Professional Documents

Culture Documents

Michael Pierro 60787467 ENGG433 Quiz 1

Uploaded by

Mike PierroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Michael Pierro 60787467 ENGG433 Quiz 1

Uploaded by

Mike PierroCopyright:

Available Formats

MICHAEL PIERRO 6078746

Varanasi Ltd. qty units Industry Average

Balance Sheet a) Quick ratio 1.00 :1 1.5:1

2021 2020 b) Current ratio 1.43 :1 2.0:1

Assets ci) Accounts receivable turnover 3.37 times/ year 8 times

Cash $ 6,000 $ 5,000 cii) Average collection period 108.33 days 45.63 days

Accounts receivable (net) $ 22,000 $ 24,300 di) Inventory turnover 5.00 times/ year 10 times

Inventory $ 12,000 $ 14,000 dii) days to sell inventory 73.00 days 36.5 days

Land $ 25,000 $ 25,000

Buildings $ 80,000 $ 80,000

Accum. Depreciation - buildings -$ 33,600 -$ 32,000

Total Asset $ 111,400 $ 116,300

Liabilities and Equity

Accounts payable $ 28,000 $ 25,900

Common stock $ 60,000 $ 60,000

Retained earning $ 23,400 $ 20,000

Total liabilities & Equity $ 111,400 $ 105,900

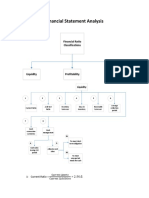

CASH + SHORT TERM INVESTMENTS + NET RECEIVABLES

QUICK RATIO (FY21) =

CURRENT LIABILITIES

CURRENT ASSETS

Current ratio (FY21) =

CURRENT LIABILITIES

NET CREDIT SALES

Accounts receivable turnover (FY20-21) =

AVG NET ACCOUNTS RECEIVABLE

365

Average collection period =

accounts receivable turnover

COGS

Inventory turnover =

Average inventory

365

Days to sell inventory =

Inventory turnover

You might also like

- Using The Following Financial Information Fill in The Table That FollowsDocument3 pagesUsing The Following Financial Information Fill in The Table That FollowsDevang ShetyeNo ratings yet

- Assignment 1a PDFDocument2 pagesAssignment 1a PDFUmaima Ali100% (1)

- Case Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, IncDocument3 pagesCase Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, Inchelsamra0% (2)

- Name of The Student: Student ID: Course: CRN: Instructor's Name: DateDocument14 pagesName of The Student: Student ID: Course: CRN: Instructor's Name: DateM shayan JavedNo ratings yet

- Financial Ratios 2017Document5 pagesFinancial Ratios 2017Marian PajarNo ratings yet

- Barry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Document11 pagesBarry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Akuw AjahNo ratings yet

- Ratio Analysis Review QuestionsDocument5 pagesRatio Analysis Review QuestionsPASTORYNo ratings yet

- Working Capital Management (Divya Jadi Booti)Document61 pagesWorking Capital Management (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisYousab KaldasNo ratings yet

- Ch.17 HW Acc PDFDocument2 pagesCh.17 HW Acc PDFyizhou FengNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- Cross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameDocument7 pagesCross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameRebecca Fady El-hajjNo ratings yet

- Quizzes - Chapter 5 - Analysis and Interpretation of Financial StatementsDocument5 pagesQuizzes - Chapter 5 - Analysis and Interpretation of Financial StatementsAmie Jane MirandaNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Cashflow Exercise - RocastleDocument1 pageCashflow Exercise - RocastleAbrashiNo ratings yet

- Razelle Ann B. Dapilaga 11 Abm, Peter DruckerDocument3 pagesRazelle Ann B. Dapilaga 11 Abm, Peter DruckerJasmine ActaNo ratings yet

- Receivables Sales/365: Lahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18Document3 pagesReceivables Sales/365: Lahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18SinpaoNo ratings yet

- Test 2 Financial MGTDocument4 pagesTest 2 Financial MGTBervie RondonuwuNo ratings yet

- FIN254 Assignment# 1Document2 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- Intro To F.M Assignment LlllsssssssssssDocument3 pagesIntro To F.M Assignment LlllsssssssssssHarmayonNo ratings yet

- Test 2 Financial - Analysis (Bervie Rondonuwu)Document5 pagesTest 2 Financial - Analysis (Bervie Rondonuwu)Bervie RondonuwuNo ratings yet

- JKON Financial Report Study NotesDocument34 pagesJKON Financial Report Study NotesJessica BernaciliaNo ratings yet

- 2 Ratio AnalysisDocument24 pages2 Ratio AnalysisLara Camille CelestialNo ratings yet

- PCOA007 - Exercise - Module 3 Part 2Document3 pagesPCOA007 - Exercise - Module 3 Part 2Eau Claire DomingoNo ratings yet

- Consolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument4 pagesConsolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsMaryjoy Sarzadilla Juanata100% (1)

- Installment Sales NotesDocument19 pagesInstallment Sales NotesTrixie HicaldeNo ratings yet

- IS - Notes (Part1)Document14 pagesIS - Notes (Part1)Andrea Marie CalmaNo ratings yet

- Module 2 Lesson 3 Ratio AnalysisDocument24 pagesModule 2 Lesson 3 Ratio AnalysisLara Camille CelestialNo ratings yet

- Excel 1 - Common Sized Financial Statements - IrvinDocument2 pagesExcel 1 - Common Sized Financial Statements - Irvinapi-581024555No ratings yet

- 1 Courier C128574 R3 TCK0 ADocument2 pages1 Courier C128574 R3 TCK0 AAgz HrrfNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Worksheet 2 Statement of Financial Position Question With SolutionDocument3 pagesWorksheet 2 Statement of Financial Position Question With SolutionNayaz EmamaulleeNo ratings yet

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Document154 pages04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNo ratings yet

- ACTIVITY # 1 - Financial Statement Analysis and RatioDocument2 pagesACTIVITY # 1 - Financial Statement Analysis and RatioSabrinaNo ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisJoy ConsigeneNo ratings yet

- Annual Report: Balance SheetDocument2 pagesAnnual Report: Balance Sheetdummy GoodluckNo ratings yet

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- Accounting 20Document5 pagesAccounting 20Kenshin HayashiNo ratings yet

- Assignment Financial Management: Student Id Unit CodeDocument7 pagesAssignment Financial Management: Student Id Unit CodeAdrian ContilloNo ratings yet

- Annual Report: Balance SheetDocument2 pagesAnnual Report: Balance Sheetshruthi sainathNo ratings yet

- Financial Analysis ExercisesDocument1 pageFinancial Analysis ExercisesSpencer MosquisaNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- Zach Industries Financial Ratio AnalysisDocument2 pagesZach Industries Financial Ratio AnalysisCarla RománNo ratings yet

- MAS311 Financial Management Exercises Financial Statement AnalysisDocument4 pagesMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Financial Management - 1 PDFDocument85 pagesFinancial Management - 1 PDFKingNo ratings yet

- Analysis of Financial Statements - Practice QuesitonsDocument3 pagesAnalysis of Financial Statements - Practice QuesitonsShakeel IqbalNo ratings yet

- Ej 2 Cap 3 Mayers CanvasDocument2 pagesEj 2 Cap 3 Mayers CanvasAlvaro LopezNo ratings yet

- Financial RatiosDocument9 pagesFinancial RatiosEdelvies Mae BatawangNo ratings yet

- Niña Joy L. Arevalo BSMA II-B 3-1. Days Sales OutstandingDocument5 pagesNiña Joy L. Arevalo BSMA II-B 3-1. Days Sales OutstandingAnimeliciousNo ratings yet

- Sadecki Corp ratios reveal improved profitabilityDocument9 pagesSadecki Corp ratios reveal improved profitabilitymohitgaba19No ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Peta BF JhayDocument10 pagesPeta BF JhayJhay Christopher GallatoNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Overall TemplateDocument5 pagesOverall TemplateUsman GhaniNo ratings yet

- Summer Training Project TopicDocument24 pagesSummer Training Project Topichoneygoel13No ratings yet

- Spring 2024 EFIN 403 (01) Syllabus 09 12 2023Document3 pagesSpring 2024 EFIN 403 (01) Syllabus 09 12 2023EDA SEYDINo ratings yet

- Payterm and payer detailsDocument1 pagePayterm and payer detailsEngels Garcia67% (9)

- Inter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)Document176 pagesInter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)pradeep ozaNo ratings yet

- RajasthanDocument230 pagesRajasthanRishi WadhwaniNo ratings yet

- Packing ListDocument1 pagePacking ListAdmin BehalNo ratings yet

- Finance E2-E3-Financial ManagementDocument39 pagesFinance E2-E3-Financial Managementpintu_dyNo ratings yet

- Project Cost Management April 2021Document189 pagesProject Cost Management April 2021bharathiNo ratings yet

- That Global Free Trade-1Document1 pageThat Global Free Trade-1Rona100% (1)

- Bank Reconciliation StatementsDocument25 pagesBank Reconciliation StatementsVernan ZivanaiNo ratings yet

- 6 Ways To Measure Cash FlowDocument3 pages6 Ways To Measure Cash FlowReza HaryoNo ratings yet

- APM-MBA Supply Chain Professional with 10+ years experienceDocument2 pagesAPM-MBA Supply Chain Professional with 10+ years experienceaizy_786No ratings yet

- Anito-Ahmed Al-Salalah-Oman PDFDocument3 pagesAnito-Ahmed Al-Salalah-Oman PDFShaikh MohammedHanifSultanNo ratings yet

- Principles of LawDocument72 pagesPrinciples of LawMakaha Rutendo100% (1)

- Variableabsorption CostingDocument77 pagesVariableabsorption Costingandrea arapocNo ratings yet

- TechnotronicsDocument1 pageTechnotronicsviral patelNo ratings yet

- Impact of Rice Tariffication Law in Selected Rice Farmers in Nueva Ecija, PhilippinesDocument7 pagesImpact of Rice Tariffication Law in Selected Rice Farmers in Nueva Ecija, PhilippinesIJAERS JOURNALNo ratings yet

- MerchandisingDocument13 pagesMerchandisingrvaraprasadNo ratings yet

- Troia VIDocument38 pagesTroia VIrahad_olNo ratings yet

- Hershey India Private LimitedDocument9 pagesHershey India Private LimitedBharath Raj SNo ratings yet

- Fundamentals of Capital Budgeting: Learning Packet 1Document17 pagesFundamentals of Capital Budgeting: Learning Packet 1jenniferNo ratings yet

- ECGC EXPORT SCHEMES: MATURITY FACTORING, OVERSEAS INVESTMENT GUARANTEE AND MOREDocument5 pagesECGC EXPORT SCHEMES: MATURITY FACTORING, OVERSEAS INVESTMENT GUARANTEE AND MORERizwan Kondkari0% (1)

- Taxation IDocument37 pagesTaxation ISarfraz AhmedNo ratings yet

- KSFTADocument522 pagesKSFTAShane CharltonNo ratings yet

- Understand Customs Duty in IndiaDocument17 pagesUnderstand Customs Duty in IndiaMubbashir Khan RanaNo ratings yet

- VAT FEATURESDocument3 pagesVAT FEATURESSiva Subramanian100% (2)

- CHAPTER 14 INTEREST RATE AND CURRENCY SWAPS SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSDocument15 pagesCHAPTER 14 INTEREST RATE AND CURRENCY SWAPS SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSBijay AgrawalNo ratings yet

- Tax 01 Introduction To Consumption TaxesDocument3 pagesTax 01 Introduction To Consumption TaxesShiela LlenaNo ratings yet

- Ca. Prabin Raj Kafle: Summary of Custom Act, 2064 & Custom Rules, 2064Document77 pagesCa. Prabin Raj Kafle: Summary of Custom Act, 2064 & Custom Rules, 2064Amrit NeupaneNo ratings yet

- Solution Manual For Financial Management Theory and Practice 14th Edition by BrighamDocument28 pagesSolution Manual For Financial Management Theory and Practice 14th Edition by BrighamKennethOrrmsqi100% (43)