Professional Documents

Culture Documents

Intro To F.M Assignment Llllsssssssssss

Uploaded by

HarmayonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intro To F.M Assignment Llllsssssssssss

Uploaded by

HarmayonCopyright:

Available Formats

Problem 13.

9 Ratio analysis

Data for Barry Computer Company and its industry average follow.

a. Calculate the indicated ratio for Barry?

b. Construct the extended Du point equation for both Barry and the industry?

c. Outline Barry‘s strengths and weakness as revealed by your analysis?

d. Suppose Morton had doubled its sales as well as its inventories, accounts receivable, and common equity

during 2010. How would that information affect the validity of your ratio analysis? (Hint: Think about

averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.)

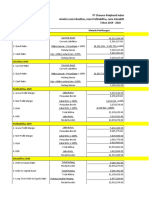

Barry Computer Company: Balance Sheet for Year Ended December

31, 2004 (Thousands of Dollars)

Accounts payable $129,000

Cash $ 77,500 Notes payable 84,000

Receivables 336,000 Other current liabilities 117,000

Inventories 241,500 Total current liabilities $330,000

Total current assets $655,000 Long-term debt 256,500

Net fixed assets 292,500 Common equity 361,000

Total assets $947,500 Total liabilities and equity $947,500

Barry Computer Company: Income Statement for Year Ended December

31, 2004 (Thousands of Dollars)

Sales $1,607,500

Cost of goods sold 1,392,500

Selling, general, and administrative expenses 145,000

Earnings before interest and taxes (EBIT) $ 70,000

Interest expense 24,500

Earnings before taxes (EBT) $ 45,500

Federal and state income taxes (40%) 18,200

Net income $ 27,300

Ratio Barry Industry Average

Current assets/Current liabilities __________ 2.0

Day’s sales outstanding __________ 35.0 days

Sales/Inventory __________ 6.7

Sales/Fixed assets __________ 12.1

Sales/Total assets __________ 3.0

Net income/Sales __________ 1.2%

Net income/Total assets __________ 3.6%

Net income/Common equity __________ 9.0%

Total debt/Total assets __________ 60.0%

Calculation is based on 365 days

total Current Assets 655,000

Current assets/Current liabilities = total Current liabilites ¿ = 330,000 = 1.98: 1

¿

Account Receivable Ending

Day’s sales outstanding = x 365

total Credit Sales

366,000

= x 365 = 83 days

1,607,500

Sales 1,607,500

Sales/Inventory = = = 6 times

inventory 241,500

Sales 1,607,500

Sales/Fixed assets = = = 5.49 times

¿ Assets 292,500

Sales 1,607,500

Sales/Total assets = = = 1.965 times

total Assets 947,500

net income 27,300

Net income/Sales = = = 1.7 %

sales 1,607,500

net income 27,300

Net income/Total assets = x100 = x 100 = 2.88%

total assets 947,500

net income 27,300

Net income/Common equity = x 100 = x100 = 7.5 %

common equity 361,000

2.0x

total debt 586,000 35.0 days

Total debt/Total assets = x 100 = = x 100 =

total Assets 947,500 6.7x

12.1x

61.9 % 3.0x

1.2%

3.6%

Ratio Barry 9.0%

Industry Average 60.0%

Current assets/Current liabilities 1.98x

Day’s sales outstanding 83 days

Sales/Inventory 6.65 x

Sales/Fixed assets 5.49x

Sales/Total assets 1.6965x

Net income/Sales 1.7 %

Net income/Total assets 2.88 %

Net income/Common equity 7.5 %

Total debt/Total assets 61.9 %

COMMENTS

a. It show sufficient current assets level is maintained to pay current liabilities.

b. Company is Collecting its ac receivable on the average in 83 days as compared to

industry 35 days it show that collection department is not doing efficiently and some

measure are to be taken to reduce the outstanding period from 83 days to 35 days.

c. Barry company sales generated power through the fixed assets is less the 15 % of

industry which might be due to following factors.

1. Inferior goods of quality is not better.

2. The behavior of stuff is not good.

3. In efficiently of sales department and marketing department

d. Industry sales is better than Barry company

e. Same interpretation.

f. 1.7 is the better the probabilities of Barry Company is rather better as compared to

industry which show the expenditure is under control.

g. The income generating power of total assets of the company is lower than the inventory

which show either some of assets are idol or not being used efficiency.

h. Net income is lower than the industry shareholders or investors maybe intended to

disinvestment.

i. The capital structure of the company is almost same of the industry.

You might also like

- Cross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameDocument7 pagesCross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameRebecca Fady El-hajjNo ratings yet

- Assignment - 01Document4 pagesAssignment - 01SP VetNo ratings yet

- Chapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Document8 pagesChapter 6 - Activity 2: Problem 1 (Day Sales Outstanding)Ravena ReyesNo ratings yet

- Practice Questions AFS1Document12 pagesPractice Questions AFS1yasirNo ratings yet

- Assignment On Ratio AnalysisDocument3 pagesAssignment On Ratio AnalysisMahmudul Hasan TusharNo ratings yet

- Analysis of Financial Statements - Practice QuesitonsDocument3 pagesAnalysis of Financial Statements - Practice QuesitonsShakeel IqbalNo ratings yet

- Assignment 1a PDFDocument2 pagesAssignment 1a PDFUmaima Ali100% (1)

- Barry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Document11 pagesBarry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Akuw AjahNo ratings yet

- Assignment 2Document14 pagesAssignment 2Bryent GawNo ratings yet

- Faiq Ubaidillah financial analysis ratios Barry companyDocument4 pagesFaiq Ubaidillah financial analysis ratios Barry companyFaiq UbaidillahNo ratings yet

- Neale Corp Financials & RatiosDocument4 pagesNeale Corp Financials & RatioskerryNo ratings yet

- Case Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, IncDocument3 pagesCase Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, Inchelsamra0% (2)

- Zain Fakhry Aziz - Tugas 5Document5 pagesZain Fakhry Aziz - Tugas 5Moe ChannelNo ratings yet

- Afs - Practice Question SolutionsDocument3 pagesAfs - Practice Question SolutionsShakeel IqbalNo ratings yet

- Test 2 Financial MGTDocument4 pagesTest 2 Financial MGTBervie RondonuwuNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Document154 pages04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNo ratings yet

- Financial Ratios QuizDocument4 pagesFinancial Ratios QuizHamieWave TVNo ratings yet

- CH 22062017 1Document9 pagesCH 22062017 1MohitNo ratings yet

- Assignment Financial Management: Student Id Unit CodeDocument7 pagesAssignment Financial Management: Student Id Unit CodeAdrian ContilloNo ratings yet

- McDowell Industries Receivables AnalysisDocument8 pagesMcDowell Industries Receivables AnalysisTABUADA, Jenny Rose V.No ratings yet

- Finance Group AssignmentDocument7 pagesFinance Group AssignmentAreej AJNo ratings yet

- Niña Joy L. Arevalo BSMA II-B 3-1. Days Sales OutstandingDocument5 pagesNiña Joy L. Arevalo BSMA II-B 3-1. Days Sales OutstandingAnimeliciousNo ratings yet

- Rasio Metode Perhitungan Likuiditas 2020Document26 pagesRasio Metode Perhitungan Likuiditas 2020nurazirapfNo ratings yet

- Solution For FM Extra QuestionsDocument130 pagesSolution For FM Extra Questionsdeepu deepuNo ratings yet

- Mayes 8e CH03 Problem SetDocument8 pagesMayes 8e CH03 Problem SetBunga Mega WangiNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument9 pagesRatio Analysis: Liquidity RatiosNikhil GuptaNo ratings yet

- Integrative-Complete ratio analysis of Sterling CompanyDocument6 pagesIntegrative-Complete ratio analysis of Sterling CompanyMariane Joy Valdez BatalonaNo ratings yet

- CH03 ProblemDocument3 pagesCH03 Problemtrangtran01010No ratings yet

- Tugas 2 - Dita Sari LutfianiDocument5 pagesTugas 2 - Dita Sari LutfianiDita Sari LutfianiNo ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- FSA Group AssignmentDocument8 pagesFSA Group AssignmentJOHN RYAN JINGCONo ratings yet

- Ch.17 HW Acc PDFDocument2 pagesCh.17 HW Acc PDFyizhou FengNo ratings yet

- Your Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / KyanDocument6 pagesYour Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / Kyanmohitgaba19No ratings yet

- M1 C2 Case Study WorkbookDocument25 pagesM1 C2 Case Study WorkbookfenixaNo ratings yet

- Asa University Bangladesh: TopicDocument6 pagesAsa University Bangladesh: Topicabed_zaman06No ratings yet

- FIN254 Assignment# 1Document2 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- Financial ratios and calculations for Illinois Paper ProductsDocument14 pagesFinancial ratios and calculations for Illinois Paper ProductsMUHAMMAD AZAM100% (2)

- FtyhtDocument4 pagesFtyhtVamsi ChennuruNo ratings yet

- FIN254 Assignment# 1Document6 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- Quiz MKDocument3 pagesQuiz MKvano aldiNo ratings yet

- Assignment LDocument6 pagesAssignment Lphprcffj2rNo ratings yet

- CH 04Document23 pagesCH 04kmarisseeNo ratings yet

- MAS311 Financial Management Exercises Financial Statement AnalysisDocument4 pagesMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNo ratings yet

- Finance Chapter 3 MathDocument35 pagesFinance Chapter 3 MathTamzid Ahmed AnikNo ratings yet

- UTS / Mid Semester Test Finance Management (M5007) - MBA ITB CCE 58 2018Document28 pagesUTS / Mid Semester Test Finance Management (M5007) - MBA ITB CCE 58 2018DenssNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Practice Set 1 Intro BS ISDocument19 pagesPractice Set 1 Intro BS ISAtul DarganNo ratings yet

- NAS Financial RatiosDocument6 pagesNAS Financial RatiosAzdzharulnizzam AlwiNo ratings yet

- BKM 10e Chap014Document8 pagesBKM 10e Chap014jl123123No ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Financial AnalysisDocument10 pagesFinancial Analysisscholta00No ratings yet

- Test 2 Financial - Analysis (Bervie Rondonuwu)Document5 pagesTest 2 Financial - Analysis (Bervie Rondonuwu)Bervie RondonuwuNo ratings yet

- Questions - RatiosDocument35 pagesQuestions - Ratios7rtqzp2fj8No ratings yet

- Analyze BJ Company ProfitabilityDocument11 pagesAnalyze BJ Company ProfitabilityMUHAMMAD AZAMNo ratings yet

- Republic CompanyDocument2 pagesRepublic CompanyLy CostalesNo ratings yet

- BMA 12e SM CH 28 Final PDFDocument13 pagesBMA 12e SM CH 28 Final PDFNikhil ChadhaNo ratings yet

- Answers To Problem Sets: Financial AnalysisDocument13 pagesAnswers To Problem Sets: Financial Analysismandy YiuNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- JS Bank of Pakistan Internship ReportDocument59 pagesJS Bank of Pakistan Internship Reportbbaahmad89100% (2)

- Promissory Note Template for Personal LoansDocument4 pagesPromissory Note Template for Personal LoansPaula Gail CarpenaNo ratings yet

- Hindu Marriage FormsDocument4 pagesHindu Marriage Formsgnsr_1984No ratings yet

- LM - Chapter 13Document18 pagesLM - Chapter 13PASCUA RENALYN M.No ratings yet

- Fin 304 Notesfdfhwefudvg Fdre Financial Markets and InstitutionDocument89 pagesFin 304 Notesfdfhwefudvg Fdre Financial Markets and InstitutionAhmed YousufzaiNo ratings yet

- TREATMENT OF DEBT INSTRUMENTS IN BAHRAIN WITH SHARIAH LAWDocument4 pagesTREATMENT OF DEBT INSTRUMENTS IN BAHRAIN WITH SHARIAH LAWAuntorip KarimNo ratings yet

- Capital Structure Decisions in A Period of Economic Intervention Empirical Evidence of Portuguese Companies With Panel DataDocument31 pagesCapital Structure Decisions in A Period of Economic Intervention Empirical Evidence of Portuguese Companies With Panel Dataclelia jaymezNo ratings yet

- Cannon Ball Review Part 2 Cash and ReceivablesDocument30 pagesCannon Ball Review Part 2 Cash and ReceivablesLayNo ratings yet

- HSBC Qatar - Personal Banking TariffDocument16 pagesHSBC Qatar - Personal Banking TariffjoeNo ratings yet

- Loan Document For Test UserDocument11 pagesLoan Document For Test UserBenedict BabuNo ratings yet

- Exercise 4. Perez Company Had The Following Transactions During JanuaryDocument3 pagesExercise 4. Perez Company Had The Following Transactions During JanuaryLysss EpssssNo ratings yet

- A comparative study of investment vs saving risks and opportunitiesDocument48 pagesA comparative study of investment vs saving risks and opportunitiesPRATEEK SINGH100% (1)

- PIH - Arab Bank Digital Flyer - V 05Document5 pagesPIH - Arab Bank Digital Flyer - V 05Edil Derrick CastilloNo ratings yet

- Embedded Derivatives in Host Contracts Under IAS 39Document170 pagesEmbedded Derivatives in Host Contracts Under IAS 39Anonymous JqimV1ENo ratings yet

- International FinanceDocument2 pagesInternational FinanceSK MunafNo ratings yet

- State Bank of India savings account statement from 11 Aug to 26 Oct 2019Document12 pagesState Bank of India savings account statement from 11 Aug to 26 Oct 2019Shalini SinghNo ratings yet

- PF FormDocument8 pagesPF FormRohini GhadgeNo ratings yet

- Negotiable Instruments Law Reviewer QuestionsDocument11 pagesNegotiable Instruments Law Reviewer QuestionsMelgen100% (1)

- CHAPTER 10 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersDocument1 pageCHAPTER 10 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersMichNo ratings yet

- 07 Heinz Private EquityDocument27 pages07 Heinz Private EquityfwfsdNo ratings yet

- The Value of Synergy: Aswath Damodaran 1Document33 pagesThe Value of Synergy: Aswath Damodaran 1Abhishek SinhaNo ratings yet

- Hanson Ski Products - Projected Quarterly Balance Sheets (In $ Thousand)Document5 pagesHanson Ski Products - Projected Quarterly Balance Sheets (In $ Thousand)Farhad KabirNo ratings yet

- CV MUHAMMAD WAQAR - Accounting and FinanceDocument3 pagesCV MUHAMMAD WAQAR - Accounting and FinanceMuhammad Waqar100% (1)

- Tutorial Solution Week 2Document4 pagesTutorial Solution Week 2Arlene Lan100% (1)

- 1 PaySlipDocument1 page1 PaySlipUpal RajNo ratings yet

- Financial Management by Prasanna Chandra IndexDocument1 pageFinancial Management by Prasanna Chandra IndexBhanwar Hudda40% (5)

- 7Document19 pages7Maria G. BernardinoNo ratings yet

- Midterm quiz on tax lawsDocument8 pagesMidterm quiz on tax lawsKurt dela TorreNo ratings yet

- Accounting (10 Marks)Document21 pagesAccounting (10 Marks)fcmitcNo ratings yet

- CHAPTER 11 - PFRS For SMEsDocument40 pagesCHAPTER 11 - PFRS For SMEsarlynajero.ckcNo ratings yet