Professional Documents

Culture Documents

Integration of FS Analysis Techniques

Uploaded by

Robert LaneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Integration of FS Analysis Techniques

Uploaded by

Robert LaneCopyright:

Available Formats

INTEGRATION OF FINANCIAL STATEMENT ANALYSIS

TECHNIQUES

LOS 20.a: Demonstrate the use of a framework for the analysis of

financial statements, given a particular problem, question, or purpose

(e.g., valuing equity based on comparables, critiquing a credit rating,

obtaining a comprehensive picture of financial leverage, evaluating the

perspectives given in managements discussion of financial results).

The basic financial analysis framework involves:

Step Input Output

Perspective of the analyst (e.g.,

evaluating a debt/equity investment or Purpose statement

1. Establish the issuing a credit rating) Specific questions to be answered

objectives Needs or concerns communicated by the Nature and content of the final report

client or supervisor Timetable and resource budget

Institutional guidelines

Financial statements

2. Collect data Communication with management, Organized financial information

suppliers, customers, and competitors

Adjusted financial statements

Common-size statements

3. Process data Data from Step 2

Ratios

Forecasts

4. Analyze data Data from Steps 2 and 3 Results

5. Develop and Report answering questions posed in Step

Results from analysis

communicate 1

Published report guidelines

conclusions Recommendations

6. Follow up Periodically updated information Updated analysis and recommendations

LOS 20.b: Identify financial reporting choices and biases that affect the

quality and comparability of companies financial statements and

explain how such biases may affect financial decisions.

LOS 20.e: Analyze and interpret how balance sheet modifications,

earnings normalization, and cash flow statement related

modifications affect a companys financial statements, financial

ratios, and overall financial condition.

The analysis focuses on the following:

Sources of earnings and return on equity

Asset base

Capital structure.

Capital allocation decisions.

Earnings quality and cash flow analysis.

Market value decomposition.

Off-balance-sheet financing.

Anticipating changes in accounting standards.

Sources of earnings and return on equity

Analyze using Du Pont Equation:

When adjusting for Investment in Associate under Equity Method:

1. Tax Burden Adjust NI for Income for Investment

2. EBT/EBIT Same (as without investment in Associate)

3. EBIT/Revenue Same (as without investment in Associate)

4. Revenue/Avg. Assets Adjust Avg. Assets for Investment in Associate

5. Avg. Assets/ Avg. Equity Although it should be adjusted, but since we do

not whether investment in Associate is financed through Equity, it would not

be prudent to adjust assets and equity for investment amount. This ratio is

thus assumed the same (as without investment in Associate)

Final Ratio after adjustment for Associate in Investment will not be equal to either

(NI Income from Assc.) / (Avg. Equity) or (NI Income from Assc.) / (Avg. Equity

adjusted for Inv. In Assc.) because of #5.

Asset base

Conduct common-size Analysis

Examine the composition of the balance sheet (i) Item-wise and (ii) over

time.

For Manufacturing firms, investments in goodwill/intangible should not be too

high.

If goodwill through acquisitions consider possibility of future impairments

Capital Structure

A firms capital structure must be able to support managements strategic

objectives as well as to allow the firm to honor its future obligations.

See composition of ST Debt, LT Debt, other liabilities and Equity

Some Liabilities may not require cash outflow (employee benefits, deferred

taxes etc.)

Also conduct Ratio analysis

Capital allocation decisions (Allocation to Business Segments):

A business segment is a portion of a larger company that accounts for more

than 10% of the companys revenues or assets, and is distinguishable from

other line(s) of business

Limited disclosure for segment-wise information required under U.S.

GAAP/IFRS but the disclosures are valuable in identifying each segments

contribution

Ratio of proportional CAPEX to proportional assets for each segment, If >1,

indicates the firm is growing the segment by allocating a greater percentage

of its CAPEX to that segment

By comparing the EBIT margin contributed by each segment to its ratio of

capital expenditure proportion to asset proportion, we can determine if the

firm is investing its capital in its most profitable segments.

Segmental cash flow data is generally not reported. We can, however,

approximate cash flow as EBIT plus depreciation and amortization to

calculate Cashflow/Avg Assets for each segment

Earnings quality and cash flow analysis.

Earnings quality refers to the persistence and sustainability of a firms

earnings.

We can disaggregate earnings into their cash flow and accruals components

using either a balance sheet approach or a cash flow statement approach.

With either approach, the ratio of accruals to average net operating assets

can be used to measure earnings quality.

Balance Sheet approach:

Accruals = Change in Net Operating Assets or ( NOA) or (NOAEND NOABEG)

NOA = Operating Assets (T.Assets cash/equivalents) Operating Liabilities

(T.Liabilites ST or LT Debt)

Accrual Ratio (for comparability in case of size differences) = NOA/Avg.

NOA

Cashflow approach:

Accruals = NI CFO CFI (CF from investing activities)

[careful for classification difference of Int/Div under IFRS (CFO or CFF)/GAAP

(CFO)]

Accrual Ratio (for comparability in case of size differences) = (NI CFO

CFI)/Avg. NOA

Interpretation of both ratios is the same: the lower the ratio, the higher the

earnings quality. Furthermore, wide variations in Accrual Ratio indicates

earnings manipulation

Earnings are considered higher quality when confirmed by cash flow. Cash

flow can be compared to operating Income by adding back cash paid for

interest and taxes to operating cash flow. (Cash generated from Operations

(CGO) = Operating Cash flow + Cash Interest paid + Cash Taxes paid = EBIT

+ NCC WCC ). Be Careful when adding back I and T in case of IFRS because

they may have been classified as Financing Activities

CGO/Operating Income close to or greater than 1 is good

Cash Return/Total Assets is useful in determining whether recent acquisition

were justified. If increasing then justified

Cash flow to reinvestment Ratio = CGO/CAPEX ( cash generated per unit

CAPEX, good)

Cash flow to Total Debt = CGO/Total Debt (at current CGO, how many years

will the company take to repay entire debt, indicates level of leverage,

good)

Cash flow interest coverage = CGO/cash interest paid (Cash-based interest

coverage ratio, good)

Market value decomposition.

In case of investment in subsidiary or affiliate, it may be beneficial to

determine the standalone value of the parent

The implied value of the parent (disregarding subsidiary) = MV Parent

Company Pro-rata share of MV Associate. (if Sub. on FCY Stock Exchange;

convert to Parents reporting currency)

Implied P/E of the parent indicates whether Parent is over/under-valued

compared to peers

Market Cap ( Parent )Prorata Market Cap ( )

Implied P/ E=

( Parent )Prorata ( )

LOS 20.c: Evaluate the quality of a companys financial data and

recommend appropriate adjustments to improve quality and

comparability with similar companies, including adjustments for

differences in accounting standards, methods, and assumptions.

The balance sheet should be adjusted for off-balance-sheet financing

activities (activities not reported on BS).

Capitalize operating leases for analytical purposes by increasing assets and

liabilities by the present value of the remaining lease payments. Also, adjust

the income statement by replacing rent expense with depreciation expense

on the lease asset and interest expense on the lease liability. (note that in

the early years of a finance lease, Dep. and Int. expense will exceed lease

payment)

Capitalizing a Finance Lease will increase leverage and Debt/Equity and

decrease interest Coverage

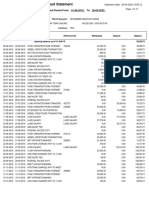

Befor

5-Year Operating Lease ($ Mn) e After

Term 5 Debt 21.75 30.85

Interest 10% Equity 50.19 50.19

Rental Payment

($Mn) 2.40 Assets 71.94 81.04

PV ($Mn) 9.10 EBIT 4.16 4.74*

Int 1.40 2.31

=4.16 + 2.4 (rental) - 1.82

Finance Lease (dep)

Balance Sheet

Assets (BS) +9.10 Ratios

Assets/Equ

Liabilities (BS) +9.10 ity 1.43 1.61

Debt/Equit

Income Statement y 0.43 0.61

EBIT/Intere

Dep Exp (IS) +1.82 st 2.97 2.05

Int Exp (IS) +0.91

Other examples of off-balance-sheet financing are debt guarantees, sales of

receivables with recourse, and take-or-pay agreements. In each case, the

analytical adjustment is similar i.e. increase assets and liabilities by the

amount of the transaction that is off-balance-sheet.

LOS 20.d: Evaluate how a given change in accounting standards,

methods, or assumptions affects financial statements and ratios.

Users must be aware of the proposed changes in accounting standards

because of the financial statement effects and the potential impact on a

firms valuation. (esp. in coming years as IFRS and GAAP converge)

FASB has generally eliminated operating lease. In most cases, firms are

required to capitalize leases. Effect Leverage ; compliance to debt

covenants more difficult.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Darden Case Book 2018-2019 PDFDocument178 pagesDarden Case Book 2018-2019 PDFmansi100% (1)

- Multinational OperationsDocument8 pagesMultinational OperationsRobert LaneNo ratings yet

- Asimov Quick MathsDocument190 pagesAsimov Quick MathsDani Ibrahim100% (2)

- Next Step GMAT E BookDocument44 pagesNext Step GMAT E BookRobert LaneNo ratings yet

- Chess FundamentalsDocument205 pagesChess FundamentalsRobert LaneNo ratings yet

- The Triggers of Sexual Desire - Men Vs WomenDocument4 pagesThe Triggers of Sexual Desire - Men Vs WomenRobert LaneNo ratings yet

- Determination Thar CoalDocument45 pagesDetermination Thar CoalRobert LaneNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IAS 34 Interim Financial Reporting PDFDocument18 pagesIAS 34 Interim Financial Reporting PDFChristian Blanza LlevaNo ratings yet

- Problem 1 San Pedro: AssetsDocument9 pagesProblem 1 San Pedro: AssetsGastelyn JacintoNo ratings yet

- Instance ShreeDocument131 pagesInstance ShreesandyNo ratings yet

- JMP Securities - ORCC - Initiation - Initiating Coverage of Industry - 50 PagesDocument50 pagesJMP Securities - ORCC - Initiation - Initiating Coverage of Industry - 50 PagesSagar PatelNo ratings yet

- HinoDocument14 pagesHinoOmerSyedNo ratings yet

- Air Thread ReportDocument13 pagesAir Thread ReportDHRUV SONAGARA100% (2)

- Ferrari PDFDocument16 pagesFerrari PDFJuditNémethNo ratings yet

- Vaswani Ipo Scam: Creating A False Demand-The Company Did Not Generate at The Beginning But Gained SubscriptionsDocument2 pagesVaswani Ipo Scam: Creating A False Demand-The Company Did Not Generate at The Beginning But Gained SubscriptionsNawazish KhanNo ratings yet

- The In-Depth Guide To Reading A Value Line Research Report PDFDocument24 pagesThe In-Depth Guide To Reading A Value Line Research Report PDFAlvaro Ramirez QNo ratings yet

- Meghna Cement Mills 2009Document50 pagesMeghna Cement Mills 2009panna000% (1)

- Calculating Profit - Extra ExercisesDocument4 pagesCalculating Profit - Extra ExercisesРустам РажабовNo ratings yet

- "Company Analysis-Hul & Marico LTD.": Financial Accounting Project Report ONDocument18 pages"Company Analysis-Hul & Marico LTD.": Financial Accounting Project Report ONarushiNo ratings yet

- ESD Forms of Business. - 054422Document9 pagesESD Forms of Business. - 054422Kudakwashe ChareraNo ratings yet

- Sample ESOP ReportDocument18 pagesSample ESOP Reportsathish_bilagiNo ratings yet

- Corporate Restructuring StrategyDocument35 pagesCorporate Restructuring StrategyJay PatelNo ratings yet

- Michael Pierro 60787467 ENGG433 Quiz 1Document1 pageMichael Pierro 60787467 ENGG433 Quiz 1Mike PierroNo ratings yet

- 5-NMIMS Banking 5 of 5Document21 pages5-NMIMS Banking 5 of 5raghav singhalNo ratings yet

- Conceptual Framework of AccountingDocument10 pagesConceptual Framework of AccountingJimbo ManalastasNo ratings yet

- Chapter - 4 Organization and Functioning of Securities MarketsDocument9 pagesChapter - 4 Organization and Functioning of Securities MarketsFarah NazNo ratings yet

- Calpine Power ProjectDocument21 pagesCalpine Power ProjectrohitmahaliNo ratings yet

- MashoodnasirDocument17 pagesMashoodnasirmashood nasirNo ratings yet

- Introduction To Companies Act 1956Document35 pagesIntroduction To Companies Act 1956Gouri ShankarNo ratings yet

- Islami Com Insurance-P-353Document383 pagesIslami Com Insurance-P-353Rumana SharifNo ratings yet

- Head Office Application For Empanelment of ValuersDocument8 pagesHead Office Application For Empanelment of ValuersMayur MukatyNo ratings yet

- Cfas Quiz 1 2 3 4Document47 pagesCfas Quiz 1 2 3 4JONATHAN LANCE JOBLENo ratings yet

- Derivatives CfaDocument3 pagesDerivatives CfavNo ratings yet

- Base de Datos Quala y ColombinaDocument16 pagesBase de Datos Quala y ColombinaSARETH VIVIANA CABANA SANCHEZNo ratings yet

- Definition of 'Amortizing Swap'Document4 pagesDefinition of 'Amortizing Swap'DishaNo ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument12 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- Tugas Akl Kelompok 2 - Chapter 17Document27 pagesTugas Akl Kelompok 2 - Chapter 17Viky Munyati100% (1)