comes of an experiment are not finite or are not equally likely? What, for exam-

le, is the probability that the gross domestic product (GDP) next year will be a

certain amount or what is the probability that there will be a recession next

year? The classical definition is not equipped to answer these questions. A more

widely used definition that can handle such cases is the relative frequency def-

inition of probability, which we will now discuss.

Relative Frequency or Empirical Definition ot Probabitity

To introduce this concept of probability, consider the following example.

Example 2.7. :

Table 2-1 gives the distribution of maéks received by 200 students on a mi-

croeconomics examination. Table 2-1 is an example of a frequency distribu-

tion showing how the rv, marks in the present example are distributed. The

numbers in column 3 of the table are called absolute frequencies, that is, the

number of occurrences of a given event. The numbers in column 4 are called

relative frequencies, that is, the absolute frequencies divided by the total

‘number of occurrences (200 in the present case). Thus, the absolute frequency

of marks between 70 and 79 is 45 but the relative frequency is 0.225, which is

45 divided by 200,

Can we treat the relative frequencies’as probabilities? Intuitively, it seems

reasonable to consider the relative frequencies as probabilities provided the

number of observations on which the relative frequencies are based is reason-

ably Jarge. This is the esséince ofthe enipirial, or relative frequency, definition of

probability

28 PART ONE: BASICS OF PROBABILITY AND STATISTICS

28

TABLE 2-1 THE DISTRIBUTION OF MARKS RECEIVED BY 200

STUDENTS ON A MICROECONOMICS EXAMINATION.

Midpoint of Absolute Relative

“Marks infeval = frequency frequency.

«) @ 6) (4) = (3200

08 5 0 o

10-19 15 0 o

20-29 25 0 0

30-39 5 10 0.050

40-49, 6 20 0.400

50-69 5 8 0175

60-69 65 50 0.250

70-79 6 45 0225

00-89 85 30 0.150

90-99 5 10 0,050

Total: 200 1.000

More formally, if in trials (or observations), m of them are. favorable to

event A, then P(A), the probability of event A, is simply the ratio m/n (te, rela-

tive frequency) provided n, the number of trials, is sufficiently large (technically,

infinite) Notice that, unlike the classical definition, we do not have to insist

that the outcome be mutually exclisive and equally likely. .

Inshort, if the number of trials is sufficiently large, we can treat the relative

frequencies as fairly good measures of true probabilities. In Table 2-1 we can,,

therefore, treat the relative frequencies given in column 4 as probabilities”

Properties of Probabilities ‘The probability of an event as defined earlier

has the following important properties:

1. The probability of an event always lies between O-and 1. Thus, the prob-

ability of event A, P(A), satisfies this relationship:

0

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Burke IndictmentDocument59 pagesBurke Indictmentjroneill100% (2)

- Econometrics and Economic Data PDFDocument6 pagesEconometrics and Economic Data PDFRiada JadaNo ratings yet

- 5 The Search For A Sound Business Idea 1Document24 pages5 The Search For A Sound Business Idea 1Baila BakalNo ratings yet

- Dash - The Story of EconophysicsDocument223 pagesDash - The Story of EconophysicsEricNo ratings yet

- Laporan Strategic Planning PT Ultrajaya TBK (FINAL)Document201 pagesLaporan Strategic Planning PT Ultrajaya TBK (FINAL)Maharani MustikaNo ratings yet

- Empirical Tools of Public Finance: Solutions and ActivitiesDocument7 pagesEmpirical Tools of Public Finance: Solutions and ActivitiesAKÇA ELGİNNo ratings yet

- Week 5 Lecture 3Document8 pagesWeek 5 Lecture 3Druthi KolaNo ratings yet

- OFSAAI Administration Guide PDFDocument42 pagesOFSAAI Administration Guide PDFDruthi KolaNo ratings yet

- MIT15 401F08 Lec15 PDFDocument29 pagesMIT15 401F08 Lec15 PDFfranciisNo ratings yet

- MIT15 401F08 Lec15 PDFDocument29 pagesMIT15 401F08 Lec15 PDFfranciisNo ratings yet

- Copula SurveyDocument69 pagesCopula SurveyAntonio VozzaNo ratings yet

- MIT15 401F08 Lec15 PDFDocument29 pagesMIT15 401F08 Lec15 PDFfranciisNo ratings yet

- FRM Reference Material PDFDocument16 pagesFRM Reference Material PDFDruthi KolaNo ratings yet

- 9.monte Carlo Methods PDFDocument25 pages9.monte Carlo Methods PDFDruthi KolaNo ratings yet

- Erp Study Guide ChangesDocument8 pagesErp Study Guide ChangesPropertywizzNo ratings yet

- FACON BURGOS Assignment 3 RevisedDocument7 pagesFACON BURGOS Assignment 3 RevisedLip SyncersNo ratings yet

- Pengaruh Inflasi, Suku Bunga Dan Nilai Tukar Terhadap Harga Saham Pada Perusahaan Bursa Efek Indonesia Di Masa Pandemi Covid-19Document17 pagesPengaruh Inflasi, Suku Bunga Dan Nilai Tukar Terhadap Harga Saham Pada Perusahaan Bursa Efek Indonesia Di Masa Pandemi Covid-19Ayu MangNo ratings yet

- Technology Firms MarketsDocument10 pagesTechnology Firms MarketsSravan KumarNo ratings yet

- HB Quiz 2018-2021Document3 pagesHB Quiz 2018-2021Allyssa Kassandra LucesNo ratings yet

- Economics A: Thursday 16 May 2019Document32 pagesEconomics A: Thursday 16 May 2019Afifa At SmartEdgeNo ratings yet

- MJ's Home and Commercial Cleaning Services Comparative Statement of Financial Performance As of December 31, 2021 - 2025 (In Philippine Peso)Document16 pagesMJ's Home and Commercial Cleaning Services Comparative Statement of Financial Performance As of December 31, 2021 - 2025 (In Philippine Peso)Jasmine ActaNo ratings yet

- Role of Agriculture in Indian EconomyDocument11 pagesRole of Agriculture in Indian EconomyAseem1No ratings yet

- Assignment 1.2 A Changing World Final Paper Name Professor Adam Mcbride American History To 1865 Strayer University August 4, 2019Document6 pagesAssignment 1.2 A Changing World Final Paper Name Professor Adam Mcbride American History To 1865 Strayer University August 4, 2019Jacques OwokelNo ratings yet

- Optimal Portfolio Strategy To Control Maximum DrawdownDocument35 pagesOptimal Portfolio Strategy To Control Maximum DrawdownLoulou DePanamNo ratings yet

- SchumpeterJ A TheTheoryofEconomicDevelopmentDocument13 pagesSchumpeterJ A TheTheoryofEconomicDevelopmentSabrina Morais CoelhoNo ratings yet

- Dougherty C12G06 2016 05 22Document31 pagesDougherty C12G06 2016 05 22rachmanmustafaNo ratings yet

- Airline Codes 1Document8 pagesAirline Codes 1B. Young100% (1)

- Monetary and Fiscal Policies TemplateDocument2 pagesMonetary and Fiscal Policies TemplateDeryl GalveNo ratings yet

- HE6 W3aDocument4 pagesHE6 W3aMa Theresa BambaoNo ratings yet

- Brief Intro of IsraelDocument28 pagesBrief Intro of Israel王郁妘No ratings yet

- PL 130307Document6 pagesPL 130307secui marianNo ratings yet

- Chapter 20 IaDocument6 pagesChapter 20 IaKiminosunoo LelNo ratings yet

- Ahsanullah University of Science and Technology: AssignmentDocument7 pagesAhsanullah University of Science and Technology: AssignmentSudip TalukdarNo ratings yet

- Solutions To Text Problems: Chapter 6: Quick QuizzesDocument60 pagesSolutions To Text Problems: Chapter 6: Quick QuizzesThư PhạmNo ratings yet

- Palconite 3bsma A Reflection Paper4Document1 pagePalconite 3bsma A Reflection Paper4Hella Mae RambunayNo ratings yet

- Energy Will Be One of The Defining Issues of This CenturyDocument1 pageEnergy Will Be One of The Defining Issues of This CenturyarragilNo ratings yet

- Bcom Sem-6 (2019) April-2023 Auditing & Corporate Governance-2Document2 pagesBcom Sem-6 (2019) April-2023 Auditing & Corporate Governance-2Hariom ShingalaNo ratings yet

- Kctmo Rydon Grenfell Tower Newsletter May 2015Document35 pagesKctmo Rydon Grenfell Tower Newsletter May 2015TonyHatNo ratings yet

- Bill No.3 - Building Works Summary: Intermediate END: Element No. Description Amount AmountDocument105 pagesBill No.3 - Building Works Summary: Intermediate END: Element No. Description Amount AmountKelvin KongNo ratings yet

- Constrained OptimizationDocument19 pagesConstrained OptimizationVikram SharmaNo ratings yet