Professional Documents

Culture Documents

Australian Federal Budget - 2017-2018

Uploaded by

Brett JacksonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Australian Federal Budget - 2017-2018

Uploaded by

Brett JacksonCopyright:

Available Formats

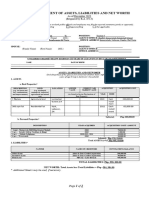

AUSTRALIAN FEDERAL BUDGET 2017-2018 | SNAPSHOT

First Home Buyers - Our office expects an apathetic response from

investment markets (FX, ASX and bond yields)

- First home buyers able to salary sacrifice up to - Negative gearing enjoying once again immortality;

$15,000 per FY into their existing Superfund, up nor was there any repeat of last years heavy-

to a total of $30,000 (i.e. $60,000 for couples) handed reach for Superannuation monies

- Monies can then be used for a home deposit - Final word: Scott Morrison evidently tied between

wanting to work towards fiscal repair; yet clearly

Small Business having to stay well away of major expense cuts,

still in the aftermath of the infamous 2014 Budget

- No highly material changes, other than: backlash. Hence, the attention has now turned to

o $20,000 instant asset write-off extended a focus on taxation increases, delivered tonight.

for another year

Big Banks

Treasurer Scott Morrison handing down his second budget

tonight in Canberra, Australia (Tuesday, 9th May 2017) - The Big4 and Macquarie will be subjected to a

$6.2Bn collective levy charged against their

Personal Tax Rates liabilities over the next four years

o Customer deposits of less than $250,000

- Increase in the Medicare Levy from 2% to 2.5% exempt

o Effective from 2019

o Expected to raise $8.2Bn Pensioners

Negative Gearing - One-off winter energy payment costing $269m

over two years

- No highly material changes, other than: o $75 to singles and $125 per couple

o No longer able to deduct cost of travel Written by Brett Jackson (M.App.Fin., B.Com., DFP)

- Residency requirements will be tougher

o More restrictive list of items which can be Director, Lantana Private Wealth

o At least 15 years of continual residence

depreciated against rent necessary

Clients welcome to contact Brett directly for further

Superannuation: discussion.

Bretts (Lantana Private Wealth) comments

- No highly material changes, other than: - Highest-taxing Budget since the GFC (fact) Disclaimer: This article should not be used for making any

o Ability for home-owning downsizers to Very left-leaning Budget for the LNP

- investment decisions. While every care has been taken to ensure

make a $300,000 contribution into their - Opposition Treasurer Chris Bowen already the accuracy of the information in this document, no guarantee of

Superannuation fund (on top of regular confirming that the ALP Accept the Budget its veracity can be given. No persons or Bodies are authorised to

CC and NCC caps) proposals re-distribute or copy the contents of this article, without the express

consent of Lantana Private Wealth Pty Ltd.

+61 (0) 409 506 828 | 1/10 Lawrance Street, Murrumbeena, VIC, Australia, 3163 | bjackson@lantanaprivatewealth.com.au | www.lantanaprivatewealth.com.au | ACN: 167 991 442

You might also like

- 1299265204mar 9 11 z3 ReducedDocument32 pages1299265204mar 9 11 z3 ReducedCoolerAdsNo ratings yet

- Tax Cuts & Jobs Act Implications for IndividualsDocument4 pagesTax Cuts & Jobs Act Implications for IndividualsgodardsfanNo ratings yet

- Saln 2023Document3 pagesSaln 2023Osman G. Lumbos LptNo ratings yet

- PointeXpress Issue 160 11-23-20Document28 pagesPointeXpress Issue 160 11-23-20Mari JayNo ratings yet

- JPM Q1 2020 PresentaitonDocument16 pagesJPM Q1 2020 PresentaitonZerohedgeNo ratings yet

- M Advisory Group - Dennis Branconier Article - October 2008Document2 pagesM Advisory Group - Dennis Branconier Article - October 2008Business Insider MagazineNo ratings yet

- Autumn Budget 2018Document20 pagesAutumn Budget 2018MoneyspriteNo ratings yet

- Best in Class Investments Budget 2019 OverviewDocument8 pagesBest in Class Investments Budget 2019 OverviewReuben SalisNo ratings yet

- 2007 Year-End Tax Planning Considerations: Synergy Financial GroupDocument4 pages2007 Year-End Tax Planning Considerations: Synergy Financial GroupgvandykeNo ratings yet

- TAQWATIMES-vol0 1Document3 pagesTAQWATIMES-vol0 1Ridzwan OsmanNo ratings yet

- Govt stimulus aims to boost consumption by ~73,000 crDocument23 pagesGovt stimulus aims to boost consumption by ~73,000 crGopalakrishnan SivasamyNo ratings yet

- Newsletter On The BudgetDocument3 pagesNewsletter On The Budgetbb3rn4rdNo ratings yet

- Join Us Jan. 9 in Welcoming Home Rep. Miccarelli: 2009-2010 State Budget Wrap UpDocument4 pagesJoin Us Jan. 9 in Welcoming Home Rep. Miccarelli: 2009-2010 State Budget Wrap UpPAHouseGOPNo ratings yet

- TaxPlanning06 07Document17 pagesTaxPlanning06 07Lathif PashaNo ratings yet

- 5 Banks Offering Highest Interest RatesDocument5 pages5 Banks Offering Highest Interest RatesStarNo ratings yet

- AFAR Notes by DR Ferrer - Summary BS AccountancyDocument28 pagesAFAR Notes by DR Ferrer - Summary BS AccountancyMABI ESPENIDONo ratings yet

- Investment Declaration ManualDocument10 pagesInvestment Declaration ManualAbhinav VivekNo ratings yet

- 10 Control Sheet - Deductible AllowancesDocument1 page10 Control Sheet - Deductible AllowancesUsman Ahmed ManiNo ratings yet

- 4561 Lecture 10 Notes Part 3 November 23, 2022Document6 pages4561 Lecture 10 Notes Part 3 November 23, 2022moshe1.bendayanNo ratings yet

- GST Credit NoticeDocument3 pagesGST Credit NoticeSam StormeNo ratings yet

- Withholding Tax Agents Duties & Resonsibilities.10.08.21.FinalDocument116 pagesWithholding Tax Agents Duties & Resonsibilities.10.08.21.FinalRobert CastilloNo ratings yet

- Index - 2021-01-12T120530.513 PDFDocument1 pageIndex - 2021-01-12T120530.513 PDFAkshay BahetyNo ratings yet

- Rep. Causer Feb. 2010Document4 pagesRep. Causer Feb. 2010PAHouseGOPNo ratings yet

- Financial Planning Case 22_10_07Document9 pagesFinancial Planning Case 22_10_07888 BiliyardsNo ratings yet

- Lower Taxes: Supporting Households, Driving Investment and Creating JobsDocument19 pagesLower Taxes: Supporting Households, Driving Investment and Creating JobsLeeNo ratings yet

- Project Brochure LatestDocument2 pagesProject Brochure LatestcasherinegNo ratings yet

- Budget 2011-2012Document4 pagesBudget 2011-2012selvalntpNo ratings yet

- Multifamily Clean Energy Financing: Pre-Development Energy LoanDocument2 pagesMultifamily Clean Energy Financing: Pre-Development Energy LoanThaddeus J. CulpepperNo ratings yet

- Petri Fall 2010 NewsletterDocument4 pagesPetri Fall 2010 NewsletterPAHouseGOPNo ratings yet

- 04AFAR QuicknotesDocument23 pages04AFAR Quicknoteshelican.wenajeandbsa1993No ratings yet

- PPT300Document28 pagesPPT300Ram RamNo ratings yet

- SBA PPP Loan Calculator - CARES ActDocument2 pagesSBA PPP Loan Calculator - CARES ActJay Mike100% (2)

- MS03 09 Capital Budgeting Part 1 EncryptedDocument8 pagesMS03 09 Capital Budgeting Part 1 EncryptedKate Crystel reyesNo ratings yet

- AFAR Notes by Dr. FerrerDocument21 pagesAFAR Notes by Dr. FerrerAko C Marz100% (1)

- Ten tax planning strategies for high-income individuals in 2016Document4 pagesTen tax planning strategies for high-income individuals in 2016Humphrey Hessel-AppiahNo ratings yet

- MECEP Tax Plan Review 10 May 2011Document2 pagesMECEP Tax Plan Review 10 May 2011gerald7783No ratings yet

- Tax Comparison TableDocument1 pageTax Comparison TableTaylor PutzNo ratings yet

- Union Budget 2010-11: Higher Spending Plan in Key Areas, Divestment Road Map and Tax ReformsDocument3 pagesUnion Budget 2010-11: Higher Spending Plan in Key Areas, Divestment Road Map and Tax ReformsVinay Kumar GuptaNo ratings yet

- DBN-Sheet-Recovery-Schemes-ComparisonDocument1 pageDBN-Sheet-Recovery-Schemes-Comparisonvictoria upindiNo ratings yet

- Tories Double Number of Big City Donors in Five Years: Coping With $50 Oil An Atrocity Too Far Credit WatchDocument34 pagesTories Double Number of Big City Donors in Five Years: Coping With $50 Oil An Atrocity Too Far Credit WatchstefanoNo ratings yet

- 2017 Church Finance Financial ManagementDocument49 pages2017 Church Finance Financial ManagementNeil RawlsNo ratings yet

- Fitch Rating Report For Hamden, CT Aug 2021Document6 pagesFitch Rating Report For Hamden, CT Aug 2021Helen BennettNo ratings yet

- US Internal Revenue Service: p530 - 2000Document12 pagesUS Internal Revenue Service: p530 - 2000IRSNo ratings yet

- DUP Rising Challenge 150dpiDocument14 pagesDUP Rising Challenge 150dpiLiban SwedenNo ratings yet

- October 2010 NewsletterDocument2 pagesOctober 2010 NewsletterKen BillburgNo ratings yet

- Dear Friends,: Reed Pleased Budget Completed Disappointed With Some DetailsDocument4 pagesDear Friends,: Reed Pleased Budget Completed Disappointed With Some DetailsPAHouseGOPNo ratings yet

- Illinois Budget and New Bills Benefit School Districts - Impact of Gambling and Legalized Marijuana Are UncertainDocument6 pagesIllinois Budget and New Bills Benefit School Districts - Impact of Gambling and Legalized Marijuana Are UncertainScott FornekNo ratings yet

- Tax 2011Document42 pagesTax 2011murabitomNo ratings yet

- Fresh Start Housing SchemeDocument5 pagesFresh Start Housing Schemecharmeyan1scribdNo ratings yet

- Income & Dividends of S Co. Cost vs Equity MethodDocument2 pagesIncome & Dividends of S Co. Cost vs Equity MethodLeonardo MercaderNo ratings yet

- Klavens SSC Energy Workshop 4-29-2010Document19 pagesKlavens SSC Energy Workshop 4-29-2010MAPC Data ServicesNo ratings yet

- Operating Investing Return FinancingDocument3 pagesOperating Investing Return FinancingAryan LeeNo ratings yet

- Livingston County 2024 Proposed BudgetDocument395 pagesLivingston County 2024 Proposed BudgetThe Livingston County NewsNo ratings yet

- State of The District's Budget and Finances (Final)Document17 pagesState of The District's Budget and Finances (Final)aaron4220No ratings yet

- Spring Budget Newsletter Mar 2010 Issue CP3Document6 pagesSpring Budget Newsletter Mar 2010 Issue CP3gmigukNo ratings yet

- Taxable Income Lecturer: Mr. S.RameshDocument4 pagesTaxable Income Lecturer: Mr. S.RameshthineshlaraNo ratings yet

- Visit To File Your Income Tax Return: S.NO. Particulars Amount (In RS.)Document4 pagesVisit To File Your Income Tax Return: S.NO. Particulars Amount (In RS.)Sandeep SinghNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- A Submission to the Government of Canada on the Subject of Poverty ReductionFrom EverandA Submission to the Government of Canada on the Subject of Poverty ReductionNo ratings yet

- Accounting Manager or Financial Reporting or Financial ReportingDocument4 pagesAccounting Manager or Financial Reporting or Financial Reportingapi-121650574No ratings yet

- Another Stupid Letter From Larry FinkDocument2 pagesAnother Stupid Letter From Larry FinkCODEPINKNo ratings yet

- Test Bank For Functional Performance in Older Adults 4th by BonderDocument3 pagesTest Bank For Functional Performance in Older Adults 4th by Bonderchompbowsawpagb8No ratings yet

- LAC - Sub-Committee - Retirement Age Recommendations - FINAL - 9oct18Document18 pagesLAC - Sub-Committee - Retirement Age Recommendations - FINAL - 9oct18BernewsAdminNo ratings yet

- PF1 Chapter 5 SlidesDocument46 pagesPF1 Chapter 5 SlidesNamie NamieNo ratings yet

- Audit Practice ExamDocument17 pagesAudit Practice ExamNoel CaingletNo ratings yet

- IRS Publication on Community Property Tax RulesDocument16 pagesIRS Publication on Community Property Tax RulesgxperryNo ratings yet

- 2.4.4 Office Manual Iv - Vol. 4Document391 pages2.4.4 Office Manual Iv - Vol. 4KuldipSonowalNo ratings yet

- Indeminity BondDocument3 pagesIndeminity BondAli KhanNo ratings yet

- Displine and Loss of EmploymentDocument64 pagesDispline and Loss of Employmentmundukuta chipunguNo ratings yet

- Schedule of Service Charges and Fees: Name of The Bank Allahabad BankDocument5 pagesSchedule of Service Charges and Fees: Name of The Bank Allahabad BankmodijiNo ratings yet

- Salary: IncomeDocument24 pagesSalary: IncomeSonu HashmiNo ratings yet

- Lec 3 SalaryDocument28 pagesLec 3 SalaryManasi PatilNo ratings yet

- HRM 10 Ech 13Document44 pagesHRM 10 Ech 13denden007No ratings yet

- VP Director Employee Benefits in NYC Resume Nancy PalmesinoDocument2 pagesVP Director Employee Benefits in NYC Resume Nancy PalmesinoNancyPalmesinoNo ratings yet

- Summary of Benefits SssDocument2 pagesSummary of Benefits SssGracee Ramat100% (1)

- Church Pension Group Annual Report 2017Document35 pagesChurch Pension Group Annual Report 2017TheLivingChurchdocsNo ratings yet

- Deductions From Gross IncomeDocument3 pagesDeductions From Gross IncomeKezNo ratings yet

- Conjugal Partnership of GainsDocument34 pagesConjugal Partnership of GainsDemi LewkNo ratings yet

- Andhra Pradesh Implements Modified Automatic Advancement SchemeDocument11 pagesAndhra Pradesh Implements Modified Automatic Advancement SchemerajaNo ratings yet

- Maternity Allowance GuideDocument47 pagesMaternity Allowance GuidergicuNo ratings yet

- Àymz Ìr D D XZM Moozm: Pradhanmantri Vaya Vandana YojanaDocument12 pagesÀymz Ìr D D XZM Moozm: Pradhanmantri Vaya Vandana YojanaEng Ravi Kant SharmaNo ratings yet

- FAQs For Coal IndiaDocument4 pagesFAQs For Coal IndiabhishmNo ratings yet

- Macquarie Pension Manager II Application Form - Collins, Patrick - 19122019 PDFDocument42 pagesMacquarie Pension Manager II Application Form - Collins, Patrick - 19122019 PDFSandy Oriño - MoncanoNo ratings yet

- Retirement Planning Calculator - MR Money TVDocument6 pagesRetirement Planning Calculator - MR Money TVCath CNo ratings yet

- Epfo Demo PageDocument2 pagesEpfo Demo PageThe HackCodeNo ratings yet

- HW Chapter 20Document2 pagesHW Chapter 20Thư LuyệnNo ratings yet

- Three categories of unclaimed moneys under Unclaimed Moneys Act 1965Document3 pagesThree categories of unclaimed moneys under Unclaimed Moneys Act 1965Syazwani RazakNo ratings yet

- NPS Benefits Employers Low Cost Retirement SavingsDocument10 pagesNPS Benefits Employers Low Cost Retirement SavingsSudeep KulkarniNo ratings yet

- 2021 Riverside County Pension Advisory Review Committee ReportDocument16 pages2021 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet