Professional Documents

Culture Documents

Paramita SDN BHD - Tax Computation For YA 2016 RM Permitted Expenses

Uploaded by

Brenda TanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paramita SDN BHD - Tax Computation For YA 2016 RM Permitted Expenses

Uploaded by

Brenda TanCopyright:

Available Formats

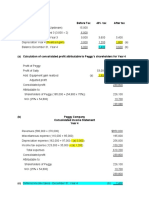

Paramita Sdn Bhd - Tax computation for YA 2016

RM

Permitted expenses:

Directors' fees 200,000

Salaries & wages of employees 350,000

Audit fee 30,000

Secreterial fee 15,000

Telephone charges 10,000

Food & drink (for employees) -

Stationery 5,000

Postage 4,000

Depreciation -

(A) 614,000

Interest 210,000

Rent 300,000

(B) 510,000

Dividends (Malaysia-single tier dividends) 900,000

Dividends (from H-Land) 150,000

Gain from sale of a piece of land 800,000

Gain from sale of shares (investments) 400,000

(C) 2,760,000

RM RM RM

S4 (c) Dividend income

Dividends (Malaysia-single tier dividends) Exempted

Dividends (from H-Land) Exempted

S4 (c) Interest income

Interest 210,000

S4 (d) Rental income

Rent (letting of own office building) 300,000

Less: Expenses

Interest on bank loan (60,000)

Maintenance expenses (90,000) (150,000)

Adjusted income 150,000

Aggregate income 360,000

Less: Fraction of permitted expenses

A x B / 4C = 614,000 x 510,000 / (4 x 2,760,000)

28,364

or 5% of B = 5% x 510000

25,500

Whichever is lower 25,500

Approved donation: within 10% x 360,000 30,000 (55,500)

Total income/ chargeable income 304,500

Tax chargeable/ Tax payable @ 24% 73,080

You might also like

- Critical Success FactorsDocument15 pagesCritical Success FactorsjsdhilipNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- SS1 - Tenang Bhd Financial Statements AnalysisDocument9 pagesSS1 - Tenang Bhd Financial Statements AnalysisAFIZA JASMANNo ratings yet

- Windows 101 Bhd StatementsDocument27 pagesWindows 101 Bhd StatementsShuhada Shamsuddin75% (4)

- Emerald SDN BHDDocument3 pagesEmerald SDN BHDBrenda TanNo ratings yet

- Sage Onion Profit LossDocument3 pagesSage Onion Profit LossLee Li HengNo ratings yet

- Answers To Reviewer in Acctg 2Document3 pagesAnswers To Reviewer in Acctg 2Fatima AsprerNo ratings yet

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Aspire CR - Conso Solution Bank - Nov 21Document25 pagesAspire CR - Conso Solution Bank - Nov 21Richie BoomaNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- CHP 7 Select Text SolutionsDocument8 pagesCHP 7 Select Text SolutionsAditya RoyNo ratings yet

- Prelim Bring Home Exam ResultsDocument12 pagesPrelim Bring Home Exam ResultsMary Joy CabilNo ratings yet

- Module 2 AdjustingDocument11 pagesModule 2 AdjustingCygresy Gomez100% (1)

- PYQ January 2018Document4 pagesPYQ January 2018Nur Amira NadiaNo ratings yet

- Excel Academy Financial StatementsDocument5 pagesExcel Academy Financial Statementsfaith olaNo ratings yet

- Tugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Document6 pagesTugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Iche IcheNo ratings yet

- Tutorial 12Document15 pagesTutorial 12lkaixin 02No ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Afar SolutionDocument2 pagesAfar SolutionTk KimNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- UntitledDocument2 pagesUntitledNur AsnadirahNo ratings yet

- Solution Tax667 - Jun 2016-1Document8 pagesSolution Tax667 - Jun 2016-1Zahiratul QamarinaNo ratings yet

- Tutorial 7 Q1 and Q2 ConsolidationDocument12 pagesTutorial 7 Q1 and Q2 ConsolidationChuah Chong AnnNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- March16 Q4Document1 pageMarch16 Q4SITI NUR DIANA SELAMATNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- 6273 - 21010126079 - Corporate Accounting 2Document15 pages6273 - 21010126079 - Corporate Accounting 2APURVA RANJANNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Multiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)Document4 pagesMultiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)anitaNo ratings yet

- Chapter17 BuenaventuraDocument8 pagesChapter17 BuenaventuraAnonnNo ratings yet

- Project 2 FAR270 SummaryDocument6 pagesProject 2 FAR270 SummaryHaru BiruNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Step 5: Compute Net Income or Net LossDocument29 pagesStep 5: Compute Net Income or Net LossTanvir Islam100% (1)

- 11 Acc 5.26 CH 6 .7 6.9 Memos 2021Document26 pages11 Acc 5.26 CH 6 .7 6.9 Memos 2021ora mashaNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Consolidated Financial Statement for 2016Document39 pagesConsolidated Financial Statement for 2016Sentra SainsNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Calculate interest expense, amortization, bond premium and discount problemsDocument2 pagesCalculate interest expense, amortization, bond premium and discount problemsLeah Mae NolascoNo ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- Bacc210 Assig 1Document6 pagesBacc210 Assig 1TarusengaNo ratings yet

- 100,000 550,000 200,000 50,000 Net Loss: 100,000/.20% 500,000Document3 pages100,000 550,000 200,000 50,000 Net Loss: 100,000/.20% 500,000Alizah BucotNo ratings yet

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- Shinny Jewel C. Vingno BSA-2 Problem 1-18Document7 pagesShinny Jewel C. Vingno BSA-2 Problem 1-18Shinny Jewel VingnoNo ratings yet

- Activity 4-IntAcc1Document2 pagesActivity 4-IntAcc10322-1975No ratings yet

- Tutorial 11 Question 3 Paramita Sdn. BHDDocument2 pagesTutorial 11 Question 3 Paramita Sdn. BHDBrenda TanNo ratings yet

- Market Values and Unrealized Gains/Losses of InvestmentsDocument7 pagesMarket Values and Unrealized Gains/Losses of InvestmentsNatividad, Kered ZilyoNo ratings yet

- Ans June 2018 Far410Document8 pagesAns June 2018 Far4102022478048No ratings yet

- ConvertibleDocument2 pagesConvertibleBrenda TanNo ratings yet

- Strength: SWOT of Proton Holdings BerhadDocument3 pagesStrength: SWOT of Proton Holdings BerhadBrenda TanNo ratings yet

- Critical Success FactorsDocument4 pagesCritical Success FactorsBrenda TanNo ratings yet

- (A) (I) & (Ii) PA Trust RM Distributable IncomeDocument3 pages(A) (I) & (Ii) PA Trust RM Distributable IncomeBrenda TanNo ratings yet

- ConvertibleDocument2 pagesConvertibleBrenda TanNo ratings yet

- At T11 Q4Document4 pagesAt T11 Q4Brenda TanNo ratings yet

- Science Form 2 Notes Chapter 1 Chapter 4Document19 pagesScience Form 2 Notes Chapter 1 Chapter 4Brenda TanNo ratings yet

- Tutorial 11 Question 3 Paramita Sdn. BHDDocument2 pagesTutorial 11 Question 3 Paramita Sdn. BHDBrenda TanNo ratings yet

- Tutorial 12 Chargeable Income Calculation 2015Document2 pagesTutorial 12 Chargeable Income Calculation 2015Brenda TanNo ratings yet

- Nil Nil NilDocument3 pagesNil Nil NilBrenda TanNo ratings yet

- New Microsoft PowerPoint DocumentDocument105 pagesNew Microsoft PowerPoint DocumentBrenda TanNo ratings yet

- At T13 Q3Document5 pagesAt T13 Q3Brenda TanNo ratings yet

- Tut 14 Revision AnswerDocument21 pagesTut 14 Revision AnswerBrenda TanNo ratings yet

- Document 8Document2 pagesDocument 8Brenda TanNo ratings yet

- Document 1Document1 pageDocument 1Brenda TanNo ratings yet

- Modul 2 PDFDocument11 pagesModul 2 PDFKhairul HaqeemNo ratings yet

- TAX T5 Question 1Document2 pagesTAX T5 Question 1Brenda TanNo ratings yet

- AP Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionDocument1 pageAP Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionBrenda TanNo ratings yet

- Document 1Document1 pageDocument 1Brenda TanNo ratings yet

- Document 2Document1 pageDocument 2Brenda TanNo ratings yet

- Document 5Document2 pagesDocument 5Brenda TanNo ratings yet

- Document 1Document1 pageDocument 1Brenda TanNo ratings yet

- Hardner Sci Am FinalDocument4 pagesHardner Sci Am FinalBrenda TanNo ratings yet

- AR Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionDocument1 pageAR Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionBrenda TanNo ratings yet

- Introduction To Accounting and BusinessDocument49 pagesIntroduction To Accounting and BusinessMatthew AlexanderNo ratings yet