Professional Documents

Culture Documents

Capital Budgeting in Corporate Sector PDF

Capital Budgeting in Corporate Sector PDF

Uploaded by

vietanhpsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting in Corporate Sector PDF

Capital Budgeting in Corporate Sector PDF

Uploaded by

vietanhpsCopyright:

Available Formats

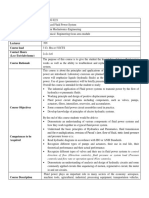

Capital Budgeting in Corporate Sector A Case Study

M. Kannadhasan1 - Dr. R. Nandagopal2

Abstract

In todays ever changing world, the only thing that does not change is change itself.

Change can trigger any corporate growth which can be measured in terms of increase in

investments or sales. A progressive business firm continually needs to expand its fixed assets

and other resources to be competitive in the race. Investment in fixed assets is an important

indicator of corporate growth. The success of the corporate growth in the long run depends

upon the effectiveness with which the management makes capital expenditure decisions. In

the dynamic business environment, making capital budgeting decisions are among the most

important and multifaceted of all management decisions as it represents major commitments

of companys resources and have serious consequences on the profitability and financial

stability. How far the corporate attains financial stability and profitability over a period of

time, while making capital budgeting needs evaluation and is a million dollar issue. In view

of this, this study has made an attempt to analyse the efficiency of the corporate sectors

capital budgeting through their financial statements.

Introduction

In todays ever changing world, the measure d in terms o f ch ange in

only thing that does not change is change investments or sales.

itself. Successful companies are always A prog ressive business fi rm

looking at ways in which they can change continually needs to expand its fixed assets

and develop. Change can trigger corporate and other resources to be competitive in

the race. Investment in fixed assets is an

gro wth and Grow th i s essential for important indicator of corporate growth.

sustaining the viability, dynamism and The success of the corporate in the long

value enhancing capability of a company, run depends upon the effectiveness with

which lead to higher profits and better the which the management makes capital

shareholders value. To achieve the desired expendi ture decisio ns. The finance

manager should ensure that he has

growth, the firm has to be competitive in

explored and identified potentially lucrative

all functional areas especially in financial investment opportunities and proposals and

management which is the back bone of any se lect the best on e based on the

business. Primarily gro wth can be opportunities identified.

1. Faculty Member, Bharathidasan Institute of Management (BIM), Trichy, kannadhasan_m@bim.edu

2. Director, PSG Institute of Management, Coimbatore, e-mail: director@psgim.ac.in

Journal of Contemporary Research in Management, January - March 2008 17

In the dynamic business environ its future performance. In view of this, this

ment, making capital budgeting decisions research provides comprehensive analysis

are among the most important and of the efficiency of the corporate sectors

multifaceted of all management decisions capital budgeting decisions which got

as it represents major commitments of reflected in their financial statements.

companys resources and have serious

consequences on the profitability and Review of Literature

financial stability. Evaluation need to be Over the years, Research on Capital

done for the extent of financial stability

budgeting is well documented in many

achieved by the firms capital budgeting

countries. Some examples of these are in

decisions over a period of time. In view of

USA (Kl amme r, 1972, Gitman and

this, this study has made an attempt to

Forrester, 1977, Cooper et. Al, 1990,

know the efficiency of the corporate sectors

Graham and Harvey 2001& 02, Ryan &

capital budgeting decisions.

Ryan, 2002 Stanley Block, 2005), the UK

Rationale of The Study (Jog & Srivastava, 1995), Asia-Pacific

Region (Wong, Farragher, and Leung, 1987,

The success of any business depends Kester & Chong, 1998, Kester et.al, 1999,)

on the adjustments and adaptations it

China & Dutch (Niels Hermes et. Al, 2005,),

makes in its operations to match the

South Africa (Hall, 2000,), Cyprus (Lazariids

external competitive environment. Swift

, 2004), and India (Prasanna Chandra,

reactio n to the changin g bu sine ss

1975, Porwal, 1976, Pandey, 1989, Rao

environment is ensured only when the

Cherukuri, 1996, Manoj Anand, 2002,

organization is effective in decision-

Sarkar 2004, Lokanandha Reddy Irala,

making in all its operational areas. This

2006, Tamilmani, 2004 & 2007).

is a good sign for the growth-oriented

companies. Growth oriented companies

The research studies so far are mostly

need to invest sizable proportion of its

concerned with the capital budgeting

capital in the fixed assets constantly. Rate

practices in corporate sector with specific

of investments in the corporate sector

focus on appraisal methods, income

depends on the internal growth decisions

measurement, determination of discount

rel atin g to various decisio ns viz.

rate and risk analysis. Almost all the

replacement, expansion, modernization,

introduction of new product lines and also studies used primary data as the basis and

capability of raising resources for financing the analysis was sketchy. Though there

growth. Thus, Capital budgeting decision have been many studies published in

is a major corporate decision because it journals relating to capital budgeting

typically affects the firms business decision in the corporate world, but no study

performance for a long period of time. While has been specifically done on capital

making capital budgeting decisions, the budgeting based on secondary data which

company needs to foresee the impact on could be dealt in this study.

18 Journal of Contemporary Research in Management, January - March 2008

Scope of The Study company from 1998-99 to 2005-06 through

their website and this study was also used

This study is confined to one limited

the directors reports pertaining to fixed

company with eight years study period from

investment decisions made during the

1998-99 to 2005-06 with special reference

study period. The data collected are

to commercial vehicle industry. The study

an alysed w ith the hel p of differe nt

is based on financial data obtained from the

accounting and statistical tools. The

published annual reports. The technique

analysed data are presented in the form of

used for the analysis is historical funds flow

funds flow statement, fixed investment

analysis which has also its own limitations.

analysis statement, fixed investment

growth statement, and statement of

Objectives of The Study

correlation.

This study has the following objectives:

Results & Discussions

1. To know the fixed investment and

financing trend of the company The sample company is the leader of

the commercial vehicle industry over the

2. To assess the growth rate in the fixed past five decades. As regards to its size, the

investment pattern of the company company belongs to the large size category

3. To trace out the influencing factors on with a net tangible fixed assets valuing is

fixed investment and financing trend 10599.75 million (2005-06). The subscribed

of the company capital of the co mpan y re main ed

unchanged till 2004-05, at Rs. 1189

Hypotheses of The Study millions and with a Rs. 33 million increase

in 2005-06. But investments in fixed

Having identified the objectives of this assets have undergone several changes

study, the following hypotheses have been during this period. The manner in which

formulated and tested during the period of the fixed investments have changed and

stu dy: 1. Corre latio n be twee n fi xed the sources of financing are discussed in

investments and the selected internal this part.

factors (sales, profits, depreciation) is not

si gnifican t. 2. Co rre lati on betwe en 1. Fixed investment Analysis Statement:

internal factors (sales, profits, depreciation) During the study period, the purpose of

of this company is not significant investments of this company is for capacity

expansion/up-gradation and R&D. We

Research Methodology observe that out of 8 years, investments

have been financed by internal sources for

The research design of this study is 5 years. Besides the internal sources, this

descriptive in nature. This study is based company have also raised funds from

on secondary data which was obtained from external sources to finance their additional

financial statements published by this fixed investments during 1998-99, 2000-

Journal of Contemporary Research in Management, January - March 2008 19

01, and 2004-05. The second major source consideration and the findings of empirical

of finance is long-term debts from term analysis.

lending institution and banks.

A.Regular/routine Investments:

2. Trends in Fixed Investment: In order Company invests less than 15 per cent of

to discover the fixed investment trend of investments as regular/routine invest ments

for maintenance and replacements and

this company, the rate of increase in fixed

assets during the year has been computed. B.Growth / expansion oriented

In the process of classification, these rates Investments: Company invests more than

are classified into two categories by taking 15 percent consider as grow th and

normal busi ness practices i nto expansion.

Table 1

Fixed Investment Classification Statements

(Figures in Millions)

Financial Year Net Fixed Fixed Assets Percent of Classification

Assets at increased Increase

the beginning during the year

of the year

1998-99 8935.22 1665.49 18.64 G

1999-00 9150.34 1076.98 11.77 R

2000-01 8915.41 1050.12 11.78 R

2001-02 9560.99 1613.16 16.87 G

2002-03 9025.19 1326.53 15.00 G

2003-04 8748.29 792.08 09.05 R

2004-05 8938.46 1796.95 20.10 G

2005-06 9432.71 2426.32 25.72 G

As we can see form the table 2, the 06 with Rs. 2426.32 millions. The highest

annual rate of growth in fixed statements rate of growth is found in the same year

and their classification. In the year 1999- with 25.72 per cent. Overall trend of fixed

00, 2000-01 and 2003-04, the investments investments during the study period is found

represents routine investments category to be increasing with an annual average

for normal maintenance and replacements investment of Rs. 1468.45 millions and

whereas the rest of the years reliable to standard deviations of Rs. 519.76. However

growth and expansion. there are deviations for some years.

The amo unt of i ncre mental Accountable Factors for Fix ed

investments increased its height in 2005- Investment: The purpose of Investments

20 Journal of Contemporary Research in Management, January - March 2008

differs one to another firm. For example, production, and promotion programmes

the purpose of expansion is to meet the provides the demand for the product goes

growing demand for products; the purpose up in the market. This has been proved by

of modernisation helps to reduce the cost this company as it occupies the good

through new production processes; and position in the market. From the analysis,

diversification helps to additions to existing it is clear that the fixed investments and

product line. All these forms help to sales have the close and direct relationship

increase the sales, in turn to increase between each other.

profits of the companies in the long run.

b. Fixed investments and profit: As

In this study, we have tried to correlate

we mentioned above, increase in fixed

each internal factors such as sales, profit

investment is to enhance the earning

and depreciation charges with fixed

capacity of the company. It is clear from

investments. the table 3 where we can find a shift from

loss into profit. There are number of

a. Fixed Investments and sales:

fluctuations with substantially high and

Trends of fixed investments and the sales low levels of the fixed investments and

show the same trend but the per cent of profits during the study period. The

changes are vary during the study period. coefficient of correlation between profits

The coefficient of correlation between sales and fixed investments is found to be 0.43

and fixed investments is found to be 0.60 (see table 3) which is statistical ly

(see table 3) which is statistical ly sig nifi cant at 5 pe r ce nt l evel of

sig nifi cant at 5 pe r ce nt l evel of significance, indicating poor association

sig nifi cance, sugge stin g th at the between the variables. This is mainly due

relationship between the variables is to ine fficient uti lisatio n of fix ed

moderate. Capital budgeting decisions may investments. Hence the management has

increase the sales through increased to improve its utilisation of fixed assets.

Table 2

Statement of Descriptive Statistics & Selected variables

(Figures in Millions)

Financial Year Incremental Fixed Sales Profit Depreciation

Investments

1998-99 1665.49 20450.71 -120.62 690.40

1999-00 1076.98 25987.18 805.86 641.42

2000-01 1050.12 26066.63 913.77 784.41

2001-02 1613.16 26304.48 1172.31 765.02

2002-03 1326.53 30739.95 1634.78 1752.18

2003-04 792.08 39272.73 2773.59 912.63

2004-05 1796.95 48112.82 3108.38 1075.91

2005-06 2426.32 60531.08 3976.11 868.24

Mean 1468.45 34683.20 1783.02 936.28

SD 519.76 13668.07 1377.19 356.61

CV 282.52 253.75 129.47 262.55

Journal of Contemporary Research in Management, January - March 2008 21

c. Fixed investments and depreciation Normally, more the investments in

charges: This is another important fix ed assets, th e hi gher will be the

depreciation charges which help the

internal factor considered to be associated

company for additional investments in

with fixed investments. In our study, we fixed assets. An appropriate method of

found that very poor relationship between depreciation on fixed assets not only helps

the variables (-0.01) and this coefficient is the company to retain the profits and also

statistically insignificant at 5 per cent level for a proper tax planning. But this

of significance. companys utilisation is very poor.

Table 3

Simple Correlation Analysis

Variables Correlation (r) t Value for r Table Value @ 5 D.F Results

Between per cent level

FI & Sales 0.60 4.5 1.895 6 Ho Rejected

FI & Profits 0.43 2.86 1.895 6 Ho Rejected

FI & -0.01 -0.06 1.895 6 Ho Accepted

Depreciation

Sales & 0.97 23.94 1.895 6 Ho Rejected

Profits

Sales & 0.16 0.97 1.895 6 Ho Accepted

Depreciation

Profits & 0.26 1.62 1.895 6 Ho Accepted

Depreciation

d. Sales, profits and depreciation at 5 per cent level of significance. The

ch arges: We have anal yse d the degree of correlation between the sales and

rel atio nshi p be twee n th e variables depreciation (0.16) and between the profits

themselves, we observe a difference and deprecation (0.26) show the low degree

picture. The coefficient of correlation of positive correlation which is significant

between sales and profits is found to be 0.97 at 5 per cent level.

which shows a high degree of positive

rel atio nshi p. The same has tested

statistically, and the result is insignificant

22 Journal of Contemporary Research in Management, January - March 2008

Conclusions References

The incremental investments in fixed 1. Chandra, Prasanna, (1975) Capital

investments show an increasing trend Expenditure Analysis in Practice,

during the study period with an average of Indian Management, July, pp10-13.

Rs. 1468.45 mil lion s an d standard

2. George W. Kester, Rosita P. Chang,

deviations of Rs. 519.76. However the

Eriinda S. Echanis, Shaiahuddin

investments are not uniform through out

Haikal, Mansor Md. Isa, Michael T.

the study period. In this study, we found

Skuiiy, Kai-Chong Tsui, and Chi-Jeng

that the coefficient of correlation between

Wang (1999), Capital Budgeting

incremental fixed assets and sales to be

Practices in the Asia- Pacific Region:

positive and significant. Similarly, the

Australia, Hong Kong, Indonesia,

coefficient of correlation between fixed

Malaysia, Philippines, and Singapore

investments and profit have the moderate

Financial Practice & Education,

relationship and statistically significant.

Spring/Summer, Vol.9, Issue 1, pp 25-

33.

However, the relationship between the

fixed investments and depreciation have 3. Graham, Jo hn R. and H arve y,

the poor relationship and statistically Campbell R. (2001), The Theory and

insignificant. As regards, the sources of Practice of Corporate Finan ce:

funds towards the fixed investments for this Evidence from the Field, Journal of

company are internal sources. Financial Economics, Volume 60,

Issue 2-3, May/June, pp.187-243.

In order to maintain the market

position with its products, every company 4. Graham, Jo hn R. and H arve y,

must produce product as good as, or better Campbell R. (2002), How Do CFOs

than its competitors. This leads to fixed make Capital Budgeting and Capital

investments decisions which can be Structure Decisions?, Journal of

classified into two: routine and expansion. Applied Corporate Finance. Volume15,

Every company has to make routine No.1, Spring. Pp. 8-23.

investments continuously whereas growth

5. Ioannis T Lazariids (2004), Capital

investments are made intermittently. Budgeting Practices: A Survey in the

Firms in Cyprus, Journal of Small

The basic challenging task of fixed

Business Management, 42 (4), pp. 427-

investment decisions lies in the search for

433.

lucrative opportunities and to derive the

benefits in the uncertainty environment 6. Kester, George W & Tsui Kai Chong

in quantitative terms. From the empirical (1998), Capital Budgeting Practices of

analysis, this companys fixed investments Listed Firms in Singapore, Singapore

decisions are wise and shows better fund Management Review, January, Vol.20,

management issue 1, pp 9-23.

Journal of Contemporary Research in Management, January - March 2008 23

7. Klammer T P (1972), Empirical 16. Stanley Block (2005), Are there

Evidence of the Adoption of sophisticated differences in capital budgeting

Capital Budgeting Techniques, Journal procedures between industries? an

of Business, pp337-357. empirical study, The Engineering

Economist, March, Vol. 50, issue 1, pp

8. Laurence G. Gitman and John R.

55-67

Forrester Jr.(1977), A survey of Capital

Budgeting Techniques Used by Major 17. Subhas Ch andra Sarkar (2004),

U.S. Firms, Financial Management, Capital Budgeting decisions in times

Fall, Vol.6, pp66-71. of inflation: an alternative approach,

9. Lokanandha Reddy Irala (2006), The Jou rnal of Acco unti ng and

Financial Management Practices in Finance, Aprial September, Vol.18,

India, fortune Jou rnal of No.2, pp33-38.

International Management, Vol.3,

No.2, July-December, pp83-92. 18. Tamilmani B (2004), A study on

Capital Budgeti ng Practices in

10. Manoj Anand (2002), Corporate Cooperative Spinning Mills in Tamil

Finance Practices in India: A Survey, Nadu, Ph.D Thesis, The Gandhigram

Vikalpa, Vol.27, No.4, October Rurual Institute Deemed University,

December, pp29-56. Gandhigram.

11. Niels Hermes, Peter Smid and Lu Yao 19. Tamilmani B (2007), Formulation,

(2005), Capital Budgeting Practices:

Appraisal, Implementation and

A Comparati ve S tudy of the

Evaluation of Capital Budgeting and its

Netherlands and China, working

performance in Cooperative Spinning

paper series, SOM Research Report,

Mill: an analytical study, The Journal

06E02, Groningen, University of

Groningen, November, available at: of Accounting & Finance, October 2006-

http://som.rug.nl. March 2007, Vol.21, No.1, pp81-94

12. Pandey I M (1989), Capital Budgeting 20. Vijay M Jog & Ashwani K Srivastava

Practices of Indian companies, MDI (1995), Capital Budgeting Practices in

Management Journal, Vol.2, No.1, pp1-15. Corporate Canada, Financial Practice

& Education, Fall/Winter, Vol.5, Issue

13. Porwal L S (1976), Capital Budgeting 2, pp 37-43.

in India, New Delhi: S Chand & Co.

21. William D Cooper, Robber G Morgan,

14. Rao, Cherukuri U (1996), Capital

Alonzo Redman, and Margart Smith

Budgeting Practices: A comparative

Study of India and select south East (1990), Capital Budgeting Models:

Asian Countries, ASCI Journal of Theory Vs Practice, Business Forum,

Mangement, Vol.25, pp 30-46. Vol.26, Nos.1& 2, pp 15-19

15. Ryan, P.A. and Ryan, G.P. (2002). 22. Wong, Kie-Ann, Edward J. Farragher

Capital Budgeting Practices of the and Rupert K.C. Leung (1987), Capital

Fortune 1000: How Have Things Investment Practices: A Survey of Large

Changed? Journal Of Business and Corporations in Malaysia, Singapore

Management. Fall 2002, vol.8, No. 4. and Hong Kong, Asia-Pacific Journal

pp. 355-364. of Management, 4, 2, pp. 112-123.

24 Journal of Contemporary Research in Management, January - March 2008

You might also like

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- PlywoodDocument26 pagesPlywoodJohn100% (1)

- High School ProjectDocument84 pagesHigh School Projectbig john100% (4)

- Equity Research-Measuring The MoatDocument117 pagesEquity Research-Measuring The MoatproxygangNo ratings yet

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationFrom EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNo ratings yet

- Working Capital ManagementDocument59 pagesWorking Capital ManagementkeerthiNo ratings yet

- Advanced Engineering Economy & CostingDocument84 pagesAdvanced Engineering Economy & Costingduraiprakash83No ratings yet

- Fruit Based DrinksDocument28 pagesFruit Based Drinksbig johnNo ratings yet

- Agricultural MechanizationDocument24 pagesAgricultural Mechanizationbig john86% (7)

- Baking PowderDocument23 pagesBaking PowderJohn100% (1)

- F3 Revision SummariesDocument45 pagesF3 Revision SummariesShahid AliNo ratings yet

- Leather Footware Making PlantDocument26 pagesLeather Footware Making PlantJohn100% (1)

- Investment Office ANRS: Project Profile On The HONEY Processing PlantDocument24 pagesInvestment Office ANRS: Project Profile On The HONEY Processing PlantJohn100% (1)

- Coffee Shop Business PlanDocument22 pagesCoffee Shop Business PlanYoseph Melesse92% (12)

- Capital Budgeting Project ReportDocument97 pagesCapital Budgeting Project ReportPriyanshu Singh0% (1)

- Laundrywashing Machine Service in The Debre Markos Town PDFDocument49 pagesLaundrywashing Machine Service in The Debre Markos Town PDFSami Gulema100% (1)

- Financial Performance MbaDocument92 pagesFinancial Performance MbaIqbalNo ratings yet

- CAPITAL BUDGETING Ultratech Cements 2015Document87 pagesCAPITAL BUDGETING Ultratech Cements 2015Nair D Sravan50% (2)

- Cosmetic Product Producing PlantDocument27 pagesCosmetic Product Producing Plantbig john100% (1)

- 1 Strange AttractorsDocument28 pages1 Strange Attractorsduraiprakash83No ratings yet

- Microsoft Word - F3 - Revision SummariesDocument45 pagesMicrosoft Word - F3 - Revision SummariesAnonymous keHdP6roNo ratings yet

- LabView CourseDocument35 pagesLabView Courseduraiprakash83No ratings yet

- Ratio Analysis of Heritage Foods India LTD 2015Document75 pagesRatio Analysis of Heritage Foods India LTD 2015Vijay ReddyNo ratings yet

- Pulses Processinng PlantDocument25 pagesPulses Processinng PlantJohn60% (5)

- Hinjigu Mixed Used BishoftuDocument37 pagesHinjigu Mixed Used BishoftuTesfaye Degefa100% (3)

- Tutorial Confar 3Document164 pagesTutorial Confar 3Mauro Fernandes0% (1)

- Financial Ratio Interpretation (ITC)Document12 pagesFinancial Ratio Interpretation (ITC)Gorantla SindhujaNo ratings yet

- Zuwari CementDocument81 pagesZuwari Cementnightking_1No ratings yet

- (A Case Study of Nwokeji Urban Planning and Architectural Studio (NupasDocument23 pages(A Case Study of Nwokeji Urban Planning and Architectural Studio (NupasSweety RoyNo ratings yet

- FM - Chapter 13Document2 pagesFM - Chapter 13Rahul ShrivastavaNo ratings yet

- Working Capital RelianceDocument113 pagesWorking Capital RelianceDr.P. Siva RamakrishnaNo ratings yet

- Project Report On Capital Budgeting @kesoramDocument75 pagesProject Report On Capital Budgeting @kesoramRajesh BathulaNo ratings yet

- FinalDocument13 pagesFinalNishuNo ratings yet

- What Is Return Driven StrategyDocument3 pagesWhat Is Return Driven Strategycolleenf-1No ratings yet

- RSB FinalDocument103 pagesRSB FinalKomal KorishettiNo ratings yet

- Tybms, 563, Chinmay Joshi - If ProjectDocument11 pagesTybms, 563, Chinmay Joshi - If ProjectVivek sharmaNo ratings yet

- The Effect of Changes in Return On Assets, Return On Equity, and Economic Value Added To The Stock Price Changes and Its Impact On Earnings Per ShareDocument11 pagesThe Effect of Changes in Return On Assets, Return On Equity, and Economic Value Added To The Stock Price Changes and Its Impact On Earnings Per Sharegrizzly hereNo ratings yet

- Chapter 13Document2 pagesChapter 13Mukul KadyanNo ratings yet

- Chapter - 1 Introduction: 1.1 Background of The StudyDocument78 pagesChapter - 1 Introduction: 1.1 Background of The StudyPRIYA RANANo ratings yet

- Report On Financial Performance of MetconDocument70 pagesReport On Financial Performance of MetconJosemon Paulson100% (1)

- UntitledDocument68 pagesUntitledSurendra SkNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementHarish.PNo ratings yet

- Study of Fundamental AnalysisDocument15 pagesStudy of Fundamental AnalysisDhananjay KumarNo ratings yet

- BushraDocument75 pagesBushraDhakeerath KsdNo ratings yet

- Itc SrinivasaraoDocument76 pagesItc SrinivasaraoVenkatesh Periketi100% (2)

- Financial Radio Analysis-AmbujaDocument94 pagesFinancial Radio Analysis-Ambujak eswariNo ratings yet

- Accounting Numbers As A Predictor of Stock Returns: A Case Study of NSE NiftyDocument12 pagesAccounting Numbers As A Predictor of Stock Returns: A Case Study of NSE NiftyAnuj PapnejaNo ratings yet

- Vol 6 Issue 4 76Document8 pagesVol 6 Issue 4 76shrutijoshi184No ratings yet

- Project Report Sem 4 BbaDocument43 pagesProject Report Sem 4 BbaTanya RajaniNo ratings yet

- Aditya PatnaikDocument55 pagesAditya PatnaikAD CREATIONNo ratings yet

- Cases in Finance Assignment FinalDocument22 pagesCases in Finance Assignment FinalIbrahimNo ratings yet

- Chapter - 1: Introduction and Design of The StudyDocument10 pagesChapter - 1: Introduction and Design of The StudyPrithivi SNo ratings yet

- Group - 3 - Assignment (Term Paper)Document13 pagesGroup - 3 - Assignment (Term Paper)Biniyam YitbarekNo ratings yet

- A Study On Analysis of Financial Statements of Bharti AirtelDocument48 pagesA Study On Analysis of Financial Statements of Bharti AirtelGulab MahtoNo ratings yet

- Mahindra and MahindraDocument60 pagesMahindra and MahindraAparna TumbareNo ratings yet

- Epwin GroupDocument4 pagesEpwin GroupgayathriNo ratings yet

- Title:-Capital Budgeting and Its Techniques in Prathi Solutions Private LimitedDocument76 pagesTitle:-Capital Budgeting and Its Techniques in Prathi Solutions Private LimitedabhishekNo ratings yet

- IJRPR18248Document5 pagesIJRPR18248mudrankiagrawalNo ratings yet

- Cap Bud - HeroDocument13 pagesCap Bud - HeroMohmmedKhayyumNo ratings yet

- Profitability Analysis: CHADARGHAT Hyderabad TelanganaDocument10 pagesProfitability Analysis: CHADARGHAT Hyderabad TelanganakhayyumNo ratings yet

- Article 1Document7 pagesArticle 1Wijdan Saleem EdwanNo ratings yet

- Article 1 PDFDocument7 pagesArticle 1 PDFWijdan Saleem EdwanNo ratings yet

- Assessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanDocument5 pagesAssessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanSunita MishraNo ratings yet

- 34682compilerfinal SFM n03n13 Cp1Document3 pages34682compilerfinal SFM n03n13 Cp1casarokarNo ratings yet

- Financial Performance of HSLDocument151 pagesFinancial Performance of HSLNareshkumar Koppala100% (2)

- TIJER2304005Document8 pagesTIJER2304005beemagani9No ratings yet

- Capital Budjeting NagarjunaDocument73 pagesCapital Budjeting NagarjunaSanthosh Soma100% (2)

- The Financial Ratio Analysis of BUMIPUTERA CONTROLLED PUBLIC LISTED COMPANIES For The Year 2008-2013Document5 pagesThe Financial Ratio Analysis of BUMIPUTERA CONTROLLED PUBLIC LISTED COMPANIES For The Year 2008-2013Puteri XjadiNo ratings yet

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisDocument8 pagesImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysissaefulNo ratings yet

- Ijrti1706020 PDFDocument6 pagesIjrti1706020 PDFSACHIN GNo ratings yet

- Project On Ratio AnalysisDocument18 pagesProject On Ratio AnalysisSAIsanker DAivAMNo ratings yet

- 1ratio Analysis of Automobile Sector For InvestmentDocument29 pages1ratio Analysis of Automobile Sector For Investmentpranab_nandaNo ratings yet

- 1.6 Review of LiteratureDocument8 pages1.6 Review of LiteratureMaha LakshmiNo ratings yet

- A Synopsis Report ON A Study On Capital Budgeting AT L&TDocument19 pagesA Synopsis Report ON A Study On Capital Budgeting AT L&TMohmmedKhayyum100% (1)

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- McENG 6221-Advanced Fluid Power System (Mechatronics)Document4 pagesMcENG 6221-Advanced Fluid Power System (Mechatronics)duraiprakash83No ratings yet

- Math Competition Winners Grade 1 To 3Document2 pagesMath Competition Winners Grade 1 To 3duraiprakash83No ratings yet

- Facinating WordsDocument2 pagesFacinating Wordsduraiprakash83No ratings yet

- Labyrinth Chaos: Department of Physics, University of Wisconsin, 1150 University Avenue, Madison, WI 53706, USADocument32 pagesLabyrinth Chaos: Department of Physics, University of Wisconsin, 1150 University Avenue, Madison, WI 53706, USAduraiprakash83No ratings yet

- Chapter 2 SummaryDocument17 pagesChapter 2 Summaryduraiprakash83No ratings yet

- AUE Tech Report 2017Document11 pagesAUE Tech Report 2017duraiprakash83No ratings yet

- PE 2011, Theory of Mechanisms and MachinesDocument5 pagesPE 2011, Theory of Mechanisms and Machinesduraiprakash83No ratings yet

- Engendered: Reconnoiter Spawned Intervened ScenarioDocument2 pagesEngendered: Reconnoiter Spawned Intervened Scenarioduraiprakash83No ratings yet

- Worksheet 323Document5 pagesWorksheet 323duraiprakash83No ratings yet

- Theory of MechanismsDocument51 pagesTheory of Mechanismsduraiprakash83No ratings yet

- Power Generation Using Wind Energy Produced by TrainsDocument19 pagesPower Generation Using Wind Energy Produced by Trainsduraiprakash83100% (1)

- Vibration Mid ExamDocument10 pagesVibration Mid Examduraiprakash83No ratings yet

- Mechanical Vibration WorksheetDocument6 pagesMechanical Vibration Worksheetduraiprakash83No ratings yet

- CH 5 Material HandlingDocument15 pagesCH 5 Material Handlingduraiprakash83No ratings yet

- Worksheet 1Document1 pageWorksheet 1duraiprakash83No ratings yet

- Specific Mechanical Tests Performed Test Method / Standard Against Which Tests Are Performed Range of Testing / Limits of Detection Accuracy ( )Document1 pageSpecific Mechanical Tests Performed Test Method / Standard Against Which Tests Are Performed Range of Testing / Limits of Detection Accuracy ( )duraiprakash83No ratings yet

- Optimization of Milling Performance of A Sugar Mill by UsingDocument12 pagesOptimization of Milling Performance of A Sugar Mill by Usingduraiprakash830% (1)

- Research MethodologyDocument1 pageResearch Methodologyduraiprakash83No ratings yet

- Diploma Long Term Prospectus 2013Document11 pagesDiploma Long Term Prospectus 2013duraiprakash83No ratings yet

- 6.revised Galvanized Iron Sheet Product Producing PlantDocument23 pages6.revised Galvanized Iron Sheet Product Producing PlantaschalewNo ratings yet

- Investment Office ANRS: Project Profile On The Establishment of Milk Production and Processing PlantDocument27 pagesInvestment Office ANRS: Project Profile On The Establishment of Milk Production and Processing PlantYolanda Riddle100% (1)

- Chapter 7 Macroeconomic MeasurDocument1 pageChapter 7 Macroeconomic MeasurKathleen CornistaNo ratings yet

- Particle Board ProjectDocument28 pagesParticle Board ProjectSisay Tesfaye100% (1)

- Wet Coffe Procgera Qacho Coffee Trading PLCDocument29 pagesWet Coffe Procgera Qacho Coffee Trading PLCRamon ColonNo ratings yet

- 11 Determinants of Working Capital - Financial ManagementDocument3 pages11 Determinants of Working Capital - Financial ManagementsharmilaNo ratings yet

- Business Plan: Presented BY: Sachin. RDocument21 pagesBusiness Plan: Presented BY: Sachin. RSachin RaikarNo ratings yet

- Investment Has Different Meanings in Finance and EconomicsDocument15 pagesInvestment Has Different Meanings in Finance and EconomicsArun IssacNo ratings yet

- Woven SacksDocument27 pagesWoven Sacksbig johnNo ratings yet

- Measuring National Income and The Cost of LivingDocument70 pagesMeasuring National Income and The Cost of LivingMichelleJohnsonNo ratings yet

- Questions For Practice Solutions: Part ADocument40 pagesQuestions For Practice Solutions: Part AMohd JamaluddinNo ratings yet

- Hotel and Restaurant at Blue Nile Falls PDFDocument25 pagesHotel and Restaurant at Blue Nile Falls PDFsohilnkNo ratings yet

- Television Set Assembly PlantDocument28 pagesTelevision Set Assembly PlantAbebeNo ratings yet

- Sample Project ProfileDocument9 pagesSample Project ProfileAnushaa BharadwajNo ratings yet

- Wire and Wire ProductsDocument29 pagesWire and Wire ProductsThomas MNo ratings yet

- Physical FitnessDocument26 pagesPhysical Fitnessmuluken walelgnNo ratings yet

- Applicability of Investment Theories in Developing Economies: Some Combobulating Realities?Document22 pagesApplicability of Investment Theories in Developing Economies: Some Combobulating Realities?Malcolm ChristopherNo ratings yet