Professional Documents

Culture Documents

The Discounted Free Cash Flow Model For A Complete Business

Uploaded by

Akash PatilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Discounted Free Cash Flow Model For A Complete Business

Uploaded by

Akash PatilCopyright:

Available Formats

The Free Cash Flow Business Valu

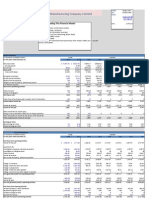

Instructions: Change any of the forecasting variables shown in red below and observe the effect on the model's outputs in

value conclusion most sensitive? To what variable is it least sensitive?

The Discounted Free Cash Flow Model for a Com

Pie In the Sky Company

Forecasting Variables:

2012 2013 2014

Revenue growth factor 20% 30% 40%

Expected gross profit margin 50% 51% 52%

S, G, & A expense % of revenue 50% 40% 30%

Depr. & Amort. % of revenue 10% 10% 10%

Capital expenditure growth factor 40% 35% 30%

Net working capital to sales ratio 19% 18% 17%

Income tax rate 40%

Assumed long-term sustainable growth rate 5% per year after 2021

Discount rate 20%

2012 2013 2014

Valuation Model Outputs:

Gross profit margin 50% 33% 43%

Net operating profit margin -150% 869% 94%

Free cash flow ($ mil) ($1.5) ($1.7) ($1.7)

Terminal value ($ mil)

PV of Company Operations ($ mil) $5.9

Market Value of Company Assets ($ mil) #REF!

h Flow Business Valuation Model

e the effect on the model's outputs in the section below. To what variable is the business

ee Cash Flow Model for a Complete Business

Pie In the Sky Company

2015 2016 2017 2018 2019 2020 2021

50% 60% 50% 40% 30% 20% 10%

53% 54% 55% 56% 57% 58% 59%

29% 28% 27% 26% 25% 24% 23%

10% 10% 10% 10% 10% 10% 10%

25% 20% -10% -15% -20% -25% -30%

16% 15% 14% 13% 12% 11% 10%

40%

5%

20%

2015 2016 2017 2018 2019 2020 2021

53% 63% 53% 43% 32% 22% 12%

21% 34% 41% 36% 30% 24% 16%

($2.1) ($2.2) ($0.8) $1.2 $3.6 $6.1 $8.1

$57.0

The Discounted Free Cash Flow Model fo

Actual |--------------------------------------------------------

2011 2012 2013

0 1 2

Total revenue $2,000,000 $2,400,000 $3,120,000

Cost of Goods Sold 1,200,000 1,200,000 1,528,800

Gross profit 800,000 1,200,000 1,591,200

Selling, general and administrative expenses 1,200,000 1,200,000 1,248,000

Earnings before interest, taxes, depr. & amort. (EBITDA) (400,000) 0 343,200

Depreciation and amortization 200,000 240,000 312,000

Earnings before Interest and taxes (EBIT) (600,000) (240,000) 31,200

Available tax-loss carryforwards 0 (600,000) (840,000)

Net taxable earnings 0 0 0

Taxes 0 0 0

Net Operating Profit After-Tax (NOPAT) (600,000) (240,000) 31,200

Add back depreciation and amortization 200,000 240,000 312,000

Subtract Capital Expenditures (1,000,000) (1,400,000) (1,890,000)

Subtract New Net Working Capital (76,000) (129,600)

Free Cash Flow ($1,400,000) ($1,476,000) ($1,676,400)

Terminal value, 2021

Present Value of Free Cash Flows @ 20% (1,400,000) (1,230,000) (1,164,167)

Present Value of Terminal Value

Total Present Value of Company Operations $5,918,060.64

ee Cash Flow Model for a Complete Business

Years Ending December 31

------------------------------------------------------------------------ Forecast ----------------------------------------------------------------------------------------|

2014 2015 2016 2017 2018 2019 2020

3 4 5 6 7 8 9

$4,368,000 $6,552,000 $10,483,200 $15,724,800 $22,014,720 $28,619,136 $34,342,963

2,096,640 3,079,440 4,822,272 7,076,160 9,686,477 12,306,228 14,424,045

2,271,360 3,472,560 5,660,928 8,648,640 12,328,243 16,312,908 19,918,919

1,310,400 1,900,080 2,935,296 4,245,696 5,723,827 7,154,784 8,242,311

960,960 1,572,480 2,725,632 4,402,944 6,604,416 9,158,124 11,676,607

436,800 655,200 1,048,320 1,572,480 2,201,472 2,861,914 3,434,296

524,160 917,280 1,677,312 2,830,464 4,402,944 6,296,210 8,242,311

(808,800) (284,640) 0 0 0 0 0

0 632,640 1,677,312 2,830,464 4,402,944 6,296,210 8,242,311

0 253,056 670,925 1,132,186 1,761,178 2,518,484 3,296,924

524,160 664,224 1,006,387 1,698,278 2,641,766 3,777,726 4,945,387

436,800 655,200 1,048,320 1,572,480 2,201,472 2,861,914 3,434,296

(2,457,000) (3,071,250) (3,685,500) (3,316,950) (2,819,408) (2,255,526) (1,691,645)

(212,160) (349,440) (589,680) (733,824) (817,690) (792,530) (629,621)

($1,708,200) ($2,101,266) ($2,220,473) ($780,016) $1,206,141 $3,591,584 $6,058,418

(988,542) (1,013,342) (892,358) (261,226) 336,612 835,288 1,174,162

--------------------------------|

2021

10

$37,777,260

15,488,676

22,288,583

8,688,770

13,599,813

3,777,726

9,822,087

0

9,822,087

3,928,835

5,893,252

3,777,726

(1,184,151)

(343,430)

$8,143,398

$57,003,784

1,315,204

9206429.295

You might also like

- Excel Spreadsheet For Mergers and Acquisitions ValuationDocument6 pagesExcel Spreadsheet For Mergers and Acquisitions Valuationisomiddinov100% (2)

- Financial Model Excel FileDocument67 pagesFinancial Model Excel FileSaumitr Mishra0% (1)

- Financial Modeling Case StudyDocument4 pagesFinancial Modeling Case StudykshitijNo ratings yet

- SBDC Valuation Analysis ProgramDocument8 pagesSBDC Valuation Analysis ProgramshanNo ratings yet

- LBO Model TemplateDocument67 pagesLBO Model TemplateAlex TovNo ratings yet

- Financial Model Forecasting - Case StudyDocument15 pagesFinancial Model Forecasting - Case Study唐鹏飞No ratings yet

- Deloitte - Financial Modelling ReportDocument42 pagesDeloitte - Financial Modelling Reportjhgkuugs100% (1)

- Hammond Manufacturing Company Limited: Guide of Reading This Financial ModelDocument4 pagesHammond Manufacturing Company Limited: Guide of Reading This Financial ModelHongrui (Henry) Chen100% (1)

- Business Valuation Model ExcelDocument20 pagesBusiness Valuation Model ExcelWagane DioufNo ratings yet

- Merger ModelDocument3 pagesMerger Modelcyberdevil321No ratings yet

- Introductory Financial ModellingDocument73 pagesIntroductory Financial ModellingWilliam WilliamsonNo ratings yet

- 03 Financial ModelDocument32 pages03 Financial Modelromyka0% (1)

- Financial Model of Zynga IPODocument76 pagesFinancial Model of Zynga IPOJack Macharla100% (1)

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Multifamily Acquisition ModelDocument4 pagesMultifamily Acquisition Modelw_fibNo ratings yet

- Commercial Real Estate Valuation Model1Document6 pagesCommercial Real Estate Valuation Model1Sajib JahanNo ratings yet

- DCF Valuation Financial ModelingDocument10 pagesDCF Valuation Financial ModelingHilal MilmoNo ratings yet

- Financial Modeling StepsDocument8 pagesFinancial Modeling Stepsmayank shridharNo ratings yet

- Exercises and Answers Chapter 5Document8 pagesExercises and Answers Chapter 5MerleNo ratings yet

- 3 Statement Model: Strictly ConfidentialDocument13 pages3 Statement Model: Strictly ConfidentialLalit mohan PradhanNo ratings yet

- Income Statement: Actual Estimated Projected Fiscal 2008 Projection Notes RevenueDocument10 pagesIncome Statement: Actual Estimated Projected Fiscal 2008 Projection Notes RevenueAleksandar ZvorinjiNo ratings yet

- 50 13 Pasting in Excel Full Model After HHDocument64 pages50 13 Pasting in Excel Full Model After HHcfang_2005No ratings yet

- Financial ModellingDocument12 pagesFinancial Modellingalokroutray40% (5)

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDocument24 pagesWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668No ratings yet

- REPE Case 02 Boston Office Value Added AcquisitionDocument282 pagesREPE Case 02 Boston Office Value Added AcquisitionDavid ChikhladzeNo ratings yet

- Financial ModelDocument83 pagesFinancial Modelapi-376449680% (5)

- Distribution Waterfall - Four ExamplesDocument14 pagesDistribution Waterfall - Four ExamplesShashankNo ratings yet

- Carried Interest Waterfall With Catch UpDocument4 pagesCarried Interest Waterfall With Catch UpricgordonNo ratings yet

- Sample Series A TermsheetDocument13 pagesSample Series A TermsheetAnonymous 4rMVkArNo ratings yet

- Commercial Real Estate Valuation Model1Document2 pagesCommercial Real Estate Valuation Model1cjsb99No ratings yet

- Financial ModelDocument22 pagesFinancial ModelRobert MascharanNo ratings yet

- Capital StructureDocument25 pagesCapital StructureMihael Od SklavinijeNo ratings yet

- Facebook - DCF ValuationDocument9,372 pagesFacebook - DCF ValuationDibyajyoti Oja0% (2)

- Five Steps To Valuing A Business: 1. Collect The Relevant InformationDocument7 pagesFive Steps To Valuing A Business: 1. Collect The Relevant InformationArthavruddhiAVNo ratings yet

- Financial Modelling and ValuationDocument5 pagesFinancial Modelling and Valuationibshyd1100% (1)

- Simple LBO ModelDocument14 pagesSimple LBO ModelSucameloNo ratings yet

- Finance (Final Final) Real EstateDocument131 pagesFinance (Final Final) Real EstateJohn Paul Chua100% (1)

- How Do Investment Banks Value Initial Public Offerings (Ipos) ?Document32 pagesHow Do Investment Banks Value Initial Public Offerings (Ipos) ?mumssrNo ratings yet

- Excel SampleDocument8 pagesExcel SampleVõ Văn PhúcNo ratings yet

- DCF ModelDocument29 pagesDCF ModelPATMON100% (7)

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationDocument49 pagesMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaNo ratings yet

- Approaches To ValuationDocument18 pagesApproaches To ValuationSeemaNo ratings yet

- Blackstone REIT Fact SheetDocument4 pagesBlackstone REIT Fact SheetchinaaffairsmonitorNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- 7 M&a Financial ModelingDocument39 pages7 M&a Financial ModelingAniket Gupta100% (1)

- Financial Model (Solera Holdings Inc.)Document7 pagesFinancial Model (Solera Holdings Inc.)Hongrui (Henry) Chen0% (1)

- 7 Consolidation Package - TemplateDocument369 pages7 Consolidation Package - TemplateOUSMAN SEIDNo ratings yet

- Constellation Software SH Letters (Merged)Document105 pagesConstellation Software SH Letters (Merged)RLNo ratings yet

- Assignment ..Document5 pagesAssignment ..Mohd Saddam Saqlaini100% (1)

- ValuationDocument53 pagesValuationArdoni Saharil100% (3)

- M&A PitchDocument13 pagesM&A PitchMatt EilbacherNo ratings yet

- Irr Waterfall TechniqueDocument16 pagesIrr Waterfall TechniquehichambhNo ratings yet

- Financial RatiosDocument20 pagesFinancial RatiosmobinnaimNo ratings yet

- Convertible Loan Agreement FundathonDocument15 pagesConvertible Loan Agreement FundathonMilesTegNo ratings yet

- COH Valuation ModelDocument123 pagesCOH Valuation ModeleamonnsmithNo ratings yet

- Valuation Cash Flow A Teaching NoteDocument5 pagesValuation Cash Flow A Teaching NotesarahmohanNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Financial Risk Modelling and Portfolio Optimization with RFrom EverandFinancial Risk Modelling and Portfolio Optimization with RRating: 4 out of 5 stars4/5 (2)

- Cost Of Capital A Complete Guide - 2020 EditionFrom EverandCost Of Capital A Complete Guide - 2020 EditionRating: 4 out of 5 stars4/5 (1)