Professional Documents

Culture Documents

Bir 2316

Bir 2316

Uploaded by

Ron VillacampaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bir 2316

Bir 2316

Uploaded by

Ron VillacampaCopyright:

Available Formats

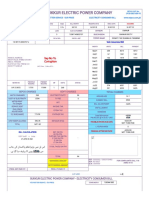

DLN:

BIR Form No.

Republika ng Pilipinas Certificate of Compensation

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Payment/Tax Withheld 2316

For Compensation Payment With or Without Tax Withheld July 2008 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 For the Year 2 For the Period

( YYYY ) From (MM/DD) To (MM/DD)

Part I Employee Information Part IV-B Details of Compensation Income and Tax Withheld from Present Employer

3 Taxpayer Amount

Identification No. A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO Code

32 Basic Salary/ 32

Statutory Minimum Wage

6 Registered Address 6A Zip Code Minimum Wage Earner (MWE)

33 Holiday Pay (MWE) 33

6B Local Home Address 6C Zip Code 34 Overtime Pay (MWE) 34

6D Foreign Address 6E Zip Code 35 Night Shift Differential (MWE) 35

36 Hazard Pay (MWE) 36

7 Date of Birth (MM/DD/YYYY) 8 Telephone Number

37 13th Month Pay 37

9 Exemption Status and Other Benefits

Single Married 38 De Minimis Benefits 38

9A Is the wife claiming the additional exemption for qualified dependent children?

Yes No

10 Name of Qualified Dependent Children 11 Date of Birth (MM/DD/YYYY)

39 SSS, GSIS, PHIC & Pag-ibig 39

Contributions, & Union Dues

(Employee share only)

40 Salaries & Other Forms of 40

12 Statutory Minimum Wage rate per day 12 Compensation

13 Statutory Minimum Wage rate per month 13 41 Total Non-Taxable/Exempt 41

Compensation Income

14 Minimum Wage Earner whose compensation is exempt from

withholding tax and not subject to income tax B. TAXABLE COMPENSATION INCOME

Part II Employer Information (Present) REGULAR

15 Taxpayer

Identification No. 42 Basic Salary 42

16 Employer's Name 43 Representation 43

17 Registered Address 17A Zip Code 44 Transportation 44

45 Cost of Living Allowance 45

Main Employer Secondary Employer

Part III Employer Information (Previous) 46 Fixed Housing Allowance 46

18 Taxpayer

Identification No. 47 Others (Specify)

19 Employer's Name

47A 47A

20 Registered Address 20A Zip Code 47B 47B

SUPPLEMENTARY

Part IV-A Summary 48 Commission 48

21 Gross Compensation Income from 21

Present Employer (Item 41 plus Item 55)

22 Less: Total Non-Taxable/ 22 49 Profit Sharing 49

Exempt (Item 41) 23

23 Taxable Compensation Income

50 Fees Including Director's 50

from Present Employer (Item 55) 24

24 Add: Taxable Compensation Fees

Income from Previous Employer 25

25 Gross Taxable 51 Taxable 13th Month Pay 51

Compensation Income 26 and Other Benefits

26 Less: Total Exemptions

52 Hazard Pay 52

27 Less: Premium Paid on Health 27

and/or Hospital Insurance (If applicable) 28

28 Net Taxable 53 Overtime Pay 53

Compensation Income 29

29 Tax Due 54 Others (Specify)

30 Amount of Taxes Withheld 30A 54A 54A

30A Present Employer 54B 54B

30B Previous Employer 30B

31 Total Amount of Taxes Withheld 31 55 Total Taxable Compensation 55

As adjusted Income

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and correct

pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

5 Date Signed

6

Present Employer/ Authorized Agent Signature Over Printed Name

CONFORME:

57 Date Signed Amount Paid

CTC No. Employee Signature Over Printed Name

of Employee Place of Issue Date of Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury, I declare,under the penalties of perjury

that the information herein stated are that I am qualified under substituted filing

reported under BIR Form No. 1604CF of Income Tax Returns(BIR Form No.

which has been filed with the Bureau of 1700), since I received purely

Internal Revenue. compensation income from only one

employer in the Phils. for the calendar

year; that taxes have been correctly

58 withheld by my employer (tax due equals

Present Employer/ tax withheld); that the BIR Form No.

Authorized Agent 1604CF filed by my employer to the BIR

Signature Over Printed shall constitute as my income tax return;

Name (Head of and that BIR Form No. 2316 shall serve

Accounting/ Human the same purpose as if BIR Form No.

Resource or Authorized 1700 had been filed pursuant to the

Representative) provisions of RR No. 3-2002, as amended.

59

Employee

Signature Over

Printed Name

You might also like

- BDO Bank-StatementDocument1 pageBDO Bank-Statementgcreates202350% (2)

- Bir 2303Document1 pageBir 2303Melissa Baday80% (5)

- 2019 SEC Cover Sheet For Financial StatementsDocument1 page2019 SEC Cover Sheet For Financial StatementsKim Balauag74% (19)

- Application For TCVC-Non-Individual (Annex C.1)Document1 pageApplication For TCVC-Non-Individual (Annex C.1)James Stephen Cubarol67% (6)

- Statement of Management's Responsibility For Annual Income TaxDocument2 pagesStatement of Management's Responsibility For Annual Income TaxJohn Heil96% (25)

- Certification of No Fire InsuranceDocument1 pageCertification of No Fire Insuranceeprints cebuNo ratings yet

- Electronic Business Permit - Renewal: Subject To InspectionDocument3 pagesElectronic Business Permit - Renewal: Subject To InspectionRose Salminao100% (1)

- Pay Slip TemplateDocument3 pagesPay Slip TemplateRachiel Kintos100% (1)

- Bir Form 2307Document3 pagesBir Form 2307Salve Dela Cruz100% (5)

- BIR Form 1932 Annex EDocument2 pagesBIR Form 1932 Annex EMelo Magno62% (13)

- CONVERGE Proof of Internet SubscriptionDocument1 pageCONVERGE Proof of Internet SubscriptionJayrald Delos SantosNo ratings yet

- Certificate of Employment: To Whom It May ConcernDocument1 pageCertificate of Employment: To Whom It May ConcernLara Michelle Sanday BinudinNo ratings yet

- Schedule of ACCOUNTS RECEIVABLESDocument1 pageSchedule of ACCOUNTS RECEIVABLESSyzygy Consultancy20% (5)

- Credit Card - COE 198141Document1 pageCredit Card - COE 198141Richmon Felix Trance67% (3)

- Authorization Letter - QC FormDocument2 pagesAuthorization Letter - QC FormCharina Marie Cadua78% (9)

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- Customer Request Form (CRF) PDFDocument1 pageCustomer Request Form (CRF) PDFMaurice Salinas100% (1)

- E SalesDocument58 pagesE Salesgrini gunayan50% (2)

- Schedules For Non-Stock, Non-Profit Organizations Sworn StatementDocument8 pagesSchedules For Non-Stock, Non-Profit Organizations Sworn StatementKateNo ratings yet

- BIR Form No. 1701Document4 pagesBIR Form No. 1701blesypNo ratings yet

- Requirements For Summary List of Sales and PurchasesDocument2 pagesRequirements For Summary List of Sales and PurchasesMary Joy Villanueva100% (2)

- Fiscal Management Reaction PaperDocument2 pagesFiscal Management Reaction PaperChristopher B. Albino100% (6)

- Bir Form 1902Document4 pagesBir Form 1902fatmaaleah100% (1)

- 1701Document6 pages1701Dolly BringasNo ratings yet

- New Pagibig STLRF FormatDocument6 pagesNew Pagibig STLRF FormatNen Mar0% (2)

- Annex DDocument1 pageAnnex DAnthonyNo ratings yet

- Company Profile JOEKKOMDocument1 pageCompany Profile JOEKKOMmel avecilla0% (1)

- Authorization LetterDocument1 pageAuthorization LetterAnthony Zabala100% (1)

- Authorization Letter DTIDocument2 pagesAuthorization Letter DTIJane Kathyrine Lim-MarquezNo ratings yet

- Bir Form 2307 SampleDocument3 pagesBir Form 2307 SampleErick Echual75% (4)

- DocumentDocument2 pagesDocumentZandie Garcia0% (1)

- Bir 2Q 2020Document4 pagesBir 2Q 2020Leo Archival ImperialNo ratings yet

- Bir Form 2307Document2 pagesBir Form 2307Dave Pagara100% (5)

- 2316 (1) 1Document2 pages2316 (1) 1dolores100% (1)

- Authorization Letter For Disconnection PLDTDocument1 pageAuthorization Letter For Disconnection PLDTSANS NT5No ratings yet

- Region 3 - 08202023 List of Passers SubDocument18 pagesRegion 3 - 08202023 List of Passers SubTheSummitExpressNo ratings yet

- How To File Form 2316 and Annex FDocument4 pagesHow To File Form 2316 and Annex FIvan Benedicto100% (1)

- Letter For Tax ClearanceDocument1 pageLetter For Tax ClearanceProbinsyana Ko0% (1)

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Document4 pagesAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagNo ratings yet

- Certificate of Travel CompletedDocument2 pagesCertificate of Travel Completedjanquil 25100% (1)

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheldjarra andrea jacaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldTrish CalumaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGeorgia HolstNo ratings yet

- Bir Form 2316Document2 pagesBir Form 2316Benjie T Madayag100% (1)

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldIan Jay BahiaNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- 2012 ItrDocument1 page2012 Itrregin pioNo ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- 28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Document4 pages28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Kenneth Vallejos CesarNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- Date/Time Patient PT Status Age Sex DOB LocationDocument56 pagesDate/Time Patient PT Status Age Sex DOB Locationzeerak khanNo ratings yet

- InvoiceDocument1 pageInvoiceCok DiahNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Classification of TaxesDocument5 pagesClassification of Taxesakanksha singhNo ratings yet

- Mepco Online BillDocument2 pagesMepco Online BillArslan ChaudharyNo ratings yet

- TAX267 - PresentationDocument16 pagesTAX267 - PresentationSyafiqNo ratings yet

- 5000 s6 Fill 21eDocument4 pages5000 s6 Fill 21ebo zouNo ratings yet

- Assignment CTP Dr. Shipra JindalDocument6 pagesAssignment CTP Dr. Shipra JindalAbhishek AroraNo ratings yet

- Dec. 20 2022 Duluth Public Schools Truth in Taxation PresentationDocument32 pagesDec. 20 2022 Duluth Public Schools Truth in Taxation PresentationJoe BowenNo ratings yet

- Schedule of Tax Payment-Iloilo City TreasurerDocument4 pagesSchedule of Tax Payment-Iloilo City TreasurerJorge ParkerNo ratings yet

- QUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Document4 pagesQUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Nathan NakibingeNo ratings yet

- Pre Departmental Reviewers Part 2Document8 pagesPre Departmental Reviewers Part 2Cañon, Lorenz GeneNo ratings yet

- Taxn 1000 First Term Exam Sy 2021-2022 QuestionsDocument8 pagesTaxn 1000 First Term Exam Sy 2021-2022 QuestionsLAIJANIE CLAIRE ALVAREZNo ratings yet

- Section 80CCD - Deduction For NPS Contribution - Budget 2016Document6 pagesSection 80CCD - Deduction For NPS Contribution - Budget 2016debajyoti dasNo ratings yet

- Income Tax Introduction FinalDocument39 pagesIncome Tax Introduction FinalSammar EllahiNo ratings yet

- Emaran Bill at TarangDocument6 pagesEmaran Bill at TarangKamakhya MallNo ratings yet

- Tds Entry Register For Prabhu Shridhar Madhukar: Financial Year: 2009-2010Document4 pagesTds Entry Register For Prabhu Shridhar Madhukar: Financial Year: 2009-2010Michelle MurphyNo ratings yet

- TC S Feb 2017 PF StatementDocument1 pageTC S Feb 2017 PF StatementjessmazNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingRISACA100% (1)

- Computer Assignment of ExcelDocument9 pagesComputer Assignment of ExcelAdeel KiayniNo ratings yet

- 10 Task PerformanceDocument5 pages10 Task Performancejeffersam31No ratings yet

- Hypermass Online Storage Salary Report Ch. 2Document2 pagesHypermass Online Storage Salary Report Ch. 2Edgard MoralesNo ratings yet

- Top 20000 Private Corp. and Top 5000 Individual TaxpayersDocument7 pagesTop 20000 Private Corp. and Top 5000 Individual TaxpayersJolina HenoguinNo ratings yet

- Goods and Services Tax - GSTR-2BDocument48 pagesGoods and Services Tax - GSTR-2BR.Roshini RNo ratings yet

- Solved The President and Vice President of Usa Corporation Receive BenefitsDocument1 pageSolved The President and Vice President of Usa Corporation Receive BenefitsAnbu jaromiaNo ratings yet

- Kensington Practice Pension Letter Joiner Mrs K. Paraiso Da Rocha 01-07-2023Document2 pagesKensington Practice Pension Letter Joiner Mrs K. Paraiso Da Rocha 01-07-2023Mia ZhandNo ratings yet

- GSTUpdate 05022022Document22 pagesGSTUpdate 05022022prathNo ratings yet

- Sepco Online BillDocument1 pageSepco Online BillGuru bhaiNo ratings yet