Professional Documents

Culture Documents

Risk Q

Risk Q

Uploaded by

Raisa Gelera0 ratings0% found this document useful (0 votes)

8 views1 pagerisk

Original Title

riskQ

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrisk

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageRisk Q

Risk Q

Uploaded by

Raisa Gelerarisk

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

You are on page 1of 1

3 Sy e ay 5 ;

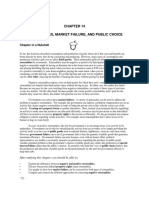

Exhibit a) ‘l tisk Analysis Questionnaire; Cash and Financial

Instruments (continued)

FINANCIAL INSTRUMENTS, INCLUDING MARKETABLE SECURITIES

1. ‘Does the client regularly invest in financial instruments?

2, Does the client have written policies and guidelines regarding imestments in financial instruments? Are the policies approved by

the board of directors? What process is used to authorize investments in financial instruments?

. Does the client have a clear polity as to whether financial instruments. are propery classified as “held for trade” versus “eld to

‘matuity"? fs there evidence thatthe cient follows the policy?

4, Has management changed the classification of Securities during the year from marketable securities to “holdtematurity” Securi-

ties? If yes, what is the teeson fr the change? Ifthe amounts were significant, were they reviewed by the audit committee end

«do the avo committee and the board concur with the change?

1s there a ready market for the securities classified as financial instruments? If te Seburties are not waded on a national stock

exchange, present evidence on the existence of marketability—including depth and breadth of transactions inthe secur.

. If there is not a liquid market forthe financial instruments, how does management go about estimating the value of the seeuritias

that need to be marked to current market value?

To what extent does the elent own financial derivatives as part ofits securty holdings? What are the econamie factors that affect

the derivatives? Has the client evaluated the market value ofthe securities?

8, Doos the clont systematically dant the risks associated with is holdings of financial instumants? Has the board of diectors

‘approved the risk associated with the investment in nontraitional securities?

8, Does the company require board approval of significant investments in financial derivatives? If yes is there evidence thatthe

company bot (@) thoroughly understands the rss associated wit the investments and (o) can quantify an manage that risk?

\What is the company’s exposure to potential losses on financial instruments? What impact on the clint would the potential default

of the securities have? Are the securities sensitive to changes in interest rates? If yes, has the client prepared a sensitivity analy

sis of the securities?

44. Does the company establish limits over the amounts that can be invested in various types of financial instruments with speci

counterparties or by individual traders? How are these limits derived and enforced?

12. Does the organization provide for effective segregation of duties among individuals responsible for making investment and credit

decisions and those responsible for the eustody of the securities?

13, Does the internal audit department conduct regular aueits of the organization's contiols over marketable Securities? If yes, review

fecent reports,

5

1

10,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Chapter 1 Partnership Formation Test BanksDocument46 pagesChapter 1 Partnership Formation Test BanksRaisa Gelera91% (23)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Indiana Jones. TempleDocument3 pagesIndiana Jones. TempleRaisa GeleraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ObligationsDocument21 pagesObligationsRaisa Gelera100% (1)

- ObligationsDocument21 pagesObligationsRaisa Gelera100% (1)

- Page 1: Introduction: BrandingDocument4 pagesPage 1: Introduction: BrandingRaisa GeleraNo ratings yet

- Problems Audit of Shareholdersx27 Equitydocx PDFDocument23 pagesProblems Audit of Shareholdersx27 Equitydocx PDFRaisa GeleraNo ratings yet

- File 7365772675460733734Document16 pagesFile 7365772675460733734Raisa Gelera100% (1)

- Loyalty Card Plus: Application FormDocument2 pagesLoyalty Card Plus: Application FormRaisa GeleraNo ratings yet

- Obe Syllabus Acct 513Document10 pagesObe Syllabus Acct 513Raisa GeleraNo ratings yet

- Ontributor Information and Titles:: One AuthorDocument4 pagesOntributor Information and Titles:: One AuthorRaisa GeleraNo ratings yet

- Externalities, Market Failure, and Public Choice: Chapter in A NutshellDocument17 pagesExternalities, Market Failure, and Public Choice: Chapter in A NutshellRaisa GeleraNo ratings yet

- Agrarian SocietiesDocument3 pagesAgrarian SocietiesRaisa GeleraNo ratings yet

- Step CritiqueDocument30 pagesStep CritiqueRaisa GeleraNo ratings yet

- Investment StudiesDocument2 pagesInvestment StudiesRaisa GeleraNo ratings yet

- Proposed Revisions On The Checklist of Requirements For BOA Accreditation of Individual CPA PDFDocument17 pagesProposed Revisions On The Checklist of Requirements For BOA Accreditation of Individual CPA PDFRaisa GeleraNo ratings yet

- Claims and Their Basis: China, The Republic of China, and The People's Republic of ChinaDocument3 pagesClaims and Their Basis: China, The Republic of China, and The People's Republic of ChinaRaisa GeleraNo ratings yet

- Ifrs News February 2014Document8 pagesIfrs News February 2014Raisa GeleraNo ratings yet

- EconDocument9 pagesEconRaisa GeleraNo ratings yet

- Rjaps v28 AnaDocument24 pagesRjaps v28 AnaRaisa GeleraNo ratings yet

- APJMR 2014-2-151 Philippines - China Relations The Case of The South China SeaDocument8 pagesAPJMR 2014-2-151 Philippines - China Relations The Case of The South China SeaRaisa GeleraNo ratings yet

- Case Studies Phil2 1Document2 pagesCase Studies Phil2 1Raisa GeleraNo ratings yet

- History of Insurance CommissionDocument4 pagesHistory of Insurance CommissionRaisa Gelera100% (1)