Professional Documents

Culture Documents

Edf17 PDF

Edf17 PDF

Uploaded by

Akshay RamaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Edf17 PDF

Edf17 PDF

Uploaded by

Akshay RamaCopyright:

Available Formats

MRA E1

PAY A SY

AS YOOU EEAA R N (PAY E)

(PA

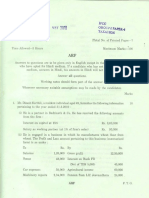

Employee Declaration Form (EDF)

In respect of income year 1 July 2017 to 30 June 2018

Applicable to an Employee who is entitled to the exemptions and reliefs mentioned in section 3 below and who wishes to have

the exemptions and reliefs taken into consideration for the purpose of PAYE.

The Employee should fill in and submit this form to his Employer.

If an Employee has more than one Employer at any one time, the form should be submitted to only ONE of his Employers.

Where during the income year ending 30 June 2018, an employee becomes entitled to new exemptions and reliefs under Section 3, he

may submit to his employer a fresh EDF claiming therein the new exemptions and reliefs to which he is entitled.

Please read the Notes at verso before you fill in this form

1 Employee's Identification

Title (Mr, Mrs, Miss)

Surname

Other Names

National Identity Card Number

2 Name of Employer ...........................................................................................................................................................................

Div / Paysite Code (Applicable to Government Employees)

3 Exemptions and Reliefs (Rs)

3.1 Income Exemption Threshold (IET)

Category A (An employee with no dependent) - Rs 300,000

Category B (An employee with one dependent) - Rs 410,000

Category C (An employee with two dependents) - Rs 475,000

Category D (An employee with three dependents) - Rs 520,000

Category E (An employee with four or more dependents) - Rs 550,000

Category F (A retired or disabled person with no dependent) - Rs 350,000

Category G (A retired or disabled person with one dependent) - Rs 460,000

Enter the IET Amount ...............................

3.2 Additional Exemption in respect of dependent child pursuing undergraduate course

Name of child Educational Institution being attended

(i) .................................................... .......................................................................... Total

(ii) .................................................... .......................................................................... Additional

(iii) .................................................... .......................................................................... Exemption

3.3 Interest Relief on secured housing loan ...............................

3.4 Relief for Medical insurance premium or contribution ...............................

Premium or contribution allowable

Self 1st dependent 2nd dependent 3rd dependent Total

(Max Rs 15,000) (Max Rs 15,000) (Max Rs 10,000) (Max Rs 10,000)

Category A

Category B

Category C

Category D/E

Category F

Category G

Enter total premium ...............................

3.5 Deduction for household employees (Max Rs 30,000) ...............................

3.6 Total Exemptions and Reliefs ...............................

4 First employment / change in employment

Have you submitted an EDF to any other employer in respect of income year ending 30 June 2018? Yes No

5 Declaration

I ....................................................................................................................................................................................................................

(full name of signatory in BLOCK LETTERS)

do hereby declare that I am employed by the employer named at section 2 above and that the information I have given

on this form is true and correct.

Date ................................................... Signature ........................................................................................

Where an employee claims additional exemption or relief under items 3.2, 3.3, 3.4 and 3.5 and it is found that the

claim/s is/are unjustified or in excess by more than 10% of the amount to which he is entitled, he shall be liable

to a penalty of 25% of the amount of tax underpaid under PAYE.

NOTES

1. Only an employee who is resident in Mauritius during the income year ending 30 June 2018 is entitled to claim an income exemption

threshold, additional exemption for dependent child pursuing undergraduate course or relief for interest paid on housing loan.

2. Where for the income year ending 30 June 2018, a person claims an income exemption threshold in respect of Category B, C, D,

E or G, the spouse of that person is entitled to claim for that year an income exemption threshold only in respect of Category A or

Category F, whichever is applicable.

3. An employee is not entitled to claim for the income year ending 30 June 2018 an income exemption threshold in respect of -

(a) Category B or Category G, if the net income and exempt income of his dependent exceeds 110,000 rupees;

(b) Category C, if the net income and exempt income of his second dependent exceeds 65,000 rupees;

(c) Category D, if the net income and exempt income of his third dependent exceeds 45,000 rupees;

(d) Category E, if the net income and exempt income of his fourth dependent exceeds 30,000 rupees.

4. "Dependent" means either a spouse, child under the age of 18 or a child over the age of 18 and who is pursuing full-time education

or training or who cannot earn a living because of a physical or mental disability.

5. "Child" means

(a) an unmarried child, stepchild or adopted child of a person;

(b) an unmarried child whose guardianship or custody is entrusted to the person by virtue of any other enactment or of an order

of a court of competent jurisdiction;

(c) an unmarried child placed in foster care of the person by virtue of an order of a court of competent jurisdiction.

6. "Retired person" means a person who attains the age of 60 at any time prior to 1 July 2017 and who, during the income year ending

30 June 2018, is not in receipt of any business income or emoluments other than retirement pension.

7. "Disabled person" means a person suffering from permanent disablement.

8. Additional exemption in respect of dependent child pursuing undergraduate course

(a) Where a person has claimed an Income Exemption Threshold in respect of category B, C, D, E or G and the dependent is a

child pursuing a non-sponsored full-time undergraduate course in Mauritius at an institution recognised by the Tertiary

Education Commision or outside Mauritius at a recognised institution, the person may claim an additional exemption of Rs

135,000 in respect of that child.

(b) The additional exemption is not allowable :-

(i) in respect of more than three children;

(ii) in respect of the same child for more than 6 consecutive years;

(iii) where the tuition fees, excluding administration and student union fees, are less than Rs 34,800 for a child following an

undergraduate course in Mauritius;

(iv) to a person whose total income (net income plus interest and dividends received) or that of his/her spouse for the income

year ending 30 June 2018 exceeds Rs 4 million.

9. Interest Relief on secured housing loan

(a) A person who has contracted a housing loan, which is secured by a mortgage or fixed charge on immoveable property and which

is used exclusively for the purchase or construction of his house, may claim a relief in respect of the interest paid on the loan.

(b) The relief to be claimed in the EDF is the amount of interest payable in the income year ending 30 June 2018. In the case of

a couple where neither spouse is a dependent spouse, the relief may be claimed by either spouse or at their option, divide the

claim equally between them.

(c) The loan must have been contracted from :-

(i) a bank, a non-bank deposit taking institution, an insurance company, or the Sugar Industry Pension Fund;

(ii) the Development Bank of Mauritius by its employees; or

(ii) the Statutory Bodies Family Protection Fund by its members.

(d) The relief is not allowable where the person or his spouse :-

(i) is, at the time the loan is contracted, already the owner of a residential building;

(ii) derives in the income year ending 30 June 2018, total income (net income plus interest and dividends received) exceeding

Rs 4 million;

(iii) has benefited from any new housing scheme set up on or after 1 January 2011 by a prescribed competent authority.

10. Relief for Medical insurance premium or contribution

A person may claim relief for premium or contribution payable for himself or his dependents in respect of whom Income Exemption

Threshold has been claimed at section 3.1:-

(a) on a medical or health insurance policy; or

(b) to an approved provident fund which has its main object the provision for medical expenses.

The relief is limited to the amount of premium or contribution payable for the income year up to a maximum of :-

- Rs 15,000 for self

- Rs 15,000 for first dependent

- Rs 10,000 for second dependent

- Rs 10,000 for third dependent

No relief should be claimed where the premium or contribution is payable by the employer or under a combined medical and life

insurance scheme.

11. Deduction for Household Employees

Where a person employs one or more household employees, he may claim a deduction of the wages paid to the household employees

up to a maximum of Rs 30,000, from his net income, provided he has duly paid the contributions payable under the National Pensions

Act and the National Savings Fund Act. In the case of a couple, the deduction shall not, in the aggregate, exceed 30,000 rupees.

You might also like

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977No ratings yet

- Economics Higher Level Paper 3: Instructions To CandidatesDocument20 pagesEconomics Higher Level Paper 3: Instructions To Candidatessnadim123No ratings yet

- Solution Set PDocument14 pagesSolution Set PChristina JazarenoNo ratings yet

- Income Tax: Chapter 2: Income Taxes For IndividualDocument87 pagesIncome Tax: Chapter 2: Income Taxes For IndividualMaria Maganda MalditaNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Title (MR, MRS, Miss) Surname Other Names National Identity Card NumberDocument2 pagesTitle (MR, MRS, Miss) Surname Other Names National Identity Card NumberDylan RamasamyNo ratings yet

- Edf FormDocument2 pagesEdf FormAbdoos Samad FurreedanNo ratings yet

- EDF2011Document2 pagesEDF2011zabeelrNo ratings yet

- Statement of Business or Professional Activities: Part 1 - IdentificationDocument6 pagesStatement of Business or Professional Activities: Part 1 - IdentificationHimanshu MohtaNo ratings yet

- EA Pin2021 2Document1 pageEA Pin2021 2AisyaNo ratings yet

- MRA O'Reily RacourcyDocument1 pageMRA O'Reily RacourcyoreilyracourcyNo ratings yet

- T2125-17e - Statement of Business or Professional Activities Fill Up FormDocument6 pagesT2125-17e - Statement of Business or Professional Activities Fill Up FormjoanaNo ratings yet

- US Internal Revenue Service: p915 - 2003Document28 pagesUS Internal Revenue Service: p915 - 2003IRSNo ratings yet

- Annex A To D - 2023 BSKEDocument8 pagesAnnex A To D - 2023 BSKEjeany gileNo ratings yet

- View PDFDocument1 pageView PDFYohan NadalNo ratings yet

- Name and Address of The Employer Name and Designation of The EmployeeDocument4 pagesName and Address of The Employer Name and Designation of The Employeeyogesh.b.lokhande9022No ratings yet

- Form No 16Document3 pagesForm No 16thapalNo ratings yet

- Esi 5Document2 pagesEsi 5msen_74No ratings yet

- Ea Form 2018 PDFDocument1 pageEa Form 2018 PDFSpeederz freakNo ratings yet

- Payroll Accounting 2018 28Th Edition Bieg Solutions Manual Full Chapter PDFDocument24 pagesPayroll Accounting 2018 28Th Edition Bieg Solutions Manual Full Chapter PDFentrickaretologyswr100% (9)

- Payroll Accounting 2018 28th Edition Bieg Solutions ManualDocument3 pagesPayroll Accounting 2018 28th Edition Bieg Solutions Manualsilingvolumedvh2myq100% (24)

- Itr62form 64cDocument1 pageItr62form 64cdizzi dagerNo ratings yet

- US Internal Revenue Service: f5500sr - 1999Document2 pagesUS Internal Revenue Service: f5500sr - 1999IRSNo ratings yet

- Full Payroll Accounting 2019 29Th Edition Bieg Solutions Manual Online PDF All ChapterDocument25 pagesFull Payroll Accounting 2019 29Th Edition Bieg Solutions Manual Online PDF All Chapterkadinkaspadial538100% (2)

- PracticeDocument17 pagesPracticeSmarty ShivamNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Final Return For TARA PDFDocument8 pagesFinal Return For TARA PDFAnonymous NaYWx2vJN100% (1)

- US Internal Revenue Service: p915 - 2002Document28 pagesUS Internal Revenue Service: p915 - 2002IRSNo ratings yet

- US Internal Revenue Service: f5500sr - 2000Document2 pagesUS Internal Revenue Service: f5500sr - 2000IRSNo ratings yet

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Document2 pagesExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldNo ratings yet

- Income Tax Deduction Card Year:: Kenya Kazi Services Limited - (220-204) P051119653FDocument2 pagesIncome Tax Deduction Card Year:: Kenya Kazi Services Limited - (220-204) P051119653FhopmwangeNo ratings yet

- US Internal Revenue Service: f5500sr - 2003Document2 pagesUS Internal Revenue Service: f5500sr - 2003IRSNo ratings yet

- Company Tax Return FormDocument6 pagesCompany Tax Return Formgabriel chinechenduNo ratings yet

- Payroll Accounting 2019 29Th Edition Bieg Solutions Manual Full Chapter PDFDocument24 pagesPayroll Accounting 2019 29Th Edition Bieg Solutions Manual Full Chapter PDFentrickaretologyswr100% (11)

- US Internal Revenue Service: p915 - 2004Document28 pagesUS Internal Revenue Service: p915 - 2004IRSNo ratings yet

- Retrenchment DocumentsDocument11 pagesRetrenchment DocumentsfizaNo ratings yet

- Farm ManagementDocument45 pagesFarm ManagementSwapnil AshtankarNo ratings yet

- Short Form Return of Organization Exempt From Income TaxDocument9 pagesShort Form Return of Organization Exempt From Income TaxHalosNo ratings yet

- 2024 TD 59Document2 pages2024 TD 59Andreas Shikh MohammadNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Q2FY23 Press ReleaseDocument9 pagesQ2FY23 Press ReleasercossichNo ratings yet

- Full Payroll Accounting 2018 28Th Edition Bieg Solutions Manual Online PDF All ChapterDocument26 pagesFull Payroll Accounting 2018 28Th Edition Bieg Solutions Manual Online PDF All Chapterkadinkaspadial538100% (2)

- US Internal Revenue Service: P15a - 2002Document58 pagesUS Internal Revenue Service: P15a - 2002IRSNo ratings yet

- SCIENCEDocument6 pagesSCIENCEAbby NavarroNo ratings yet

- 16NEconomics Paper 3 HLDocument20 pages16NEconomics Paper 3 HLMustafa Al-TaieNo ratings yet

- Individuals (Self-Employed Persons) Annual Return of Income and Tax PayableDocument5 pagesIndividuals (Self-Employed Persons) Annual Return of Income and Tax PayableTahj BrownNo ratings yet

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- Q1FY23 Press ReleaseDocument10 pagesQ1FY23 Press Releaseahmedowyunus85No ratings yet

- Analysis of Alumni Batch Placements and Relating Co-FactorsDocument40 pagesAnalysis of Alumni Batch Placements and Relating Co-Factorssumuk kattaNo ratings yet

- Revised Budqet ForDocument4 pagesRevised Budqet ForZeeshan Hyder BhattiNo ratings yet

- Offer Letter - Naga Mythili JuturDocument3 pagesOffer Letter - Naga Mythili JuturAnu RadhaNo ratings yet

- Benevolent Fund Application Form: Private & ConfidentialDocument6 pagesBenevolent Fund Application Form: Private & ConfidentialThe Origin EditNo ratings yet

- Form 3 (Pen) Part-I Application For Pension And/Or GratuityDocument11 pagesForm 3 (Pen) Part-I Application For Pension And/Or GratuityADNAN KHANNo ratings yet

- Q3FY23 Press ReleaseDocument9 pagesQ3FY23 Press ReleasercossichNo ratings yet

- Airbus India - SAMPLE - Offer - LetterDocument2 pagesAirbus India - SAMPLE - Offer - LetterKshitij SinghNo ratings yet

- 22981qp Ipcc May10gp1 4Document7 pages22981qp Ipcc May10gp1 4HAYAGRIVAS 23No ratings yet

- 2010 Blank IRS Form 1065Document5 pages2010 Blank IRS Form 1065Nick PechaNo ratings yet

- TablesDocument30 pagesTablesapi-19777944No ratings yet

- Middle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesFrom EverandMiddle East and North Africa Economic Developments and Prospects, October 2013: Investing in Turbolent TimesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Porter´s (1980) Generic Strategies, Performance and Risk: An Empirical Investigation with German DataFrom EverandPorter´s (1980) Generic Strategies, Performance and Risk: An Empirical Investigation with German DataNo ratings yet

- Solidworks 2018 Learn by Doing - Part 3: DimXpert and RenderingFrom EverandSolidworks 2018 Learn by Doing - Part 3: DimXpert and RenderingNo ratings yet

- Economic Indicators for Southeastern Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeastern Asia and the Pacific: Input–Output TablesNo ratings yet

- CHAPTER 15 - Transfer Business TaxDocument9 pagesCHAPTER 15 - Transfer Business TaxKatKat Olarte67% (3)

- CIR Vs CA and PAJONARDocument2 pagesCIR Vs CA and PAJONARBryan Jay NuiqueNo ratings yet

- Tax Deduction Authority: Purpose of This FormDocument1 pageTax Deduction Authority: Purpose of This FormRosamaria FranzeNo ratings yet

- Income-Taxation 5-7 ValenciaDocument56 pagesIncome-Taxation 5-7 ValenciaDevonNo ratings yet

- Customs Valuation NotesDocument9 pagesCustoms Valuation NotesSheila ArjonaNo ratings yet

- Tax Planning - How To Save Tax in FY 2012-13 (AY - 2013-14)Document122 pagesTax Planning - How To Save Tax in FY 2012-13 (AY - 2013-14)Shankar JhaNo ratings yet

- PEOPLECERT 2020-2021 Languages Pricelist - SpainDocument2 pagesPEOPLECERT 2020-2021 Languages Pricelist - SpainJohnNo ratings yet

- Sri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesDocument17 pagesSri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesMaithri Vidana KariyakaranageNo ratings yet

- CIR v. General FoodsDocument3 pagesCIR v. General FoodsShiella RealNo ratings yet

- PWC Tanzania Tax Datacard 2011 20121170527Document6 pagesPWC Tanzania Tax Datacard 2011 20121170527Zimbo KigoNo ratings yet

- Decree - CDDM001883Document52 pagesDecree - CDDM001883thesacnewsNo ratings yet

- Mcit and RcitDocument5 pagesMcit and RcitMary Joanne PatolilicNo ratings yet

- B-Tax Book PDFDocument129 pagesB-Tax Book PDFpurvi doshiNo ratings yet

- CH 16Document36 pagesCH 16DrellyNo ratings yet

- Bangladesh Tax Handbook 2015-2016Document128 pagesBangladesh Tax Handbook 2015-2016Syed Tamjidur RahmanNo ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- Vaibhav 2023 NewDocument71 pagesVaibhav 2023 NewNeo MatrixNo ratings yet

- Tax Accounting For ARDocument14 pagesTax Accounting For ARJanardhanNo ratings yet

- Final Examinations: Attempt HistoryDocument11 pagesFinal Examinations: Attempt Historyrpmrpsy40No ratings yet

- Final Memo RespondentDocument26 pagesFinal Memo RespondentaakankshaNo ratings yet

- ASK Italian NEST FW Letter 1 NewDocument2 pagesASK Italian NEST FW Letter 1 NewGiovanni CanisiNo ratings yet

- 1st Issue E-Gyan, July-2013Document13 pages1st Issue E-Gyan, July-2013mevrick_guyNo ratings yet

- 2023 24 SARS ElogbookDocument17 pages2023 24 SARS ElogbookSiphesihleNo ratings yet

- Incomes Chargeable To Tax Under The Head "Profits and Gains of Business or Profession" (Section 28) - Attempt ReviewDocument5 pagesIncomes Chargeable To Tax Under The Head "Profits and Gains of Business or Profession" (Section 28) - Attempt Reviewaarishak786No ratings yet

- Gross EstateDocument3 pagesGross EstateShielle AzonNo ratings yet

- Cinema '84, Richard M. Greenberg, Tax Matters Partner, Karin M. Locke, Box Office Partnership and Joseph E. Goodwin, Jo Ann Scarfia, Participating Partner, First Blood Associates v. Commissioner of Internal Revenue, 294 F.3d 432, 1st Cir. (2002)Document19 pagesCinema '84, Richard M. Greenberg, Tax Matters Partner, Karin M. Locke, Box Office Partnership and Joseph E. Goodwin, Jo Ann Scarfia, Participating Partner, First Blood Associates v. Commissioner of Internal Revenue, 294 F.3d 432, 1st Cir. (2002)Scribd Government DocsNo ratings yet

- Cases-Taxation (2) .1Document5 pagesCases-Taxation (2) .1Edel VillanuevaNo ratings yet