Professional Documents

Culture Documents

BeanGame For Valuing Money PDF

Uploaded by

Snehil VargheseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BeanGame For Valuing Money PDF

Uploaded by

Snehil VargheseCopyright:

Available Formats

THE BEAN GAME

Living on a 20 Bean Salary

Recreated and Reproduced by

Jana Darrington, M.S.

Family and Consumer Science Agent

Utah State University Extension, Utah County

Game Instructions

Purpose

Managing money means making choices. There is never enough money available for all of the things wed like

to have or do. This game will help you decide what is most important to you.

How to Play

This game may be played individually, but optimum results come from playing in a group of 2 or more.

Divide participants into groups of at least 2 and not more than 5. Each individual/group receives 20 beans

and a set of spending category sheets. The individual/group must decide how to spend their income based

on life circumstances, values and goals. Each item has a set number of squares which indicates how many

beans are needed to pay for that item.

ROUND #1 ROUND #2

First, each individual/group must select one item Your income has just been cut to 13 beans. What

in each of the categories with the gold stars (Food, will you give up? What changes will you make?

Housing, Furnishings, Transportation, Insurance Make changes until you only have 13 beans on

and Clothing & Laundry). Once you have finished your spending sheets.

selecting items in the required categories, DISCUSSION QUESTIONS

continue selecting items until you have used up What kinds of items did you choose to

your 20 bean income. give up? Why? What did you learn about

DISCUSSION QUESTIONS yourself and money in this process? Compare

Why did you choose the items you did? In your budget-cutting choices with another

what ways were you influenced by your values? individual/group.

Your goals? Your previous experiences? OTHER CHOICES you may have to make

Compare what you spent your beans on with 1) Someone in the family just broke their leg. If

another individual/group. you have insurance, you dont need to do

anything. If you dont, take off 3 beans.

Resources: 2) Your mom or dad just got a 2 bean raise!

Parker, L. (n..d.). The Bean Game. Washington State University Extension, Family Decide where it should be spent.

Resource Management Specialist.

Office of State Treasurer John Perdue. (n.d.). The Budget Game: Living on a 20

Square Salary. Financial Education Programs, Charleston, WV.

Retrieved October 26, 2008 from http://www.wvtreasury.com.

Distributed by:

Utah State University Extension, Utah County

100 E Center St., L600, Provo, UT 84606

801-851-8460

http://extension.usu.edu/utah

Utah State University is an affirmative action/equal opportunity institution.

Insurance

Housing with Utilities

Auto

live with relatives sharing

Liability coverage

only

cost of utilities (no

phone) Complete coverage

share an apartment or Health and Disability

house with others,

including basic utilities No coverage No Cost

(no phone) Fringe benefits of job

rent place of your own,

including basic utilities Basic health coverage

(no phone) Individual health &

disability coverage

Renters

Communications Property and liability

coverage

No phone No cost

Phone with limited long distance calls Gifts

Phone with many long distance calls Make your own

Cell phone Purchase cards or small

gifts occasionally

High-speed Internet Purchase frequent gifts

for family and friends

Savings Furnishings

Change in piggy bank No cost

Five percent of income Borrow from relatives or friends No cost

Ten percent of income Rent furniture or live in furnished apartment

Invest for retirement Buy at a garage sale or thrift shop

Contribution to

charities and religious Buy new furniture

groups

Gold Star denotes Required Category

Utah State University is an affirmative action/equal opportunity institution.

Check Out These Budgeting Tips

Wants vs. Needs A need is a necessity, such as housing or

food. A want can be anything and may not be a necessity. Be Average Expenditure

careful when spending on wants. Breakdown

for Total Household Income

Pay Yourself First After budgeting for necessities and

before spending anything for wants, always tuck away some 30% Housing

money from each paycheck for emergencies into a rainy day 18% Transportation

savings account. 16% Food

8% Charity / Misc.

Before Charging Ask yourself: 1) Do I really need it? and 5% Clothing

2) Will I still have this 5 years from now? If the answers are No, 5% Medical

then wait until you can pay cash. 5% Recreation

5% Utilities

Rule of Percentages A good rule of thumb for budgeting 4% Savings

your salary is: 70% pay current bills, 20% save for future purchases, 4% Other Debts

10% invest for long term.

Money Tracking We often spend money without thinking about it. Keep track of all your expenditures

(cash, checks, debit cards, ATM withdrawals and credit cards), even the smallest ones. Record them every

time in a notebook or register. Review them regularly to make yourself aware of where your money goes.

Fixed, Flexible or Luxury? Categorize the expenses in your budget. Is it fixed, such as rent or a car

payment? Is it flexible such as groceries, gas or long distance use? Or is it luxury, such as entertainment or

going out to eat?

Rule of 72 (to double your money) If you know the interest rate you can get, divide 72 by the known

interest rate and it will give you how many years it will take to double your money. If you know how many

years you have, divide 72 by the number of years and it will tell you what interest rate you must have to

double your money.

Examples: If interest rate is 6%. 72 6 = 12 years. If time is 10 years. 72 10 = 7.2% interest rate needed.

Utah State University is an affirmative action/equal opportunity institution.

Recreation Personal care

Basic products like

Hiking, walking, visiting friends or

No cost

soap, shampoo,

toothpaste, make-up,

library etc.

TV, snacks, picnics, driving around Occasional professional

haircuts, basic personal

care products

Cable TV, sports and movies Regular professional

Fishing, hunting, hobbies hairstyling, name brand

personal care products

CDs/music, books, DVDs

Concerts, vacations & spectator

sports Clothing & Laundry

Clothing

Wear present wardrobe No Cost

Food Use your sewing skills

Buy at a discount store,

thrift shop, or used

Cook at home; dinner out

once a week clothing store

Frequent fast food lunches Buy at a department store

and weekly dinner out; cook

other meals at home Shop for designer clothes

All meals away from home Laundry

Do laundry at parents No Cost

Use Laundromat; some

dry cleaning

Transportation Rent or purchase washer

or dryer

Walk or bike No cost

Ride bus or join a carpool More choices

Buy fuel for family car Books or other items

purchased on installment plan

Buy used car and fuel Newspaper and magazine

subscriptions

Buy new car and fuel New TV, DVD player or iPod

Gold Star denotes Required Category

Utah State University is an affirmative action/equal opportunity institution.

You might also like

- Monthly Budget Worksheet: (804) 323-6800 (800) 285-6609 Visit A Branch MobileDocument1 pageMonthly Budget Worksheet: (804) 323-6800 (800) 285-6609 Visit A Branch MobileMikaila BurnettNo ratings yet

- Speed - Miriam JosephDocument97 pagesSpeed - Miriam JosephLone Hansen100% (1)

- CWSB The ConfederacyDocument45 pagesCWSB The ConfederacyEd Franks Jr.100% (2)

- Budgeting Worksheet: Non-Monthly Expenses Annual ResourcesDocument2 pagesBudgeting Worksheet: Non-Monthly Expenses Annual ResourcesDavid GreeneNo ratings yet

- Personal Expense Summary 2022.02.09 VI.5Document2 pagesPersonal Expense Summary 2022.02.09 VI.5Brandon HoganNo ratings yet

- Compare Needs VsDocument4 pagesCompare Needs Vsapi-5848438970% (1)

- Traversing The Doctorate: Reflections and Strategies From Students, Supervisors and AdministratorsDocument439 pagesTraversing The Doctorate: Reflections and Strategies From Students, Supervisors and AdministratorsAng Chuen YuenNo ratings yet

- COMPARE - Needs vs. WantsDocument3 pagesCOMPARE - Needs vs. WantsCAMDEN SCHROEDER100% (1)

- DLL SubstanceDocument3 pagesDLL SubstanceReign Honrado100% (1)

- Multi-Family BuildingsDocument152 pagesMulti-Family BuildingsEERI New York-Northeast Regional ChapterNo ratings yet

- Transfer Switch Controls TS1311 (Line-To-neutral) - Cummins Inc.Document4 pagesTransfer Switch Controls TS1311 (Line-To-neutral) - Cummins Inc.ManoelNo ratings yet

- BS en Iso 11125-6-1997 (2000) BS 7079-E11-1994 PDFDocument12 pagesBS en Iso 11125-6-1997 (2000) BS 7079-E11-1994 PDFShankar GurusamyNo ratings yet

- The Game Is Playing Your Kid: How to Unplug and Reconnect in the Digital AgeFrom EverandThe Game Is Playing Your Kid: How to Unplug and Reconnect in the Digital AgeNo ratings yet

- Seminar 6 MICROECONOMIE The Bean GameDocument4 pagesSeminar 6 MICROECONOMIE The Bean GameGabriel LăcătușNo ratings yet

- Bean GameDocument4 pagesBean Gameadriana espinoza de los monterosNo ratings yet

- Survey Questionnaire (With CBA Comments) DocxDocument6 pagesSurvey Questionnaire (With CBA Comments) DocxMajoy Asilo MaraatNo ratings yet

- 1 MergedDocument17 pages1 MergedSift AbbasNo ratings yet

- Budgeting 101: Personal Budget CategoriesDocument7 pagesBudgeting 101: Personal Budget CategoriesKyle LuNo ratings yet

- CFPB Well-Being Spending-TrackerDocument3 pagesCFPB Well-Being Spending-TrackerPiily Mendoza GonzalezNo ratings yet

- Making Choices Candy GameDocument3 pagesMaking Choices Candy GameNasr jobairNo ratings yet

- Personal BudgetingDocument14 pagesPersonal BudgetingRAIZZNo ratings yet

- Week 5 Safety Net Spring 2023Document2 pagesWeek 5 Safety Net Spring 2023zoe gaughanNo ratings yet

- Sec: A: Questionnaire: Social Awareness EvaluationDocument3 pagesSec: A: Questionnaire: Social Awareness EvaluationAshley ClarkNo ratings yet

- 9F5DF1215 ComprehensiveCalc Universal Credit Monthly ResultDocument7 pages9F5DF1215 ComprehensiveCalc Universal Credit Monthly ResultAbdelhamid GuerchaouiNo ratings yet

- Poverty Informed Community PresentationDocument22 pagesPoverty Informed Community Presentationapi-517766519No ratings yet

- Income and Expenditure FormDocument1 pageIncome and Expenditure Formraj6912377No ratings yet

- Application For Benefits: You Must Hand Deliver, Fax or Mail The Completed Application To Your Local County OfficeDocument14 pagesApplication For Benefits: You Must Hand Deliver, Fax or Mail The Completed Application To Your Local County OfficeChance AndersonNo ratings yet

- Application For Health Coverage & Help Paying Costs: Use This Application To See What You Qualify ForDocument20 pagesApplication For Health Coverage & Help Paying Costs: Use This Application To See What You Qualify ForPatrick PerezNo ratings yet

- Financial StatementDocument1 pageFinancial Statementanon-680689No ratings yet

- Technology and Livelihood Education Home Economics Module 3Document17 pagesTechnology and Livelihood Education Home Economics Module 3Mario EstrellaNo ratings yet

- Section 1: Who Persona Name: Product IntroductionDocument3 pagesSection 1: Who Persona Name: Product Introductionpratik PangeniNo ratings yet

- Functional Update Form - ENDocument3 pagesFunctional Update Form - EN9cwqqpyvpkNo ratings yet

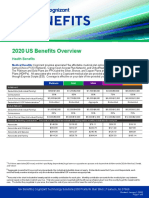

- 2020 US Benefits OverviewDocument5 pages2020 US Benefits OverviewrdmNo ratings yet

- CBM Global Feasibility Assessment For Inclusive Cash Transfer ProgrammingDocument14 pagesCBM Global Feasibility Assessment For Inclusive Cash Transfer ProgrammingRifat RahmanNo ratings yet

- 32 Needs Vs Wants - 703063Document6 pages32 Needs Vs Wants - 703063tryguy088No ratings yet

- BUDGETING BASICS MODULE2 Yuri ParraDocument6 pagesBUDGETING BASICS MODULE2 Yuri Parrayuri cecilia parra suarezNo ratings yet

- Debt Worksheet: Fixed Obligations Variable SpendingDocument2 pagesDebt Worksheet: Fixed Obligations Variable SpendingMark McGaleNo ratings yet

- Debt Worksheet: Fixed Obligations Variable SpendingDocument2 pagesDebt Worksheet: Fixed Obligations Variable SpendingMark McGaleNo ratings yet

- Welcome To The State of Delaware Health and Social Services (DHSS)Document19 pagesWelcome To The State of Delaware Health and Social Services (DHSS)PEnelopENo ratings yet

- Tim New PicsDocument2 pagesTim New PicsChildHopeNo ratings yet

- Mental Health Supportive Housing Options App 2022jonathaDocument15 pagesMental Health Supportive Housing Options App 2022jonathaBarbara A. Orraca-TettehNo ratings yet

- Investment Planning Workbook: Getting StartedDocument8 pagesInvestment Planning Workbook: Getting StartedshanpiePLNo ratings yet

- Poverty Reflection AssignmentDocument6 pagesPoverty Reflection AssignmentKoem JrystalNo ratings yet

- 68 Financial TimesDocument37 pages68 Financial Timestodd.brown01No ratings yet

- CFC FlyerDocument2 pagesCFC Flyerbradley_sherwoodNo ratings yet

- About Lifeline: RulesDocument13 pagesAbout Lifeline: RulesShawnda K GrayNo ratings yet

- Anthem Enhance Benefits July 2021Document2 pagesAnthem Enhance Benefits July 2021Michelle HuynhNo ratings yet

- Financial Benefits SummaryDocument2 pagesFinancial Benefits Summarythe One1No ratings yet

- Food Stamps FormDocument9 pagesFood Stamps FormValentin ParraNo ratings yet

- Ethics PM Toy CaseDocument7 pagesEthics PM Toy CaseGAYATRIDEVI PAWARNo ratings yet

- Week 3. Understanding Marketing EnvironmentDocument42 pagesWeek 3. Understanding Marketing Environmentshiyikang5No ratings yet

- Financial ResourcesDocument4 pagesFinancial ResourcesblogsbybeckyNo ratings yet

- More Ways To SaveDocument4 pagesMore Ways To SaveJomelson Tan CoNo ratings yet

- EMP0433 pdf-1799253631Document2 pagesEMP0433 pdf-1799253631Chass BelcourtNo ratings yet

- Emp 0433Document2 pagesEmp 0433claudine BelisleNo ratings yet

- PCK 14Document9 pagesPCK 14Khate MacalingayNo ratings yet

- Topic 10 - Family DynamicsDocument23 pagesTopic 10 - Family Dynamics李柯宜No ratings yet

- 10 INF 04 Attachment 1Document2 pages10 INF 04 Attachment 1Henry Jacob Baker JrNo ratings yet

- MR - Long's Debate Class Homework 04: Child Labor Pros & ConsDocument4 pagesMR - Long's Debate Class Homework 04: Child Labor Pros & ConsCloudSpireNo ratings yet

- What To Do When Your Income DropsDocument4 pagesWhat To Do When Your Income DropsGeros dienosNo ratings yet

- Survey Form LatesDocument2 pagesSurvey Form LatesAshritha ChillapalliNo ratings yet

- Cuddl Deck - New Mar 2022Document24 pagesCuddl Deck - New Mar 2022Wira AnindyagunaNo ratings yet

- Working and Poor Directions: Refer To Table 4.2, "Budget Worksheet: Single Parent With Children Ages 3 and 6Document5 pagesWorking and Poor Directions: Refer To Table 4.2, "Budget Worksheet: Single Parent With Children Ages 3 and 6Tanmoy NaskarNo ratings yet

- POFL Ulpan Child IssuesDocument28 pagesPOFL Ulpan Child Issues642g2md8ntNo ratings yet

- 20 Ways To Help During COVID-19Document8 pages20 Ways To Help During COVID-19Tre HuntNo ratings yet

- The Australian Assistance Animal Handbook: Part III: Dealing with the NDISFrom EverandThe Australian Assistance Animal Handbook: Part III: Dealing with the NDISNo ratings yet

- Ptep Form B - 1 Sy1819Document2 pagesPtep Form B - 1 Sy1819api-314402585No ratings yet

- 3rd Quarter Pre-Post-Test Applied Math CHDocument3 pages3rd Quarter Pre-Post-Test Applied Math CHapi-314402585No ratings yet

- Ptep Goal 1 Sy1718 - BataclanDocument2 pagesPtep Goal 1 Sy1718 - Bataclanapi-314402585No ratings yet

- Ptep Form B - 1 Sy1819Document2 pagesPtep Form B - 1 Sy1819api-314402585No ratings yet

- Ptep Form B Sy 17-18Document3 pagesPtep Form B Sy 17-18api-314402585No ratings yet

- 1st Quarter Pre-Post Test Applied Math CHDocument2 pages1st Quarter Pre-Post Test Applied Math CHapi-314402585No ratings yet

- Guam Department of Education Mail - Elden IoanisDocument2 pagesGuam Department of Education Mail - Elden Ioanisapi-314402585No ratings yet

- Standard/Skill: NCTM1 Numbers and Operations: Do Not Write On Quiz. Show Your Work On Separate Paper.Document2 pagesStandard/Skill: NCTM1 Numbers and Operations: Do Not Write On Quiz. Show Your Work On Separate Paper.api-314402585No ratings yet

- Igp Service Learning Sy1718Document1 pageIgp Service Learning Sy1718api-314402585No ratings yet

- Guam Department of Education Mail - Savanna Blas Make-Up WorkDocument1 pageGuam Department of Education Mail - Savanna Blas Make-Up Workapi-314402585No ratings yet

- Formulas & TablesDocument2 pagesFormulas & Tablesapi-314402585No ratings yet

- PLC NotesDocument2 pagesPLC Notesapi-314402585No ratings yet

- Exit Ticket 1Document1 pageExit Ticket 1api-314402585No ratings yet

- Guam Department of Education Mail - Jan Derrick de GuzmanDocument3 pagesGuam Department of Education Mail - Jan Derrick de Guzmanapi-314402585No ratings yet

- Presentation - TarrynDocument6 pagesPresentation - Tarrynapi-314402585No ratings yet

- Guam Department of Education Mail - Kens Progress in Applied MathDocument1 pageGuam Department of Education Mail - Kens Progress in Applied Mathapi-314402585No ratings yet

- Guam Department of Education Mail - Shayla CanareDocument2 pagesGuam Department of Education Mail - Shayla Canareapi-314402585No ratings yet

- Optimization Project - Sy1617Document1 pageOptimization Project - Sy1617api-314402585No ratings yet

- ProdquoactwithanswersDocument2 pagesProdquoactwithanswersapi-314402585No ratings yet

- Homogenize RsDocument16 pagesHomogenize RsNamraNo ratings yet

- Telephone Directory 2018Document6 pagesTelephone Directory 2018CLO GENSANNo ratings yet

- 0852 Drive-In 4P With PLC: Assembly and Operating Instructions E-Rtg / RTG Electrification SystemDocument9 pages0852 Drive-In 4P With PLC: Assembly and Operating Instructions E-Rtg / RTG Electrification SystemAbd Elrahman ElserafyNo ratings yet

- The Writing Process (Pre-Writing Strategies) - (Literacy Strategy Guide)Document8 pagesThe Writing Process (Pre-Writing Strategies) - (Literacy Strategy Guide)Princejoy ManzanoNo ratings yet

- Ict351 4 Logical FormulasDocument32 pagesIct351 4 Logical FormulastheoskatokaNo ratings yet

- 65 Tips To Help You Find A Job Quicker: Mark PearceDocument20 pages65 Tips To Help You Find A Job Quicker: Mark PearceMubeen GhawteNo ratings yet

- tv1 MagDocument6 pagestv1 MagKim SindahlNo ratings yet

- Data Structure and Algorithum LAB 02Document8 pagesData Structure and Algorithum LAB 02earn moneyNo ratings yet

- 2 ND PartDocument101 pages2 ND Partvishnu m vNo ratings yet

- Options Strategies Model PaperDocument11 pagesOptions Strategies Model PaperAshish Singh100% (1)

- Preliminary Energy Audit Methodology Preliminary Energy Audit Is A Relatively Quick Exercise ToDocument1 pagePreliminary Energy Audit Methodology Preliminary Energy Audit Is A Relatively Quick Exercise Tojons ndruwNo ratings yet

- Allama Iqbal Open University, Islamabad (Assignment#2)Document12 pagesAllama Iqbal Open University, Islamabad (Assignment#2)ahsanNo ratings yet

- TYBSc Photography and Audio Visual ProductionDocument19 pagesTYBSc Photography and Audio Visual ProductionvinurNo ratings yet

- Tigist Berhanu Supply ChainDocument73 pagesTigist Berhanu Supply Chainmissy advinculaNo ratings yet

- Prosiding Faperta 2018 Fix PDFDocument676 pagesProsiding Faperta 2018 Fix PDFAgus Kaspun100% (1)

- Visit Char Dham in A Budget Trip by Public TransportDocument12 pagesVisit Char Dham in A Budget Trip by Public TransportAvinash DubeyNo ratings yet

- Issue 490Document44 pagesIssue 490The Independent MagazineNo ratings yet

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsDocument53 pagesChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingNo ratings yet

- Running Man LandmarkDocument4 pagesRunning Man LandmarkTanisha BiaspalNo ratings yet

- Hy1906b Hooyi PDFDocument11 pagesHy1906b Hooyi PDFJose Antonio Ramos MuñosNo ratings yet

- AgilescrummethodologyDocument29 pagesAgilescrummethodologyNasir NaseemNo ratings yet

- Almaz BaruDocument9 pagesAlmaz BaruHarry WSNo ratings yet

- ME ProgramDocument21 pagesME Programadyro12No ratings yet

- Dim 1001Document7 pagesDim 1001Kokxing KkxNo ratings yet