Professional Documents

Culture Documents

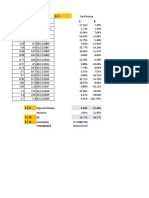

Optimalisasi Portfolio Dengan Sharpe Ratio: TSPC Unvr KLBF Portfolio Ihsg

Uploaded by

Achmad Agus0 ratings0% found this document useful (0 votes)

13 views1 pageThis document discusses optimizing a portfolio using the Sharpe ratio. It provides average returns, standard deviations, and Sharpe ratios for several stocks and a portfolio. The optimal portfolio composition was found to be 49.48% in TSPC stock, 20.13% in UNVR stock, and 30.39% in KLBF stock, with an expected return of 3.00% and Sharpe ratio of 0.30. Monthly return data for the stocks and portfolio from January 2011 to October 2012 is also presented.

Original Description:

perhitungan portofolio with microsoft excel

Original Title

Portfolio Optimal

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses optimizing a portfolio using the Sharpe ratio. It provides average returns, standard deviations, and Sharpe ratios for several stocks and a portfolio. The optimal portfolio composition was found to be 49.48% in TSPC stock, 20.13% in UNVR stock, and 30.39% in KLBF stock, with an expected return of 3.00% and Sharpe ratio of 0.30. Monthly return data for the stocks and portfolio from January 2011 to October 2012 is also presented.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageOptimalisasi Portfolio Dengan Sharpe Ratio: TSPC Unvr KLBF Portfolio Ihsg

Uploaded by

Achmad AgusThis document discusses optimizing a portfolio using the Sharpe ratio. It provides average returns, standard deviations, and Sharpe ratios for several stocks and a portfolio. The optimal portfolio composition was found to be 49.48% in TSPC stock, 20.13% in UNVR stock, and 30.39% in KLBF stock, with an expected return of 3.00% and Sharpe ratio of 0.30. Monthly return data for the stocks and portfolio from January 2011 to October 2012 is also presented.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

OPTIMALISASI PORTFOLIO DENGAN SHARPE RATIO

Risk Free ret. (annual) 5.75%

Risk Free ret. (monthly) 0.47%

TSPC UNVR KLBF Portfolio IHSG

Avg. Return 4.12% 1.32% 2.29% 3.00% 0.40%

Std. Deviation 12.88% 7.15% 9.02% 8.30% 5.41%

Sharpe Ratio 0.28 0.12 0.20 0.30 -0.01

Weight 49.48% 20.13% 30.39% 100.00%

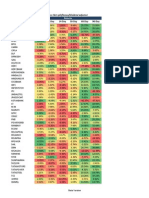

Bulan TSPC UNVR KLBF Portfolio IHSG

Jan-11 -12.87% -8.79% -13.79% -12.33% -7.95%

Feb-11 0.67% 7.64% 12.00% 5.52% 1.79%

Mar-11 16.67% -5.56% -3.57% 6.04% 6.00%

Sep-12 16.19% -3.87% 18.82% 12.95% 4.98%

Oct-12 5.74% 0.00% 30.69% 12.17% 2.06%

You might also like

- Ejercicio Portafolio Óptimo A (DESARROLLO)Document5 pagesEjercicio Portafolio Óptimo A (DESARROLLO)Valeria MaldonadoNo ratings yet

- Date S&P500 Aapl MSFT BAC XOM PFE Correlation MatrixDocument14 pagesDate S&P500 Aapl MSFT BAC XOM PFE Correlation MatrixZeynep DerinözNo ratings yet

- Beta Management SolutionDocument5 pagesBeta Management SolutionMuhammad IlyasNo ratings yet

- Potfolio ManagementDocument3 pagesPotfolio Managementsomya guptaNo ratings yet

- HC Investimentos IBOV SMLL DiversificaçãoDocument7 pagesHC Investimentos IBOV SMLL DiversificaçãoFabiano MorattiNo ratings yet

- Lupin Case Study c1Document15 pagesLupin Case Study c1Muskan behlNo ratings yet

- Absence Effetif 2021 2022 Sur 20Document246 pagesAbsence Effetif 2021 2022 Sur 20Bouzarmine Mohammed El HabibNo ratings yet

- Resumen Mercados Junio 2021Document10 pagesResumen Mercados Junio 2021Axel VarelaNo ratings yet

- HC Investimentos - Como Calcular A Correlação Entre InvestimentosDocument7 pagesHC Investimentos - Como Calcular A Correlação Entre InvestimentosMario Sergio GouveaNo ratings yet

- Average Monthly Returns: Date S&P 500 3 Month T-Bill RJR HasbroDocument16 pagesAverage Monthly Returns: Date S&P 500 3 Month T-Bill RJR HasbroKing CheungNo ratings yet

- Alex Sharp's PortfolioDocument6 pagesAlex Sharp's PortfolioFurqanTariqNo ratings yet

- Share Price Data Saved AsDocument15 pagesShare Price Data Saved AsMaithri Vidana KariyakaranageNo ratings yet

- Grasim Industries LTD.: Group HeadDocument4 pagesGrasim Industries LTD.: Group Headsanchit bhasinNo ratings yet

- Ta2 1-3Document12 pagesTa2 1-3Marcelo DelgadilloNo ratings yet

- Efficient FrontiersDocument10 pagesEfficient FrontiersMuhammad Ahsan MukhtarNo ratings yet

- Alex Sharpe - S PortfolioDocument7 pagesAlex Sharpe - S PortfolioPedro José ZapataNo ratings yet

- Fin RatiosDocument7 pagesFin Ratiosakankshag_13No ratings yet

- Beta Management CorpDocument11 pagesBeta Management CorpKaneez FatimaNo ratings yet

- Simple ScreeningDocument2 pagesSimple ScreeningJeffry KurniadiNo ratings yet

- Price and Return Data For Walmart (WMT) and Target (TGT)Document8 pagesPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17No ratings yet

- Ch8 VaRCVaROptDocument229 pagesCh8 VaRCVaROptvaskoreNo ratings yet

- Year Period (Month) Price (I) Price (M) Ri RMDocument2 pagesYear Period (Month) Price (I) Price (M) Ri RMMahmudul KabirNo ratings yet

- MF Risk CalculationDocument10 pagesMF Risk CalculationBhaskar RawatNo ratings yet

- Reporte de Ratios Estados Unidos - NasdaqDocument10 pagesReporte de Ratios Estados Unidos - NasdaqMarta Alejandra GiacheNo ratings yet

- NadiDocument7 pagesNadisamikriteshNo ratings yet

- HC Investimentos - HedgeDocument11 pagesHC Investimentos - HedgeFabiano MorattiNo ratings yet

- Determinacion de Portafolio OptimoDocument8 pagesDeterminacion de Portafolio OptimoDanie RomaniNo ratings yet

- Reporte de Ratios Nasdaq - Mayo 2020Document10 pagesReporte de Ratios Nasdaq - Mayo 2020Pety SuarNo ratings yet

- Mutual Fund Student DataDocument10 pagesMutual Fund Student DataJANHVI HEDANo ratings yet

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- Accounts (A), Case #KE1056Document25 pagesAccounts (A), Case #KE1056Amit AdmuneNo ratings yet

- Nifty Beat 02 Nov 2010Document1 pageNifty Beat 02 Nov 2010FountainheadNo ratings yet

- Efficient Frontier: Month HDFC TCS % Return TCS % Return HDFC HDFC TCS RP S.D Portfolio Mix (W)Document1 pageEfficient Frontier: Month HDFC TCS % Return TCS % Return HDFC HDFC TCS RP S.D Portfolio Mix (W)Rajarshi DaharwalNo ratings yet

- Charting Filter - 02242018Document115 pagesCharting Filter - 02242018Titus Keith CaddauanNo ratings yet

- VIDF - Monthly Returns May 2017Document2 pagesVIDF - Monthly Returns May 2017Ashwin HasyagarNo ratings yet

- Salinan REVISI Window Dressing CalcDocument148 pagesSalinan REVISI Window Dressing CalcPTPN XIIINo ratings yet

- PORCENTAJESDocument2 pagesPORCENTAJESmaresa45No ratings yet

- Act 3Document2 pagesAct 3Aranza LozaNo ratings yet

- OBJECTIVE: To Find The Valuation of ALLCARGO LOGISTICSDocument26 pagesOBJECTIVE: To Find The Valuation of ALLCARGO LOGISTICSDeepak KshirsagarNo ratings yet

- FISM 11-12 AssignmentDocument2 pagesFISM 11-12 AssignmentSaksham BavejaNo ratings yet

- Series HistoricasDocument51 pagesSeries HistoricasCata QuinteroNo ratings yet

- Fundsatwork: Investment Returns For January 2021Document4 pagesFundsatwork: Investment Returns For January 2021hong BaaNo ratings yet

- Excel Lecture 3a - SolvedDocument22 pagesExcel Lecture 3a - SolvedRimpy SondhNo ratings yet

- Alex Case StudyDocument4 pagesAlex Case StudyPratiksha GhosalNo ratings yet

- Apuntes 29-Oct-2020Document13 pagesApuntes 29-Oct-2020Gabriel D. Diaz VargasNo ratings yet

- % Var - Mastercard: Gráfico de BetaDocument16 pages% Var - Mastercard: Gráfico de BetaMario RefNo ratings yet

- Prueba Largo Plazo A.KDocument13 pagesPrueba Largo Plazo A.KAngelica ReyNo ratings yet

- Alex Sharpe CaseDocument17 pagesAlex Sharpe Casemusunna galibNo ratings yet

- Hedge Fund Statistical Analysis: Prepared ForDocument5 pagesHedge Fund Statistical Analysis: Prepared Forbillroberts981No ratings yet

- Alex Sharpe 1Document4 pagesAlex Sharpe 1Twisha Priya100% (1)

- Long Lasting ResourcesDocument41 pagesLong Lasting ResourcesOsmar ZayasNo ratings yet

- AMFEIX - Monthly Report (October 2019)Document15 pagesAMFEIX - Monthly Report (October 2019)PoolBTCNo ratings yet

- Calcul Des RatiosDocument1 pageCalcul Des RatiosChaima GritliNo ratings yet

- Dataset 1 - Class ExerciseDocument3 pagesDataset 1 - Class ExerciseRitesh SahaNo ratings yet

- Monthly Returns Excess ReturnsDocument4 pagesMonthly Returns Excess ReturnsSagar KansalNo ratings yet

- Rendimientos Mensuales - Portafolios 2023-1Document2 pagesRendimientos Mensuales - Portafolios 2023-1Lucero ÁlvarezNo ratings yet

- ATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.Document4 pagesATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.JBPS Capital ManagementNo ratings yet

- Instructors Manual/ Corporate Finance/ Ross, Westerfield, Jaffe & Kakani/ 8 Edition/ Special Indian Edition/ Mcgraw Hill /2009Document2 pagesInstructors Manual/ Corporate Finance/ Ross, Westerfield, Jaffe & Kakani/ 8 Edition/ Special Indian Edition/ Mcgraw Hill /2009Kunal Kumar100% (1)

- StaksDocument17 pagesStaksJerome Christopher BaloteNo ratings yet