Professional Documents

Culture Documents

Unidentifiable Shares of Stocks

Unidentifiable Shares of Stocks

Uploaded by

Samjo Cortez0 ratings0% found this document useful (0 votes)

16 views1 pageThe document discusses methods for calculating the adjusted net asset value and cost basis of stocks when shares cannot be properly identified. It provides an example of calculating capital gains using FIFO (first-in, first-out) when shares of a stock were purchased at different prices and later sold. The rules specify using FIFO, moving average, or allocating costs of original shares to stock dividends received.

Original Description:

Original Title

Unidentifiable Shares of Stocks.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses methods for calculating the adjusted net asset value and cost basis of stocks when shares cannot be properly identified. It provides an example of calculating capital gains using FIFO (first-in, first-out) when shares of a stock were purchased at different prices and later sold. The rules specify using FIFO, moving average, or allocating costs of original shares to stock dividends received.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageUnidentifiable Shares of Stocks

Unidentifiable Shares of Stocks

Uploaded by

Samjo CortezThe document discusses methods for calculating the adjusted net asset value and cost basis of stocks when shares cannot be properly identified. It provides an example of calculating capital gains using FIFO (first-in, first-out) when shares of a stock were purchased at different prices and later sold. The rules specify using FIFO, moving average, or allocating costs of original shares to stock dividends received.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

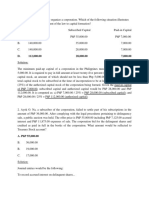

Market value per tax Independent

declaration Zonal valuation appraiser

P2,500,000 P5,000,000 P6,000,000

The adjusted net asset of M corporation would be:

Fair value of assets:

Fair value of assets P10,000,000

Adjustment increase

real property (P6M - P2M) 4,000,000 14,000,000

Less: Fair value of liabilities 6,000,000

Adjusted net asset values P 8,000,000

Divided by outstanding shares 5,000

Adjusted value per share of stock P 1,600

Unidentifiable Shares of Stocks

If the shares of stocks cannot be properly identified, the following

rules are applicable to compute the cost of the shares of stocks:

1. The cost to be assigned shall be on the basis of the first-In,

first-Out (FIFO) method;

2. If the seller maintains the books of accounts where every

transaction of a particular stock is recorded, the moving

average is to be used; and

3. If the stock dividends are received, an allocated cost of the

original cost shall be assigned to the said stock dividends.

Illustration 1 - Without stock dividends

Assume the following investment transactions in the books of

accounts of Sara Lee in the common shares of stock of PNB:

October 20, 200A Purchased 50 shares at P120 per share

May 10, 200B Purchased 50 shares at P140 per share

September 3, 200B Sold 75 shares directly to a buyer at P150 per share

FIFO Method. If the FIFO method were used, the computation of

capital gain on sale of investment in stock would be

Selling price (P150 x 75) P11,250

Less: Cost of shares sold:

October purchase (P120 x 50 shares) P6,000

May purchase (P140 x 25 shares) 3,500 9,500

Capital gain on sale of investment in stocks P1,750

You might also like

- Assignment No. 3Document4 pagesAssignment No. 3Sherren Marie Nala100% (2)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Copy Treasury StocksDocument213 pagesCopy Treasury StocksJuren Demotor Dublin100% (2)

- Shareholders' Equity: PROBLEM 1: Prepare Journal Entries To Record Each of The FollowingDocument14 pagesShareholders' Equity: PROBLEM 1: Prepare Journal Entries To Record Each of The FollowingAccounting LayfNo ratings yet

- Capital Gains TaxDocument38 pagesCapital Gains TaxRenievave TorculasNo ratings yet

- FAR-03-Inventories-2nd Sem AY2324Document5 pagesFAR-03-Inventories-2nd Sem AY2324Nanase SenpaiNo ratings yet

- TAX NotesDocument6 pagesTAX Notesadrian carinoNo ratings yet

- Chapter08 Inventory Cost Other Basis Student Copy LectureDocument9 pagesChapter08 Inventory Cost Other Basis Student Copy LectureAngelo Christian B. OreñadaNo ratings yet

- Wesleyan University - PhilippinesDocument3 pagesWesleyan University - Philippinessalamat lang akinNo ratings yet

- FAR1 ReviewerDocument5 pagesFAR1 ReviewerMikaella SanchezNo ratings yet

- Options SwapsDocument7 pagesOptions SwapsMaurice AgbayaniNo ratings yet

- Corporation ProblemsDocument5 pagesCorporation ProblemsKathleenNo ratings yet

- Im Share Capital Transactions Subsequent To Original IssuanceDocument7 pagesIm Share Capital Transactions Subsequent To Original IssuanceElaine OlivarioNo ratings yet

- Consolidated FsDocument7 pagesConsolidated FsfreyawonderlandNo ratings yet

- Business CombinationDocument8 pagesBusiness CombinationEvita Ayne Tapit0% (1)

- MODULE 5.1 - Review On Accounting For CorporationsDocument15 pagesMODULE 5.1 - Review On Accounting For CorporationsMNo ratings yet

- Chapter 21 Ia2Document15 pagesChapter 21 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- Mock Quiz 3 FAR InvestmentSecutities X InventoriesDocument11 pagesMock Quiz 3 FAR InvestmentSecutities X InventoriesMARISA SYLVIA CAALIMNo ratings yet

- 01 Review of Share Capital TransactionsDocument15 pages01 Review of Share Capital TransactionsAlloysius ParilNo ratings yet

- Equity SecuritiesDocument25 pagesEquity Securitieslana del reyNo ratings yet

- Module No. 1 - Week 1 Businessn CombinationDocument5 pagesModule No. 1 - Week 1 Businessn CombinationJayaAntolinAyusteNo ratings yet

- Auditing Problems: RequiredDocument2 pagesAuditing Problems: RequiredvhhhNo ratings yet

- DividendsDocument27 pagesDividendsJoyce Bernardo AdlaoNo ratings yet

- #17 Dividends and Stock RightsDocument4 pages#17 Dividends and Stock RightsZaaavnn VannnnnNo ratings yet

- Equity InvestmentsDocument6 pagesEquity Investmentsela kikayNo ratings yet

- Stock AcquisitionDocument5 pagesStock AcquisitionPrankyJellyNo ratings yet

- Quiz On Intercompany Profits Quiz 3 THEORY-The First Four Numbers Should Be Answered Using The FollowingDocument9 pagesQuiz On Intercompany Profits Quiz 3 THEORY-The First Four Numbers Should Be Answered Using The FollowingAgatha de CastroNo ratings yet

- Businessn-Combination v2Document4 pagesBusinessn-Combination v2MarvinNo ratings yet

- On Line Lesson 2 Treasury StocksDocument26 pagesOn Line Lesson 2 Treasury StocksKimberly Claire AtienzaNo ratings yet

- Wash SaleDocument14 pagesWash SaleSharon Ann BasulNo ratings yet

- Treasury Shares Rights Issue and Share SplitDocument46 pagesTreasury Shares Rights Issue and Share Splitmerry grace tuanNo ratings yet

- AFARDocument9 pagesAFARRed Christian PalustreNo ratings yet

- Instruction: Write Your Answer in A One Whole Sheet of Paper and Upload It inDocument2 pagesInstruction: Write Your Answer in A One Whole Sheet of Paper and Upload It inJeane Mae BooNo ratings yet

- Chapter 8 HomeworkDocument7 pagesChapter 8 Homeworkklm klm100% (1)

- Accounting For Business CombinationsDocument2 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- SHE - Treasury Shares, Right Issue, Share Split With Warrants - 0Document50 pagesSHE - Treasury Shares, Right Issue, Share Split With Warrants - 0lilienesieraNo ratings yet

- On-Line Lesson 1 Part 2Document28 pagesOn-Line Lesson 1 Part 2Kimberly Claire AtienzaNo ratings yet

- PAS16Document62 pagesPAS16Sel BarrantesNo ratings yet

- Lecture 4 IFRS 9 Financial Instruments Financial Assets at Fair Value Through Other Comprehensive IncomeDocument11 pagesLecture 4 IFRS 9 Financial Instruments Financial Assets at Fair Value Through Other Comprehensive IncomeKhulekani SbonokuhleNo ratings yet

- Shareholders-Equity - Part 1Document29 pagesShareholders-Equity - Part 1cj bNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsFelsie Jane PenasoNo ratings yet

- 3rd ActivityDocument2 pages3rd Activitydar •No ratings yet

- Lecture 3 IFRS 9 Financial Instruments Financial Assets at Fair Value Through Profit or LossDocument11 pagesLecture 3 IFRS 9 Financial Instruments Financial Assets at Fair Value Through Profit or LossKhulekani SbonokuhleNo ratings yet

- ParCor QuizDocument4 pagesParCor QuizJinx Cyrus Rodillo0% (1)

- Exercises For Accounting For Merchandise StoresDocument4 pagesExercises For Accounting For Merchandise StoresAnne Dorene ChuaNo ratings yet

- Chapter InventoriesDocument38 pagesChapter InventoriesJustine ReyesNo ratings yet

- 12 - Lower of Cost and Net Realizable ValueDocument26 pages12 - Lower of Cost and Net Realizable Valuelheamaecayabyab4No ratings yet

- Last QuizDocument5 pagesLast QuizMariah MacasNo ratings yet

- Shareholders' EquityDocument49 pagesShareholders' EquityPeter Banjao50% (2)

- NCI in The Fair ValueDocument2 pagesNCI in The Fair ValueWawex DavisNo ratings yet

- IT Module No. 6 Capital Gains Taxation Module Specific Learning OutcomesDocument18 pagesIT Module No. 6 Capital Gains Taxation Module Specific Learning Outcomesdesiree bautistaNo ratings yet

- Business Combination Drill PDFDocument2 pagesBusiness Combination Drill PDFMelvin MendozaNo ratings yet

- Business - Combination DrillDocument2 pagesBusiness - Combination DrillcpacpacpaNo ratings yet

- Exercises 122Document2 pagesExercises 122Athena Fatmah AmpuanNo ratings yet

- Quiz On L2 and L3: 60,000 Loss Not GAIN 1,500,000Document2 pagesQuiz On L2 and L3: 60,000 Loss Not GAIN 1,500,000Unknown WandererNo ratings yet

- Reviewer in BFDocument2 pagesReviewer in BFFelicity EspinosaNo ratings yet

- Confra - Stockholders' EquityDocument74 pagesConfra - Stockholders' EquityJoanSerranoMijares100% (1)

- Module 4 CFASDocument60 pagesModule 4 CFASRizell Mae PruebasNo ratings yet

- Perform Financial Calculation AssignmentDocument9 pagesPerform Financial Calculation AssignmentBiruk HabtamuNo ratings yet

- A. Patents B. Designs C. Trademark D. All of The Above (Ans: C)Document1 pageA. Patents B. Designs C. Trademark D. All of The Above (Ans: C)Samjo CortezNo ratings yet

- 1-Intellectual Property Rights (IPR) Protect The Use of Information and Ideas That Are ofDocument1 page1-Intellectual Property Rights (IPR) Protect The Use of Information and Ideas That Are ofSamjo CortezNo ratings yet

- Creator of The Contents of The Letter. (B) Both T and TheDocument1 pageCreator of The Contents of The Letter. (B) Both T and TheSamjo CortezNo ratings yet

- IPC Reviewer Part 5Document1 pageIPC Reviewer Part 5Samjo CortezNo ratings yet

- IPC Reviewer Part 3Document1 pageIPC Reviewer Part 3Samjo CortezNo ratings yet

- IPC Reviewer Part 2Document1 pageIPC Reviewer Part 2Samjo CortezNo ratings yet