Professional Documents

Culture Documents

Tariff Sheet - Regular / Basic Services Demat Account (BSDA) Tariff Sheet - Regular / Basic Services Demat Account (BSDA)

Uploaded by

laughterclub84Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tariff Sheet - Regular / Basic Services Demat Account (BSDA) Tariff Sheet - Regular / Basic Services Demat Account (BSDA)

Uploaded by

laughterclub84Copyright:

Available Formats

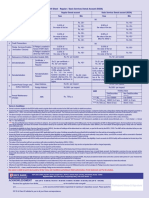

Tariff Sheet - Regular / Basic Services Demat Account (BSDA)

Sr. Regular Demat account Basic Services Demat account (BSDA)

Fee Head Type

No. Fees Min Fees Min

1 Account opening charges Nil

Debit Transactions Equity SPEED-e / Easiest Rs. 20/- Rs. 40/-

/ Mutual Funds (Market / 0.04% of 0.06% of

2 HDFC Securities Rs. 25/- Rs. 45/-

Off Market) the value of the txn. the value of the txn.

Manual Rs. 40/- Rs. 60/-

Debit Transactions Debt / SPEED-e / Easiest Rs. 20/- Rs. 40/-

0.04% of 0.06% of

3 Mutual Funds (Market / HDFC Securities the value of the txn. Rs. 25/- the value of the txn. Rs. 45/-

Off Market) (Max Rs 5000/-) (Max Rs 5000/-)

Manual Rs. 40/- Rs. 60/-

4 Credit Transactions Nil

Pledge Services(Creation If Pledge is marked in 0.02% of

Rs. 40/-

0.04% of

Rs. 60/-

/ Invocation / Closure) favour of HDFC Bank the value of the txn. the value of the txn

5

If Pledge is marked to 0.04% of 0.06% of

Rs. 40/- Rs. 60/-

other than HDFC Bank the value of the txn the value of the txn

6 Reissuance of Delivery Instruction Booklet (DIB) Rs.75/- per booklet Rs.75/- per booklet

Certicate +

Rs.5/- per certicate + Rs.5/- per certicate +

7 Dematerialisation Dematerialisation Rs. 40/- Rs. 40/-

Rs. 35/- per request Rs. 35/- per request

Request

Rs.30/- per request + NSDL Rs.30/- per request + NSDL /

/ CDSL actuals, Currently CDSL actuals, Currently

a) Rs. 10/- for ever y a) Rs. 10/- for every hundred

Rematerialisation hundred securities or part Rs.40/- (min) securities or part thereof) a at Rs.40/- (min)

Request thereof) a at fee of Rs. 10/- Rs.5,00,000 (max) fee of Rs. 10/- per certicate Rs.5,00,000 (max)

per certicate whichever is whichever is higher

higher

8 Rematerialisation Reconversion of Mutual Funds Rs 30/- per request Reconversion of Mutual Funds Rs 30/- per request + NSDL /

+ NSDL / CDSL actuals,Currently Rs 10/- per request CDSL actuals,Currently Rs 10/- per request in NSDL & Rs

Reconversion of in NSDL & Rs 5.50/- per request in CDSL

Mutual Funds/ 5.50/- per request in CDSL

Redemption of Mutual Fund units Rs 30/- per Redemption of Mutual Fund units Rs 30/- per request +

Redemption of request + NSDL / CDSL actuals, Currently Rs 4.50/-

Mutual Fund units NSDL / CDSL actuals, Currently Rs 4.50/- per request in NSDL

per request in NSDL & Rs 5.50/- per request in CDSL & Rs 5.50/- per request in CDSL

Courier/Postal Charges only Inland Address Rs.35/- per request Rs.35/- per request

9

(Adhoc Statement) Foreign Address Rs.500/- per request Rs.500/- per request

*** Holding Value between 0 to 50,000 - Nil AMC

Annual Maintenance

10 Charges AMC Rs. 750 p.a. *** Holding Value between 50,001 to 2 Lacs - Rs.100 p.a.

*** Holding Value more than 2 Lacs - Rs.750 p.a.

Terms & Conditions:

Demat customers eligible for the BSDA facility need to register their mobile number for the SMS alert facility for debit transactions

Customers who have a banking relationship with HDFC Bank to provide a debit authorisation for the recovery of service charges.

The above charges are exclusive of Service Tax levied @ 14%, Swachh Bharat Cess levied @ 0.50% and Krishi Kalyan Cess levied @ 0.50% and other taxes / statutory charges levied by Government bodies /

statutory authorities from time to time, which will be charged as applicable.

All charges / service standards are subject to revision at the Banks sole discretion and as per the notications given by ordinary post / courier companies, at any given point of time.

Customers who have only a Depository relationship will be required to pay an advance fee of Rs. 7,500/- , for each Demat account, which will be adjusted against the service charges. The customer also

needs to replenish the balances immediately if and when it falls below Rs. 5,000/-

*** The Annual Maintenance Charges are levied, in advance, for a period of one year at the beginning of the billing cycle. For the computation of AMC for Managed Program, the transactions for the previous

year will be evaluated, and basis the number of transactions done by the customer, AMC will be levied as per the transaction slabs dened.

To evaluate the eligibility for Basic Services Demat Accounts (BSDA), the value of holdings will be determined on a daily basis, as per the le sent by the NSDL / CDSL The AMC will be calculated at the pro-rata

basis based on the value of holding of securities in the account.

In case of BSDA, such accounts would be levied AMC applicable basis the value of holdings exceeding the precribed limit immediately from the next day of exceeding such limit.

Incase the Demat accounts with BSDA facility does not meet the listed eligibility as per guideline issued by SEBI or any such authorIty at any point of time, such BSDA accounts will be converted to Standard

program Demat accounts without further reference to the respective customers and will be levied standard Program pricing.

Incase if the Demat accounts with BSDA facility exceed the prescribed limits and move out of the stipulated BSDA criteria, the eligibility of such accounts for BSDA facility will be evaluated on the last day of the

Annual billing cycle. "

The value of the transaction will be in accordance with rates provided by Depositories (NSDL / CDSL)

The transaction charges will be payable monthly. The charges quoted above are for the services listed. Any service not quoted above will be charged separately.

The operating instructions for the joint accounts must be signed by all the holders.

All instructions for transfer must be received at the designated DP servicing branches of the Bank at least 24 hours before the execution date.

The charges for processing of instructions submitted on the execution date (accepted at client's risk) will be 0.25 % on the value of transaction, minimum of Rs.25/- per instruction.

In case of non-recovery of service charges due to inadequate balance in your linked bank account or inadequate advance fees or invalid bank account, the Depository services for your account will be

temporarily discontinued. Any request for resuming the services will be charged at Rs. 250/- and services will be resumed in a minimum of three working days from the date of receipt of request with HDFC

Bank and post payment of all outstanding dues towards Depository charges.

In case the Demat accounts are with nil balances / transactions or incase if the customer defaults in payment of AMC, the physical statement shall not be sent to the customer after period of 1 year. However the

electronic statement of holding will be sent only to the customers whose email IDs are registered for e-statement.

The Depositories have started dispatching Consolidated Account Statement (CAS) to the customers w.e.f. March 2015, hence despatch of physical statements will be discontinued.

Your Transaction cum Billing statement will be available on NetBanking under Demat tab by second week of every month with option to view /download.

I/we agree to abide by and to be bound by all the Terms and Conditions pertaining to Debit authorisation, E-mail statement and Fee & schedule.

You might also like

- Tariff Sheet - Regular Demat vs Basic Demat AccountDocument1 pageTariff Sheet - Regular Demat vs Basic Demat AccountMunish ParasharNo ratings yet

- HDFC Fees For DEMAT TransactionsDocument1 pageHDFC Fees For DEMAT TransactionsPAWAN KAMALESHNo ratings yet

- HDFC Fees For DEMAT TransactionsDocument1 pageHDFC Fees For DEMAT TransactionsPAWAN KAMALESHNo ratings yet

- HDFC Fees For DEMAT TransactionsDocument1 pageHDFC Fees For DEMAT TransactionsPAWAN KAMALESHNo ratings yet

- Tariff sheet for HDFC Bank Demat accountsDocument1 pageTariff sheet for HDFC Bank Demat accountsSourav mNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat Accounts - Regular / Basic Services Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accounts - Regular / Basic Services Demat AccountRAPETI SAI KUMAR (N160490)No ratings yet

- DownloadDocument1 pageDownloadkishore kumarNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- Schedule of Charges For Nri Accounts PrimeDocument4 pagesSchedule of Charges For Nri Accounts PrimeSonam SharmaNo ratings yet

- Edelweiss Broking LTD.: V03/Feb/2020Document2 pagesEdelweiss Broking LTD.: V03/Feb/2020Shyam KukrejaNo ratings yet

- Demat ComparisonDocument2 pagesDemat ComparisonMohit ChhabraNo ratings yet

- Loans: Proposed Schedule of Charges - 1st Jan-30th June, 2015Document2 pagesLoans: Proposed Schedule of Charges - 1st Jan-30th June, 2015Junaid MalikNo ratings yet

- Acc No: 207977242 Bsno: 33: Ms Sapna D/O Sh. Gurbachan Lal AroraDocument4 pagesAcc No: 207977242 Bsno: 33: Ms Sapna D/O Sh. Gurbachan Lal Aroraranjanrajeev1501No ratings yet

- New Bank of Baroda New Commission Chart 28.11.2020Document1 pageNew Bank of Baroda New Commission Chart 28.11.2020kaleeswaran MNo ratings yet

- Schedule of Charges For Nri PriorityDocument4 pagesSchedule of Charges For Nri PriorityAnnuRawatNo ratings yet

- Issuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesIssuance Fee (Personalised Debit Card) Rs.150/-: Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABSäñtôsh Kûmãr PrâdhäñNo ratings yet

- NRI Savings Account Tariff StructureDocument4 pagesNRI Savings Account Tariff StructureRishiNo ratings yet

- Grace Period Granted - 1 Month As Per RBI Guidelines To Restore MABDocument2 pagesGrace Period Granted - 1 Month As Per RBI Guidelines To Restore MABprasanNo ratings yet

- Plans Margins and Plan Information: Charges Currency Futures Currency OptionsDocument1 pagePlans Margins and Plan Information: Charges Currency Futures Currency OptionsManu ShrivastavaNo ratings yet

- Caart PDFDocument2 pagesCaart PDFvinodNo ratings yet

- Revised Schedule of ChargesDocument2 pagesRevised Schedule of Chargesmayankmehta052No ratings yet

- Branch)Document3 pagesBranch)Jeyavel NagarajanNo ratings yet

- Phole BillDocument2 pagesPhole BillmadhavarapuNo ratings yet

- KFS_Deutsche_Bank_AG_-_PakistanDocument3 pagesKFS_Deutsche_Bank_AG_-_PakistanPrijin UnnunnyNo ratings yet

- BC Point Commission Structure for Aadhaar Payments and Banking ServicesDocument1 pageBC Point Commission Structure for Aadhaar Payments and Banking ServicesJai mishraNo ratings yet

- Baroda Apex Academy, Gandhinagar: S. No Commission Per TransactionDocument1 pageBaroda Apex Academy, Gandhinagar: S. No Commission Per TransactionJitenNo ratings yet

- IndusInd Bank service charges scheduleDocument4 pagesIndusInd Bank service charges schedulesatyabrataNo ratings yet

- Bundled Savings Account Monthly ChargesDocument2 pagesBundled Savings Account Monthly ChargesSweta MistryNo ratings yet

- PRAN Transaction StatementDocument3 pagesPRAN Transaction StatementPrince NakulNo ratings yet

- DP Tariff Latest 1500Document1 pageDP Tariff Latest 1500Vinodh KumarNo ratings yet

- HDFC Bank Marketing StrategiesDocument28 pagesHDFC Bank Marketing Strategiespriya choudharyNo ratings yet

- Schedule of Charges Edge Business 1st Feb 20 PDFDocument2 pagesSchedule of Charges Edge Business 1st Feb 20 PDFRavie S DhamaNo ratings yet

- Soc Ca 01.01.22Document4 pagesSoc Ca 01.01.22Abhishek ShivappaNo ratings yet

- Service BasicDocument9 pagesService Basickselvaa1No ratings yet

- Service Basic PDFDocument9 pagesService Basic PDFkselvaa1No ratings yet

- Savings - Account - Mar - 2019 - 20190325104947Document4 pagesSavings - Account - Mar - 2019 - 20190325104947Manish kumar yadavNo ratings yet

- Jubilee Plus Savings Account Features and ChargesDocument2 pagesJubilee Plus Savings Account Features and ChargesRuthvik TMNo ratings yet

- ITI Admission Counselling Fee Payment ChallanDocument1 pageITI Admission Counselling Fee Payment ChallanAkn NanthanNo ratings yet

- Core Savings Account - IDBIDocument2 pagesCore Savings Account - IDBIprasanNo ratings yet

- Jan Tata Bill RS GandhiDocument9 pagesJan Tata Bill RS Gandhideepak_sharma9323No ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- Indusind Bank BenefitsDocument1 pageIndusind Bank BenefitsParvinder MehraNo ratings yet

- Schedule of Charges-Depository Services: MandatoryDocument3 pagesSchedule of Charges-Depository Services: MandatorysandeepksrinivasNo ratings yet

- 141121120000AMIOP Key Fact Current Accounts ConvDocument5 pages141121120000AMIOP Key Fact Current Accounts Convdesignify101No ratings yet

- Core Savings AccountDocument2 pagesCore Savings AccountVarshaNo ratings yet

- Statement 122925Document3 pagesStatement 122925Itsmevenki SmileNo ratings yet

- Ap2011janm21 958230704 904229210Document6 pagesAp2011janm21 958230704 904229210Neeraj Kumar GuptaNo ratings yet

- Meezan Bank schedule of charges update Jan-Jun 2021Document1 pageMeezan Bank schedule of charges update Jan-Jun 2021Nawaz SharifNo ratings yet

- Demat and transaction charges comparison across multiple depository participantsDocument146 pagesDemat and transaction charges comparison across multiple depository participantssekradNo ratings yet

- Service Charges As Per Rbi GuidelinesDocument10 pagesService Charges As Per Rbi Guidelineskrunal3726No ratings yet

- Upcoming Changes to Meezan Bank Schedule of Charges Jan-Jun 2019Document1 pageUpcoming Changes to Meezan Bank Schedule of Charges Jan-Jun 2019Ahsan IqbalNo ratings yet

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocument1 pageCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNo ratings yet

- Or2010julm17 874749141 976745542Document2 pagesOr2010julm17 874749141 976745542raghu0912No ratings yet

- Schedule of Service Charges and Fees: Name of The Bank Allahabad BankDocument5 pagesSchedule of Service Charges and Fees: Name of The Bank Allahabad BankmodijiNo ratings yet

- Schedule of ChargesDocument6 pagesSchedule of ChargesRayan PaulNo ratings yet

- Standard Schedule of Charges For SB-CA-NRI-July 1 2016Document4 pagesStandard Schedule of Charges For SB-CA-NRI-July 1 2016Vasundhara GuptaNo ratings yet

- Service Charges Schedule of JK BANKDocument27 pagesService Charges Schedule of JK BANKclassmateNo ratings yet

- Chapter - Returns: Form Gstr-1Document13 pagesChapter - Returns: Form Gstr-1DevNo ratings yet

- Chapter - Returns: Form Gstr-1Document13 pagesChapter - Returns: Form Gstr-1DevNo ratings yet

- Clarification Dec2017Document3 pagesClarification Dec2017Brodsky RjNo ratings yet

- Tariff Sheet - Regular / Basic Services Demat Account (BSDA) Tariff Sheet - Regular / Basic Services Demat Account (BSDA)Document1 pageTariff Sheet - Regular / Basic Services Demat Account (BSDA) Tariff Sheet - Regular / Basic Services Demat Account (BSDA)laughterclub84No ratings yet

- Taxation of PEDocument73 pagesTaxation of PERanjeet GeraNo ratings yet

- Taxation of PEDocument73 pagesTaxation of PERanjeet GeraNo ratings yet

- A Guide To Company Secretaryship-Study and ExaminationDocument21 pagesA Guide To Company Secretaryship-Study and ExaminationsoumyaranjanismishraNo ratings yet

- Only This Much Content Details (Laws Applicable To A Company) Book For Company Secretary Executive Program SyllabusDocument2 pagesOnly This Much Content Details (Laws Applicable To A Company) Book For Company Secretary Executive Program SyllabusOnly This Much100% (2)

- Fabozzi CH 32 CDS HW AnswersDocument19 pagesFabozzi CH 32 CDS HW AnswersTrish Jumbo100% (1)

- Strategic Finance ManagementDocument8 pagesStrategic Finance ManagementShiv KothariNo ratings yet

- Unit 7 Finance and BankingDocument100 pagesUnit 7 Finance and BankingAlen Pestek100% (1)

- Application for Compensation Against Delayed Real Estate ProjectDocument6 pagesApplication for Compensation Against Delayed Real Estate ProjectHimanshu SachdevaNo ratings yet

- Logistics Business Investment Strategies: Presented byDocument34 pagesLogistics Business Investment Strategies: Presented byIsaac OwusuNo ratings yet

- NumerixCVA BrochureDocument8 pagesNumerixCVA Brochureprachiz1No ratings yet

- KSB Pumps LTD: PCG ResearchDocument8 pagesKSB Pumps LTD: PCG ResearchRavi VishnuNo ratings yet

- Manipal University Jaipur School of Law: INSIDER TRADING - A Study Based On Cases"Document12 pagesManipal University Jaipur School of Law: INSIDER TRADING - A Study Based On Cases"Aarav SinghNo ratings yet

- USES OF BANK FUNDSDocument15 pagesUSES OF BANK FUNDSBatool AbbasNo ratings yet

- BDP Rport On Jwellery StoreDocument41 pagesBDP Rport On Jwellery StoreJigoku ShojuNo ratings yet

- Long-Term Construction Contracts and FranchisingDocument7 pagesLong-Term Construction Contracts and FranchisingEpal AkoNo ratings yet

- History of Bank Nationalization in IndiaDocument24 pagesHistory of Bank Nationalization in Indiajoy parimalaNo ratings yet

- Yilmana DensaDocument23 pagesYilmana DensaJames Wiggins100% (1)

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- NOTES On Statement of Financial PositionDocument13 pagesNOTES On Statement of Financial PositionJenevic D. MariscalNo ratings yet

- Circular No 14Document4 pagesCircular No 14Muhammad Ali JinnahNo ratings yet

- Bata IndiaDocument13 pagesBata IndiaNeel ModyNo ratings yet

- Balaji Telefilms bets big on digital with Alt Digital launchDocument4 pagesBalaji Telefilms bets big on digital with Alt Digital launchMudit KediaNo ratings yet

- Nepal sole trading registration requirementsDocument2 pagesNepal sole trading registration requirementsAnup Jung BasnetNo ratings yet

- Manufacturing and Operations ManagementDocument52 pagesManufacturing and Operations ManagementRohit DhawareNo ratings yet

- Apollo Tyres Ltd Introduction Chapter SummaryDocument84 pagesApollo Tyres Ltd Introduction Chapter SummaryMayank Jain NeerNo ratings yet

- Funds Holdings - AMUNDI S&P GLOBAL LUXURY UCITS ETF - EUR (C) - LU1681048630 - 04022021 - LUX - EN - GBDocument6 pagesFunds Holdings - AMUNDI S&P GLOBAL LUXURY UCITS ETF - EUR (C) - LU1681048630 - 04022021 - LUX - EN - GBabcdNo ratings yet

- Heiken Ashi ExplanationDocument6 pagesHeiken Ashi ExplanationExpresID100% (2)

- SPiCE-VC - SEC FORM DDocument5 pagesSPiCE-VC - SEC FORM DSidney LorickNo ratings yet

- Assignment 03 Investments in Debt SecuritiesDocument4 pagesAssignment 03 Investments in Debt SecuritiesJella Mae YcalinaNo ratings yet

- Efficient Securities MarketsDocument18 pagesEfficient Securities MarketsDiny Fariha ZakhirNo ratings yet

- Chocolate Shop - Business Plan Heza - ChocolitaDocument10 pagesChocolate Shop - Business Plan Heza - ChocolitaDeepakNo ratings yet

- CB Insights Venture Report Q2 2021Document190 pagesCB Insights Venture Report Q2 2021BrentjaciowNo ratings yet

- Construction Contracts Seatwork PDFDocument13 pagesConstruction Contracts Seatwork PDFaccounting prob100% (1)

- Sunrise resource constraintsDocument3 pagesSunrise resource constraintsHIRA MAZHAR IQBALNo ratings yet