Professional Documents

Culture Documents

HR 1 Deficits and Debt

Uploaded by

Circa NewsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HR 1 Deficits and Debt

Uploaded by

Circa NewsCopyright:

Available Formats

CONGRESSIONAL BUDGET OFFICE Keith Hall, Director

U.S. Congress

Washington, DC 20515

November 8, 2017

Honorable Richard Neal

Ranking Member

Committee on Ways and Means

U.S. House of Representatives

Washington, DC 20515

Dear Congressman:

This letter responds to your request for information about the estimated

deficits and debt under the Chairmans amendment in the nature of a

substitute to H.R. 1, the Tax Cuts and Jobs Act.

The staff of the Joint Committee on Taxation determined that provisions in

the Chairmans amendment would increase deficits over the 2018-2027

period by $1.4 trillion (not including the macroeconomic effects of enacting

the legislation). By CBOs estimate, additional debt service would boost the

10-year increase in deficits to $1.7 trillion. CBOs June 2017 baseline

projects that debt held by the public in 2027 will be 91.2 percent of gross

domestic product. As a result of those higher deficits, debt held by the

public in that year, under H.R. 1, would be about 6 percent greater,

reaching 97.1 percent of gross domestic product.

If you wish further details on this estimate, we will be pleased to provide

them.

Sincerely,

Keith Hall

Enclosure

cc: Honorable Kevin Brady

Chairman

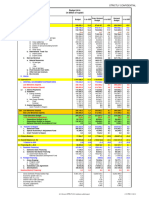

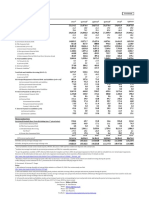

Estimated Deficits and Debt Under the Chairman's Amendment in the Nature of a Substitute to H.R. 1 11/8/2017

The "Tax Cuts and Jobs" Act

By Fiscal Year 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2018-2027

In Billions of Dollars

Deficit

CBO's June 2017 Baseline -563 -689 -775 -879 -1,027 -1,057 -1,083 -1,225 -1,352 -1,463 -10,112

a

Estimated effects on the deficit from H.R. 1 -114 -219 -207 -188 -172 -95 -50 -89 -122 -156 -1,414

Estimated debt service b -1 -5 -11 -18 -25 -31 -35 -39 -44 -50 -259

Total -115 -224 -219 -206 -198 -126 -85 -128 -165 -205 -1,672

Deficit including H.R. 1 -677 -913 -993 -1,086 -1,225 -1,184 -1,168 -1,352 -1,517 -1,668 -11,784

Debt Held by the Public (End of Year)

CBO's June 2017 Baseline 15,537 16,282 17,108 18,037 19,109 20,212 21,342 22,613 24,014 25,524 n.a.

Cumulative Adjustment 115 339 557 764 962 1,088 1,173 1,300 1,466 1,671 n.a.

Debt Held by the Public including H.R. 1 15,652 16,621 17,666 18,801 20,071 21,300 22,514 23,914 25,479 27,195 n.a.

Memorandum:

Gross Domestic Product in CBO's June 2017 baseline 19,924 20,671 21,380 22,165 23,037 23,951 24,905 25,896 26,927 27,999 236,856

As a Percentage of Gross Domestic Product

Deficit

CBO's June 2017 Baseline -2.8 -3.3 -3.6 -4.0 -4.5 -4.4 -4.3 -4.7 -5.0 -5.2 -4.3

a

Estimated effects on the deficit from H.R. 1 -0.6 -1.1 -1.0 -0.8 -0.7 -0.4 -0.2 -0.3 -0.5 -0.6 -0.6

Estimated debt service b * * -0.1 -0.1 -0.1 -0.1 -0.1 -0.1 -0.2 -0.2 -0.1

Total -0.6 -1.1 -1.0 -0.9 -0.9 -0.5 -0.3 -0.5 -0.6 -0.7 -0.7

Deficit including H.R. 1 -3.4 -4.4 -4.6 -4.9 -5.3 -4.9 -4.7 -5.2 -5.6 -6.0 -5.0

Debt Held by the Public (End of Year)

CBO's June 2017 Baseline 78.0 78.8 80.0 81.4 82.9 84.4 85.7 87.3 89.2 91.2 n.a.

Cumulative Adjustment 0.6 1.6 2.6 3.4 4.2 4.5 4.7 5.0 5.4 6.0 n.a.

Debt Held by the Public including H.R. 1 78.6 80.4 82.6 84.8 87.1 88.9 90.4 92.3 94.6 97.1 n.a.

Sources: Congressional Budget Office and the staff of the Joint Committee on Taxation

NOTES

Numbers may not sum to totals because of rounding.

Does not incorporate any macroeconomic effects of enacting the legislation.

n.a. = not applicable; * = between -0.05 percent and zero.

a. Estimate provided by the staff of the Joint Committee on Taxation November 3, 2017, JCX-47-17, https://go.usa.gov/xnbwR.

b. Debt service refers to a change in interest payments resulting from a change in the estimate of the deficit.

You might also like

- Financial Accounts of The United States: First Quarter 2022Document205 pagesFinancial Accounts of The United States: First Quarter 2022AchmAd AlimNo ratings yet

- z1 (First Quarter 2017)Document198 pagesz1 (First Quarter 2017)Bulankov OlegNo ratings yet

- Chap 4 PDFDocument15 pagesChap 4 PDFFatimaIjazNo ratings yet

- Statement: Annual BudgetDocument76 pagesStatement: Annual Budgetshani2010No ratings yet

- ITBA Post Budget Seminar 16-Jun-2009Document39 pagesITBA Post Budget Seminar 16-Jun-2009sanirao100% (2)

- SummaryDocument1 pageSummaryPicoNo ratings yet

- State Budget 2021: Should You Have Further Questions, Please Do Not Hesitate To Contact UsDocument34 pagesState Budget 2021: Should You Have Further Questions, Please Do Not Hesitate To Contact UsncitramandaNo ratings yet

- Fin - Accounts DecemberDocument198 pagesFin - Accounts DecemberAdm TntNo ratings yet

- Financial Accounts of The United States: Second Quarter 2019Document198 pagesFinancial Accounts of The United States: Second Quarter 2019JingaNo ratings yet

- Domestic External DebtDocument9 pagesDomestic External Debtshab291No ratings yet

- Fed z1 201912 PDFDocument198 pagesFed z1 201912 PDFPoNo ratings yet

- S.A. 667Document4 pagesS.A. 667Celeste KatzNo ratings yet

- Z1.second Quarter 2017Document198 pagesZ1.second Quarter 2017Bulankov OlegNo ratings yet

- Domestic and External DebtDocument9 pagesDomestic and External DebtYasir MasoodNo ratings yet

- Fed - Flows of Funds Rate - 1Q 2020Document198 pagesFed - Flows of Funds Rate - 1Q 2020Sam RobnettNo ratings yet

- I Account APBN-P 2010Document1 pageI Account APBN-P 2010rizkisaputroNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19Document1 pagePakistan's Debt and Liabilities-Summary: Jun-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19coolasim79No ratings yet

- Annual Budget Statement 20212022Document79 pagesAnnual Budget Statement 20212022Syed Ali TurabNo ratings yet

- Budget Brief 2017Document70 pagesBudget Brief 2017shahzad32552372No ratings yet

- 1ARMEA2022002Document69 pages1ARMEA2022002animertarchianNo ratings yet

- SummaryDocument1 pageSummaryfarhanNo ratings yet

- Chapter 04Document13 pagesChapter 04Wadar BalochNo ratings yet

- Pakistan Debt and Liabilitie ProfileDocument1 pagePakistan Debt and Liabilitie ProfilezadaNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Jun-17Document1 pagePakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Jun-17Khalid HameedNo ratings yet

- Chapter - 1 THE BUDGET 2020-21 Salient Features: Entered On 11/06/2020 23:59Document36 pagesChapter - 1 THE BUDGET 2020-21 Salient Features: Entered On 11/06/2020 23:59M Farooq ArbyNo ratings yet

- 2021 Fiscal Performance, Part 2Document5 pages2021 Fiscal Performance, Part 2Fuaad DodooNo ratings yet

- Abs22 23Document78 pagesAbs22 23Ali HussnainNo ratings yet

- NG Debt Press Release June 2023 1Document2 pagesNG Debt Press Release June 2023 1Ma. Theresa BerdanNo ratings yet

- Olam International Limited: Management Discussion and AnalysisDocument24 pagesOlam International Limited: Management Discussion and Analysisashokdb2kNo ratings yet

- 1SOMEA2022002Document108 pages1SOMEA2022002South West Youth Council AssociationNo ratings yet

- Document #9B.2 - FY2018 Operating Budget Report - November 15, 2017 PDFDocument3 pagesDocument #9B.2 - FY2018 Operating Budget Report - November 15, 2017 PDFGary RomeroNo ratings yet

- Total Debt of Pakistan-11!02!2019Document1 pageTotal Debt of Pakistan-11!02!2019MeeroButtNo ratings yet

- PFO-July June 2022 23Document10 pagesPFO-July June 2022 23Murtaza HashimNo ratings yet

- 2017 18 BP1 7 Assets and LiabilitiesDocument15 pages2017 18 BP1 7 Assets and Liabilitiesvishnu m vNo ratings yet

- Statistical - Appendix Eng-21Document96 pagesStatistical - Appendix Eng-21S M Hasan ShahriarNo ratings yet

- Budget 2023-24: CTV 2023&24 DK LKJDocument20 pagesBudget 2023-24: CTV 2023&24 DK LKJdeepu sarwaraNo ratings yet

- 6.0 Division of Revenue Bill Standoff Peter GichubaDocument13 pages6.0 Division of Revenue Bill Standoff Peter GichubaREJAY89No ratings yet

- Senate Amendment 2137 To H.R. 3684, The Infrastructure Investment and Jobs Act, As Proposed On August 1, 2021Document19 pagesSenate Amendment 2137 To H.R. 3684, The Infrastructure Investment and Jobs Act, As Proposed On August 1, 2021Cynthia MoranNo ratings yet

- Budget Call Circular FY2017 39 - 080716Document13 pagesBudget Call Circular FY2017 39 - 080716sorenttoNo ratings yet

- DSCR CalculationDocument2 pagesDSCR CalculationusmanthesaviorNo ratings yet

- Debt 3Document16 pagesDebt 3mohsin.usafzai932No ratings yet

- Chapter IVDocument6 pagesChapter IVmohsin.usafzai932No ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Mar-16 Mar-17Document1 pagePakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Mar-16 Mar-17Zahid Hussain KhokharNo ratings yet

- UnionBudget-Feb01 17Document10 pagesUnionBudget-Feb01 17Dharmendra B MistryNo ratings yet

- India Fiscal Preview: 2021-22 Union BudgetDocument13 pagesIndia Fiscal Preview: 2021-22 Union BudgetKaushik BaidyaNo ratings yet

- Domestic and External Debt: 6.1 OverviewDocument22 pagesDomestic and External Debt: 6.1 OverviewSameer AslamNo ratings yet

- Financial Statement For The FY 2023 2024 BudgetDocument5 pagesFinancial Statement For The FY 2023 2024 BudgetkarthanzewNo ratings yet

- BudgetBrief 2015 PDFDocument85 pagesBudgetBrief 2015 PDFFarukh MalikNo ratings yet

- Annual Budget StatementDocument22 pagesAnnual Budget StatementFunkaarNo ratings yet

- Appendix-3: Bangladesh: Some Selected StatisticsDocument28 pagesAppendix-3: Bangladesh: Some Selected StatisticsSHafayat RAfeeNo ratings yet

- 2021 Fiscal PerformanceDocument5 pages2021 Fiscal PerformanceFuaad DodooNo ratings yet

- Summary TablesDocument36 pagesSummary Tablesapi-25909546No ratings yet

- Pakistan's Debt and Liabilities-Summary: Items Jun-15Document1 pagePakistan's Debt and Liabilities-Summary: Items Jun-15Waqas TayyabNo ratings yet

- (IMF Working Papers) Barbados' 2018-19 Sovereign Debt Restructuring-A Sea ChangeDocument23 pages(IMF Working Papers) Barbados' 2018-19 Sovereign Debt Restructuring-A Sea ChangeEmiliaNo ratings yet

- FM - Assignment 02Document19 pagesFM - Assignment 02SaadNo ratings yet

- Committee For Development Policy 24 Plenary SessionDocument30 pagesCommittee For Development Policy 24 Plenary SessionDivino EntertainmentNo ratings yet

- Domestic and External Debt: 8.1 OverviewDocument19 pagesDomestic and External Debt: 8.1 OverviewMuhammad Hasnain YousafNo ratings yet

- Analysis of State Budget Finances 2023Document9 pagesAnalysis of State Budget Finances 2023Manasee RatnakarNo ratings yet

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Michael Cohen Plea DocumentsDocument19 pagesMichael Cohen Plea DocumentsCirca NewsNo ratings yet

- 2018 IPAWS National Test Fact SheetDocument2 pages2018 IPAWS National Test Fact SheetCirca News100% (1)

- Letter of PermissionDocument9 pagesLetter of PermissionCirca NewsNo ratings yet

- Nej Mo A 1808082Document10 pagesNej Mo A 1808082Circa NewsNo ratings yet

- Nicholas Rakowsky Nikitovich v. TrumpDocument10 pagesNicholas Rakowsky Nikitovich v. TrumpCirca NewsNo ratings yet

- Bustamante Report 2018Document6 pagesBustamante Report 2018Circa NewsNo ratings yet

- Michael Cohen's Written Testimony To HouseDocument20 pagesMichael Cohen's Written Testimony To HouseCirca NewsNo ratings yet

- Jeff Sessions Resignation LetterDocument1 pageJeff Sessions Resignation LetterCNBCDigitalNo ratings yet

- HR 302 As Amended Summary FinalDocument5 pagesHR 302 As Amended Summary FinalCirca NewsNo ratings yet

- 2018-09-05 Sangamo Announces 16 Week Clinical Results 423Document5 pages2018-09-05 Sangamo Announces 16 Week Clinical Results 423Circa NewsNo ratings yet

- Violent Threats and Incidents in SchoolsDocument16 pagesViolent Threats and Incidents in SchoolsCirca NewsNo ratings yet

- MCD FoodJourney Timeline v25cDocument1 pageMCD FoodJourney Timeline v25cCirca NewsNo ratings yet

- Apprehension, Processing, Care, and Custody of Alien Minors and Unaccompanied Alien ChildrenDocument203 pagesApprehension, Processing, Care, and Custody of Alien Minors and Unaccompanied Alien ChildrenCirca NewsNo ratings yet

- BillsDocument540 pagesBillsCirca NewsNo ratings yet

- More Than 75 Percent Decline Over 27 Years in Total Flying Insect Biomass in Protected AreasDocument21 pagesMore Than 75 Percent Decline Over 27 Years in Total Flying Insect Biomass in Protected AreasCirca NewsNo ratings yet

- 17-459 1o13Document43 pages17-459 1o13Circa NewsNo ratings yet

- Identity Theft IRS Needs To Strengthen Taxpayer Authentication EffortsDocument67 pagesIdentity Theft IRS Needs To Strengthen Taxpayer Authentication EffortsCirca NewsNo ratings yet

- Troester v. StarbucksDocument35 pagesTroester v. StarbucksCirca NewsNo ratings yet

- START GTD Overview2017 July2018Document3 pagesSTART GTD Overview2017 July2018Circa NewsNo ratings yet

- Store Closing ListDocument2 pagesStore Closing ListSteve HawkinsNo ratings yet

- Mollie Tibbetts Wiring InstructionsDocument1 pageMollie Tibbetts Wiring InstructionsCirca NewsNo ratings yet

- Execution LetterDocument1 pageExecution LetterCirca NewsNo ratings yet

- 2018 07 02 Immigration Trend For ReleaseDocument8 pages2018 07 02 Immigration Trend For ReleaseCirca NewsNo ratings yet

- Hiv Proven Prevention Methods 508Document2 pagesHiv Proven Prevention Methods 508Circa NewsNo ratings yet

- Liquid Water On MarsDocument4 pagesLiquid Water On MarsCirca NewsNo ratings yet

- Dating of Wines With Cesium-137: Fukushima's ImprintDocument3 pagesDating of Wines With Cesium-137: Fukushima's ImprintCirca NewsNo ratings yet

- PJ 2017.02.09 Experiential FINALDocument41 pagesPJ 2017.02.09 Experiential FINALCirca NewsNo ratings yet

- + Results Shown Reflect Responses Among Registered VotersDocument18 pages+ Results Shown Reflect Responses Among Registered VotersCirca NewsNo ratings yet

- Prep101 Consumer InfoDocument2 pagesPrep101 Consumer InfoCirca NewsNo ratings yet

- Statement of Account For Month Ending: 04/2022 PAO: 62 SUS NO.: 1941041 TASK: 21Document2 pagesStatement of Account For Month Ending: 04/2022 PAO: 62 SUS NO.: 1941041 TASK: 21The Aaryan MATHURNo ratings yet

- Cost Terminology and Cost BehaviorsDocument2 pagesCost Terminology and Cost BehaviorsNicole Anne Santiago SibuloNo ratings yet

- FMI7e ch09Document44 pagesFMI7e ch09lehoangthuchien100% (1)

- Setting Up in DIFCDocument128 pagesSetting Up in DIFClinga2014No ratings yet

- Employee Master File Creation FormDocument4 pagesEmployee Master File Creation Formmuhammad younasNo ratings yet

- Bhanu Chaitanya Kumar (11) : Presented byDocument16 pagesBhanu Chaitanya Kumar (11) : Presented bySriramya PediredlaNo ratings yet

- LimitsDocument30 pagesLimitsSwapnali100% (1)

- Landl Co vs. Metropolitan Bank & Trust CompanyDocument1 pageLandl Co vs. Metropolitan Bank & Trust Companyvallie21No ratings yet

- Microfinance CommunityDocument19 pagesMicrofinance CommunityrahulskullNo ratings yet

- Tax Expenditures in Latin America Civil Society Perspective English Ibp 2019Document27 pagesTax Expenditures in Latin America Civil Society Perspective English Ibp 2019Paolo de RenzioNo ratings yet

- Confidential: Dear Mr. Chaitanya SonawaneDocument2 pagesConfidential: Dear Mr. Chaitanya SonawaneColab ITNo ratings yet

- 101 Finals Departmental-JenDocument8 pages101 Finals Departmental-Jenmarie patianNo ratings yet

- 605C-Entrepreneurial DevelopmentDocument21 pages605C-Entrepreneurial DevelopmentRudra PrasadNo ratings yet

- Part 1Document3 pagesPart 1PRETTYKO100% (1)

- Bank Reconciliation StatementDocument39 pagesBank Reconciliation StatementinnovativiesNo ratings yet

- Income Recognition and Asset ClassificationDocument21 pagesIncome Recognition and Asset Classificationsagar7No ratings yet

- 2.1c Business Finance Test Review Class 2020 With AnswersDocument4 pages2.1c Business Finance Test Review Class 2020 With Answersbobhamilton3489No ratings yet

- NBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Document1 pageNBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Sajid rasoolNo ratings yet

- GARP 2023 FRM PART I-Book 3 - Financial Markets and ProductsDocument298 pagesGARP 2023 FRM PART I-Book 3 - Financial Markets and Productsivan arista100% (1)

- Aurora TextilesDocument14 pagesAurora TextilesYale Brendan CatabayNo ratings yet

- Promissory Note TemplateDocument1 pagePromissory Note TemplatejamesrockhardNo ratings yet

- A Level Economics Papers Nov2010 PDFDocument97 pagesA Level Economics Papers Nov2010 PDFLincolnt LeeNo ratings yet

- Aud Ar AnswerDocument5 pagesAud Ar Answerlena cpaNo ratings yet

- Banking - As - A - Service - An - Objective - Analysis - Research Paper - SG Fintech PDFDocument40 pagesBanking - As - A - Service - An - Objective - Analysis - Research Paper - SG Fintech PDFAshwin BS100% (2)

- Project Economy Group 5 Section 7 BFC 44602 Economy EngineeringDocument37 pagesProject Economy Group 5 Section 7 BFC 44602 Economy EngineeringfuadNo ratings yet

- Variance Analysis (Practice Problems)Document7 pagesVariance Analysis (Practice Problems)Godwin De GuzmanNo ratings yet

- Bill HotelDocument54 pagesBill Hotelidhul bram sakti100% (1)

- Incontinence Medical Supplies 1Document10 pagesIncontinence Medical Supplies 1sury koNo ratings yet

- Translation Exposure Management PDFDocument13 pagesTranslation Exposure Management PDFpilotNo ratings yet

- Pan Europa FoodsDocument10 pagesPan Europa FoodsRobbi Wan100% (2)