86% found this document useful (7 votes)

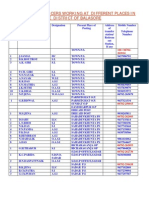

4K views2 pagesVendor Master Form

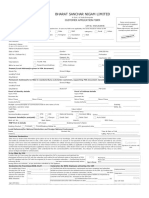

This document is a vendor master form used to collect information from vendors to make payments, issue tax certificates, and provide notifications. It requests contact details, tax registration numbers, payment details including bank account information, and industry status from the vendor. The form notes that missing or incomplete information could result in taxes not being paid or exemptions not being provided.

Uploaded by

rekhaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

86% found this document useful (7 votes)

4K views2 pagesVendor Master Form

This document is a vendor master form used to collect information from vendors to make payments, issue tax certificates, and provide notifications. It requests contact details, tax registration numbers, payment details including bank account information, and industry status from the vendor. The form notes that missing or incomplete information could result in taxes not being paid or exemptions not being provided.

Uploaded by

rekhaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Vendor Master Form Details: This section contains fields for vendor information required for financial transactions, including personal, business, tax, and bank details.