0% found this document useful (0 votes)

381 views10 pagesQMS Risk and Opportunity Assessment Guide

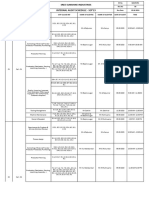

1. This document provides a framework for identifying, analyzing, and tracking risks and opportunities that could affect the quality management system.

2. Risks are rated on a scale of 1 to 5 based on the negative consequences' impact on performance, compliance, objectives, and return on investment. Opportunities are rated based on positive consequences for shareholder value, best practices, capacity, and cost reduction.

3. For each identified risk or opportunity, the document tracks the source, current controls, planned actions, and results to determine if the risk is acceptable or if further action is needed.

Uploaded by

johnoo7Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

381 views10 pagesQMS Risk and Opportunity Assessment Guide

1. This document provides a framework for identifying, analyzing, and tracking risks and opportunities that could affect the quality management system.

2. Risks are rated on a scale of 1 to 5 based on the negative consequences' impact on performance, compliance, objectives, and return on investment. Opportunities are rated based on positive consequences for shareholder value, best practices, capacity, and cost reduction.

3. For each identified risk or opportunity, the document tracks the source, current controls, planned actions, and results to determine if the risk is acceptable or if further action is needed.

Uploaded by

johnoo7Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd