Professional Documents

Culture Documents

Answer Key AP

Uploaded by

PrankyJellyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer Key AP

Uploaded by

PrankyJellyCopyright:

Available Formats

P1. Investments Corporation purchased P500,000 8% bonds on January 1, 2014.

The bonds

were purchased to yield 10% interest. Interest is payable semiannually on June 30 and

December 31. The bonds mature on December 31, 2018.

On January 31, 2016, the business model of the company changed to realizing gains.

The market values of the bonds are as follows:

January 1, 2016 488,999

January 31, 2016 490,449

December 31, 2016 486,963

January 1, 2017 487,271

December 31, 2017 484,482

The company uses the calendar period. Round PV factors to two decimal places.

Required:

1. Interest income on 2016?

2. Carrying amount of the bonds on January 31, 2016?

3. Gain or loss on reclassification?

4. Gain or loss on December 31, 2016?

5. Gain or Loss on December 31, 2017?

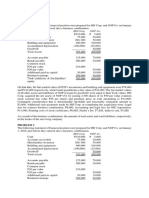

The ff amortization schedule will be useful in computing for the requirements:

DATE EFFECTIVE NOMINAL AMORTIZATION CA

INTEREST INTEREST

1/1/14 459,400

6/30/14 22,970 20,000 2,970 462,370

12/31/14 23,118.5 20,000 3,118.5 471,488.5

6/30/15 23,574.425 20,000 3,574.425 475,062.925

12/31/15 23,753.14625 20,000 3,753.14625 478,816.0713

6/30/16 23,940.80356 20,000 3,940.80356 482,756.8749

12/31/16 24,137.84374 20,000 4,137.84374 486,894.7186

1. Interest on 6/30/16 23,940.80356

Interest on 12/31/16 24,137.84374

Interest Income 48,078.65000

2. CA on 12/31/15 478,816.0713

Amortization (3,940.80356 x 1/6) 656.8005

CA on 1/31/16 479,472.87

No reclassification yet on January 31, 2016. PRFS 9 defines reclassification date

as the first day of the reporting period following the change in business model,

which is January 1, 2017 (based on the problem), therefore the company will still

hold the investment through amortized cost until December 31, 2016.

3. CA on 12/31/16 486,894.7186

MV at 1/1/17 487,271.0000

Gain 376.28

PFRS 9, par 5.6.2 provides that when an entity reclassifies a financial asset at

Amortized Cost to financial asset at Fair Value, the fair value is determined at

reclassification date.

4. NIL / Zero

No reclassification on 2016, the bonds is still carried through Amortized Cost,

therefore no gain or loss.

5. CA on 1/1/17 487,271

MV at 12/31/17 484,482

Loss 2,789

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Broiler Chicken Production Business PlanDocument3 pagesBroiler Chicken Production Business PlanEin-Ein AsariNo ratings yet

- Capital Budgeting 3MA3 MMD: Problem ADocument9 pagesCapital Budgeting 3MA3 MMD: Problem AShao BajamundeNo ratings yet

- 1st - LawDocument23 pages1st - LawPrankyJellyNo ratings yet

- Test I Test Ii Test IiiDocument2 pagesTest I Test Ii Test IiiPrankyJellyNo ratings yet

- F Drill 1Document2 pagesF Drill 1PrankyJellyNo ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- Dahon CompanyDocument2 pagesDahon CompanyPrankyJellyNo ratings yet

- Business Combination Problems Quiz 2Document7 pagesBusiness Combination Problems Quiz 2PrankyJellyNo ratings yet

- Aud Rev ProblemsDocument12 pagesAud Rev ProblemsPrankyJellyNo ratings yet

- BCDocument3 pagesBCPrankyJelly0% (1)

- CayDocument25 pagesCayPrankyJellyNo ratings yet

- Preferential TaxationDocument2 pagesPreferential TaxationPrankyJellyNo ratings yet

- Finance Can Be Defined AsDocument6 pagesFinance Can Be Defined AsPrankyJellyNo ratings yet

- Time Value of MoneyDocument5 pagesTime Value of MoneyPrankyJellyNo ratings yet

- Partnership Asset Investment, Appraisal, and Liquidation AccountingDocument1 pagePartnership Asset Investment, Appraisal, and Liquidation AccountingPrankyJellyNo ratings yet

- Business Combination Problems Quiz 2Document7 pagesBusiness Combination Problems Quiz 2PrankyJellyNo ratings yet

- Answer KeyDocument3 pagesAnswer KeyPrankyJellyNo ratings yet

- Stock AcquisitionDocument5 pagesStock AcquisitionPrankyJellyNo ratings yet

- PDocument9 pagesPPrankyJellyNo ratings yet

- Case Consti BBBBDocument2 pagesCase Consti BBBBPrankyJellyNo ratings yet

- Practice of law prohibition for government prosecutors collecting retainer feesDocument12 pagesPractice of law prohibition for government prosecutors collecting retainer feesPrankyJellyNo ratings yet

- Salomon V. FrialDocument2 pagesSalomon V. FrialPrankyJellyNo ratings yet

- Investment in EquityDocument1 pageInvestment in EquityPrankyJellyNo ratings yet

- Salomon V. FrialDocument2 pagesSalomon V. FrialPrankyJellyNo ratings yet

- Isap Accountancy Promotion and Retention: ST NDDocument2 pagesIsap Accountancy Promotion and Retention: ST NDPrankyJellyNo ratings yet

- CorpoDocument1 pageCorpoPrankyJellyNo ratings yet

- QuizDocument3 pagesQuizPrankyJellyNo ratings yet

- Installment SaleDocument2 pagesInstallment SalePrankyJellyNo ratings yet

- INSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inDocument8 pagesINSTRUCTIONS: Shade The Letter of Your Choice On The Answer Sheet Provided. If Your Answer Is Not inPrankyJelly0% (1)

- CENTRAL BANK EMPLOYEES ASSOC v. BSP discriminates rank-and-fileDocument6 pagesCENTRAL BANK EMPLOYEES ASSOC v. BSP discriminates rank-and-filePrankyJellyNo ratings yet

- Answer Q1 - AFAR ReviewDocument22 pagesAnswer Q1 - AFAR ReviewPrankyJellyNo ratings yet

- ADV FIN ACCOUNTING DERIVATIVES HEDGINGDocument3 pagesADV FIN ACCOUNTING DERIVATIVES HEDGINGPrankyJellyNo ratings yet

- AC222 Final Exam Study GuideDocument12 pagesAC222 Final Exam Study GuidePablo MercadoNo ratings yet

- Malaysian Airline SWOT Analysis Highlights Strengths, Weaknesses, Opportunities, ThreatsDocument5 pagesMalaysian Airline SWOT Analysis Highlights Strengths, Weaknesses, Opportunities, ThreatsutemianNo ratings yet

- Assignment Public SectorDocument3 pagesAssignment Public SectorCeciliaNo ratings yet

- Chapter017 SolutionsDocument3 pagesChapter017 SolutionsSumbul JavedNo ratings yet

- Security AnalysisDocument60 pagesSecurity AnalysisShezad Lalani [LUC]No ratings yet

- 12 Economics Balance of Payment Impq 1Document2 pages12 Economics Balance of Payment Impq 1RitikaNo ratings yet

- ECOC 514 Ques DoneDocument6 pagesECOC 514 Ques Doneshohab4nNo ratings yet

- 10 Wise Co v. MeerDocument2 pages10 Wise Co v. MeerkresnieanneNo ratings yet

- Solutions Week 12 - Intangible AssetsDocument6 pagesSolutions Week 12 - Intangible AssetsjoseluckNo ratings yet

- Investors Perception Towards Real Estate InvestmentDocument38 pagesInvestors Perception Towards Real Estate InvestmentMohd Fahd Kapadia25% (4)

- Kci Kendilo Profile PDFDocument1 pageKci Kendilo Profile PDFRdy SimangunsongNo ratings yet

- Review of The Literature: Chapter - IIIDocument10 pagesReview of The Literature: Chapter - IIIVįňäý Ğøwđã VįñîNo ratings yet

- NCBJ Unaudited Consolidated Financial Results For The Three Months Ended December 31st 2010Document22 pagesNCBJ Unaudited Consolidated Financial Results For The Three Months Ended December 31st 2010Cedric ThompsonNo ratings yet

- Earnings Presentation FY24 Q3Document35 pagesEarnings Presentation FY24 Q3Zerohedge JanitorNo ratings yet

- Singapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationDocument3 pagesSingapore-Listed DMX Technologies Attracts S$183.1m Capital Investment by Tokyo-Listed KDDI CorporationWeR1 Consultants Pte LtdNo ratings yet

- Bakery Project in NigeriaDocument8 pagesBakery Project in NigeriaOladeji Idowu100% (1)

- Top correlated pairs from correlation matrixDocument22 pagesTop correlated pairs from correlation matrixSharadNo ratings yet

- Project Report On Comparison of Mutual Funds With Other Investment OptionsDocument57 pagesProject Report On Comparison of Mutual Funds With Other Investment Optionsdharmendra dadhichNo ratings yet

- Summary Ins EconomicsDocument24 pagesSummary Ins EconomicsJensNo ratings yet

- Block 3 ECO 08 Unit 1Document18 pagesBlock 3 ECO 08 Unit 1ThiruNo ratings yet

- Lesson 6: Typical Account UsedDocument23 pagesLesson 6: Typical Account UsedAices Jasmin Melgar BongaoNo ratings yet

- Risk in Financial ServicesDocument308 pagesRisk in Financial ServicesAkhilesh SinghNo ratings yet

- Fundraising Techniques and MethodsDocument22 pagesFundraising Techniques and MethodsPratyush GuptaNo ratings yet

- Final ProjectDocument16 pagesFinal ProjectBilly OnteNo ratings yet

- Security Valuation: Soumendra RoyDocument38 pagesSecurity Valuation: Soumendra RoySoumendra Roy0% (1)

- Trade War Between China and USDocument5 pagesTrade War Between China and USShayan HiraniNo ratings yet

- Real Estate Agent Company ProfileDocument14 pagesReal Estate Agent Company ProfileAkash Ranjan100% (1)

- Strategic AlliancesDocument19 pagesStrategic Alliancesmonam100% (1)