Professional Documents

Culture Documents

C. Polymer and Chemical Based Industries PCBI

Uploaded by

Antony Joseph0 ratings0% found this document useful (0 votes)

22 views2 pagesthis is hair oil making and how to do it.

Original Title

Hair Oil

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentthis is hair oil making and how to do it.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesC. Polymer and Chemical Based Industries PCBI

Uploaded by

Antony Josephthis is hair oil making and how to do it.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Sl. No.

Group / Name of Village Industries Code Page

C. Polymer and Chemical Based Industries PCBI

57. Hair Oil Manufacturing PCBI-05 113

PCBI-05

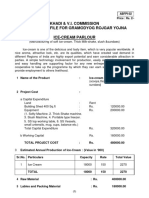

KHADI & VILLAGE INDUSTRIES COMMISSION

PROJECT PROFILE FOR GRAMODYOG ROZGAR YOJANA

HAIR OIL MANUFACTURING

All are very much aware of the hair health and all are using different types of hair oil to maintain their hair

health. Good quality hair oils have high demand in the market. Accordingly to the need of the place right

type of oil and herbs are to be mixed and the qualitative product if pa dad attractively can sell like hot cake.

1. Name of the Product : Hair Oil

2. Project Cost :

(a) Capital Expenditure

Land : Own

Building Shed 500 Sq.ft. : Rs. 100000.00

Equipment : Rs. 180000.00

(Boiling kettle with stirrer, Bottle cap sealing

M/c, Filtering unit, Storage tank etc.)

Total Capital Expenditure : Rs. 280000.00

(b) Working Capital : Rs. 174000.00

TOTAL PROJECT COST : Rs. 454000.00

3. Estimated Annual Production of Hair Oil : (Value in 000)

SI. No. Particulars Capacity (NO.OF.PKT.) Rate Total Value

1. Hair Oil 10000.00 Liters 70.00 698.20

TOTAL 10000.00 Liters 70.00 698.20

4. Raw Material : Rs. 400000.00

5. Labels and Packing Material : Rs. 20000.00

6. Wages (Skilled & Unskilled) : Rs. 130000.00

7. Salaries : Rs. 36000.00

8. Administrative Expenses : Rs. 15000.00

9. Overheads : Rs. 25000.00

10. Miscellaneous Expenses : Rs. 10000.00

11. Depreciation : Rs. 23000.00

12. Insurance : Rs. 2800.00

13. Interest (As per the PLR)

(a) Capital Expenditure Loan : Rs. 36400.00

(b) Working Capital Loan : Rs. 22620.00

Total Interest : Rs. 59020.00

14. Working Capital Requirement

Fixed Cost : Rs. 100200.00

Variable Cost : Rs. 597620.00

Requirement of Working Capital per Cycle : Rs. 174455.00

15. Estimated Cost Analysis

Sl.No. Particulars Capacity Utilization (Rs. in 000)

100% 60% 70% 80%

1. Fixed Cost 100.20 60.12 70.14 80.16

2. Variable Cost 598.00 358.80 418.60 478.40

3. Cost of Production 698.20 418.92 488.74 558.56

4. Projected Sales 850.00 510.00 595.00 680.00

5. Gross Surplus 151.80 91.08 106.26 121.44

6. Expected Net Surplus 129.00 68.00 83.00 98.00

Note:

1. All figures mentioned above are only indicative and may vary from place to place.

2. If the investment on Building is replaced by Rental Premises-

(a.) Total Cost of Project will be reduced.

(b) Profitability will be increased.

(c) Interest on Capital Expenditure will be reduced.

You might also like

- Tax Avoidance and Tax EvasionDocument6 pagesTax Avoidance and Tax EvasionBhavanaNo ratings yet

- Family Budget PlannerDocument9 pagesFamily Budget PlannerLisa NurhasanahNo ratings yet

- Goat Farming Project Report 500 20 GoatsDocument8 pagesGoat Farming Project Report 500 20 GoatsAntony Joseph100% (1)

- Week 2Document6 pagesWeek 2Maryane AngelaNo ratings yet

- Taxation II DigestsDocument365 pagesTaxation II DigeststakyousNo ratings yet

- Dairy Business PlanDocument17 pagesDairy Business Planvector dairy100% (4)

- D365 Supply Chain MGMT Cert Learning PathDocument1 pageD365 Supply Chain MGMT Cert Learning PathAntony JosephNo ratings yet

- A Primer On Whole Business SecuritizationDocument13 pagesA Primer On Whole Business SecuritizationSam TickerNo ratings yet

- Responsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesDocument3 pagesResponsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesAriel DicoreñaNo ratings yet

- Dairy Farm Project Report - Crossbred Cow (Large Scale) - Project ReportDocument2 pagesDairy Farm Project Report - Crossbred Cow (Large Scale) - Project ReportAntony Joseph100% (1)

- Dairy Farm Project Report - Crossbred Cow (Large Scale) - Project ReportDocument2 pagesDairy Farm Project Report - Crossbred Cow (Large Scale) - Project ReportAntony Joseph100% (1)

- Marketing Plan For Organic SoapDocument19 pagesMarketing Plan For Organic Soapkatakhijau270% (10)

- Cattle Feed Manufacturing and Processing UnitDocument20 pagesCattle Feed Manufacturing and Processing UnitAntony Joseph100% (1)

- List of Farm Machine Manufactures in Tamil Nadu PDFDocument13 pagesList of Farm Machine Manufactures in Tamil Nadu PDFDivya Natarajan100% (2)

- CIR Vs Isabela Cultural CorporationDocument2 pagesCIR Vs Isabela Cultural CorporationLauren KeiNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Project Report ShampooDocument2 pagesProject Report Shampoovineetaggarwal50% (2)

- SOAP PLANT Project Report CompleteDocument8 pagesSOAP PLANT Project Report CompleteER. INDERAMAR SINGH52% (25)

- SOAP PLANT Project Report CompleteDocument8 pagesSOAP PLANT Project Report CompleteER. INDERAMAR SINGH52% (25)

- Laundarysoap PDFDocument2 pagesLaundarysoap PDFTanya KaushalNo ratings yet

- C. Polymer and Chemical Based Industries PCBIDocument2 pagesC. Polymer and Chemical Based Industries PCBIAntony JosephNo ratings yet

- Agarbatti PDFDocument2 pagesAgarbatti PDFAntony JosephNo ratings yet

- Project Report VermicompostDocument2 pagesProject Report VermicompostShishir Kumar100% (2)

- Onionpaste PDFDocument2 pagesOnionpaste PDFPushpak DeshmukhNo ratings yet

- Poha UnitDocument2 pagesPoha UnitBharat PatelNo ratings yet

- Masalasmall PDFDocument2 pagesMasalasmall PDFVIJAY PAREEKNo ratings yet

- ATTACHAKKIDocument2 pagesATTACHAKKIgoutham.lokNo ratings yet

- Establishment of RestaurantDocument2 pagesEstablishment of RestaurantDeepak JinaNo ratings yet

- Two Wheeler Repairing ShopDocument2 pagesTwo Wheeler Repairing Shopkrishna samNo ratings yet

- Project Profile On Exhaust FansDocument2 pagesProject Profile On Exhaust FansPhilip KotlerNo ratings yet

- Project Profile On Oil Crusher Expeller PDFDocument2 pagesProject Profile On Oil Crusher Expeller PDFMallikarjunReddyObbineniNo ratings yet

- Ashish Vishvkarma Udaipur, Rajasthan, 313001Document2 pagesAshish Vishvkarma Udaipur, Rajasthan, 313001ashish vishwakarmaNo ratings yet

- Honneyhouse PDFDocument2 pagesHonneyhouse PDFankit_kon_mnnitNo ratings yet

- Model Project Profile On Plastic Bottle (Pcbi)Document2 pagesModel Project Profile On Plastic Bottle (Pcbi)sivanagendrarao beharabhargavaNo ratings yet

- Bakery ProjectsDocument2 pagesBakery ProjectsfasmekbakerNo ratings yet

- Beverage Manufacturing SchemeDocument2 pagesBeverage Manufacturing SchemeUjjwal DwivediNo ratings yet

- Beverage Manufacturing Scheme PDFDocument2 pagesBeverage Manufacturing Scheme PDFUjjwal DwivediNo ratings yet

- Beverage Manufacturing SchemeDocument2 pagesBeverage Manufacturing SchemenathaanmaniNo ratings yet

- Beverage PDFDocument2 pagesBeverage PDFUjjwal DwivediNo ratings yet

- Khadi & V.I. Commission Project Profile For Gramodyog Rojgar Yojna Beverage Manufacturing SchemeDocument2 pagesKhadi & V.I. Commission Project Profile For Gramodyog Rojgar Yojna Beverage Manufacturing SchemeUjjwal DwivediNo ratings yet

- Project Profile On Groundnut Oil and Oil Cake Manuafcuring PDFDocument2 pagesProject Profile On Groundnut Oil and Oil Cake Manuafcuring PDFnathaanmani100% (2)

- Onion Paste Manufacturing SchemeDocument2 pagesOnion Paste Manufacturing SchemePhilip KotlerNo ratings yet

- Project Profile On Coconut Oil and Oil Cake Manuafcuring PDFDocument2 pagesProject Profile On Coconut Oil and Oil Cake Manuafcuring PDFnathaanmaniNo ratings yet

- Project Profile On Gingilee Oil and Oil Cake ManuafcuringDocument2 pagesProject Profile On Gingilee Oil and Oil Cake ManuafcuringnathaanmaniNo ratings yet

- Project Profile On Gingilee Oil and Oil Cake Manuafcuring PDFDocument2 pagesProject Profile On Gingilee Oil and Oil Cake Manuafcuring PDFnathaanmaniNo ratings yet

- Khadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana PlumbingDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana PlumbingMohammed Mohsin YedavalliNo ratings yet

- Project Profile On Mustard Oil and Oil Cake ManuafcuringDocument2 pagesProject Profile On Mustard Oil and Oil Cake Manuafcuringnathaanmani100% (1)

- Khadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana Handmade Paper Conversion UnitDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana Handmade Paper Conversion UnitAKvermaNo ratings yet

- Besan Manufacturing Unit PDFDocument2 pagesBesan Manufacturing Unit PDFDev MoryaNo ratings yet

- Ice-Cream ParlourDocument2 pagesIce-Cream ParlourRupesh SharmaNo ratings yet

- Project Profile On Aluminium FabricationDocument2 pagesProject Profile On Aluminium FabricationRNo ratings yet

- Ice-Cream ParlourDocument2 pagesIce-Cream ParlourRaj sbnNo ratings yet

- Project Profile Rojgar For Gramodyog YojanaDocument2 pagesProject Profile Rojgar For Gramodyog YojanaCherian MominNo ratings yet

- Beverage Manufacturing SchemeDocument3 pagesBeverage Manufacturing SchemeSameer KhanNo ratings yet

- Pulses Processing UnitDocument2 pagesPulses Processing UnitBurra Madhav100% (1)

- Project Profile On Chemical Etching On WoodDocument2 pagesProject Profile On Chemical Etching On Woodquraishi831No ratings yet

- Project Profile On Kurkure Type Snacks PDFDocument2 pagesProject Profile On Kurkure Type Snacks PDFSundeep Yadav100% (3)

- Daliya Manufacturing Unit PDFDocument2 pagesDaliya Manufacturing Unit PDFpardeepNo ratings yet

- Project Profile On Naphthalene BallsDocument2 pagesProject Profile On Naphthalene BallsOmkar KshirsagarNo ratings yet

- Tenthouse PDFDocument2 pagesTenthouse PDFSujit KumarNo ratings yet

- Broom MakingDocument2 pagesBroom MakingTom TomNo ratings yet

- TWO WHEELER REPAIRING SHOP ProjectDocument2 pagesTWO WHEELER REPAIRING SHOP ProjectBhanwar SinghNo ratings yet

- Project Profile On Gem Cutting and PolishingDocument2 pagesProject Profile On Gem Cutting and Polishingpramod kumar singh100% (1)

- Project Profile On Wooden Toys and Decorative PiecesDocument2 pagesProject Profile On Wooden Toys and Decorative PiecesinfernohubckdNo ratings yet

- Project Profile On Canvas ShoesDocument2 pagesProject Profile On Canvas ShoesPandey DivyNo ratings yet

- Manufacturing of Detergent Powder & CakeDocument2 pagesManufacturing of Detergent Powder & Cakeramu_uppadaNo ratings yet

- Project Profile On Personnelcomputers AssemblyDocument2 pagesProject Profile On Personnelcomputers AssemblyNaveen InfocomNo ratings yet

- Kurkure Type SnacksDocument2 pagesKurkure Type SnacksVikas KumarNo ratings yet

- Project Profile On Bee - Metallurgical CokeDocument2 pagesProject Profile On Bee - Metallurgical CokeAjmalNo ratings yet

- App 25377589Document2 pagesApp 25377589KANNADIGA ANIL KERURKARNo ratings yet

- ADDONCARDSFORCOMPUTERDocument2 pagesADDONCARDSFORCOMPUTERAR MOHANRAJNo ratings yet

- Khadi & Village Industries Commission Project Profile For Gramodyog Rojgar Yojana Papad ManufacturingDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rojgar Yojana Papad ManufacturingAMIT SRIVASTAVANo ratings yet

- Bindi Manufacturing UnitDocument2 pagesBindi Manufacturing Unitsunsp52No ratings yet

- Steelfurniture PDFDocument2 pagesSteelfurniture PDFEknath karale100% (1)

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- Financial ReportDocument1 pageFinancial ReportAntony JosephNo ratings yet

- Goat Farming Project Report Information - Goat FarmingDocument8 pagesGoat Farming Project Report Information - Goat FarmingAntony JosephNo ratings yet

- DownloadlyDocument1 pageDownloadlyAntony JosephNo ratings yet

- Goat Farming Project Report - Investment, Expenses & ProfitDocument10 pagesGoat Farming Project Report - Investment, Expenses & ProfitAntony JosephNo ratings yet

- Core SamplerDocument1 pageCore SamplerAntony JosephNo ratings yet

- NLM Guidelines Final Approved by ECDocument68 pagesNLM Guidelines Final Approved by ECAntony JosephNo ratings yet

- PBXact KH Extention PDFDocument3 pagesPBXact KH Extention PDFAntony JosephNo ratings yet

- Agriculture Borewell Permission and Subsidy in India - Agri FarmingDocument4 pagesAgriculture Borewell Permission and Subsidy in India - Agri FarmingAntony Joseph100% (1)

- Online JobDocument1 pageOnline JobAntony JosephNo ratings yet

- 0604183125model - Indigenous Poultry Farming EnglishDocument9 pages0604183125model - Indigenous Poultry Farming EnglishAntony JosephNo ratings yet

- Adapting Bio Oc Technology For Use in Small Scale Ponds With Vertical SubstrateDocument6 pagesAdapting Bio Oc Technology For Use in Small Scale Ponds With Vertical SubstrateAntony JosephNo ratings yet

- Refresh Parent Grid After Sub-Grid Save in UI For ASP - NET MVC Grid - Telerik ForumsDocument3 pagesRefresh Parent Grid After Sub-Grid Save in UI For ASP - NET MVC Grid - Telerik ForumsAntony JosephNo ratings yet

- Nabard Poultry FarmingDocument9 pagesNabard Poultry Farmingtaurus_vadivelNo ratings yet

- Amaidhiyum Aarokiyamum (Monthly Magazine) - August Month 2017Document32 pagesAmaidhiyum Aarokiyamum (Monthly Magazine) - August Month 2017Antony JosephNo ratings yet

- 0604182934model - Indigenous Cow Farming EnglishDocument17 pages0604182934model - Indigenous Cow Farming EnglishAntony JosephNo ratings yet

- Grass For CowsDocument1 pageGrass For CowsAntony JosephNo ratings yet

- Ragi Expert SystemDocument12 pagesRagi Expert SystemAntony JosephNo ratings yet

- Install Cu9 - Step by Step - Part 1Document22 pagesInstall Cu9 - Step by Step - Part 1Antony JosephNo ratings yet

- NSIF ReportDocument6 pagesNSIF ReportAntony JosephNo ratings yet

- Specific Objectives Chapter by Chapter Basics of AccountingDocument2 pagesSpecific Objectives Chapter by Chapter Basics of AccountingAntony JosephNo ratings yet

- Chapter 7: Ppe and Intangibles: 1. Types of Non-Current AssetsDocument14 pagesChapter 7: Ppe and Intangibles: 1. Types of Non-Current AssetsMarine De CocquéauNo ratings yet

- Topic 2Document5 pagesTopic 2Karl Anthony Tence DionisioNo ratings yet

- Money TalksDocument138 pagesMoney TalksFernanda RabacaNo ratings yet

- An Analysis On Consumer Perception Towards Brand ExtensionDocument47 pagesAn Analysis On Consumer Perception Towards Brand ExtensionSaviral ChoudharyNo ratings yet

- Planning For Success in Your Aquaculture BusinessDocument8 pagesPlanning For Success in Your Aquaculture Businessjoao pedro FonsecaNo ratings yet

- Seminar 12 - Intangible Assets and Impairment Testing1Document36 pagesSeminar 12 - Intangible Assets and Impairment Testing1Celine LowNo ratings yet

- Name: Score: Course & Section: DateDocument11 pagesName: Score: Course & Section: DateDan RyanNo ratings yet

- Jurists Bar Review Center: Schedule of Online Pre-Bar Lectures and ActivitiesDocument4 pagesJurists Bar Review Center: Schedule of Online Pre-Bar Lectures and ActivitieskulayarnieNo ratings yet

- Republic Vs Iac: None of Which Is Present in This CaseDocument11 pagesRepublic Vs Iac: None of Which Is Present in This CaseFrancis Coronel Jr.No ratings yet

- RP-Sanjiv Goenka Group: Growing LegaciesDocument10 pagesRP-Sanjiv Goenka Group: Growing Legaciessouvik dasguptaNo ratings yet

- Schematic Diagram of Propose Mayo Hydroelectric PlantDocument3 pagesSchematic Diagram of Propose Mayo Hydroelectric Plantswoosh nessNo ratings yet

- ACCOUNTING - Definition, Phases, Importance With SpeechDocument6 pagesACCOUNTING - Definition, Phases, Importance With SpeechCaryl Anne MagalongNo ratings yet

- Formulae For The Computation of The VariancesDocument5 pagesFormulae For The Computation of The VariancesGkæ E. GaleakelweNo ratings yet

- Prospectus 2000Document275 pagesProspectus 2000rc7534No ratings yet

- Measuring GDP and Economic Growth: Chapter 21, Michael ParkinDocument21 pagesMeasuring GDP and Economic Growth: Chapter 21, Michael ParkinOyon Nur newazNo ratings yet

- Tugas 2Document4 pagesTugas 2calvin sijabatNo ratings yet

- JSPL Financial Report PDFDocument5 pagesJSPL Financial Report PDFRatish Kumar mishraNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- Joa and PSC Dt.22.12.94 of Enron, Ongc & RilDocument574 pagesJoa and PSC Dt.22.12.94 of Enron, Ongc & RilwaftmoversNo ratings yet

- Zulfan FasyaDocument27 pagesZulfan FasyaZulfan FasyaNo ratings yet

- FIFO LIFO PracticalDocument16 pagesFIFO LIFO Practicalkrishna aroraNo ratings yet

- Mil Report 07Document92 pagesMil Report 07Shuchi BhattNo ratings yet

- Share Capital and Creditor Protection Efficient Rules For A Modern Company LawDocument54 pagesShare Capital and Creditor Protection Efficient Rules For A Modern Company LawMichelle T.No ratings yet